Anyone who has hosted a game night over video chat or ordered groceries to be delivered at home for the first time understands how profoundly the COVID-19 crisis has changed our behavior as consumers. But which of these changes will stick? We see several that are key:

- Flight to online

- Shock to loyalty

- Need for hygiene transparency

- Back to basics and value

- Rise of the homebody economy

We’ve boiled down extensive McKinsey consumer research into ten exhibits to illustrate the trends and the consumer segments associated with each.

Flight to online

1. Digital shopping is here to stay

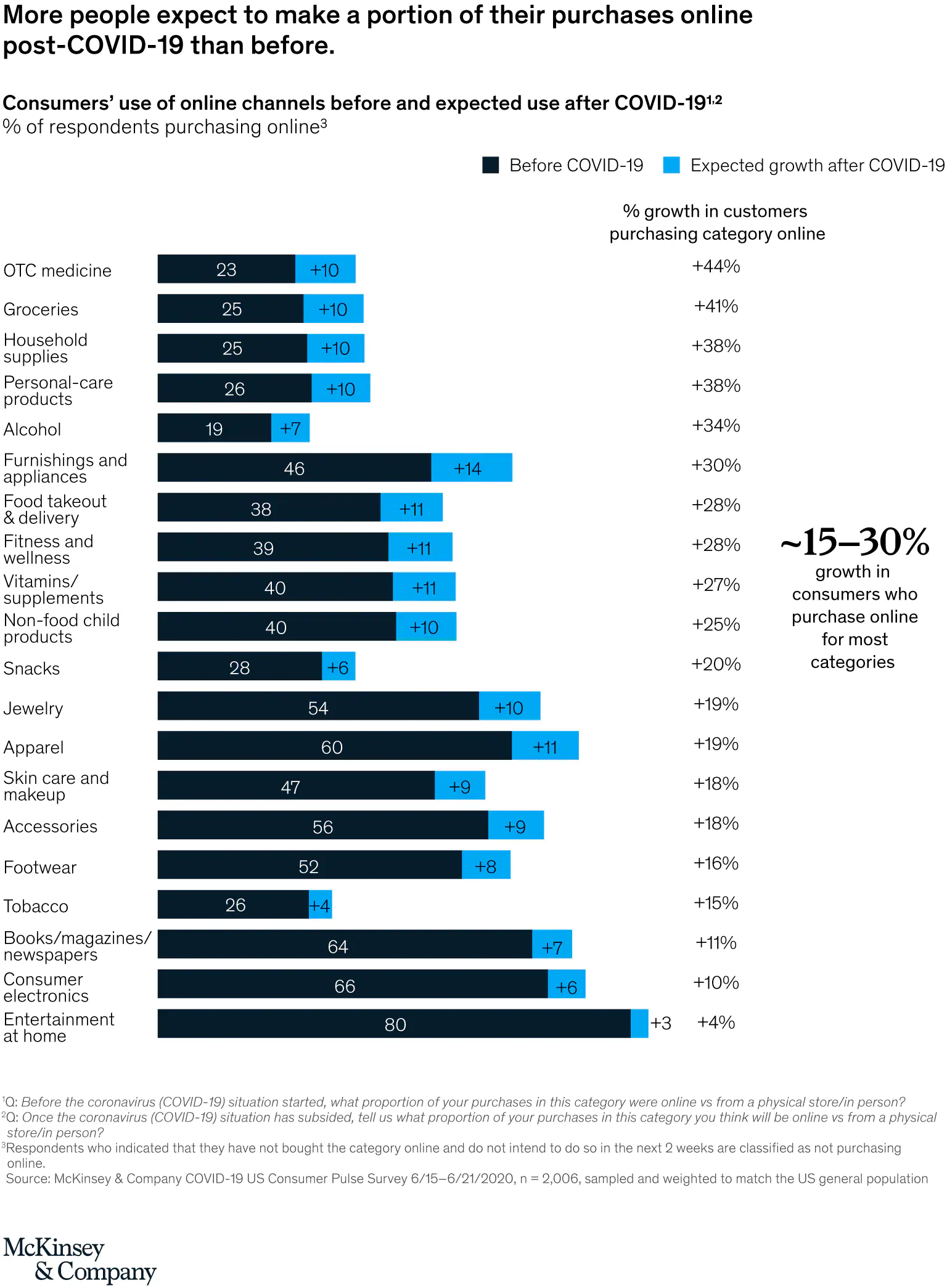

Physical distancing and stay-at-home orders have forced whole consumer segments to shop differently. A few months into COVID-19, consumer shopping online has increased significantly across many categories. Consumer intent to shop online continues to increase, especially in essentials and home-entertainment categories. More interestingly, these habits seem like they’re going to stick as US consumers report an intent to shop online even after the COVID-19 crisis. Categories where expected growth in online shoppers exceeds 35 percent include essentials such as over-the-counter (OTC) medicine, groceries, household supplies, and personal-care products. Even discretionary categories such as skin care and makeup, apparel, and jewelry and accessories show expected customer growth of more than 15 percent.

2. Millennials and high-income earners are in the lead when it comes to shopping online

While the shift to online shopping has been near universal across categories, high-income earners and millennials are leading the way in shifting spend online across both essential and nonessential items. Gen X has experienced a similar online shift, although not at the same scale as millennials. Gen Z has concentrated its shift online in particular categories: apparel and footwear, at-home entertainment, and food takeout/delivery.

Would you like to learn more about our Marketing & Sales Practice?

Shock to loyalty

3. Consumers are switching brands at unprecedented rates

The crisis has prompted a surge of new activities, with an astonishing 75 percent of US consumers trying a new shopping behavior in response to economic pressures, store closings, and changing priorities. This general change in behavior has also been reflected in a shattering of brand loyalties, with 36 percent of consumers trying a new product brand and 25 percent incorporating a new private-label brand. Of consumers who have tried different brands, 73 percent intend to continue to incorporate the new brands into their routine. Gen Z and high earners are most prone to switching brands.

The beneficiaries of this shift include big, trusted brands, which are seeing 50 percent growth during the crisis, and private labels, which have outpaced the retail market. Some 80 percent of customers who started using a private brand during the pandemic indicate they intend to continue using it once the COVID-19 crisis subsides.

4. Brands need to ensure strong availability and also convey value

Shoppers have cited a number of reasons for switching brands, with availability (in-store and online), convenience, and value leading the pack.

For marketers, this highlights the need to quickly become aware of when shoppers are migrating brands or retailers and then to manage the logistics to ensure product and service availability. Looking at China, which is further along in its recovery cycle than most countries, the increase in promotional activity to cater to consumers’ focus on value in apparel is expected to continue.

Need for hygiene transparency

5. US consumers are changing how they shop in response to health and safety concerns

As Americans contemplate going back out to shop, hygiene and hygiene transparency have emerged as important sources of concern. It is becoming increasingly important for stores and restaurants to not only follow hygiene protocols (thorough cleaning and masks for consumers and employees are top priorities) but also communicate effectively that they are following those procedures.

US consumers have already started to change their behavior in response to hygiene concerns. Technologies that enhance hygiene, particularly contactless activities such as food and grocery delivery and curbside pickup, are taking off. There is strong intent to continue contactless activities across the United States. As an example, 79 percent of consumers intend to continue or increase their usage of self-checkout in retail after COVID-19. Millennials and Gen Z are the widest adopters of contactless activities.

Back to basics and value

6. Consumer shopping intent is focused on essentials

Around 40 percent of US consumers have reduced spending in general, and they expect to continue to cut back on nonessentials specifically. This reality reflects profound discomfort about the state of the economy.

With overall consumer spending declining, intent to spend in essential categories is increasing. Even among those with higher incomes, we see that while essentials show spending momentum, intent to buy discretionary products still lags significantly. As the worst of the crisis abates, we do see online spending in nonessential categories such as apparel and footwear starting to come back. This effect is strongest among high-income earners, consumers in the Northeast, and Gen Z.

7. Consumers want value for their money—especially in essential categories

Tied to the concern about the state of the economy is an increasing consumer focus on value—especially for essential categories. For example, in shampoo on Amazon, value and mass products have experienced the greatest increase in share, at two- and five-percentage-points gains, respectively. Premium shampoo products have seen significantly less growth in comparison, losing more than five points of volume.

How marketing leaders can both manage the coronavirus crisis and plan for the future

Rise of the homebody economy

8. Americans are changing how they spend their time at home

Americans are spending more of their at-home time on domestic activities, media, and news. Intent to eat more at home post-COVID-19 has strengthened significantly over the past three months. Usage of popular online entertainment platforms has skyrocketed. (The popular video game Fortnite recently hosted a concert that was “attended” by 12.3 million users.1) Investment in at-home fitness through equipment purchases and online activity is growing. Consumers still expect to spend more time on at-home activities, even in less-restricted regions.

9. Americans are concerned about going back to regular activities outside the home

As economies reopen, 73 percent of consumers are still hesitant to resume regular activities outside the home. They are concerned about going to a hair salon, gym, or restaurant, but are especially worried about shared environments, such as public transportation, ride sharing, air travel, and being in crowded spaces, such as attending large indoor or outdoor events.

Behaviors vary by consumer segment

10. ‘Great consumer shift’ trends vary by consumer segment

US consumer-segment behavior varies significantly across the next-normal trends. We have identified five customer segments driven by optimism, health, and financial concerns, each of relatively similar size. These five segments exhibit the consumer trends to a different degree and have the following characteristics:

Affluent and unaffected: These consumers express general optimism about the future (~20 percent higher than the overall US consumer population), skew male (60 percent), and make more than $100,000 a year. They tend to be able to stay at home during the pandemic crisis, allowing them to shop more online. This group is slightly less price sensitive than other cohorts due to greater job stability.

Uprooted and underemployed: These consumers are feeling major impact on both their finances and health due to job insecurity. They are cautious about how they spend money, with low optimism about future economic conditions. Not surprisingly, this group is trading down to essentials and value, swapping out brands, and shopping online when possible.

Financially secure but anxious: This population is largely 65 years old and older and is generally pessimistic about economic conditions after COVID-19, which has had a major impact on their habits. This group has expressed the greatest need for hygiene transparency, with above-average concerns on safety and well-being and concerns about the ability to get necessary supplies.

Out trying to make ends meet: These consumers are being cautious about how they spend money and feel that their jobs and job security have been heavily impacted by COVID-19. This group has significant representation from minority groups and rural populations. They are less likely to be able to stay at home (hence their lower likelihood to be part of the homebody economy), but they are strongly moving toward shopping for essentials and value.

Disconnected and retired: This category denotes those who are retired, over 65, and have a lower income level than the financially-secure-but-anxious segment. They are broadly optimistic about economic conditions after COVID-19 and are less likely to display any of the next-normal characteristics. Predominantly from Southern and suburban areas of the country, this group has not exhibited significant changes in shopping behavior.

As retailers contemplate the changes in consumer behavior, they will need to adjust their strategies and execution to adapt to the new norms, including:

- Adjusting mix and spend to where the consumer is now (go digital, ensure full coverage of bottom-funnel marketing and demand capture, think region-by-region)

- Revamping messaging and creative to be in sync with the times, particularly in terms of hygiene and value

- Ensuring the end-to-end journey meets the new hygiene and at-home needs

- Managing corporate social-responsibility efforts to build brand strength authentically

- Refocusing on online and pickup solutions and rebuilding real-time measurement plans, as traditional media-mix models won’t suffice

Further, it will be important for brands to reevaluate and reprioritize their target audience and consumer segments, as the emphasis on each of the next-normal trends will vary based on the target consumer.