Same-day delivery has the potential to fundamentally change the way we shop. It integrates the convenience of online retail with the immediacy of bricks-and-mortar stores. In recent years an increasing number of companies have started piloting and operating new models of same-day delivery, including incumbent logistics providers such as DHL, DPD, FedEx, and UPS. Demand is expected to increase significantly given the compelling value proposition of same-day delivery for consumers.

Consumers clearly attach a value to same-day delivery. In a recent representative survey conducted by McKinsey in Germany, France, Sweden, and the UK, 50 percent of respondents indicated that they would be willing to pay same-day delivery costs of EUR 6 to 7 for a EUR 59 purchase.

Online retailers are expected to benefit from reduced delivery time as almost immediate product access improves their position versus stationary retailers, and makes the greater choice, higher convenience and often lower prices of online shopping even more appealing. Bricks-and-mortar retailers in turn have a unique opportunity to combine their existing local infrastructure with an e-commerce channel to offer same-day delivery on a broad scale. A multichannel approach could enable them to win back customers who are becoming increasingly focused on online shopping.

Three operating models have emerged to fulfill the logistics need. The first consists of incumbent parcel logistics providers with an additional delivery wave. Second, retailers can use broker platforms that provide access to existing courier capacity to offer instant or scheduled delivery. And third, large retailers maintain their own fleet to handle same-day deliveries. In the long run, parcel logistics providers will be able to operate at the lowest cost while offering integrated logistics solutions ranging from orders through fulfillment to delivery and return.

The opportunities ahead are huge. Logistics providers need to position themselves for the upcoming transformation, and adapt their existing networks accordingly. This report examines the drivers at work in the current landscape, the coming scenario, and the challenges the winning players will need to overcome.

1. Same-day delivery combines the convenience of online shopping with the immediate product access of stationary retail

Imagine ordering a new pair of shoes or groceries for dinner in the morning and receiving the goods when you return home from work. The world’s largest retailers, including Amazon and Walmart, are nurturing this vision and experimenting with innovative delivery concepts. But can same-day delivery really become a standard delivery option for the masses, or will it merely remain an option for a limited number of impatient consumers with deep pockets?

Same-day delivery as the next evolutionary step in parcel logistics

The “last mile”—the final delivery step to the consumer—is gaining importance due to the rising share of online retail. The latter has turned into a major driving force of B2C parcel logistics and triggered intensive evolution of the service offering towards greater convenience (Exhibit 1). Alongside alternative pickup and delivery options (e.g., locker-boxes and parcel shops), speed is the main push in this evolution. Next-day or two-day delivery is currently the industry standard in all developed countries, but the next evolutionary step is affordable same-day delivery.

With same-day delivery, orders are delivered within a few hours after purchasing them, or in a chosen time window on the same day. “Same-day delivery is a game changer because it combines the immediate product availability of retail with the convenience of ordering from home.” (SVP of a logistics company)

The express segment with its focus on B2B and international shipments has historically been the driver of innovation in logistics. B2C same-day is now closing the service offering gap for local and domestic delivery, and is likely to outgrow the B2B segment in terms of the number of shipments.

Market development is picking up

As early as the dot.com era, start-ups such as Kozmo and Webvan identified same-day delivery as an opportunity, but failed to build a sustainable business model around it. The companies tried to integrate all steps along the value chain in-house, but were unable to bring down their costs sufficiently due to lack of demand (and therefore scale). Today, the market for same-day delivery is moving toward the next stage of development. Following its pledge to be a truly customer-centric organization, Amazon, the largest online retailer in the world (USD 61 billion in revenues in 2012), is actively promoting same-day delivery, and has already introduced the service in several cities. There are many other initiatives in the pilot phase, and only few of the players generate significant revenues from same-day delivery. But many same-day delivery promoters have successfully launched new pilots and companies over the last few years. Moreover, other important multichannel and online retailers such as Walmart and Alibaba have same-day delivery on their agenda. The main centers of development are e-commerce-savvy cities in both developed countries (such as San Francisco, New York, London, or Berlin) and less developed markets (e.g., Beijing or São Paulo). Similar to other evolutionary industrial developments (mobile phones, for example, or online banking), it seems reasonable to anticipate that same-day delivery will leapfrog day-definite last mile delivery and become the immediate standard for e-commerce in some emerging countries. Development on the supply side is driven by three groups of players: parcel logistics providers, brokers of courier capacity, and retailers themselves.

Strong fundamental drivers support the growth of same-day delivery

The market for same-day delivery is fueled by underlying macro-trends, including increasing GDP per capita, rapid e-commerce adoption, urbanization, and changing consumer expectations.

Same-day delivery requires a critical mass of consumers with sufficient financial resources to pay for such a premium service. Rising GDP per capita becomes even more critical when it applies to large metropolitan areas. Accordingly, the relevant economic units are metropolitan areas rather than nations. Yet the existence of densely populated areas with extensive buying power is not enough. A high level of e-commerce adoption is a prerequisite for same-day delivery to actually take off. In Western Europe, the share of online retail will almost double from 6 to 11 percent between 2012 and 2020. The ongoing substitution of stationary retail sales by online sales will lead to a significant increase in B2C shipments, of which a share is likely to be delivered by same-day delivery (Exhibit 2). The availability of same-day delivery is actually expected to further support e-commerce adoption and drive the online sale of product categories not yet bought online on a large scale (such as groceries).

These developments are accompanied by rising consumer expectations. Consumers are demanding ever more convenience when they buy online, particularly where delivery is concerned. They want to have multiple delivery options to choose from, and to receive their products as fast as possible. Once consumers have experienced a superior service level, they are usually reluctant to return to the previous inferior level. Few people would be willing to wait four days for a digital camera they have ordered online if they can get Amazon to deliver it the next day (assuming both options are free). Judging from recent survey results1 , younger generations (e.g., millennials), people living in small households, those working long hours, and consumers with higher incomes are among those particularly willing to pay for more convenience.

2. Consumer perspective: Willingness to pay for same-day delivery—at the right price

The results of the above-mentioned survey draw a positive and rather intriguing, if mixed picture of consumers’ familiarity with and attitude towards a same-day delivery service offering (Exhibit 3).

Clearly, consumer familiarity with same-day delivery as a service differs across countries. 60 percent of the UK respondents in the 2013 survey were familiar with or have used same-day delivery, compared to roughly half the number in Germany. Yet in spite of these variances and the fact that so far only less than one-third of all survey participants think the service fulfills a need, consumers in Western Europe are willing to pay for same-day delivery. Roughly 50 percent of respondents indicated that they would be prepared to pay up to EUR 6 or EUR 7 for a EUR 59 purchase—and an even slightly higher share of respondents would pay for instant rather than for scheduled same-day delivery. And even better news is that—as was confirmed by other expert interviews and surveys—more than 70 percent of consumers in Europe would be willing to pay EUR 3.50 to 4.50 (average price for a standard parcel in Germany).

Consumers seem to perceive same-day delivery as attractive if it costs less than 7 to 8 percent of the basket value. This is confirmed by observations of the courier network Shutl, which states an actual conversion rate of more than 30 percent once delivery cost falls below 7 percent of the basket value or the value of the entire purchase made. The conversion rate appears to be the same for all product categories. Those with high average basket sizes, e.g., consumer electronics (around EUR 330), are easier to penetrate since the delivery costs as a percentage of the basket value are not as significant as those for a EUR 100 grocery order.

The founder and CEO of Shutl argues: “Consumer expectations only go in one direction—once they have tried same-day delivery, they don’t want to go back.”

3. Retailer perspective: Same-day delivery as a catalyst for online sales

“The first retailer to master same-day delivery […] could attract customers who have avoided online purchases because they wanted items immediately, and encourage current shoppers to add products that they usually buy from supermarkets or drugstores.” (The New York Times)

Online retailers are the main originators of B2C shipments. They share a large interest in reducing delivery time, as immediate product access significantly improves their competitive positioning against stationary retailers. With same-day delivery, online retail will be able to further increase its share of total retail and foster the sale of product categories typically not sold online—DIY products such as tools, for example, that are usually purchased for immediate use.

For multichannel retailers, same-day delivery constitutes an opportunity to participate in the e-commerce boom and provide more convenience to their customers at the same time. Amazon’s move into same-day delivery in 2009 was perceived as a threat by many multichannel retailers, and triggered a number of initiatives by retailers and the emergence of new players like Shutl. Retailers are looking for possibilities to leverage their network of retail outlets in order to offer same-day delivery. Their advantage over online retailers is local product availability, reducing the required time and potentially also cost of a same-day delivery. Walmart, the world’s biggest multichannel retailer, is responding to this threat by further developing its e-commerce channel “Walmart To Go.” Walmart already started piloting same-day delivery from some outlets in late 2010, but has not yet introduced such a service at scale. The company has a network of more than 9,000 stores worldwide, providing the local coverage required to offer same-day delivery on a broad scale. “[Our same-day delivery pilots] build on a testament to try to provide greater convenience to our customers. But we’re still very much focused on learning more from customers about what they want.” (Wal-Mart spokesperson)

Same-day delivery is a big opportunity for all retailers to improve their service level, but requires a high degree of sophistication. Major challenges, such as real-time product visibility across warehouses, very short fulfillment lead-times and flexible last-mile delivery, have to be overcome while bringing cost down to a level that consumers are willing to pay for. Large retailers generating most of the B2C shipments could then institutionalize same-day delivery as a fast, capillary distribution mode in densely populated areas with a critical mass of online shoppers—but would then also need to have an extensive, accessible, and standardized distribution network that operates at an acceptable cost.

Retailers are expected to reap additional benefits from offering same-day delivery. Experience at Amazon shows that the option of same-day delivery alone actually increases purchase conversion during the checkout process by 20 to 30 percent, although only a few customers actually opt for same-day delivery. The survey results support this claim: more than half of respondents would buy online more frequently if they were offered a same-day delivery option. “A good delivery experience is a key part of keeping our customers happy and encouraging repeat purchases as well as helping to build brand warmth.” (Nick Robertson, CEO, asos.com) The availability of enhanced delivery options has positive effects on customer loyalty and reduces the goods return rate, according to Shutl and Amazon. A reduction in the return rate is very appealing to online retailers since the current share and attributed cost of returns is a significant burden on their operations and financial results.

To capture the benefits, retailers will have to subsidize same-day services for the foreseeable future. Same-day delivery costs charged to consumers currently range from about EUR 5 up to EUR 20 per shipment, but the willingness to pay such high prices is limited according to the survey. Consumers are used to subsidized shipping, and are reluctant to pay extra for it. Companies such as Amazon and Zalando shaped the e-commerce market by educating customers that they don’t have to pay for shipping at all.

4. Logistics perspective: Incumbent logistics providers, new entrants, and retailers themselves are developing same-day delivery solutions

Same-day delivery is a consolidation play. A large network with sufficient volume will benefit from significant economies of scale and outperform smaller networks. Countries with a high share of inhabitants living in densely populated areas, such as the UK (almost 60 percent of the population live in areas with at least 500 inhabitants per km²), provide favorable conditions for establishing a network of this kind, as more deliveries can be carried out per km². Currently no established networks provide same-day delivery at scale, so consumers handle most of their shopping logistics themselves.

The complex challenge of processing, fulfilling, and delivering an order within a few hours requires new types of networks. The current processes used by parcel logistics providers are not suited to same-day delivery at scale. More flexible city couriers, on the other hand, are too small to deal with large retailer volumes.

The creation of a same-day delivery network comes at a high cost. Large volumes in each delivery district need to be achieved, which is difficult in the beginning and—depending on the operating model—may require extensive upfront investment. In addition, the speed at which the deliveries are made necessitates a more sophisticated asset and capability base that inevitably results in a higher price point for the logistics service.

Nonetheless, some big logistics companies, many start-ups, and several retailers have taken on the challenge and started creating networks capable of providing same-day delivery services at scale. The following three archetypes have been identified in this context: parcel logistics providers enabling same-day delivery, brokers of courier capacity, and multichannel retailers building their own fleet.

Parcel logistics providers are rethinking their traditional operational models to enable same-day delivery

In catering to the needs of the growing B2C segment, parcel logistics companies are increasingly focusing on convenience features such as alternative pickup and delivery options (e.g., parcel locker-boxes), flexible delivery timing (i.e., scheduled delivery), and delivery speed (i.e., same-day delivery). These companies are the natural suppliers of B2C parcel delivery services. They derive their strength from last-mile delivery via a hub-and-spoke system with overnight sorting and fixed delivery routes. Their infrastructure and processes are optimized for next-day delivery, so one of the key challenges will be to enhance existing assets and capabilities. Parcel logistics providers struggle to offer same-day delivery as it requires flexible intraday pickup and delivery with a maximum of one transition point.

Nonetheless, some parcel logistics providers—whether DHL, USPS (Metro Post), Royal Mail, UPS, or FedEx—are piloting same-day delivery. “UPS and FedEx are testing strategies for a same-day delivery market fueled by Web retailers trying to match the instant gratification their bricks-and-mortar competitors offer shoppers.” (Bloomberg)

From a theoretical standpoint, the most promising approach is the introduction of an evening delivery wave. However, any time window needs to be large enough to ensure that sufficient parcel volume is economically viable. Providers can build on their existing infrastructure (e.g., sorting hubs, vehicles, and IT) and feed in shipments from the regular parcel network to increase the capacity utilization of the additional delivery wave.

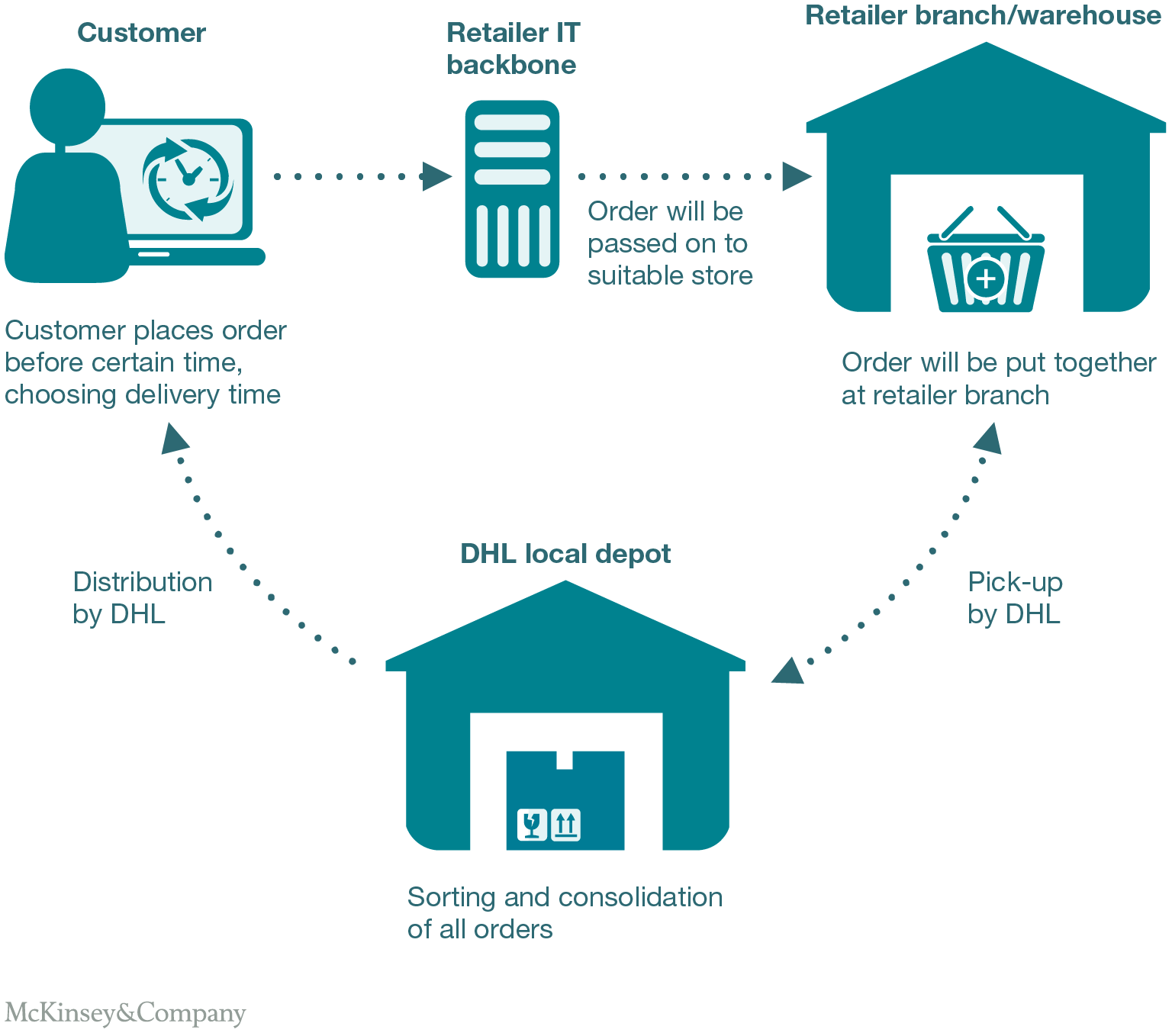

Example: the DHL pilot in several German cities (Berlin, Cologne, Munich, and the Ruhr area) offering online and multichannel retailers a scheduled same-day delivery option is an example of how existing assets can be utilized. Shoppers can choose from two time windows (6 to 8 p.m. and 8 to 10 p.m.) and have to order before a certain time, depending upon the retailer’s setup. The shipments are picked-up, sorted, consolidated, and then disseminated from a single local depot with partly automated sorting. One major challenge is to be able to fast-track shipments intraday. However, the company explains that it will be able to handle the fast-tracking of same-day deliveries in the automated last-mile depots currently being rolled out in Germany. The shipment volume is still very small, but the logistics provider is able to produce the service at a lower cost than the retailers themselves can.

Brokers of courier capacity are entering the market by developing platforms to orchestrate existing logistics capacity

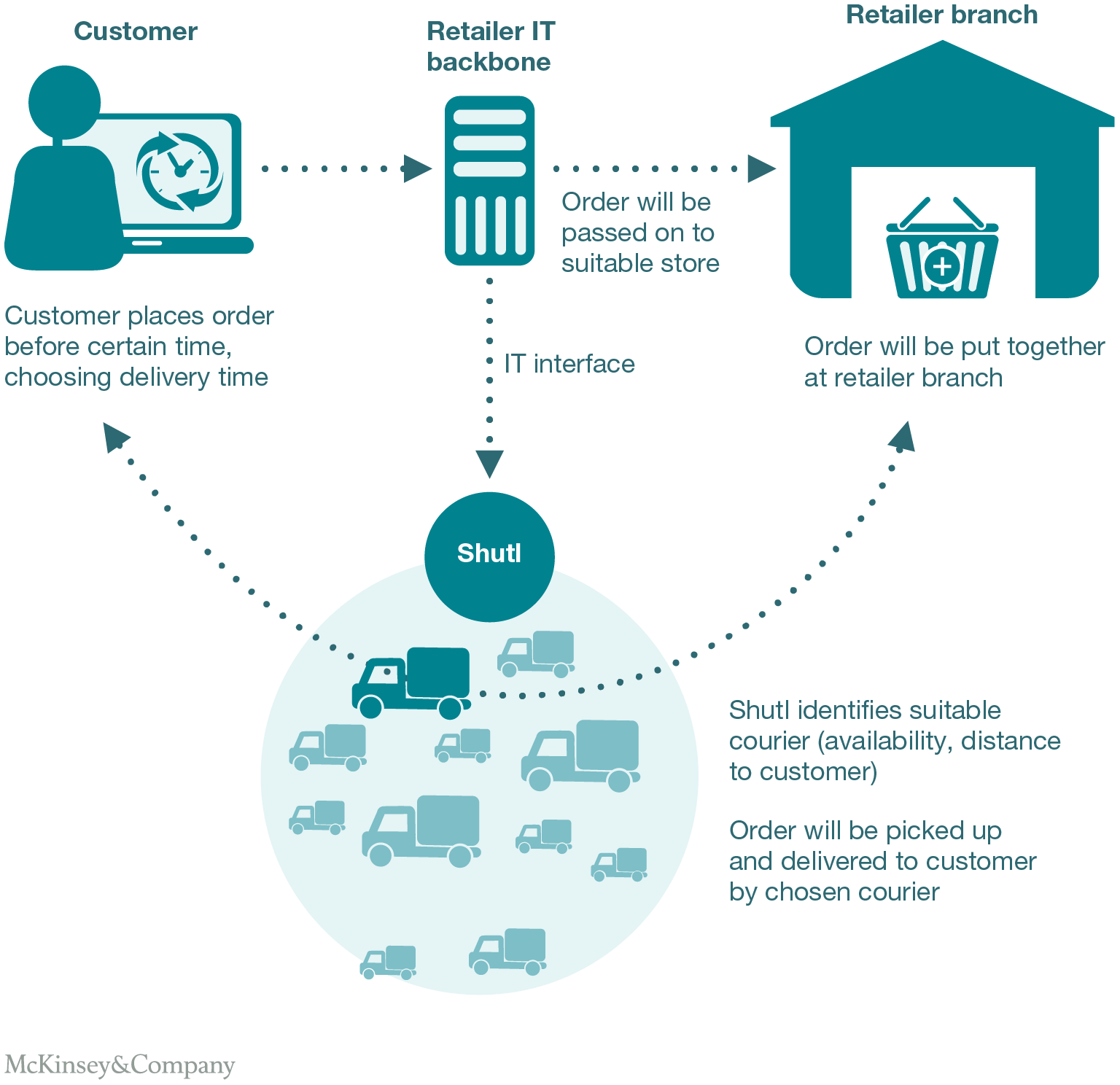

Conventional B2B-oriented city couriers can deliver same-day, but there are thousands of them and they are too small to be an adequate partner for retailers. A new type of player is entering the market to make existing courier capacity accessible for retailers in a scalable manner. Technology start-ups such as Shutl and tiramizoo aggregate local courier capacity on a broker platform to form flexible courier networks. Retailers that are integrated with this platform can offer same-day delivery as an additional option in the checkout process of their online shops. Single orders are dynamically assigned to a courier with free capacity from the network, which picks up and delivers the order within a couple of hours. Shutl’s CEO claims that point-to-point delivery using a flexible courier network is less costly than hub-and-spoke systems for distances of less than 15 km. The main cost drivers for delivery via such a network are variable cost per hour and the distance between stops. With sufficient liquidity in the system and an increasing pickup factor, delivery costs decrease to a level below that of just using the cheapest subcontractors. The asset-light technology companies running the platforms have attracted investments from both venture capital funds and strategic investors, including UPS, e.ventures (Otto Group), and Daimler. eBay’s acquisition of Shutl and tiramizoo’s partnership with DPD marks the starting point of further growth, as these developments give the networks access to larger shipment volumes.

Example: Shutl has managed to dimension its platform so as to achieve significant scale in the UK. It is quoted as handling 30,000 shipments per day. The company claims to cover most urbanized areas (85 percent of the UK population). The broker platform closes the gap between existing but fragmented courier capacity and UK retailers. “We are faster and we augment existing services with features customers are craving for, such as evening delivery or delivery in a defined time-slot.” (Gregor Melhorn, CTO, Shutl) Most of its retail partners are consumer electronics or fashion retailers with relatively high average basket sizes. The company has already won Argos, one of the largest multichannel retailers in the UK, as a retail partner. As part of eBay, Shutl will further drive eBay’s same-day delivery efforts in the US, piloted in the project eBay Now. Up to now Shutl has operated as an independent distribution channel without its own retail operations, and has therefore had the advantage of avoiding channel conflicts such as Amazon creates by simultaneously acting as both marketplace and retailer. The downside for retailers is the absence of enforced quality standards and guaranteed delivery (such as when incoming demand peaks around Christmas time). The more retailers integrate with the platform, the higher the liquidity for couriers, bringing significant network effects into play. The more liquidity the platform bundles, the better couriers can balance the demand variability of their B2B shipment volumes and optimize their capacity utilization. To achieve this, the platform integrates with the transportation management systems of the couriers, allowing them to optimize their routes. Small courier companies can scale their capacity relatively fast, and have lower variable costs than larger logistics companies. This has allowed Shutl’s flexible courier network to grow significantly. The company is now expanding into the US, which is even more urbanized and equally e-commerce-savvy.

Multichannel retailers are building their own delivery fleets to offer customers more convenience

For most retailers, it is not viable to build and maintain a delivery fleet since they do not have sufficient purchases per day. However, some large grocery retailers do have enough online volume to justify the investment. They integrate delivery into their operations in order to gain full control over the entire process, and because standard delivery companies cannot always provide the specifics required, particularly in grocery, as this has special transport prerequisites, such as cooling, freshness expectations, and transportation in non-conveyable shopping bags (bags that are not appropriate for conveyor operations). Amazon has also chosen to build up a fleet for its e-grocery pilot, AmazonFresh, in Seattle.

Conventional parcel logistics providers are often not prepared to process such shipments. Nonetheless, they want to tap this substantial market potential and work on solutions to produce e-grocery deliveries. Some players are developing conveyable passively-cooled plastic boxes that allow the delivery of frozen and chilled goods when delivery is made on the same day. Retailers with their own fleets tend to operate at higher costs than multi-user platforms because less volume can be aggregated. It is therefore likely that a multi-user platform will be more cost efficient if operated at scale. Cost of delivery is even more important for grocery delivery than other product categories since the average basket size is fairly small and margins relatively low.

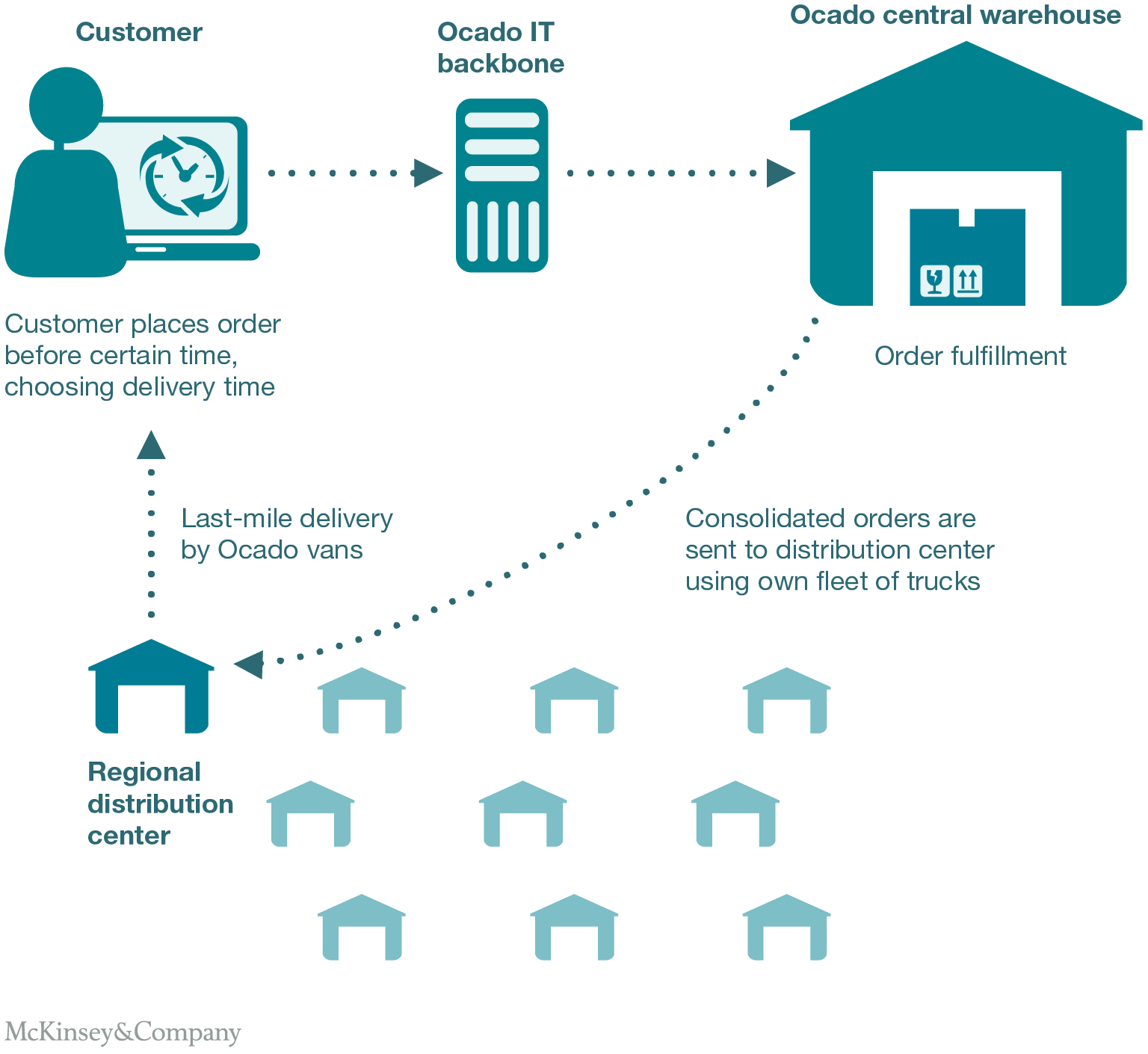

The retailer fleet model is most common in the UK, where grocery retailers Tesco, ASDA, Sainsbury, and Ocado (among others) have built up their own delivery fleets to cope with the growing e-grocery volumes and offer additional convenience to their customers. They are also increasingly pushing to offer same-day delivery. “Same-day encourages shoppers who are currently put off by having to wait until the next day for their shopping to try us.” (Jason Gissing, Finance Director, Ocado)

Example: Ocado runs its own last-mile operations. The online grocery retailer has control over its entire logistics process, ensuring the highest level of convenience for its customers. Orders are fulfilled in a central warehouse and distributed in branded vans from ten regional distribution centers. Same-day delivery is currently only available in selected areas, as the limited shipment volume per geographic unit and reliance upon the central warehouse does not permit broad service coverage.

5. Economics: Same-day delivery is a scale game

Large shipment volumes are crucial for all three archetypes because they can reduce costs significantly. While courier networks can only reach higher consolidation on a vehicle level, parcel logistics providers can also reduce costs via process automation. However, last-mile providers can only scale their operations if the retailer has adequate interfaces.

Only technologically advanced retailers and logistics providers will be able to offer same-day delivery

In the current market environment, four prerequisites need to be fulfilled to enable same-day delivery: product availability, real-time product visibility, fulfillment capacity, and flexible last-mile capability.

First, products need to be locally available. Depending upon the operational model, regional product availability could be sufficient, especially when the respective retailer generates enough volume to justify frequent pickup/delivery routes to the main urban centers. That said, same-day delivery still remains a service limited to urbanized areas, and is rarely available to the entire population of a country. Multichannel retailers already have local product availability because they maintain a network of stores. Online retailers, on the other hand, will first need to invest in building up a network of local urban warehouses.

Second, retailers need to have a real-time overview of their inventories across their warehouses and outlets, otherwise it will not be possible to determine whether the goods are available for same-day delivery during the checkout process. Many retailers still struggle with this hurdle, which requires that they invest more in their IT infrastructures. The logistics provider needs to be informed of where and when to pick up the shipment via a real-time interface, with the information preferably being fed directly into the respective transportation management system.

Third, the picking and packing processes need to be fast, and fast-tracked over regular orders wherever necessary. Experience at Amazon has shown that significant investment in the logistics infrastructure is necessary to reduce lead time. Retailers planning to ship from their stores first need to develop the capability to efficiently fulfill the orders in-store. The introduction of click and collect serves as a prestage to the introduction of same-day delivery.

Fourth and finally, last-mile delivery needs to be flexible enough to pick up and deliver orders adhoc or multiple times throughout the day. Dynamic rerouting using geo-fencing allows logistics providers to instantly respond to new shipments. For logistics providers using a transition point, the ability to fast-track same-day delivery shipments in sorting stations is crucial.

Once these four prerequisites have been fulfilled, same-day delivery turns into a pure game of scale.

The example of USPS’ suspended Metro Post same-day delivery pilot in San Francisco shows that the implementation of the service is far from trivial. The pilot will be suspended by March 1, 2014, while a similar pilot in New York City continues. The service offered to deliver e-commerce products between 4 p.m. and 8 p.m. when ordered by 2 p.m. on the same day within the San Francisco area. According to a report from the USPS Inspector General the service failed to attract sufficient parcel volumes: Only 95 packages were sent by the six participating retailers over a 5-month period (as of June 2013), while the target was to have 200 packages per delivery day. The reasons cited for the failure of the program included that the service did not provide signature confirmation and did not allow purchase of exact postage for deliveries—it required purchase of postage in dollar increments rather than exact amounts. The foremost issue, however, was that only one large retailer got involved and that the small retailers in the pilot did not generate the target daily parcel volume.

6. Parcel networks can beat courier networks on variable cost per shipment once they have reached significant scale

The economics of same-day delivery are mainly driven by the degree of shipment consolidation (Exhibit 5). Variable costs per unit decrease as the number of shipments per day and city grow. A retailer fleet operating several time windows during normal business hours has consistently higher variable costs per shipment than multi-user platforms. In addition, it is much more difficult for a single retailer to reach such scale in a single city. A parcel network offering same-day delivery using an evening wave can consolidate shipments from multiple retailers and is much more likely to achieve profitability, assuming that retailers pay an average price of EUR 7 per delivery. Variable costs decline much more quickly because delivery routes can be optimized and capacity utilization is expected to be higher than with retailer fleets. A courier network operating the entire day starts with significantly lower variable costs at lower volumes. Increasing shipment volumes have a much weaker effect on variable costs since the couriers can mainly achieve consolidation on a vehicle level. Nonetheless, brokers of courier capacity may be able to achieve a price premium compared to retailers and logistics providers because they can offer instant delivery throughout the entire day.

7. Outlook 2020: Same-day delivery could become a game changer in retail logistics

The development of same-day delivery is driven by the trends outlined in this report as well as the sophistication of retailers and logistics providers. As these factors differ greatly depending on country and city, same-day delivery is bound to develop at varying speeds.

Market development depends on e-commerce adoption and geographical population distribution in European countries

Same-day delivery is likely to become available at most retailers with an online channel on a broad scale in urbanized areas in countries with dense metropolitan areas. It is fully subsidized once a certain basket value has been reached. Economies of scale drive down the cost of same-day deliveries significantly, reaching a level still higher than regular domestic shipments but much lower than today. Multi-user same-day delivery networks run by parcel logistics providers reach enough scale to increase the consolidation factor to about 10 to 12 drops per hour and operate multiple pickup and delivery waves per day. Standard next-day delivery is partially cannibalized, but the broad availability of same-day delivery further propels the adoption of e-commerce as new use cases like spontaneous online purchases emerge, and thus increases total market size.

In countries with fewer metropolitan areas and slower e-commerce adoption, such as Spain or Italy, same-day delivery will likely remain an expensive option only offered by a few select retailers in major metropolitan areas. Consumers generally choose the option on special occasions (last-minutes gifts, or if they cannot make it to the supermarket), but do not adjust their general expectations towards convenience in delivery. Parcel logistics providers cannot maintain specialized networks for same-day delivery due to lack of volume, so they cooperate with flexible courier networks by feeding in some domestic shipments that are supposed to be delivered faster or within a specific time window. Next-day delivery remains the industry standard.

Applying the two scenarios to the respective countries, the market for same-day delivery is expected to grow to about EUR 3 billion in Western Europe by 2020 (Exhibit 6). In the main markets, same-day delivery will continually outgrow the parcel market and gain importance in urban areas. The UK remains the most important market in Europe, closely followed by Germany and France. The demand for local same-day delivery will predominantly be driven by fashion and consumer electronics retailers, followed by household/furniture, grocery, and DIY retailers.

Same-day delivery offers large upside potential for retailers and logistics providers alike

The introduction of same-day delivery will take the online shopping experience of customers in the metropolitan areas of Western Europe to a new level of convenience. The product variety available online from specialized e-tailers (e.g., redcoon for consumer electronics) combined with the price transparency that e-commerce offers (e.g., via product search machines) and same-day product availability is a powerful customer value proposition. However, given the increased complexity of same-day delivery across logistics operations, prices for same-day delivery are likely to remain at a level well above the current price level for standard next-day delivery.

Retailers have a same-day delivery “sweet spot” with their existing local infrastructure, particularly shops and warehouses in or close to metropolitan areas. The proximity to the end customer enables them to provide customers with delivery on the day of the purchase, ideally combined with an option for a time window. Most retailers have already added an e-commerce channel to their traditional bricks-and-mortar sales approach. The combination with same-day delivery could help to win back some of the customers that have been lost to online shopping over the last decade.

Finally, same-day delivery is both an immense opportunity and an operational challenge for logistics providers who are the natural partner for same-day delivery on a broad scale due to their existing network and scale advantages. The underlying trends of increasing e-commerce adoption and urbanization will create a strong urge for evolution from the current next-day standard in B2C parcel to same-day. Logistics providers need to position themselves for the upcoming transformation, adapting their networks from overnight sorting and next-day delivery to same-day capability. In addition there is an opportunity to expand into fulfillment services given the need for minimal pick and pack lead times to enable same-day delivery.