As dairy players across the value chain scramble to keep pace with powerful trends in the industry and global economy—and some seek relief in bankruptcy—a handful of companies are finding new growth and building competitive advantages. Based on our research, we believe that while overall growth in dairy will likely remain low, sales will rise sharply in some product categories and in new domestic and international markets, and that winning in a changing marketplace requires new ways of thinking.

Powerful trends are changing the landscape. Dairy prices have risen globally, up 1.7 percent in November 2019 alone, even as trade disputes and rising tariffs in the US, Europe, and China have put pressure on milk prices, shifted market access, and fueled uncertainty. The USDA reports that the value of US dairy exports rose from $5.5 to $5.9 billion in 2019. Other bright spots include the continuous imports from China (664,000 million tons of WMP, 29 percent more than 2018 and the second-best year on record) and the signing of a phase 1 deal with the US; the US-Japanese trade agreement, which has opened doors for US cheese exports to Japan and shifted competitive dynamics in the region as the US benefits now from same access to Japan as New Zealand, Australia, and Canada; the newly signed USMCA, which is opening doors for the US into the Canadian dairy market, and the elimination of Canadian class 7, used for exports out of Canada.

Over half of dairy executives we surveyed in 2019 believe that trade disputes will have a lasting impact on the US dairy market. Despite these concerns, 35 percent of them believe dairy sales volume growth will increase in the next three years.

Challenges will arise, however. As in every other consumer industry, shoppers’ preferences and behaviors are changing. Generation Z, for example, is gaining influence with alternative tastes and demands, including less affinity for traditional dairy products and more interest in health and sustainability. Winning over these new consumers will become more important as they become the largest group globally in 2020, especially because they tend to consume less dairy than millennials or the average American. Americans in general are thinking more about sustainability; the share of consumers who cite it as a major reason for switching products increased from 19 to 24 percent from 2016 to 2019.

For many traditional players, these and other trends have been devastating. In Wisconsin, for example, “America’s Dairyland,” more than a thousand dairy farms have stopped milking cows in the last two years, and more than 200 have disappeared. Dean Foods, the largest dairy producer in the US, filed for bankruptcy in November, and Borden followed suit in January. Both companies are more than 90 years old. But despite serious challenges in the market overall, some players are growing share, volume and earnings. In this brief article, we explain their new recipes for success.

Tough times in the consumer world—and clouds on the horizon

Globally, consumer confidence has reached its highest levels since 2001, but consumer industry revenues grew only 2.5 percent in 2019—while dairy retail volume shrank by about 2 percent and revenues rose by about 0.5 percent, driven by pricing and mix. Retailers still recognize the importance of dairy, but many are now relying on the pricing of private label brands to help drive competitive traffic, which has created mix and pricing pressures.

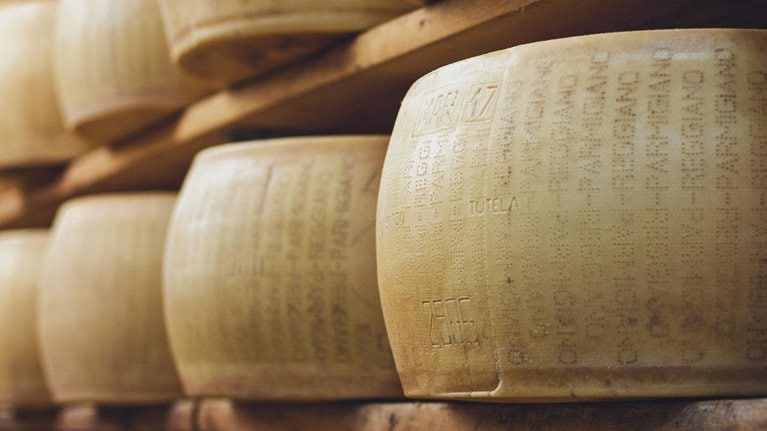

Growth varies across categories. Volume in traditional fluid milk declined from –2 to –4 percent from 2016 to 2019, but revenues have been increasing since 2018. Cheese has been rising since 2017, now at about 3 percent. While overall dairy volume is down in retail, pricing and mix are favorable, particularly in categories such as cheese and yogurt.

Would you like to learn more about our Agriculture Practice?

In this shifting environment, new challenges may be on the horizon. The next economic downturn appears “overdue,” for example. In the US, about half of business executives report worsening economic conditions in the last six months; globally, 23 percent expect a recession or depression in the next six months.1

Leaders should be thinking now about how to weather the next downturn, which we believe is likely to be different from those in the past. The sources of capital are shifting, for example. Private equity has been moving even more to the food industry. Since 2007, interest rates have declined by about three points, and central bank liability in the US and Europe has quadrupled. Two-thirds of consumer company CEOs believe that additional cost-cutting efforts will be difficult,2 since most of the low-hanging fruit has already been taken. Meanwhile, populism is on the rise, raising uncertainty in markets around the globe, and real incomes are stagnant.

The impact of plant-based dairy alternatives on traditional dairy growth

Milk alternatives continued to grow in 2019, even though the overall category, including dairy and plant-based alternatives, is declining in retail.

While some observers credit plant-based dairy alternatives for volumes decline in fluid milk, the forces at work are complex. In fact, changes in consumer patterns, and other beverages like water and tea are responsible for roughly 90 percent of the total traditional dairy decline, while dairy alternatives actually increase the size of the overall category and have only a marginal effect on product transference.

To understand the real impact of milk alternatives—whether they are growing the category, cannibalizing or side-stepping sales of traditional dairy products—we conducted an incremental growth analysis. While dairy volume fell by 290 million gallons from 2015 – 2019 and the volume of plant-based alternatives rose by 50 million, the impact on traditional dairy is less stark. About 56 percent of plant-based sales might be attributed to dairy sales volume decline; the data suggest these overlapping sales were in lieu of dairy purchases. About 44 percent of plant-based sales, or 22 million gallons from 2015 to 2019, were incremental, representing overall beverage category expansion.

The higher sales volume of almond and soy fluids suggests their larger role in cannibalization and incremental growth. Roughly 90 percent of the rest of the decline can be attributed to other beverages, with bottled water contributing to about half of the decline in milk consumption. This analysis reveals that a move into plant-based alternatives won’t necessarily cannibalize fluid milk sales—and could support margin and category growth.

Other pockets of growth have appeared in the last three years, such as in premium high-fat and high-protein products. Premium butter retail revenue grew 5 percent, for example, exceeding butter’s overall growth by two percentage points, while select yogurt brands grew more than 50 percent. Despite trade disputes, sales of high-protein products have grown: export volumes of whey protein isolate were up 7 percent and milk protein concentrate by 5 percent in volume in 2019. These examples illustrate the favorable impacts of pricing and mix on dairy sales growth, and are corroborated by consumer trends. Roughly a quarter of US consumers across generations reported buying more cheese in 2019.

The outperformers in dairy share three crucial traits

Among the 16 dairy companies we studied, the top five in terms of EBITA margin started higher and grew much faster than their average peers, as shown in Exhibit 1. The outperformers vary in terms of size, geography, and business model, but they all tend to excel in three areas: product differentiation, mergers & acquisitions, and resource allocation.

Differentiation appears to be the most important tool by far, according to McKinsey research and polling at the 2019 International Dairy Foods Association board meeting. The outperformers have twice the product differentiation of their median peers— not surprisingly, margins are low on products that consumers consider commodities.

For most leaders, differentiation requires innovation to respond to the changing preferences of US dairy consumers, 42 percent of whom tried a new dairy brand in the last year. Responding to our survey, 86 percent of dairy leaders cited innovation among the three most important ingredients in success; nearly 60 percent say they’re innovating.

Five insights into the views and behaviors of the US dairy consumer

Mergers & acquisitions and strategic resource allocation also correlate closely to value creation. Three out of four winners in the industry have high mergers & acquisitions activity, although only 30 percent of leaders surveyed consider programmatic mergers & acquisitions “very important.” The industry’s rationale for mergers & acquisitions has changed dramatically: while most deal volume from 2009 to 2015 aimed to expand portfolios to new categories, companies now spend more on snapping up challengers in the same category.

Most companies use the same reallocation tactics every year, but the roughly 40 percent who invest human and financial resources in more creative, agile ways deliver significantly higher total returns to shareholders. Indeed, McKinsey Quarterly’s survey of more than 625 senior executives found that the talent-related practice most predictive of winning against competitors was frequent reallocation of high performers to the most critical strategic priorities. Organizations that reallocated talent in step with their strategic plans were more than twice as likely to outperform their peers. Nearly 60 percent of dairy CEOs say they reallocate investments across major business units at least once a year.

These three traits appear to give the winners enduring advantages. Plotting a “power curve” of 16 dairy companies of varying size and type, we found that the four top performers are growing and most of the middle performers are standing in place or declining, as shown in Exhibit 2.

To harness these three tools, most dairy companies need to refocus on where to win, rethink the playbook for resilience, and reimagine how to operate with agility

Some fundamentals of the dairy business have barely changed for thousands of years, but the business environment, and consumers’ preferences and power, are changing faster than ever. We believe that to keep pace, most dairy companies need to think and act in new ways.

They will likely need to refocus on where and how to win. Perhaps not surprisingly, there is tremendously high correlation between a company’s presence in high-growth categories and its overall growth. For example, premium butter sales rose 5 percent in the last three years, as noted, and some Icelandic styles of yogurt grew 35 percent. Companies with the deepest consumer insights will be more likely to spot powerful new trends on the horizon and gain first-mover advantages.

Moving into new categories is difficult, to be sure—only 16 percent of the dairy executives we surveyed said their companies were “very agile” in responding to consumer trends and market opportunities – which is one reason faster-moving competitors keep winning.

In our experience, true agility in consumer products requires more than innovative product design and marketing. Dairy industry leaders are now using advanced analytics and other digital tools, for example, to manage prices and drive share and margin, and to improve manufacturing flexibility, speed, and productivity. Many are also using data to optimize their procurement and supply chains, conserve working capital and improve strategic decision making.

Across industries, leading companies with well-known brands and longstanding relationships with producers, retailers, employees, communities, and customers often find it difficult to rethink their businesses. This is true in dairy, where companies that generate at least a billion dollars in annual revenue account for only about a quarter of all innovation. But they can take a page from giants in other industries. Amazon is not just a bookseller today; Netflix no longer sends DVDs through the mail; Google offers more than a search engine. In other words, making big moves requires thinking in new ways.

The winners in the dairy business in the years ahead may continue to put milk in bottles and cheese in caves. But they will harness their talent, money, facilities, and relationships in new ways and move in new directions—and the most common thread is almost certainly that they will always be evolving.

Notes on our research

To deepen our perspective on these dynamics and inform our recommendations, we turned to four main sources of insight. First, more than three years of McKinsey-led research into 2,000 companies (for the full analyses, please see Strategy Beyond the Hockey Stick gave us data on the three big moves that help industry leaders outperform. We conducted resilience analyses of more than 110 companies, including more than 15 major dairy players, to reveal how companies can thrive in challenging times. We also surveyed and interviewed more than 50 dairy executives—representing roughly 70 percent of the US market—to uncover powerful top-of-mind insights. Finally, to track nuances in the evolving demand landscape, we fielded a behavioral study of more than 3,000 consumers in three countries. The results helped us identify overlaps and discontinuities among executive priorities, market trends, consumer preferences and purchasing behavior.