Lessons for new CEOs: Go big, go fast, or go home

How do you get off to a great start as a new CEO? There is no shortage of literature on the subject from seasoned executives, management advisors and scholars, but much of it is qualitative and anecdotal. We at McKinsey love our data, so recently my colleagues and I sought to find empirical links between new CEOs’ strategic actions and company performance. We examined major moves that almost 600 CEOs took during their first two years in office, then assessed how those moves influenced the company’s returns and the CEOs’ tenure.

Some of the results surprised us. But, above all, two points came out loud and clear. New CEOs should:

- make big, decisive moves quickly; and

- adopt an outsider’s perspective when they evaluate the business, whether they themselves come from within or outside the company.

Here are the key takeaways from our research.

Don’t follow the herd.

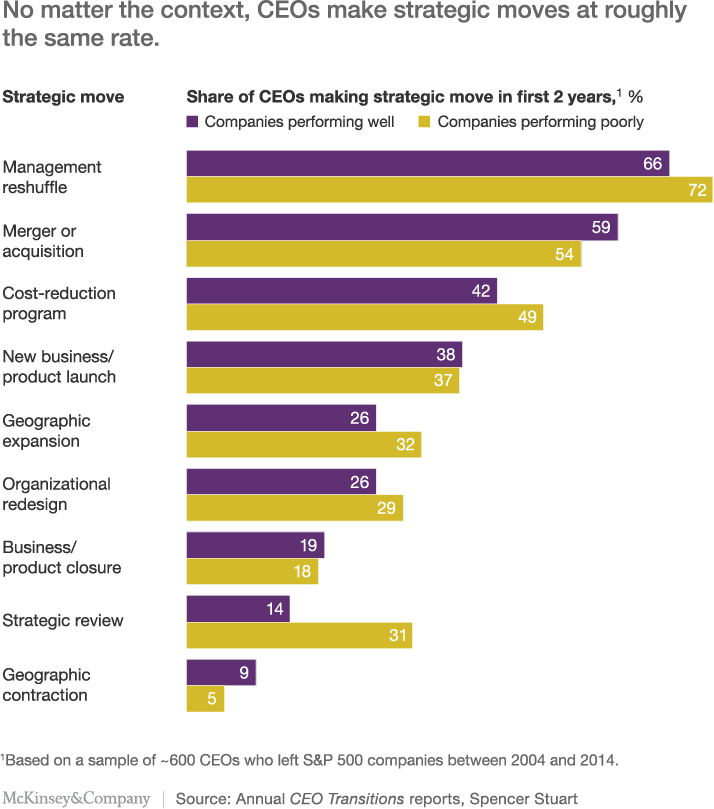

We expected that CEOs taking the helm at poorly performing companies would have a greater propensity to make strategic moves, because they’d feel compelled to try new ways to improve results. Yet we found that new leaders take similar actions, and with similar frequency, regardless of the company context.

Not surprisingly, the effectiveness of these actions differs significantly.

Consider:

- Undertaking an organizational redesign correlates with 1.9 percent performance improvement at thriving companies, on average, but not at low performers

- Strategic reviews correlate with 4.3 percent performance boost on average for companies that lag competitors but are less helpful for thriving corporations

- Underperformers enjoyed an improvement on average when they reshuffled their management teams. But when well-performing companies did so, they destroyed value.

The lesson: New CEOs need to assess their starting points carefully before deciding how to act. There isn’t a standard CEO playbook that suits every situation.

When you’re behind, use the whole toolkit.

Last year, I presented some of our research on successful CEO transitions at a leadership retreat for potential CEOs in Napa. One participant asked how aggressively a leader taking the helm of an underperforming organization should act. It’s a tricky balance: do too much, too fast and the organization might not be able to cope; too little, too slowly and the opportunity goes begging.

The data suggests the path. On average, CEOs taking leadership of underperforming companies do better when they make more big moves. Those who pulled four or more strategic levers during their first two years achieved an average performance boost of 3.6 percent relative to peers, while their less bold counterparts eked out only a 0.4 percent increase.

That doesn’t mean you should do everything at once, but it does suggest that—in business, as in classical mythology—fortune favors the bold. These findings are in line with other research my colleagues and I have done, which showed that companies tend to perform better when they shift more resources between business units to capture new opportunities.

Adopt an outsider’s mindset.

One of the most intriguing findings is that CEOs hired from outside the company deliver better results on average than insiders. Why would that be? The data gives us a strong clue: External CEOs have a greater propensity to act. They are more likely to make six out of the nine strategic moves we examined in their first two years, perhaps because they are typically able to view the situation with greater objectivity and are less encumbered by organizational and personnel history and politics.

That doesn’t mean that companies should necessarily hire outsiders—indeed, more of the CEOs in the top 20 per cent are insiders—but it does highlight the importance of combining dispassionate analysis of the situation with a readiness to act boldly. One internally promoted CEO whom I have observed closely posed this question to the organization: If a private-equity firm bought the company or an activist investor took a major stake, what would they do and how fast would they act? He then led the management team to match that ambition for change, redesigning the organization, reviewing the strategy, reshuffling the management, closing businesses, exiting geographies, and then making a transformational acquisition. He took the lens of an active owner—and he and the company have been rewarded with standout shareholder returns relative to industry peers.

Time is not on your side.

Finally, while it’s true that new CEOs have a singular opportunity to shape the companies they lead, the window doesn’t stay open long. On average, an inflection point arrives during the third year of a CEO’s tenure. At that point, the chief executive whose company is underperforming is roughly twice as likely to depart as an outperforming company’s leader—by far the highest level at any time in a chief executive’s tenure.

I encourage you to read a more detailed exploration of our findings in this recently published article.

Michael Birshan is a partner in McKinsey’s London office.

Originally published on LinkedIn.