In this episode of the McKinsey Podcast, Simon London speaks with McKinsey senior partners Acha Leke and Georges Desvaux about the opportunity before companies to develop and grow their businesses in Africa.

Podcast transcript

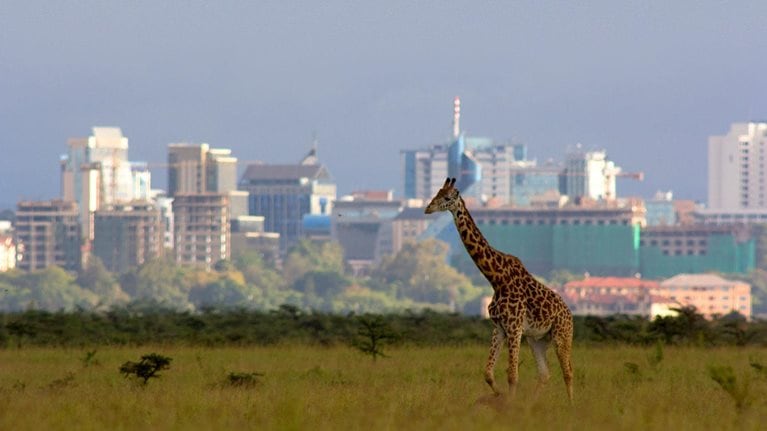

Simon London: Hello, and welcome to this edition of the McKinsey Podcast, with me, Simon London. When you think about Africa, what comes to mind? It’s hard not to be swayed by years of news reports of crisis and conflict. But as we’ll hear, another narrative is starting to take hold. It’s one centered on urbanization, technology, rising incomes, and better government. It’s a story told compellingly in a new book, Africa’s Business Revolution, coauthored by McKinsey partners Acha Leke and Georges Desvaux and McKinsey alumnus Mutsa Chironga. I was lucky enough to catch up with Acha and Georges in person for a wide-ranging conversation about Africa’s business scene today, how and why it’s changing, and why Africa might just be the world’s next great growth market.

Georges and Acha, welcome to the podcast, thanks for being here.

Acha Leke: Thanks for having us.

Georges Desvaux: Delighted to be with you.

Simon London: Imagine for a minute that I’m running a big multinational company. I’ve got options to invest in many different parts of the world. Why should I prioritize Africa? Why should I be thinking about scaling up in Africa in particular?

Acha Leke: If you’re a multinational company, there’s no better place to invest in than in Africa. If you think of the continent today, it’s young, it’s fast growing, and it’s urbanizing. Half of Africans are under the age of 19, so if you’re taking a long-term, ten-, 20-, 30-year view, where else do you want to be?

The continent is going to add another billion or so Africans over the next 20 to 30 years (Interactive). We’ll have the largest working population, larger than China, in 6,000 days. And it’s urbanizing, so we’re the fastest-urbanizing region in the world. Every year we have 24 million Africans moving to cities. To reach them is not that difficult. You decide to focus on a few critical cities.

As you put all that together, when you take a long-term view as a consumer-facing company, it’s hard to think of a better place. I’ll give an example. In Nigeria alone, there are more babies born every year than in the whole of Western Europe. If you’re a diaper company, where would you want to be based?

Georges Desvaux: It’s a little like thinking about whether [companies] should have gone into China 25 years ago. Having lived in China at the time, you can see the parallels playing out in Africa. It’s roughly the same population but also what I find quite extraordinary is the level of energy, the level of development. When you go to a city like Lagos, you really think you are in China 25 years ago.

When you look at this and you look at the energy, the entrepreneurship, the drive, it will probably take a different shape and form, but it will actually develop. There are two differences which I think are very important: in Africa, the young population, as Acha mentioned, will drive the development on a different scale because we’ll get to two billion people in the next 20 years.

Second is the availability of technology. Where Africa is, contrary to where China was 25 years ago, is actually leapfrogging in many places with technology and that opens up a lot more opportunities that people may not have seen at this stage.

Acha Leke: I’ll add one thing that we mentioned in the book: we talked a lot about the population growth. But you also think about the growth of disposable income because what we’re finding is there’s GDP growth and that’s translating into disposable-income growth. When you combine those two factors, it’s more like exponential growth than linear growth. There are very few places in the world today where you will really get those two factors coming together that strongly.

Simon London: You two must spend a lot of time talking with clients about Africa and the Africa opportunity. What are some of the misconceptions that you hear as you do that?

Acha Leke: I would say there’s a big difference between perception of risk versus the reality on the ground. A lot of clients who are not based on the continent tend to read the news and the sensational headlines you hear. And their view of the risk is quite different from what’s on the ground. I used to have a client, a downstream oil company, and they said, “Look, we’re in 30 countries. Every year five will blow up, but we don’t know which ones. But the other 25 will do great.” What they always told me was, “But we love being in Africa because we do very well. And so we’re very happy for people out there to think Africa is too risky.” They would come into the market, and they would have less competition. There’s a big difference between perceived risk and the reality on the ground.

Georges Desvaux: And the other thing that I think people fail to realize is how important Africa already is in terms of the industrial or private sector. It is in fact doing quite well. We surveyed companies to understand how big they are in Africa. When we would ask executives in Africa or outside of Africa how many companies do you think have revenues of more than $1 billion a year, most people would argue between 50 and a hundred.

Acha Leke: Many wouldn’t even say ten.

Georges Desvaux: Some would say ten. And the reality is there are more than 400 of them. Not only are they large institutions but on top of that they tend to grow faster than their peers in the world and be at least as profitable. It’s actually a healthy place if you know what you’re doing and if you know how to capture the opportunity.

Simon London: You’re dead right. I read the book, and I was very surprised to find that number, 400 companies with over a billion dollars of revenue.

Acha Leke: There are only two people who have gotten that number right, and each time we do the presentation we typically ask, “How many such companies do you think exist?” The last time I did it was actually in Barcelona two weeks ago, and the answer we got was between ten and 20. Typically they tell us 50 to 100, one of the two people who have gotten it right was Aliko Dangote, who has a good feel for what’s going on in the continent as we know. He is the richest African and the richest black man in the world. But very few people realize the extent of how big the private sector is and the scale of the kind of companies you can build on the continent.

Georges Desvaux: And part of the reason why they don’t realize how big the private sector is is because 70 percent of those companies are African. If you’re African, you know. Africans CEOs figured out and are very happy with what’s happening and what they are able to achieve. But the rest of the world typically underestimates what’s happening because they heard about all the failures, and the ones who are active and successful tend to be quite understated.

Africa’s Business Revolution: How to Succeed in the World’s Next Big Growth Market

Simon London: Just to be devil’s advocate, the political risk is very real as you pointed out, Acha. There are certain countries, in any given five-year period where there will be more political risk and volatility than there might be in some other regions of the world. How do you respond to that? As a CEO, how do you manage around that?

Acha Leke: Let’s be clear: there are risks. Political is one, so we urge our clients simply to think not just from a growth perspective but also combine growth and risk. When you do that you see three very clear sets of countries that emerge. There are the countries that are quite stable and growing fast. And that tends to be the East African and the francophone African countries. So the Rwandas and the Ethiopias of the world, but also you see some countries like Cote d’Ivoire, Morocco, countries like that. Then you have some that are what we call vulnerable growers, so they’re still growing but they’ve been exposed to some of the shocks. The oil shocks affected places like Nigeria and Angola.

Then you have a set of countries that have struggled to just grow. Places like South Africa. Those are the three segments, and in the past as an executive looking at the continent you could literally go anywhere and you’d find growth. Now you have to be a lot more granular, a lot more careful because there are pockets of growth where it’s more important to really understand the situation on the ground. Because when you find growth, you have to really get a better sense for how the countries are doing but how the sector even is doing in the country you’re interested in.

Georges Desvaux: You also have to look at it and say, this is a long-term play. This is a 20-, 30-years play. It’s the same as China was 30 years ago, India was 15 years ago. Africa is going to be the next pillar of growth because of demographics, because of the natural resources, because of urbanization. And so what you need to do is you need to build the resilience that enables you to manage the risks that are inherent to those three different types of countries that Acha was talking about in order to make sure you are able to go through and weather the storms at some point.

Because you take a country like Nigeria, for example, which many people would say, “Well, it’s difficult, it’s dangerous, there are risks, there is Boko Haram, there are issues.” But there are 180 million inhabitants, with a striving group of entrepreneurs who are really driving very hard to develop their own enterprises, and that’s a force that you cannot ignore.

And you have that with Nigeria, you have Ethiopia with about 90 million people. You have the whole francophone West Africa, which is another 100 million, so those are massive places where people are really trying hard to develop and build their economies.

Acha Leke: Definitely, I think diversifying your portfolio makes sense. What we’ve found is the most successful companies have typically been across multiple countries because like I said, you just never know when something could happen. If you look at the multinationals that have been most successful, they’ve been in ten or more countries and they’ve been here for a long time. So that’s one. But the second thing, which is important, is we’ve also realized in building these companies that have revenues over a billion dollars, it’s very difficult to build a billion-dollar business if you’re not in one of three economies.

If not in South Africa, Nigeria, or Egypt, it’s just very difficult, you just don’t have enough scale. As you think about diversifying your portfolio think also about what is the role that one or many of these three countries will play in that portfolio.

Simon London: Just talk a little bit more about what it takes to win in Africa. The backbone of the book is building for resilience in your strategy, taking that into account. That’s clearly a lever. What are the other things that jump out to you? What’s the secret sauce?

Acha Leke: A lot of the book was focused on what’s the secret sauce. We found four elements to that and I’ll bring them all together, and we’ll talk about each (Exhibit 1). One was, as Georges talked about, mapping your Africa strategy, which is very much about where to play. Which countries should you play in? Do you want to do what I call a Vodacom strategy?

Or do you want a MTN strategy , which is to go across multiple countries at once? You can be very successful at either one, but you need to pick. We always say if you’re a consumer-facing company, think cities not countries. So what 20 cities do you want to be in versus what five countries? But that’s really about, where do you want to play?

Then after there’s innovating a business model. What parts do you want to innovate in? We’ve seen a number of places who have innovated in products and services. We’ve seen others who could leverage technology to innovate. So you have to think about is it just driving costs down to really be one of the lowest-cost producers?

There’s a third element that we’ve talked about, and that’s the resilience. How are you going to build resilience? How do you make sure that you’re here for the long term, because you’re going to have ups and downs. It’s a continent. There are 54 countries. Through ups and downs, how do you build resilience?

And within that is what parts of the value chain do you want to control? We’ve seen a lot of companies that have been successful have had to insource a lot of work they would typically outsource in other markets because they need to gain control of that. And then fourth is talent. How are you going to build the talent you need? And each of these on its own is not rocket science.

But I’ll say two things: where we’ve seen companies that have been successful, they’ve been able to be successful across each of those four elements. They’ve known exactly where to play, they’ve been very careful about where they’re going to innovate, they’ve been very careful about how they build resilience. And they’ve found a way to really grow talent.

The second thing we found, which is actually quite interesting for us, is the most successful companies have come up at it from wanting to do the right thing for the continent. So it’s about what we call doing good by doing well. They didn’t come here just because they wanted to make money. They said, “I want to solve a problem and on the back of that I will make money.” You have a longer-term perspective. You have a mind-set of really trying to make a difference and improving people’s lives. And on the back of that also being a quite successful company for its shareholders.

Want to subscribe to The McKinsey Podcast?

Georges Desvaux: One thing that’s very clear in Africa is you need to really think hard about the product and services and be able ready to innovate. You could say that in most markets in the world, but I think it’s particularly relevant in Africa because the needs are going to be quite local. You need to think about colors and taste and price points, and so it’s not about replicating a business model or services that has worked somewhere else.

There’s an example of this Chinese company that was making smartphones for Africa. They are dedicated to building them for Africa. What they did is they modified the camera’s features so that they can give better rendering for people with dark skin because that is something that is appealing to African consumers. So you really need to go down into the details, in the trenches of what really matters for African consumers, if you want to be relevant to them.

Acha Leke: Equity Bank is a bank in Kenya. What Equity has been able to do is provide banking services to millions and millions of Kenyans. What they did is leverage technology, and so they didn’t go out to build a bunch of branches. Africa has the highest number of mobile money subscribers around the world; 100 million Africans use mobile money. That’s because there’s leapfrogging in that sector. They were not building branches. So that’s one.

But you see a lot of technology innovation across sectors. We started seeing it in the financial-services space. We’re seeing it in energy. So at the time when you want to get energy through a region, you had to build these transmission lines all the way to villages. You would never be able to make a return on your investment. Governments didn’t have money to build it. But now with some systems such as BBOXX and a number of other solar-home-system players leveraging mobile technology and leveraging mobile payment, you can literally buy a solar home system for yourself, take a loan for it and pay on a daily basis, and then pay it off, and on the back of that you can get a loan for another product. (See Exhibit 2 for an example of a solar home system.)

Simon London: Talk a little bit more about this whole concept of choosing where to play in the value chain, and in some cases actually integrating. Just talk a little bit more about why that might matter in the Africa context, and maybe a couple of examples?

Georges Desvaux: This notion of getting a real understanding of where in the value chain you need to create control and quality is very important to success. For example, in e-commerce for a company like Jumia, they will also try to control and improve their last mile and be able to deliver because they have to do it the same way that Alibaba and Tencent did it in China. They were placated because you can’t get the last mile, so you have to control it and you have to have the right service level and you have the right security, safety for the goods, and so on and so forth. So in some cases you just have to have it in order to give the right level of customer satisfaction.

Simon London: And Jumia is Africa’s e-commerce giant or trying to become Africa’s e-commerce giant?

Georges Desvaux: So Jumia is replicating the whole idea of the e-commerce that has happened in China. They have 400,000 merchants online. It’s developing very well, and it serves a need. The need is interesting because we talked a bit earlier about why would that work? Part of the reason and what they’ve found in Jumia is that a lot more of their sales came from the rural areas than expected. They expected everything to come from urban areas, and part of the reason is because there is no availability of retail stores.

People who have decent income in more rural areas, they don’t have the time, they can’t really access an urban center, and they’re very happy to transact online as long as they can get the delivery there. And so you come back to how do you guarantee—

Simon London: And that’s the last mile?

Georges Desvaux: And that’s the last mile.

Simon London: So Amazon or whoever you can rely on, the United States Postal Service, or UPS, or whoever does your deliveries, but that’s not available in rural Africa so they have to own that piece of the value chain.

Acha Leke: We always talk about Dangote. Twelve years ago, Nigeria imported all of its cement. Every bit of cement was imported and then-Nigerian President Olusegun Obasanjo had this discussion with him. He said, “What’s it going to take for your cement importers to produce locally?” And Dangote said, “Well, give us an incentive to produce locally.” What they decided was to implement what they called backward-integration policy. They said they’d only give licenses to import cement to those who can show them that they’re building cement plants.

They said, “This year you can import X amount and that’s going to decrease every year. And after four years, you shouldn’t import anything else. You won’t have a license to import because your plant should be up and running.” Fast forward: today Nigeria is a net exporter of cement. So they produce enough for the local market, and they export it, and they’ve created the richest black man in the world.

So there’s a big piece around import substitution. That’s very important for our countries. We still import billions of dollars of food every year across the continent. And how much of that can you produce locally. That’s important. And then as a company what you then need to do once you decide where you want to play there is understand how much of your inputs you need to control because of the inefficiencies in the ports; the inefficient infrastructure is a problem.

Dangote, for example, has 10,000 trucks to go deliver the cement in more advanced markets. He could outsource that to somebody. But that’s a huge competitive advantage to him, understanding where your company’s advantage is and how you can control that.

Georges Desvaux: There is a massive need for producing locally for local demand. We estimate that there’s about $500 billion worth of industrial manufacturing in Africa. We believe it could be doubled within a decade.

Simon London: So to a trillion?

Georges Desvaux: Roughly a trillion. But of that, contrary to what China was 30 years ago, in Africa, two-thirds would be for local consumption. All of this can be produced, and it’s an opportunity that, for example, Chinese companies have seized. In Ethiopia, you have the largest ceramic tile factory in Africa and it was built by a Chinese company. It is one of the market leaders. And that has been replicated many times. So there’s also this notion of just going where the needs are and building the right service model because the demand is there.

Acha Leke: It was funny because of that $500 billion of products that are manufactured today, Chinese companies account for about 12 percent. These are not products manufactured in China and imported on the continent. These are Chinese companies like the ceramic tile manufacturer based in Angola, in Kenya, in Cameroon, in Senegal, manufacturing locally about 12 percent of Africa’s full production.

Simon London: I was going to ask you about that because there’s been some McKinsey research when one reads about it in the media as well. On the ground, it’s a very real phenomenon?

Georges Desvaux: China in Africa is incredibly real. It’s interesting because I think there are a lot of myths about Chinese presence because what’s generally reported is the whole infrastructure project and the project financing by the Chinese government and all of this, which does exist. But what I think is misunderstood is the sheer economic presence from the Chinese private sector. Our own research, we had to interview a thousand Chinese companies in Chinese to understand what really was happening.

We believe there are about 10,000 Chinese companies operating in Africa. But 85 percent of them are private and they’re private because these are Chinese entrepreneurs who 25 years ago in China built a manufacturing plant for flip-flops or for ceramic tiles. They realized that they can replicate this because they look at the market, there is a market, there is demand. There is just no supply. And so they build it. It’s beneficial for Africa because about 85 percent of their employees are African. It is really an economic force that is misunderstood very often.

Simon London: So, as you say, the Chinese entrepreneurs, they’re creating a lot of jobs. They’re actually leveraging local talent. It’s one of the themes of the book, as you mentioned, Acha. It’s part of the secret sauce is that getting the talent right on the ground in Africa. Again, imagine I’m a CEO, what’s the advice you give to me about how I think about talent in Africa?

Georges Desvaux: One of the things that always has been striking for me is, and quite different, I would say than Asia, to draw the parallel, is very senior leadership or top talent. You have very, very good talent in Africa. Very well educated. They went to all the best universities, come back, and there is a passion to be there. You also have the people at the front line who are extremely ambitious, want to develop, and they don’t always have the right craftsmanship.

What’s really going to be a struggle for most people is going to be to develop the intermediary talent and to develop leadership over time. And that is really one of the challenges that we’ve heard many times. And so some people like Jumia, for example, have created a university to try to build their own middle management and build them over time. Some other people like an oil company, for example, is building technical and vocational training to create whole families of mechanics who can then open up their own garages that can then use the right products. The challenge is going to be around vocational talent and early management.

Acha Leke: I think I would agree. Over time as a multinational the question is, how do you Africanize your talent, right, and make it much more African? Some companies like GE and Standard Chartered, have been very, very successful. So there’s a way to do it. To Georges’s point, for the frontline workers, just also rethinking a bit what success looks like and what are the markers for success in these candidates? And take a bit of risk.

Simon London: And being prepared to be flexible, to do some investment where you might not do it in other parts of the world. And to your point, Georges, thinking long term as well.

Georges Desvaux: That’s going to take time to grow the talent and it has to be part of your strategy from day one. What you need to put in place is systems and the processes to make sure it happens. You give them the opportunities, give them the right coaching, the right training, and then when you do that, it grows over time. But the other thing about talent is an opportunity that’s linked to diversity and gender diversity. You have a very strong talent pool with women, and women in Africa are already playing an important role in the economic society. That’s also an area where you have an immense potential to develop talent and to develop strong African women leaders. Some of them are very impressive whether they’re in the governments or others. They’re quite influential. It is an area where I think, especially for multinationals, you have access to terrific talent.

Simon London: A lot of our conversation so far has been very positive and rightly very positive. There’s a lot to play for in Africa clearly. But there are also some pretty big barriers to doing business in Africa. What’s the reality of doing business on the ground and what are some of the barriers just to getting things done?

Acha Leke: There are clear barriers. Infrastructure is one. Look at the continent today, we are spending $80 billion a year on infrastructure. We used to spend $40 billion but we need to spend $150 billion. Infrastructure gets in the way, whether it’s power, or it’s roads, or it’s airports, ports, across any asset class. We’re completely underindexed relative to any other emerging market. There are ways around it, but that’s a barrier.

Ease of doing business if you look at the World Bank rankings. Many of the African countries are at the bottom of that ranking. A number have improved significantly. Nigeria, for example, went up 24 places last year.

Rwanda has been a darling, as Mauritius has been. A lot of countries are making efforts to reform and make the business realm an easier.

Simon London: And ease of doing business to be practical is?

Acha Leke: Permitting. Starting the company. Paying taxes. Getting access to electricity for your business. All the normal things that business would expect that will be provided to them. Progress has been made on that but still a lot more needs to be made. Corruption is another issue that people talk about a lot on the continent, which is real. But it takes two to tango in this front as well, so it’s not just blaming the government.

There are a number of challenges, but those who have been successful have been those who have been able to take these challenges and recast them as opportunity. Because behind every challenge is an opportunity, and that’s what differentiates the winners from the losers.

Georges Desvaux: Those barriers are real. But you have to take them into the perspective of, are they being addressed? Are they improving? The regional groupings—East Africa community, inside those regions, you can see the trade going up 15 percent or more. (See Exhibit 3 for a look at the eight economic communities on the continent.) Things are progressing, and to some extent, they remind me a little bit of the early days of China and Southeast Asia, where, in 2000, if you wanted to deliver trucks from Beijing to Guangzhou, you’d take two or three weeks and you had to stop at every border, at every provincial border. And there are no highways. That’s where you are. But, it will get there, and you can find ways around it in the meantime. And then as the barriers improve, your business opportunity will continue.

Acha Leke: And I’ll give you another example: travel across Africa. McKinsey has been working in partnership with the African Development Bank and World Economic Forum on this because if we’re going to—we could talk about Africa, but it’s 54 countries. To be able to increase intra-Africa trade, the 75 percent of manufacturing for which there are opportunities in Africa needs to circulate across the continent. We need people to be able to travel around.

Five years ago, we did this analysis and we showed then that, on average, an African needed visas for 60 percent of African countries. At the time, a European needed visas for 52 percent of African countries and an American needed visas for 45 percent of African countries. So it was easier for an American or European to travel across the continent. There were only five countries that allowed any African to travel—either you could go there without a visa or you could just get it on arrival. Only five. And we’ve been doing a lot of work, and we published a report every year that now the African Development Bank publishes called African Visa Openness Index, and the good news is today we have 20 countries. We’re up to 20 that allow visa-free access to any African. That’s out of 54 countries, so we still have a long way to go. But that’s the kind of progress that has been made in five years. You already see a lot of impact on tourism, so a lot of impact on intra-Africa trade, and just travel from Africans visiting those countries. We’re hoping to see much more of that going forward.

Simon London: I know there’s ambitions for an Africa-wide free-trade area. Do we think that’s going to happen in reality, and it’s been approved in principle but now needs to be ratified.

Acha Leke: It’s happening, we have a lot more countries. I think South Africa has actually signed up now. I think the only big country that hasn’t signed up now is Nigeria. So it’s going to happen. I think we realize it’s 54 countries, and for us to really grow as a continent, we need one big economic community for us to be able to speak to a China or speak to an India. India and China each have the same amount of people, but it’s one country. Under the leadership of African Union Chairman Paul Kagame, we got it ratified, which is great. You need a lot more countries to come on board. You need it passed by the local parliaments, but we’re going to get there because everybody realizes that that is critical for us to be able to carry our weight as a continent globally.

Simon London: I think that’s all we have time for, but, Acha Leke and Georges Desvaux, thank you very much for joining us. Great conversation.

Acha Leke: Thank you for having us. We’re looking forward to seeing many more companies accessing the African opportunity.

Georges Desvaux: Thank you again, and we hope that you will enjoy the book and that it will draw your interest into very practical actions to be present in Africa.

Simon London: And thanks as always to you, our listeners. If you want to learn more about Africa’s business revolution, you can buy the book online or look out for it at your local bookstore. Or please visit us at McKinsey.com.