Unit-linked products (ULPs) are a pillar of the global life insurance industry. They combine individual investment strategies with the protection of an insurance policy under one plan, providing customers with an incentive to save in the long term, especially for retirement purposes. Yet in Asia–Pacific, ULPs have underperformed overall in recent years, with varied relevance and performance by market. Since 2014, their overall market share declined from approximately 16 percent of total premiums to 10 percent, while traditional products, such as participating funds and protection, make up most of the rest.

Using McKinsey’s Global Insurance Pools data, we investigated the state of ULPs in Asia–Pacific life insurance. In general, we see an opportunity for ULPs to catch up with other life products, especially considering fast-growing personal financial assets in the middle class, an ineffective allocation of assets, and a growing retirement gap—all of these can be addressed through ULPs. Based on our analysis, we offer three considerations to help life insurers shape their approach to ULPs: understand market dynamics (and how to meet both supply and demand needs), advance unit-linked product propositions, and enhance customers’ financial-planning capabilities.

1. Understand both emerging and mature market dynamics

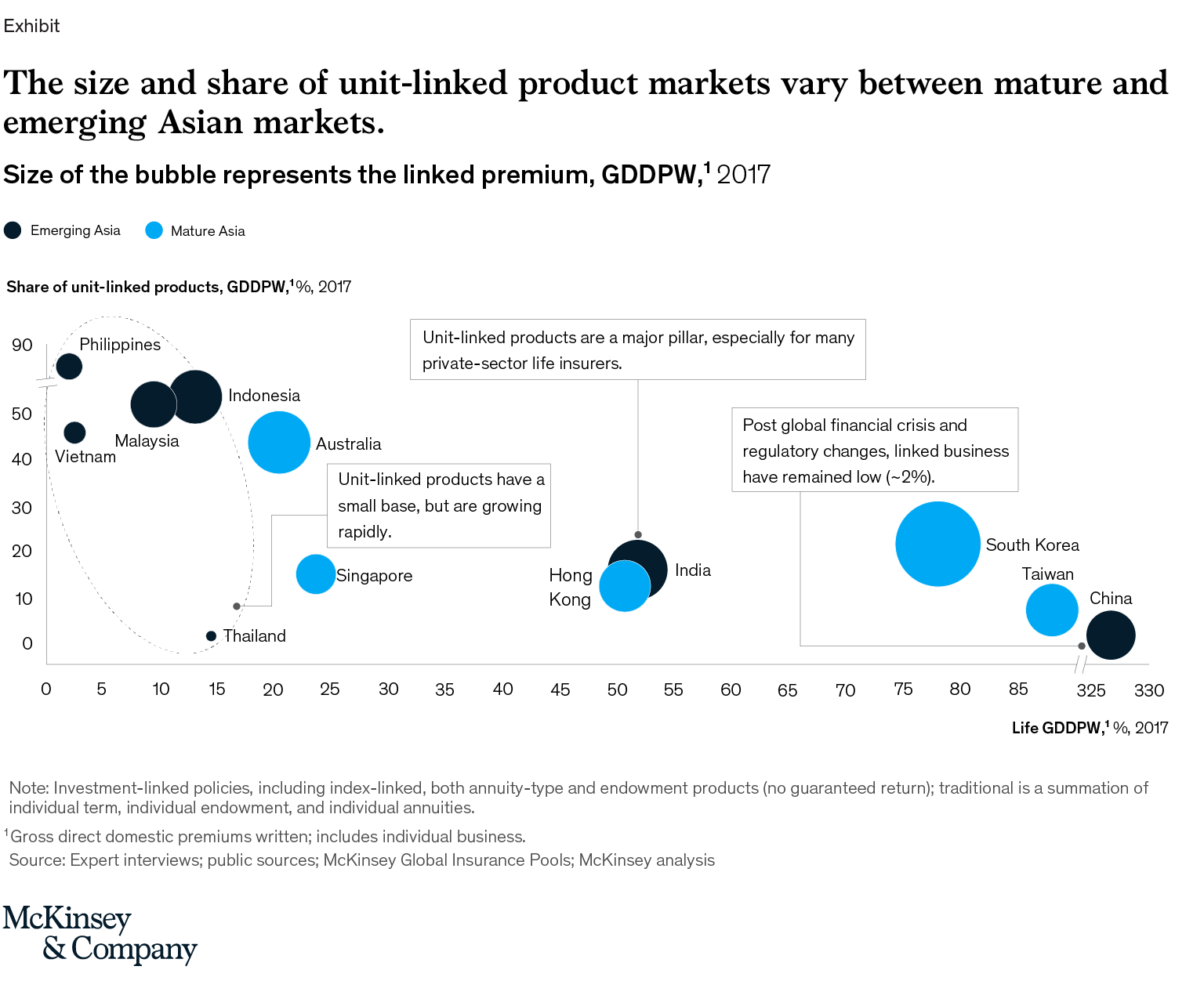

Currently, the share of ULPs across Asia–Pacific is uneven. China is an extreme case, with ULPs making up only 2 percent of premiums thanks to a regulatory push against short-term investment products. Other big markets—Hong Kong, Japan, Singapore, South Korea, and Taiwan—also have comparably low market share in the range of 15 to 25 percent. In contrast, most Southeast Asian markets are dominated by ULPs—Indonesia, Malaysia, and Vietnam all have ULP market shares of around 50 percent (exhibit). Understanding these differences and the dynamics of each market can help carriers better tailor their approaches to each market.

Looking ahead, ULPs are well positioned to meet a variety of different market needs from both the demand and supply side.

From the demand side, Asia–Pacific’s emerging markets have a burgeoning middle class with fast-growing personal financial assets. As customer sophistication increases, this group will be more open to allocating funds into tailored individual financial solutions, especially as an alternative to cash and real estate. More specifically, ULPs offer a potential solution to consumer concerns around retirement income, offering appealing investment and protection features. ULPs could also be a source for innovative underlying asset allocations and investment strategies appealing to affluent customers in mature markets.

From the supply side, many insurers aim to complement their large general account base of participating and guarantee products with more investment-oriented offerings to tap into a wider customer pool. Also, ULPs avoid spreading risks and have a lower capital requirement from asset liability management and market risks, which becomes more relevant as solvency regulations tighten across markets.

2. Advance unit-linked product offerings

Most ULPs across Asia–Pacific are structured around actively managed fund portfolios comprising mainly equities.

Life insurers can tailor ULPs to better meet the specific needs of different customer groups, making them more distinctive and individual relative to other offerings. They can do this by broadening underlying asset classes and products, supporting their preferred investment styles, enhancing investment strategies, adding financial risk management, and guaranteeing options through reallocations and hedging.

To develop these new offerings, insurers should enhance their in-house capabilities in investment operations, risk management, and marketing. Carriers should also focus on developing new kinds of partnerships with banks, asset managers, and reinsurers. Of course, the likelihood that insurers will succeed with this strategy depends on the availability of cash assets and the sophistication of capital markets as well as the regulatory environment.

To advance ULP products, insurers should consider four actions:

- Offer a broad range of assets, from low-cost exchange-traded funds solutions to more distinctive asset classes and products, including foreign-exchange products.

- Provide distinctive investment strategies and dynamic asset-allocation solutions that allow clients to adjust their risk-return preferences over time.

- Offer financial risk management and capital markets–based guarantees, either through hedging strategies or through ULPs with contract terms that allow customers to adjust their risk setting as their risk profile changes.

- Combine flexible protection elements with unit-linked investments, allowing various insurance covers to be adjustable over time and provide a link to retirement income.

3. Enhance customers’ financial-planning capabilities

More than half of Asia’s middle class has no financial-planning support. They are likely unaware of the benefits and risks of most investment products, including ULPs, which allow individual tailoring and flexibility for customers in asset, investment strategy, and risk-return choices compared with more traditional insurance products.

However, educating consumers requires carriers to build capabilities and enhance technical support. Today, only a few agents and relationship managers are equipped to offer this financial planning advice at scale.

The carrier’s distribution channel and regulatory environment will influence which approach it takes to help consumers with financial planning.

Insurers can enhance their financial-planning capabilities in three ways:

- Strengthen customer financial literacy and foster an understanding of retirement and long-term savings and protection needs through B2C content marketing, communication, or simulation tools.

- Improve the advisory skills of subgroups of agents and advisers through special training and even advanced licensing.

- Provide tech-enabled advice tools to support agents or provide self-guided product configuration. Robo-advice tools could also improve customer-service quality and documentation of customer issues.

ULPs have lagged behind other life products in the Asia–Pacific market, but we believe insurers can catch up. Indeed, there are reasons to be optimistic given evolving customer needs and interest in savings. Life insurers aiming to tap into customers’ growing personal assets and play a more meaningful role in their long-term financial planning can use ULPs as their value proposition.