As executives reflect on 2018, their views on current economic conditions are more downbeat than they have been all year, both domestically and globally. And while pockets of optimism for the economy’s prospects are evident in certain geographies, such as India and Latin America, respondents to McKinsey’s latest survey on executive sentiment express overall cautious expectations for the future.1 The shares predicting conditions will decline in their home economies and the world economy are the highest they have been in years, and respondents in developed Asia report an especially wary outlook on their home countries and their own companies. As they have throughout 2018, executives across the world continue to cite policy- and politics-related issues as top threats to economic growth.

Unfavorable views of current conditions

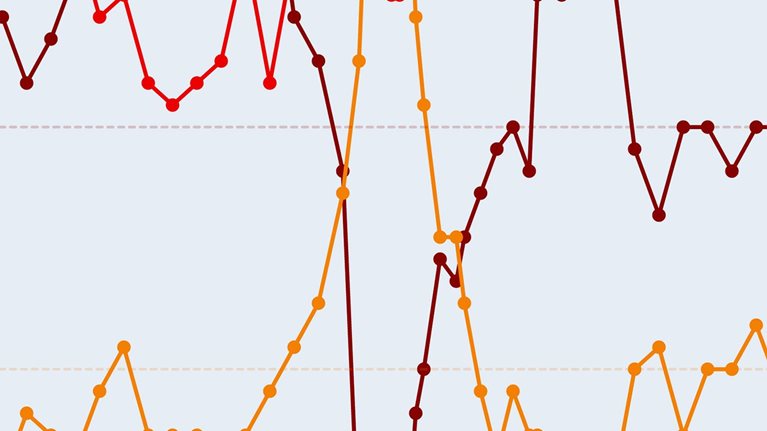

Respondents’ assessments of conditions in their home economies have become gloomier throughout 2018, and respondents are now more likely to say conditions in their countries have declined than to say they have improved (Exhibit 1). Across regions, respondents in developed Asia2 and North America report the largest shifts toward negative country-level sentiment since September. More than one-third of those in North America say their countries’ economies are worse than six months ago, up from 14 percent who said so in the previous survey. And in developed Asia, nearly half of respondents say economic conditions have worsened, compared with 27 percent in September.

Still, emerging-economy respondents are on average more likely than those in developed economies to say conditions at home have worsened in recent months (48 percent versus 40 percent). This was also the case three and six months ago, but the gap between the two groups has shrunk. In September, the share of emerging-economy respondents reporting negative views was nearly double the share of their developed-economy peers.

One glimmer of optimism comes from Latin America, where six months ago, respondents’ expectations were the least positive from any region. In the latest survey, nearly half say their economies are better now than they were six months ago, up from 17 percent in September. Among respondents in all other regions, just one-quarter share that view in this month’s survey.

Respondents’ views of the current global economy continue to darken as well, as increasing shares of respondents have reported worsening conditions throughout 2018 (Exhibit 2). Over half of respondents say global economic conditions are worse now than they were six months ago, nearly three times the share saying conditions have improved. Also, unlike in September, developed-economy respondents are now just as glum as their peers in emerging economies.

Growing concern for the months ahead

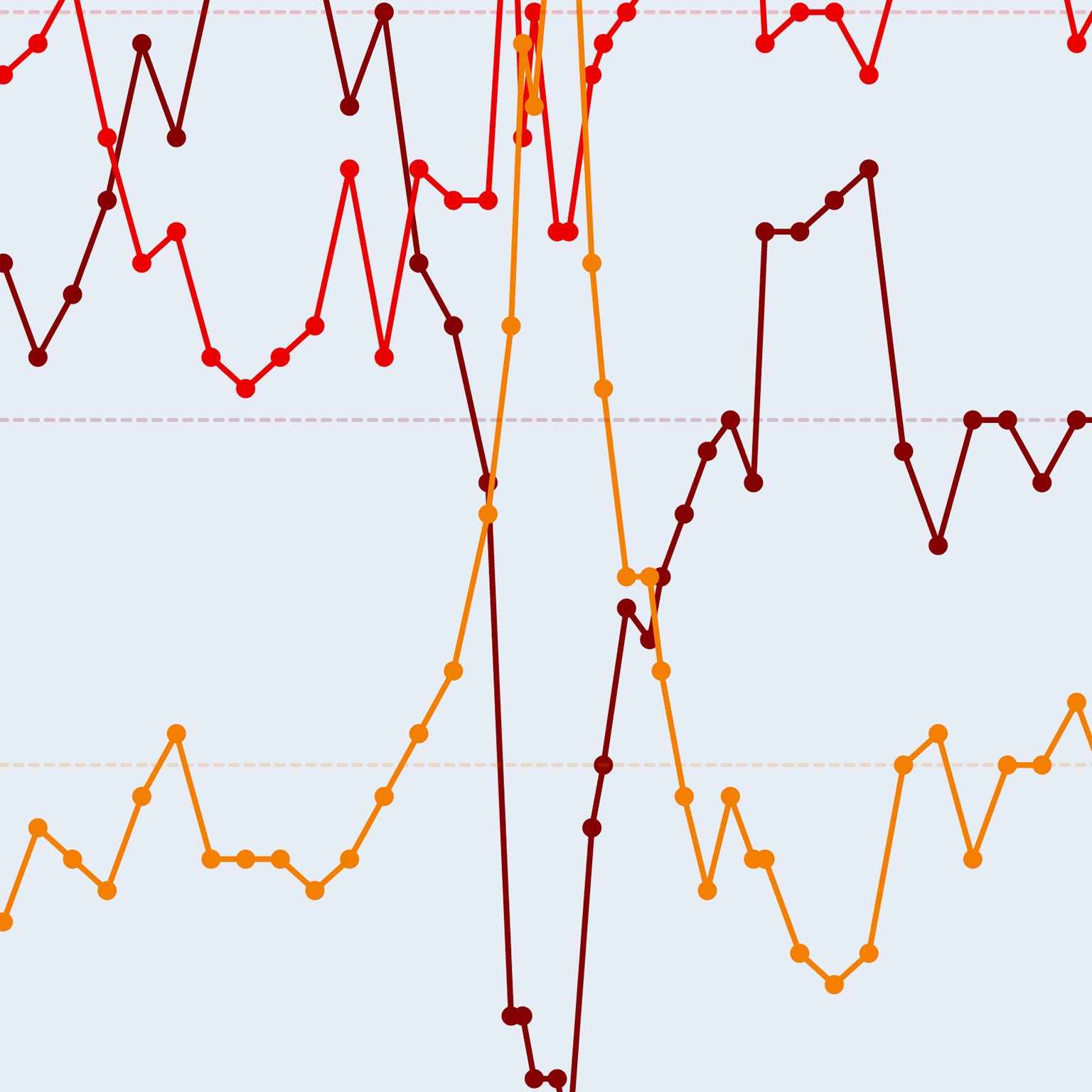

Looking ahead, a growing share of respondents expect conditions in their home countries to decline in the next six months: 42 percent now say so, which is the highest share since April 2009. However, the outlook varies by region (Exhibit 3). Those in developed economies are especially cautious: 47 percent expect conditions to worsen, compared with 31 percent in emerging economies—and a change from September, when the expectations from developed and emerging economies were largely aligned.

Concerns for the future are particularly acute in developed Asia. Respondents in the region are 4.6 times likelier to expect their home economies to worsen over the next six months than to expect improvements. Even when considering their companies’ prospects, respondents in developed Asia are the only ones across regions who are as likely to predict a decline as an increase in demand for their products or services. Executives in the region are now much less likely to expect higher demand than they were in the previous survey (37 percent, compared with 67 percent in September). Likewise, just over half of respondents in the region expect an increase in profits, compared with roughly three-quarters in the previous survey. And what’s more, a smaller share of respondents than in September expect their workforces to grow in the next six months.

What executives think about the economy: 2004 to now

By contrast, India and Latin America are the only geographies where a majority of respondents expect domestic conditions to improve. Likewise, respondents in India and Latin America are the most likely across regions to expect their countries’ growth rates to increase, rather than contract, in the first half of 2019.

The overall shift toward pessimism is true at the global level as well. With each quarterly survey during 2018, larger shares of respondents have predicted that the global economy will worsen and its growth rate will decline (Exhibit 4). The share now saying conditions will be worse six months from now—46 percent—is the biggest since our June 2012 survey. And similar to the views on country-level prospects, developed-economy respondents are likelier than their emerging-economy peers to report a pessimistic outlook for the global economy and its growth rate over the next six months.

Policy- and politics-related risks remain top threats

As has been the case all year, respondents tend to see risks related to policy and politics as the most pressing threats to economic growth, both globally and domestically. For the fourth survey in a row, changes in trade policy are the most commonly cited risk to global economic growth (Exhibit 5). But concerns about trade policy have tempered: respondents are less likely to identify it now than earlier in the year. While geopolitical instability has been cited second most often throughout 2018 as a risk to global growth, the United Kingdom’s exit from the European Union is now the third most commonly cited risk.

With respect to country-level risks, domestic political conflicts have overtaken changes in trade policy as the most commonly cited threat to growth, though each of those is cited by more than one-third of respondents. Transitions of political leadership remain the third most common risk for the third survey in a row, identified by about one-fifth of respondents. Other risks are of particular concern in specific regions. For example, geopolitical instability is an outsize concern in Europe, where the share of respondents citing it is more than double the share of respondents elsewhere. Meanwhile, a slowdown in China’s economic activity continues to be a top risk mentioned by respondents in developed Asia—as it was in September—and leadership transitions are more commonly identified by respondents in India than by respondents elsewhere.

Considering risks to growth at the company level, respondents place changes in the trade environment as one of the top two threats to growth over the next year. As in September, respondents in emerging economies are more likely to cite trade changes as a top risk to their businesses than those in developed economies are. And those in developed economies continue to be more likely than their peers to cite concerns about business-model disruptions in their industries.