Attracting and keeping the right talent in the United Kingdom has never been as challenging as it was in 2022. While the record-tight labour market conditions are set to ease somewhat in 2023, recruitment, retention, and pay pressures will not abate as evenly. Long-standing issues, such as an ageing population, skills shortages, and structural tightness in some sectors, mean that organizations need to be prepared for a continued war for talent.

The UK labour market is already easing, but from its tightest-ever level

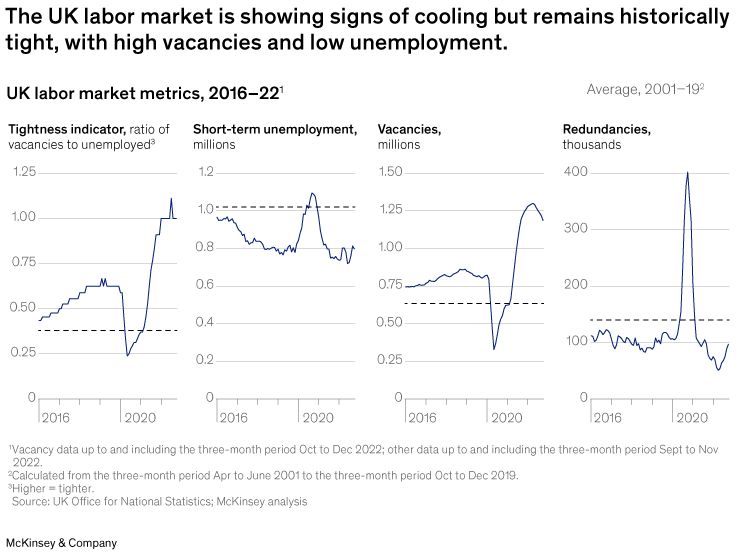

Despite COVID-19 inflicting the largest shock on the UK economy since World War I, employment has recovered remarkably quickly. By January 2022, unemployment—which rose to 5.2 percent during the pandemic—had already declined to 3.5 percent—below its pre-pandemic level. The previous time unemployment had been this low was nearly 50 years ago, in 1974. Last year there were also fewer redundancies and record-high vacancy rates in every sector of the economy.

One consequence of such tight conditions for labour supply was historically high wage growth. Relative to the previous year, total pay grew by 6.4 percent in the three-month period from September to November 2022, marking the second-highest rate in the last 20 years1. However, even these record increases were significantly below inflation, leaving real wage growth at a negative 2.6 percent—something many workers considered inadequate—resulting in an increasing number of labour disputes2.

The full dynamics of both the economic and inflation cycles, and the bargaining in labour relations, are yet to play out. However, with the possibility of a recession looming, forecasters are expecting unemployment to rise back towards 5 percent during 2023. Indeed, key indicators of labour market tightness have turned a corner, showing that conditions are already easing (Exhibit 1).

A looser labour market doesn’t necessarily mean vacancies and pay pressures will evaporate

Will this make employers’ task of filling vacancies easier and reduce wage pressures? Probably, somewhat, but there are four reasons to remain cautious.

-

An unemployment rate of five percent is still low by historical standards. While the relationship between earnings growth and unemployment is not clear-cut, at the whole-economy level, real wages have tended to exhibit negative growth when unemployment is above 7 percent. However, 2022 was an exception, with soaring inflation and real wages falling, despite a tight labour market. The question for 2023 is whether this is sustainable. In other words, has the balance of power shifted in employers’ favour? That seems unlikely. It is more likely that, in 2022, compensation was simply lagging what turned out to be unexpectedly high inflation3, primarily driven by elevated natural gas prices caused by the war in Ukraine. For 2023, even if unemployment increases to around 5 percent, employers who review and adjust compensation in line with the cost of living—which, for the full year of 2023, is forecast to increase by around 5 percent to 7 percent4—will be much more competitive in attracting and retaining talent.

Moreover, organizations will need to be cognisant of the significant differences between pay growth for those who stay in their jobs, compared with those who leave. In 2021, workers who had moved both jobs and occupations received, on average, an increase in hourly earnings of more than 12 percent, while those who stayed in their existing role received less than 3 percent. This divergence creates a significant incentive for employees to quit unless their compensation is matched more closely with what they would receive from another employer.

- The “great resignation” is still taking place. Yes, more workers are apprehensive about quitting, as they worry about their chances of finding another job. However, on balance, the trend towards a greater number of resignations kicked off by post-pandemic readjustments continues. During the three-month period from July to September 2022, job-to-job moves were slightly down from the more than one million in 2021, but still highly elevated, and more than 30 percent above their pre-pandemic level. Nearly 40 percent of these moves were due to people voluntarily resigning to go to a new job, while redundancies accounted for only 6 percent5. McKinsey’s global research into the “great attrition” also shows this trend continuing, both in the United Kingdom, the United States, and in other European countries.

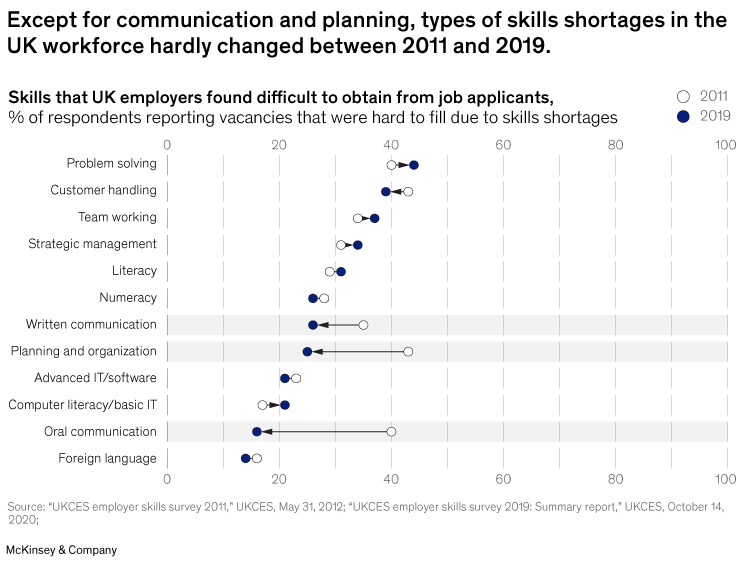

- Long-term trends, such as an ageing population and the continued shift in labour demand towards higher-educated, service-oriented, health-related, digitally-enabled, and technology jobs, create persistent shortages. Education, training, and upskilling—whether funded and provided by the government, educational institutions, businesses, or charities—are failing to keep up with demand. Exhibit 2 provides a fascinating illustration: the incidence of the types of skills shortages that employers reported when trying to fill vacancies hardly changed between 2011 and 2019. And the pipeline of new talent into the labour market is unlikely to help much. In the next few years, the UK’s working-age population—16–70-year-olds—is expected to grow only 0.4 percent per year6.

- Even if overall labour market tightness abates, the easing will be less marked in specific sectors. In the next section, we take a closer look at these differences by analyzing the likely outlook for vacancies, which also tend to be a strong predictor of pay pressures.

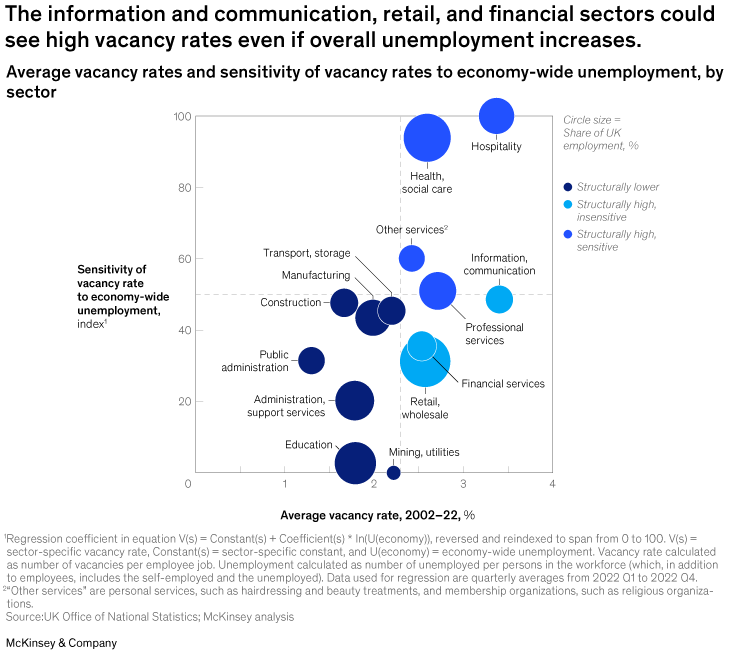

Specific sectors are prone to higher vacancy rates even when unemployment increases

The number of vacancies in a sector at any point in time is a factor of many economy-wide and sector-specific influences. Some sectors—such as health and social care, information and communication, and professional services—are competing for talent for which demand is constantly growing. In other sectors, such as hospitality and retail, staff turnover is relatively high, so vacancy rates are often elevated, as it takes time to replace workers who have left. The demand for employees will also fluctuate. For example, demand for utility services is insensitive to the overall business cycle, whereas construction and retail are more impacted by economic conditions.

In Exhibit 3, we have plotted UK sectors on two axes: one displays the average, long-term vacancy rate, and the other shows the sensitivity of each sector’s vacancy rate to overall economy-wide unemployment. This helps us anticipate which sectors might find labour market conditions easing the most and the least if unemployment rises in 2023. In this analysis, UK sectors fall broadly into three categories:

Businesses can act now to respond to both short and longer-term labour market pressures

While the exact challenges facing each business are going to be specific to their circumstances, there are some broad prescriptions that tend to apply to any organization8.

- Understand, and correct, causes of attrition. The fewer desirable workers who leave the organization, the fewer vacancies there are to fill. With the wave of resignations, businesses should take the opportunity to ask departing employees about their reasons for doing so, as well as analyze broader patterns. McKinsey’s research suggests that, in Europe, the top reasons for quitting in 2022 were inadequate total compensation and lack of career advancement. Both can be tackled, in part, with a more systematic approach to staff development. With greater skills and aptitudes, workers can deliver better results—hence allowing employers to pay them more— and will find their prospects more promising—building loyalty towards their existing organization.

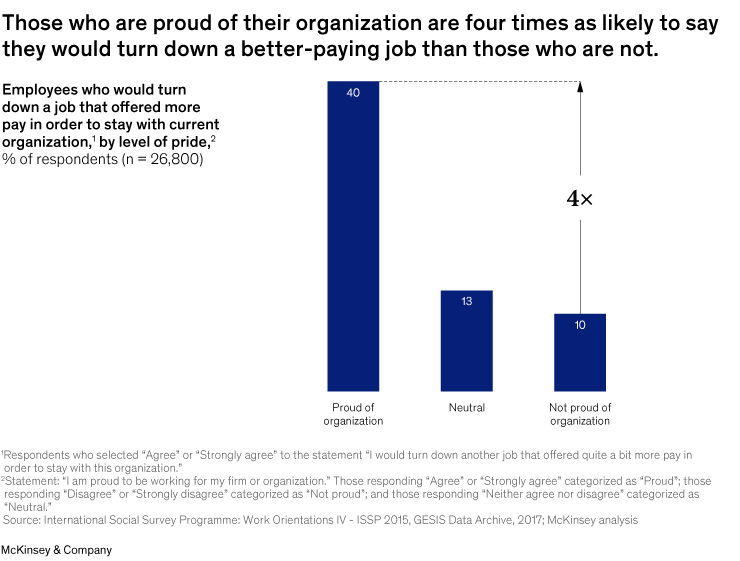

- Build long-term loyalty by attending to workers preferences for relational, and not just transactional, elements of their jobs. A culture that supports an individual’s needs for recognition, connection, and autonomy, fosters a sense of belonging to the organization. By helping employees better connect with their purpose, employers can reduce staff turnover. For example, research shows that people who are proud of their company are four times as likely to say they would turn down a job at another organization than those who are not proud, even if it offered higher pay (Exhibit 4).

- Rethink recruitment sources and mechanisms. One of the silver linings of the “great attrition” has been employees’ willingness to change careers to find a better fit with a new employer and often in a new type of role. This is an opportunity for organizations to seek talent outside traditional sources. For example, focusing on candidates’ skills and potential, rather than just qualifications and industry experience, can widen the pool of possible hires considerably.

* * *

The outlook for UK labour markets is complicated. While unemployment is likely to rise, that doesn’t automatically translate into materially lower vacancies or pay demands across all sectors, occupations, or roles. Nor does it mean that long-term skills shortages will abate any time soon. The best way for organizations to get ahead would include revamping their recruitment, training, and culture, to respond to the changing shape of the labour market.

This article was edited by Thomas Farrar, a manager of communications, based in McKinsey’s London office.

3 The Bank of England’s forecast in November 2022 for 2022 Q4 inflation was 3.4%, while the actual inflation figures published by the Office for National Statistics in January 2023 recorded a rate of 10.7%; Sources: https://www.bankofengland.co.uk/-/media/boe/files/monetary-policy-report/2021/november/monetary-policy-report-november-2021.pdf?la=en&hash=72336FA2809F28D79CA9C1274ED3851261C61CA9 and https://www.ons.gov.uk/economy/inflationandpriceindices/timeseries/d7g7/mm23

6 McKinsey analysis of https://www.nomisweb.co.uk/datasets/ppsyoa

7 The largest sub-sectors within “Other services” are personal services, such as hairdressing, and membership organizations, such as religious organizations.

8 Adapted from “European talent is ready to walk out the door. How should companies respond?”, McKinsey Quarterly, December 2022.