The global investment in research and development (R&D) is staggering. In 2019 alone, organizations around the world spent $2.3 trillion on R&D—the equivalent of roughly 2 percent of global GDP—about half of which came from industry and the remainder from governments and academic institutions. What’s more, that annual investment has been growing at approximately 4 percent per year over the past decade.1

While the pharmaceutical sector garners much attention due to its high R&D spending as a percentage of revenues, a comparison based on industry profits shows that several industries, ranging from high tech to automotive to consumer, are putting more than 20 percent of earnings before interest, taxes, depreciation, and amortization (EBITDA) back into innovation research (Exhibit 1).

What do organizations expect to get in return? At the core, they hope their R&D investments yield the critical technology from which they can develop new products, services, and business models. But for R&D to deliver genuine value, its role must be woven centrally into the organization’s mission. R&D should help to both deliver and shape corporate strategy, so that it develops differentiated offerings for the company’s priority markets and reveals strategic options, highlighting promising ways to reposition the business through new platforms and disruptive breakthroughs.

Yet many enterprises lack an R&D strategy that has the necessary clarity, agility, and conviction to realize the organization’s aspirations. Instead of serving as the company’s innovation engine, R&D ends up isolated from corporate priorities, disconnected from market developments, and out of sync with the speed of business. Amid a growing gap in performance between those that innovate successfully and those that do not, companies wishing to get ahead and stay ahead of competitors need a robust R&D strategy that makes the most of their innovation investments. Building such a strategy takes three steps: understanding the challenges that often work as barriers to R&D success, choosing the right ingredients for your strategy, and then pressure testing it before enacting it.

Overcoming the barriers to successful R&D

The first step to building an R&D strategy is to understand the four main challenges that modern R&D organizations face:

-

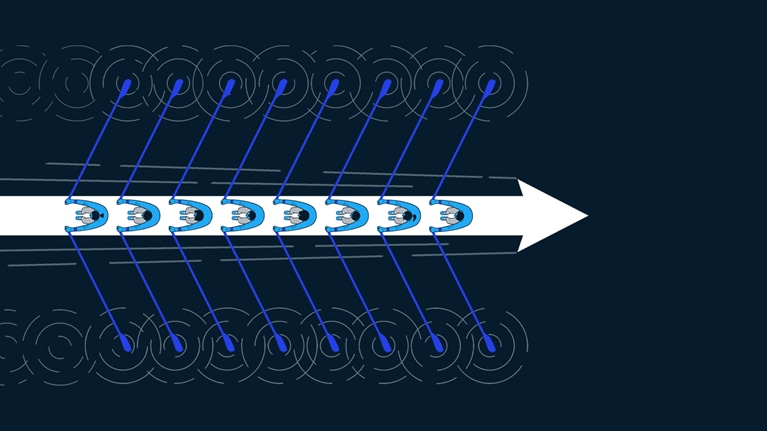

Innovation cycles are accelerating. The growing reliance on software and the availability of simulation and automation technologies have caused the cost of experimentation to plummet while raising R&D throughput. The pace of corporate innovation is further spurred by the increasing emergence of broadly applicable technologies, such as digital and biotech, from outside the walls of leading industry players.

But incumbent corporations are only one part of the equation. The trillion dollars a year that companies spend on R&D is matched by the public sector. Well-funded start-ups, meanwhile, are developing and rapidly scaling innovations that often threaten to upset established business models or steer industry growth into new areas. Add increasing investor scrutiny of research spending, and the result is rising pressure on R&D leaders to quickly show results for their efforts.

-

R&D lacks connection to the customer. The R&D group tends to be isolated from the rest of the organization. The complexity of its activities and its specialized lexicon make it difficult for others to understand what the R&D function really does. That sense of working inside a “black box” often exists even within the R&D organization. During a meeting of one large company’s R&D leaders, a significant portion of the discussion focused on simply getting everyone up to speed on what the various divisions were doing, let alone connecting those efforts to the company’s broader goals.

Given the challenges R&D faces in collaborating with other functions, going one step further and connecting with customers becomes all the more difficult. While many organizations pay lip service to customer-centric development, their R&D groups rarely get the opportunity to test products directly with end users. This frequently results in market-back product development that relies on a game of telephone via many intermediaries about what the customers want and need.

-

Projects have few accountability metrics. R&D groups in most sectors lack effective mechanisms to measure and communicate progress; the pharmaceutical industry, with its standard pipeline for new therapeutics that provides well-understood metrics of progress and valuation implications, is the exception, not the rule. When failure is explained away as experimentation and success is described in terms of patents, rather than profits, corporate leaders find it hard to quantify R&D’s contribution.

Yet proven metrics exist to effectively measure progress and outcomes. A common challenge we observe at R&D organizations, ranging from automotive to chemical companies, is how to value the contribution of a single component that is a building block of multiple products. One specialty-chemicals company faced this challenge in determining the value of an ingredient it used in its complex formulations. It created categorizations to help develop initial business cases and enable long-term tracking. This allowed pragmatic investment decisions at the start of projects and helped determine the value created after their completion.

Even with outcomes clearly measured, the often-lengthy period between initial investment and finished product can obscure the R&D organization’s performance. Yet, this too can be effectively managed by tracking the overall value and development progress of the pipeline so that the organization can react and, potentially, promptly reorient both the portfolio and individual projects within it.

-

Incremental projects get priority. Our research indicates that incremental projects account for more than half of an average company’s R&D investment, even though bold bets and aggressive reallocation of the innovation portfolio deliver higher rates of success. Organizations tend to favor “safe” projects with near-term returns—such as those emerging out of customer requests—that in many cases do little more than maintain existing market share. One consumer-goods company, for example, divided the R&D budget among its business units, whose leaders then used the money to meet their short-term targets rather than the company’s longer-term differentiation and growth objectives.

Focusing innovation solely around the core business may enable a company to coast for a while—until the industry suddenly passes it by. A mindset that views risk as something to be avoided rather than managed can be unwittingly reinforced by how the business case is measured. Transformational projects at one company faced a higher internal-rate-of-return hurdle than incremental R&D, even after the probability of success had been factored into their valuation, reducing their chances of securing funding and tilting the pipeline toward initiatives close to the core.

As organizations mature, innovation-driven growth becomes increasingly important, as their traditional means of organic growth, such as geographic expansion and entry into untapped market segments, diminish. To succeed, they need to develop R&D strategies equipped for the modern era that treat R&D not as a cost center but as the growth engine it can become.

Would you like to learn more about our Strategy & Corporate Finance Practice?

Choosing the ingredients of a winning R&D strategy

Given R&D’s role as the innovation driver that advances the corporate agenda, its guiding strategy needs to link board-level priorities with the technologies that are the organization’s focus (Exhibit 2). The R&D strategy must provide clarity and commitment to three central elements: what we want to deliver, what we need to deliver it, and how we will deliver it.

-

What we want to deliver. To understand what a company wants to and can deliver, the R&D, commercial, and corporate-strategy functions need to collaborate closely, with commercial and corporate-strategy teams anchoring the R&D team on the company’s priorities and the R&D team revealing what is possible. The R&D strategy and the corporate strategy must be in sync while answering questions such as the following: At the highest level, what are the company’s goals? Which of these will require R&D in order to be realized? In short, what is the R&D organization’s purpose?

Bringing the two strategies into alignment is not as easy as it may seem. In some companies, what passes for corporate strategy is merely a five-year business plan. In others, the corporate strategy is detailed but covers only three to five years—too short a time horizon to guide R&D, especially in industries such as pharma or semiconductors where the product-development cycle is much longer than that. To get this first step right, corporate-strategy leaders should actively engage with R&D. That means providing clarity where it is lacking and incorporating R&D feedback that may illuminate opportunities, such as new technologies that unlock growth adjacencies for the company or enable completely new business models.

Secondly, the R&D and commercial functions need to align on core battlegrounds and solutions. Chief technology officers want to be close to and shape the market by delivering innovative solutions that define new levels of customer expectations. Aligning R&D strategy provides a powerful forum for identifying those opportunities by forcing conversations about customer needs and possible solutions that, in many companies, occur only rarely. Just as with the corporate strategy alignment, the commercial and R&D teams need to clearly articulate their aspirations by asking questions such as the following: Which markets will make or break us as a company? What does a winning product or service look like for customers?

When defining these essential battlegrounds, companies should not feel bound by conventional market definitions based on product groups, geographies, or customer segments. One agricultural player instead defined its markets by the challenges customers faced that its solutions could address. For example, drought resistance was a key battleground no matter where in the world it occurred. That framing clarified the R&D–commercial strategy link: if an R&D project could improve drought resistance, it was aligned to the strategy.

The dialogue between the R&D, commercial, and strategy functions cannot stop once the R&D strategy is set. Over time, leaders of all three groups should reexamine the strategic direction and continuously refine target product profiles as customer needs and the competitive landscape evolve.

-

What we need to deliver it. This part of the R&D strategy determines what capabilities and technologies the R&D organization must have in place to bring the desired solutions to market. The distinction between the two is subtle but important. Simply put, R&D capabilities are the technical abilities to discover, develop, or scale marketable solutions. Capabilities are unlocked by a combination of technologies and assets, and focus on the outcomes. Technologies, however, focus on the inputs—for example, CRISPR is a technology that enables the genome-editing capability.

This delineation protects against the common pitfall of the R&D organization fixating on components of a capability instead of the capability itself—potentially missing the fact that the capability itself has evolved. Consider the dawn of the digital age: in many engineering fields, a historical reliance on talent (human number crunchers) was suddenly replaced by the need for assets (computers). Those who focused on hiring the fastest mathematicians were soon overtaken by rivals who recognized the capability provided by emerging technologies.

The simplest way to identify the needed capabilities is to go through the development processes of priority solutions step by step—what will it take to produce a new product or feature? Being exhaustive is not the point; the goal is to identify high-priority capabilities, not to log standard operating procedures.

Prioritizing capabilities is a critical but often contentious aspect of developing an R&D strategy. For some capabilities, being good is sufficient. For others, being best in class is vital because it enables a faster path to market or the development of a better product than those of competitors. Take computer-aided design (CAD), which is used to design and prototype engineering components in numerous industries, such as aerospace or automotive. While companies in those sectors need that capability, it is unlikely that being the best at it will deliver a meaningful advantage. Furthermore, organizations should strive to anticipate which capabilities will be most important in the future, not what has mattered most to the business historically.

Once capabilities are prioritized, the R&D organization needs to define what being “good” and “the best” at them will mean over the course of the strategy. The bar rises rapidly in many fields. Between 2009 and 2019, the cost of sequencing a genome dropped 150-fold, for example.2 Next, the organization needs to determine how to develop, acquire, or access the needed capabilities. The decision of whether to look internally or externally is crucial. An automatic “we can build it better” mindset diminishes the benefits of specialization and dilutes focus. Additionally, the bias to building everything in-house can cut off or delay access to the best the world has to offer—something that may be essential for high-priority capabilities. At Procter & Gamble, it famously took the clearly articulated aspiration of former CEO A. G. Lafley to break the company’s focus on in-house R&D and set targets for sourcing innovation externally. As R&D organizations increasingly source capabilities externally, finding partners and collaborating with them effectively is becoming a critical capability in its own right.

-

How we will do it. The choices of operating model and organizational design will ultimately determine how well the R&D strategy is executed. During the strategy’s development, however, the focus should be on enablers that represent cross-cutting skills and ways of working. A strategy for attracting, developing, and retaining talent is one common example.

Another is digital enablement, which today touches nearly every aspect of what the R&D function does. Artificial intelligence can be used at the discovery phase to identify emerging market needs or new uses of existing technology. Automation and advanced analytics approaches to experimentation can enable high throughput screening at a small scale and distinguish the signal from the noise. Digital (“in silico”) simulations are particularly valuable when physical experiments are expensive or dangerous. Collaboration tools are addressing the connectivity challenges common among geographically dispersed project teams. They have become indispensable in bringing together existing collaborators, but the next horizon is to generate the serendipity of chance encounters that are the hallmark of so many innovations.

Testing your R&D strategy

Developing a strategy for the R&D organization entails some unique challenges that other functions do not face. For one, scientists and engineers have to weigh considerations beyond their core expertise, such as customer, market, and economic factors. Stakeholders outside R&D labs, meanwhile, need to understand complex technologies and development processes and think along much longer time horizons than those to which they are accustomed.

For an R&D strategy to be robust and comprehensive enough to serve as a blueprint to guide the organization, it needs to involve stakeholders both inside and outside the R&D group, from leading scientists to chief commercial officers. What’s more, its definition of capabilities, technologies, talent, and assets should become progressively more granular as the strategy is brought to life at deeper levels of the R&D organization. So how can an organization tell if its new strategy passes muster? In our experience, McKinsey’s ten timeless tests of strategy apply just as well to R&D strategy as to corporate and business-unit strategies. The following two tests are the most important in the R&D context:

- Does the organization’s strategy tap the true source of advantage? Too often, R&D organizations conflate technical necessity (what is needed to develop a solution) with strategic importance (distinctive capabilities that allow an organization to develop a meaningfully better solution than those of their competitors). It is also vital for organizations to regularly review their answers to this question, as capabilities that once provided differentiation can become commoditized and no longer serve as sources of advantage.

- Does the organization’s strategy balance commitment-rich choices with flexibility and learning? R&D strategies may have relatively long time horizons but that does not mean they should be insulated from changes in the outside world and never revisited. Companies should establish technical, regulatory, or other milestones that serve as clear decision points for shifting resources to or away from certain research areas. Such milestones can also help mark progress and gauge whether strategy execution is on track.

Additionally, the R&D strategy should be simply and clearly communicated to other functions within the company and to external stakeholders. To boost its clarity, organizations might try this exercise: distill the strategy into a set of fill-in-the-blank components that define, first, how the world will evolve and how the company plans to refocus accordingly (for example, industry trends that may lead the organization to pursue new target markets or segments); next, the choices the R&D function will make in order to support the company’s new focus (which capabilities will be prioritized and which de-emphasized); and finally, how the R&D team will execute the strategy in terms of concrete actions and milestones. If a company cannot fit the exercise on a single page, it has not sufficiently synthesized the strategy—as the famed physicist Richard Feynman observed, the ultimate test of comprehension is the ability to convey something to others in a simple manner.

Cascading the strategy down through the R&D organization will further reinforce its impact. For example, asking managers to communicate the strategy to their subordinates will deepen their own understanding. A useful corollary is that those hearing the strategy for the first time are introduced to it by their immediate supervisors rather than more distant R&D leaders. One R&D group demonstrated the broad benefits of this communication model: involving employees in developing and communicating the R&D strategy helped it double its Organizational Health Index strategic clarity score, which measures one of the four “power practices” highly connected to organizational performance.

R&D represents a massive innovation investment, but as companies confront globalized competition, rapidly changing customer needs, and technological shifts coming from an ever-wider range of fields, they are struggling to deliver on R&D’s full potential. A clearly articulated R&D strategy that supports and informs the corporate strategy is necessary to maximize the innovation investment and long-term company value.