What distinguishes sales organizations at fast-growing companies from their lagging peers? In a wide-ranging survey of more than 1,000 companies, we unearthed five meaningful differences:

1. Commitment to the future

That the world is changing ever more quickly may be a cliché, but that makes it no less true: all sales leaders know that they need to anticipate changes that could turn into opportunities or threats. Yet the best leaders move beyond acknowledgement to commitment.

They make trend analysis a formal part of the sales process through systematic investments of time, money, and people. Building and sustaining the capability to take a forward-looking view of the market is not easy. In discussions with more than 200 sales leaders while researching our new book, Sales Growth, two common characteristics emerged: the mind-set of sales leadership and resource commitment.

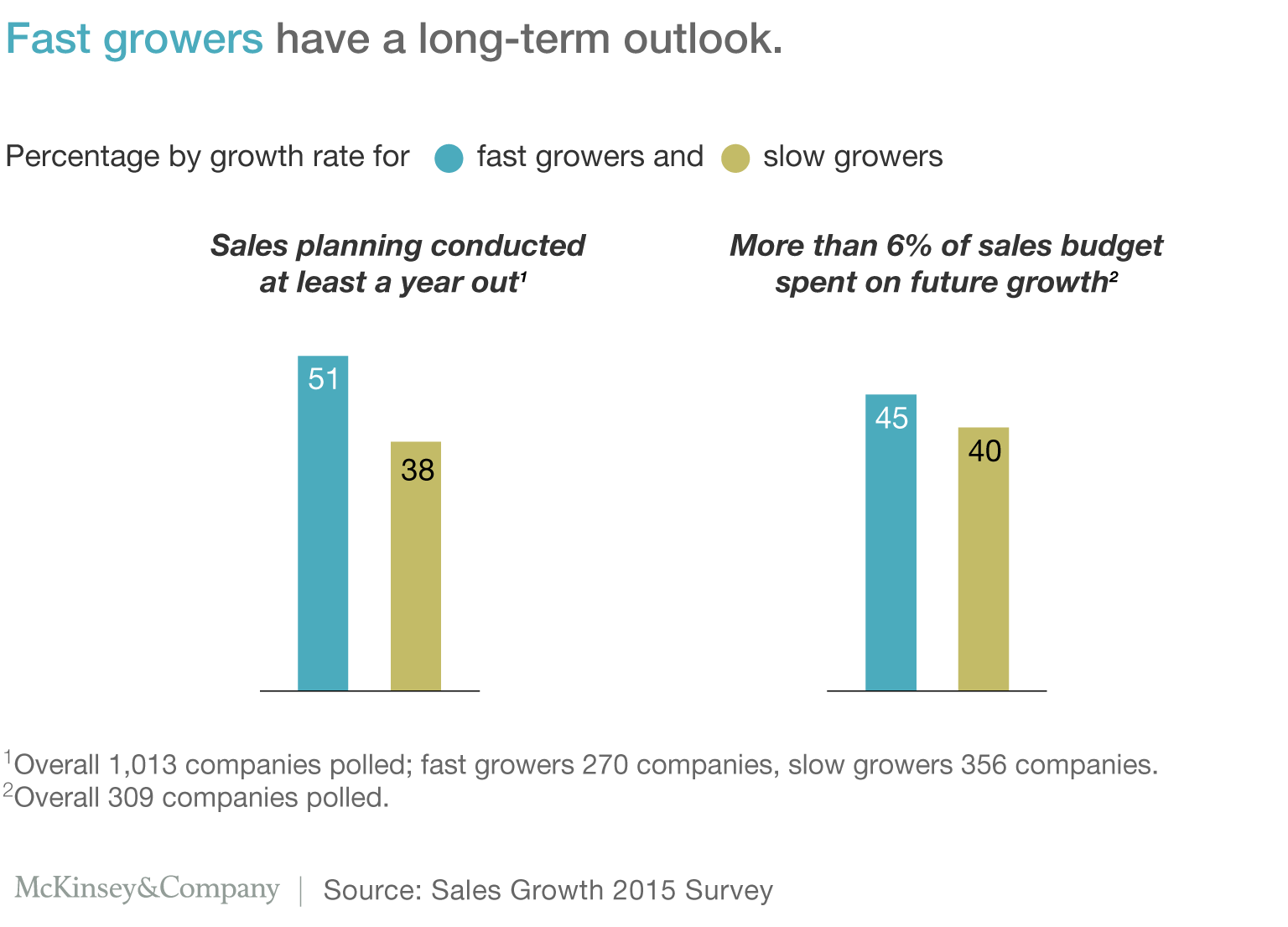

Sales leaders must consistently monitor the macro-environment in search of sales opportunities, no easy task given the relentless pressure to hit near-term targets. Forward planning must be part of someone’s job description—not just part of top management’s lengthy to-do list—with sufficient resources to take advantage of the best opportunities. Companies have to be willing to take risks now to create sales capacity long before the revenue will materialize. More than half of the fast-growing companies1 we analyzed look at least one year out, and 10 percent look more than three years out.

After planning, sales leaders aren’t afraid to put their money where they think the growth will be: 45 percent of fast-growing companies invest more than 6 percent of their sales budget on activities supporting goals that are at least a year out—a significant commitment in an environment where sales leaders fight for each dollar of investment.

2. Focus on key aspects of digital

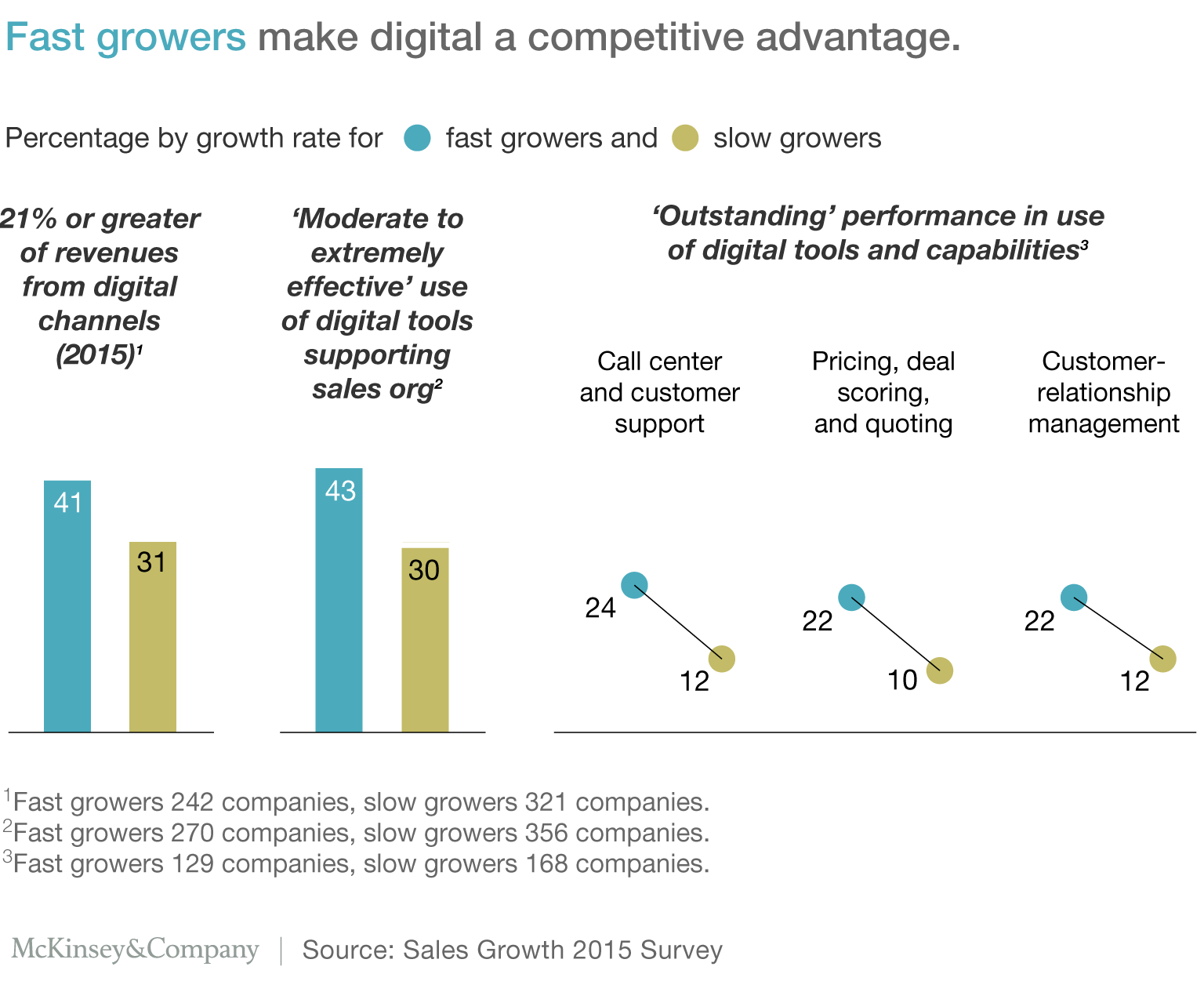

Successful brands don’t just “do digital”; they use their full arsenal of capabilities to massively increase the effectiveness of their sales force and to transform the customer buying experience to be “digital first.” It pays off: digital channels provided at least a fifth of 2015 revenues for 41 percent of the fast-growing companies we surveyed—both business-to- business and business-to-consumer—compared with just 31 percent at slow-growing companies.

This trend is only becoming more important, as almost two-thirds of all US retail sales by 2017 will involve some form of online research, consideration, or purchase.2

Would you like to learn more about our Marketing & Sales Practice?

When it comes to customer experience, leading organizations are building out digital routes to market or augmenting traditional direct or indirect sales with digital. For traditional software companies, the focus on SaaS-based products is driving a change toward a digital sales experience where they discover, demo, and trial, all within a few clicks online. Many industrial companies are seeing their products also sold in external marketplaces, which is prompting them to build out their own e-commerce platforms to directly shape the customer experience.

Sales leaders are especially strong at harnessing digital tools and capacities to support the sales organization. Fast-growing companies are more effective than slower-growing ones at using digital tools and capabilities to support the sales organization (43 percent versus 30 percent). They tend to focus on three fronts:

First, they arm sales teams with digital tools that can quickly deliver relevant and usable insights. Second, they treat partners as an extension of the sales force and invest in collaboration tools to improve the flow of data between organizations. Third, they recognize the potential for big micromarket or macrotrend analyses to improve planning and capture opportunities most effectively. As the technology emerges, they are making targeted investments in tools, technologies, and talent to make the most of these opportunities. Success in digital comes from fanatical optimization—not as a one-off project, but as a continuous process. It comes from harnessing mobile technologies to drive growth, understanding how customers use and switch between the mobile channel and other channels. And it comes from integrating digital into a great omnichannel experience that spans marketing to post-purchase.

3. Harnessing of the full range of sales analytics

Only now is the promise of advanced analytics catching up to the hype. Take customer analytics. Companies that use it extensively see profit improvements 126 percent higher than competitors who don’t. And when it comes to sales improvements through the extensive use of advanced analytics, the difference is even larger: 131 percent.3

The value of advanced analytics is wide ranging, but where sales leaders excel against their peers is in making better decisions, managing accounts, uncovering insights into sales and deal opportunities, and sales strategy. In particular, they are shifting from analysis of historical data to being more predictive. They use sophisticated analytics to decide not only what the best opportunities are but also which ones will help minimize risk. In fact, in these areas three quarters of fast-growing companies believe themselves to be above average, while between 53 and 61 percent of slow-growing companies hold the same view.

The new world of sales growth

But even among fast-growing companies, only just over half—53 percent—claim to be moderately or extremely effective in using analytics to make decisions. For slow-growing companies, it drops to a little over a third. This indicates that there remains significant untapped potential in sales analytics.

4. Investment in people

A rigorous focus on sales-force training is a clear differentiator between the fast- and slow-growing companies we surveyed. Just under half the fast growers spend significant time and money on sales-force training, compared to 29 percent of slow growers. There’s room for improvement, though. Among fast growers, just over half believe their organization has the sales capabilities it will need in the future, while a third of the slow growers feel similarly equipped. As few as 18 percent of fast growers think they excel at pipeline management, and even in the most successful area—understanding specific customer needs—only 29 percent claimed to be outstanding.

What is notable from our research, however, is that fast growers are committed to improving sales talent and performance. The head of sales at a North American consumer-services company, for example, tried a new approach to improving sales performance after years of fruitless initiatives. Instead of focusing solely on what the sales force had to do, the program also devoted significant attention to building the talents and capabilities to enable them to do it, making a substantial investment in teaching skills and enforcing their use with specific goals. The result? A 25 percent improvement in rep productivity across all regions within 18 months. More impressive still, the gains stuck, and two years later performance was still improving.

5. Marriage of clear vision with leadership action

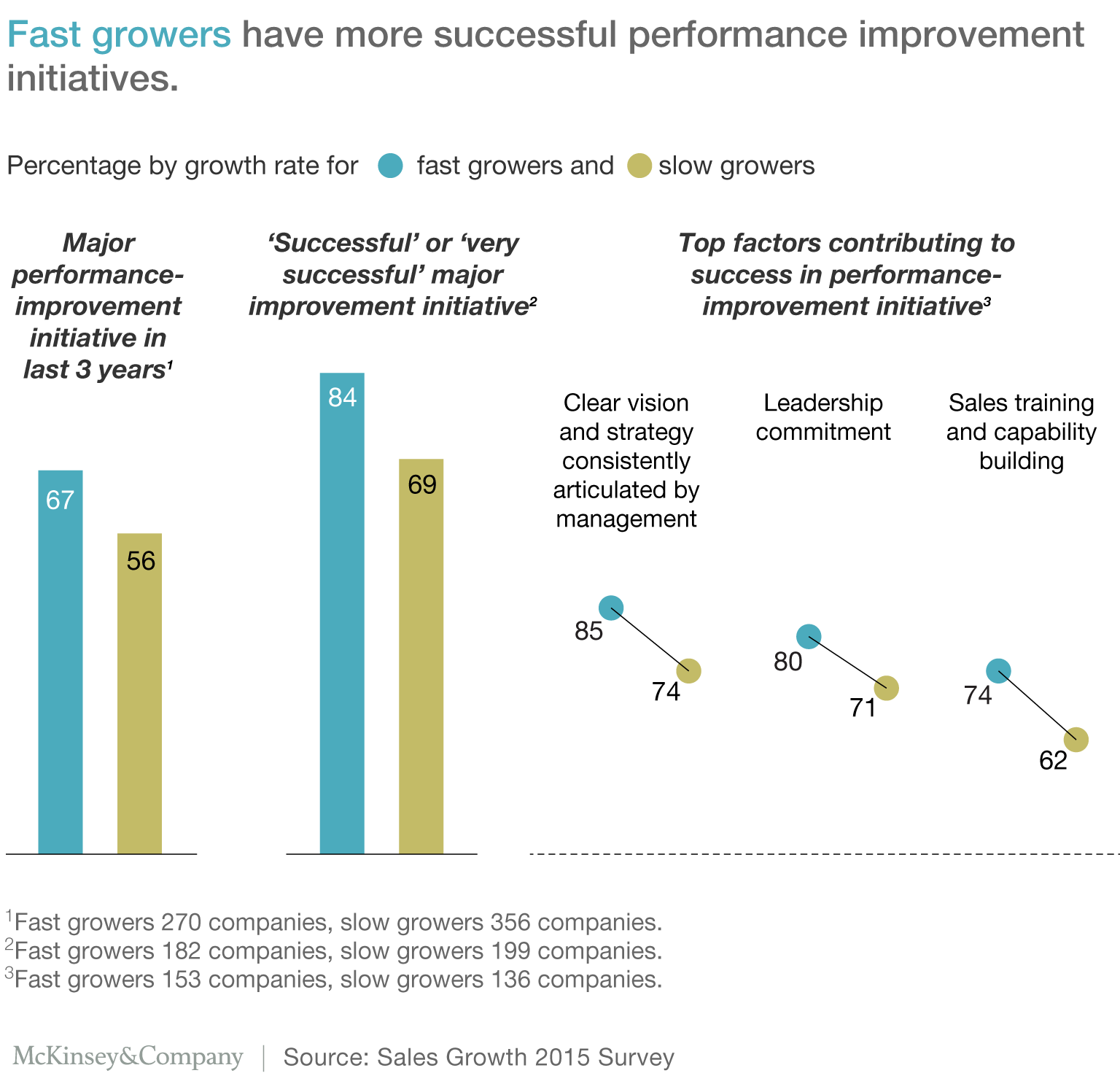

Two-thirds of fast-growing companies undertook a major performance improvement over the previous three years, and 84 percent considered it successful or very successful.

Sales leaders at these organizations said the two most important factors that contributed to that success were management articulation of a clear and consistent vision and strategy, followed by leadership commitment.

Articulating the vision should be simple. The chief executive officer of an emerging-markets telecommunications firm, for example, announced a “3 × 3 × 3” growth aspiration: three years to expand beyond its home country, three years to expand beyond its region, and three years to become a leading global brand. Besides being simple, the aspiration was bold, specific, and easily measurable.

No sales transformation will work without steadfast support from the very top. Only a committed leader can override internal politics, see the big picture, and focus on the best solution regardless of past practices. Sometimes, the commitment can be very personal. For example, the head of sales at another telecom firm recognized how fundamental customer experience was for success. At the same time that he controversially clamped down on aggressive sales techniques that had a negative effect on customer experience, he proposed to his CEO that customer satisfaction ratings should determine 25 percent of his variable pay.

Sales leaders face a dizzying array of issues and opportunities to manage, often at speeds that seemed unimaginable even a few years ago. But by focusing on what really matters, sales leaders can break away from their competitors.

Click here for more information about the second edition of Sales Growth: Five Proven Strategies from the World’s Sales Leaders.