In this episode of our Inside the Strategy Room podcast series, McKinsey’s Sean Brown introduces Deanna Mulligan, the president and CEO of Guardian Life Insurance, who spoke at a recent event introducing the book Strategy Beyond the Hockey Stick: People, Probabilities and Big Moves to Beat the Odds (John Wiley & Sons, February 2018). An edited transcript of her remarks follows. (Subscribe to the series on Apple Podcasts or GooglePlay.)

Podcast transcript

Sean Brown: Today we’ll hear from Deanna Mulligan. Deanna is the president and CEO of the Guardian Life Insurance Company of America, a role she’s held for the past eight years. Guardian Life is a Fortune 220 company based in New York, and one of the largest mutual-life-insurance companies in the United States.

Before joining Guardian Life, Deanna held senior positions at AXA Financial and New York Life, and she was also a partner at McKinsey. Deanna recently joined McKinsey senior partner Martin Hirt in New York at the launch of McKinsey’s book Strategy Beyond the Hockey Stick, which Hirt coauthored with Chris Bradley and Sven Smit.

Deanna reflected on how, along with her team, she’s applying the strategic levers in the book to develop a strategy for a company that’s starting with a strong endowment but that’s working in an industry facing headwinds. Here’s Deanna Mulligan.

Deanna Mulligan: Thank you very much. I’m honored that you invited me to come speak about our experiences with strategy here tonight. I think many of you probably know Guardian, of which I’m the CEO, but for those of you who don’t, we’re a Fortune 220 company, we’re based here in New York, and we are a mutual company. We’re owned by our policyholders, and therefore we don’t have some of the restrictions, some might say, that stock companies have. However, we do have policyholders, a board of directors, and rating agencies, and so we have some of the same pressures in terms of people wanting to understand how we’re doing quarter to quarter.

Subscribe to the Inside the Strategy Room podcast

I found this book very applicable to a situation that we’re going through right now, and we are going through a strategy process. I had an advanced copy of this book, and I gave it to one of my staff members, and the first thing he said was, “Wow, there’s some really funny cartoons in here. I didn’t know McKinsey could be funny.” He was very taken. He actually photocopied a couple of cartoons and handed them around in a meeting.

I wanted to make a comment on the few pieces of the book that struck me particularly. The first thing is that this is heavily data driven and quantitative—most strategy books aren’t. As an insurance company, we have a lot of people who are data nerds; we are just nerds. I thought, “Finally this is something I can give my team that they’re actually going to believe in.” It’s obvious that the data is tractable.

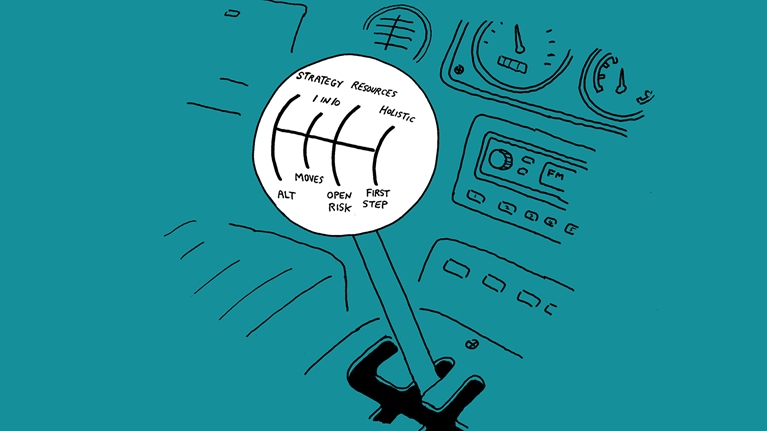

I’d also like to reflect on a few of the experiences that we’re going through now, that are relevant in the book, and give you a little context on where we stand with some of the ten levers. I came into the job I’m in with a good endowment for the type of company that we are. Unfortunately, being in the insurance industry, our trend is not terrific. We’re not in a fast-growing industry. It is, if anything, the opposite.

What my team and I are left with are the moves. I started thinking through each of the moves: what we’ve been doing, what we’ve been told by others, how we think about it, and then how this book is game changing on a few.

First, the M&A and divestments program. We have been on an M&A program for about five years, and we’ve made a lot of small acquisitions. Sometimes it’s hard to tell just one, two, or three years into the program what the impact is going to be, but I think we probably would have been a little bit bolder in some of the acquisitions if we’d had the data in this book.

In terms of resource allocation, I think this is where the social side of strategy really comes in. Those of you who have worked in big companies know that it’s hard to take resources away from powerful business-unit heads, even if you’re the CEO. Because there is a social component when you say to somebody, “Sorry, you’re either not getting enough return on the money we’ve allocated to you, or your business isn’t as important as we thought it was when we allocated it to you.” Thinking through how to deal with the people part of that is going to be important.

One of the conversations that we’re having as a team is about introducing the notion of corporate assets. We’re treating people as corporate assets. I have actually clawed back the career decisions about certain people and said that person is a corporate asset, because they’re either so talented, or they’re in a position that generates so much economic value for us, that we have to think of them as a corporate asset.

I was having this conversation with one of my directors who said, “Well, you know what’s next? Now you have to start clawing back certain pieces of people’s budgets and make that a corporate asset as well.” Which is what you say in the book. So we’re on the beginning of that journey. But I have to say, sometimes when I come home from those meetings I’m exhausted, and I think my team is too, because those are very difficult conversations to have if you haven’t had them in the past. And absent data to the contrary, some teams will just choose not to have those conversations.

Capital expenditure is interesting. Again, I think this is where a lot of companies go for the peanut butter because it’s easier and less risky to place lots of small bets. To go to the extent that you’re talking about here, in terms of changing your capital-expenditure budget or making it a lot bigger, obviously there are trade-offs to that. The trade-off is earnings now or earnings this year versus investment for the future. This is a conversation that we’ve all been having, because we know we need to make a lot of technology expenditures, because we’re in an industry that hasn’t quite yet been fully disrupted. We can see all the beginnings of the disruption coming, and we have been making capital expenditures, but if we follow the advice in your book, they’re going to have to be much bigger.

What that means is a conversation with the board and shareholders where we say, “We’re going to be earning less, and we’re going to be dropping less to the bottom line, because we’re going to be making these big capital-expenditure bets.” When you have the data and you read it, it makes sense. When you actually have to do it, it’s difficult.

My team and I have already been having this discussion. We had a small one with our board just yesterday and said, “Here’s a waterfall chart. Here is where we were last year. Here are all the ups and downs of our earnings. Here is where we think we’re going to be next year. And here is what we’re going to invest in the future—and that’s another subtractor from the waterfall chart.” I think it’s important to show how our business would generate this in earnings, but in order to invest in the future, this is the piece that we’re going to set aside for capital expenditure. It’s a tough thing to do.

Productivity improvement is also interesting. I love the statistic of 25 percent more than your competitors. We’re already ahead of our competitors, we think, in productivity. We’ve worked hard to get there. But I now have to go back and check whether we are really 25 percent ahead. If we’re not, I’m going to have some disappointed people on my team, because we already have a lot on our plate.

It’s the same with differentiation improvement. I read this almost as pricing power, in some ways. You either have pricing power or you don’t. To improve where you are in pricing power, you have to implement a whole strategy. That’s a strategy embedded within the strategy.

Subscribe to the Shortlist

McKinsey’s new weekly newsletter, featuring must-read content on a range of topics, every Friday

As I read the book, I think a lot of CEOs might think, “M&A is an easy one.” Either you’re the type of CEO that likes to go for the big dramatic move or you’re not. The social side comes out in terms of the strategy room, and definitely with the team it’s important, but I think where the social side really comes out is with the board and shareholders. And with your rating agencies. Sometimes it takes a long time to build that up. It’s hard to burst onto the scene with a new strategy and say, “We’re going to do things totally differently.” Even if you have the data to back it up. It’s easier to do if you have been delivering on what you’ve said you’re going to deliver on over a long period of time.

I think there is potential here to change the way companies do business and the way companies think about strategy. I think the good news is that so many companies can make it out of that mushy middle to the top. I know there are statistics in the book about the numbers who fall to the bottom. But I think somewhere in the book it talks about the number of companies in the middle who made big strategic acquisitions—and almost nobody fell to the bottom, and almost everybody moved up. So there is some hope in the book, that most companies don’t do this, but the ones that do, even if they don’t do it perfectly, if they do it big enough, their odds of moving up are greatly improved. And to me that was counterintuitive. I’m thinking that part of the reason for that is technology. We’re turning into a winner-take-all economy in terms of the way technology companies grow.

I would sum up by saying I have read a lot of strategy books, and I find that I rarely make it past the first chapter or two. I do think this book, for a data geek in the insurance industry, is groundbreaking. For the industry I’m in, where we all try to make small improvements, because we have such a long tail in most of our businesses, it’s hard to pull a big lever. You don’t see the consequences for a long time, so it makes it even more difficult to judge whether you’re doing the right thing. To be in a business like ours, where we sell risk management, and for you to come out and say, “Take more risks, take bigger risks, pull more levers,” it’s highly counterintuitive. But I do believe the data. The good news for our industry is that we have a lot of data geeks, and so we can convince them with data. I think this is going to be a great discussion starter with my team. Thank you.