Despite bright economic prospects, most emerging Asian countries—China, India, and the Association of Southeast Asian Nations (ASEAN)—continue to suffer from underdeveloped infrastructure. In India, for example, electricity generation is 16 percent to 20 percent short of what is needed to meet peak demand, thanks to persistent underinvestment and poor maintenance. In Indonesia, infrastructure investments dropped from 5 percent to 6 percent of GDP in the early 1990s to 2 percent to 3 percent of GDP for much of the last ten years. We estimate that the consequent deterioration in energy, transport, housing, communications, and water facilities has restrained economic growth by 3 to 4 percentage points of GDP.

We believe that situation is about to change. Across the Asian region as a whole, we calculate that around $8 trillion will be committed to infrastructure projects over the next decade to remedy historical underinvestment and accommodate the explosion in demand.

Traditionally, most Asian infrastructure projects have been funded by governments or domestic banks. Foreign investors were mostly excluded. Those that were allowed to participate faced severe restrictions, including complex regulatory and legal regimes, uneven workforce quality, and occasional political interference.

In the wake of the financial crisis, however, we have started to see signs that global private capital is increasingly welcome. The combined effects of increased stimulus spending and reduced tax receipts have increased deficits, with the result that restrictions on foreign investment are easing and a growing number of projects are being carried out under public–private partnerships (PPP). We estimate that over the next ten years fully $1 trillion of the $8 trillion of projected infrastructure projects will be open to private investors under PPPs.

The questions for owners of global capital are how to identify the opportunities, how to mitigate the main risks, and how to develop appropriate entry strategies.

Growing demand for outside capital

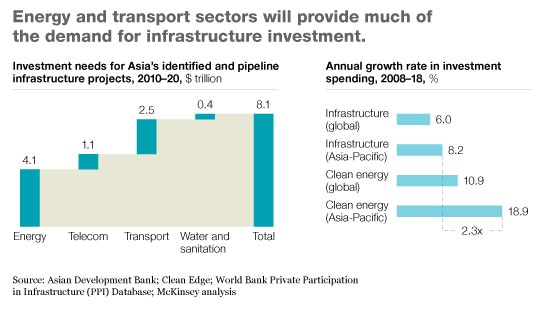

More than 80 percent of the demand for infrastructure investment in emerging Asia over the next ten years will come from energy and transport, the sectors most critical to supporting heightened economic activity. Exhibit 1 shows the full breakdown.

Our analysis suggests that much of this new investment will be in advanced technologies. For example, Asia may leapfrog developed economies in its adoption of clean-energy technologies, thanks to falling costs and improving effectiveness.

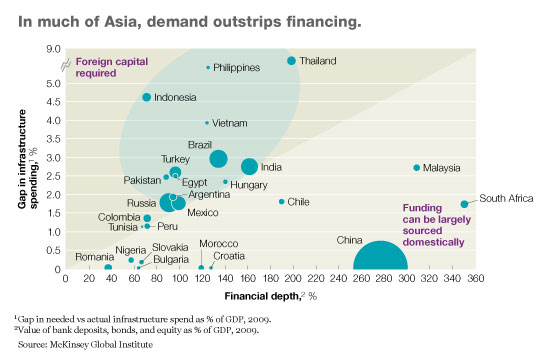

Several countries, such as China and Malaysia, have sufficient financial depth in their domestic private-capital markets to meet their infrastructure funding requirements (Exhibit 2). Foreign investors should therefore focus on countries such as India, Indonesia, Thailand, Vietnam, and the Philippines, where the financial markets have less capacity.

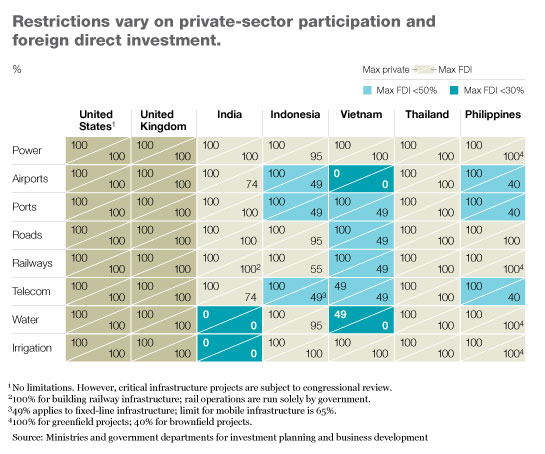

Although the environment is changing, even in these countries the bulk of infrastructure investments will likely remain effectively closed to private investment. The obstacles are varied. Many governments, for instance, have ill-defined PPP policies that, because of their vagueness, inhibit private participation, while capital controls frequently deter investors who worry that they may not be able to repatriate their cash flow. Weak regulatory or legal systems intensify the risk, and while shallow or illiquid capital markets make private investment necessary, they also complicate exit strategies. Exhibit 3 calculates the effect of restrictions on foreign direct investment in India, Indonesia, the Philippines, Thailand, and Vietnam.

Despite all this, Asia remains an exciting place for infrastructure investment over the next ten years. India alone is set to spend $500 billion on projects from 2007 to 2011, thereby raising its infrastructure investment from 4 percent to 8 percent of GDP per annum. Domestic capital markets will finance some but not all of this demand: as in other parts of the region, global investors will have an opportunity to fill the gap.

Key risks to be managed

Once they have decided to invest, foreign firms must overcome several risks. Thanks to political pressures, environmental considerations, and local issues, there are often long delays between planning and project approval; this can severely affect capital deployment and productivity. The Hangzhou Bay Bridge project in China, for example, was held up for 10 years, and the Bandra-Worli Sea Link in Mumbai, India, required more than 20 years before approval was finally given.

As in other parts of the world, infrastructure investors in Asia should have long investment horizons and should be prepared to have capital locked up for many years.

They need to be wary of—and ensure they make changes to—partnership agreements that are often poorly structured and drafted due to a lack of skills or experience in government departments.

They should plan for the possibility of continuing political, legal, and regulatory uncertainty with respect to foreign ownership restrictions, capital controls, and partnership terms. During the 1997 Asian financial crisis, for example, several countries suddenly imposed capital controls, which in some cases were only lifted many years later.

And global investors must find ways around capital markets that lack the full range of financial instruments for risk mitigation. For example, the foreign-exchange (FX) markets for some emerging Asian currencies might not be liquid enough to allow full hedging of a currency exposure, while local derivative instruments may be insufficient to offset particular risks.

Offshore products or structures domiciled in financial centers like Singapore and Hong Kong could be a solution when local currencies are illiquid. One example is the use of a Singaporean dollar fund (or fund of funds) that then invests in, say, Vietnamese infrastructure assets. The currency risk between Vietnamese đόng (VND) and the Singapore dollar (SGD) is mitigated by a simultaneous synthetic contract that is renewed annually. While this does not completely do away with the currency risks, it reduces the volatility significantly.

Another option is to set up a holding company in a tax-friendly jurisdiction rather than have the investment in the underlying infrastructure special-purpose vehicle (SPV), which is a domestic asset. The fund-raising entity enters into a contract outside the country, which at least partially helps to reduce the sovereign risk.

Third, partnerships between foreign players and a dominant local institution—SBI-Macquarie Fund in India and the CIMB-Principal fund in ASEAN are two examples—can help.

Selecting the right form of participation

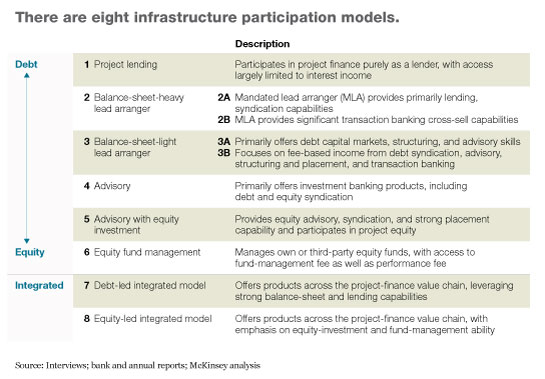

In addition to mitigating the inherent risks, investors must choose the right participation model if they are to maximize. Exhibit 4 explains the choices, several of them suitable for use in a PPP.

Foreign investors and institutions typically follow an equity-led entry strategy in the initial years, since their local balance sheets tend to be insufficiently capitalized to support debt-led models. Domestic and regional banks, by contrast, typically use their strong local balance sheets to engage in debt financing.

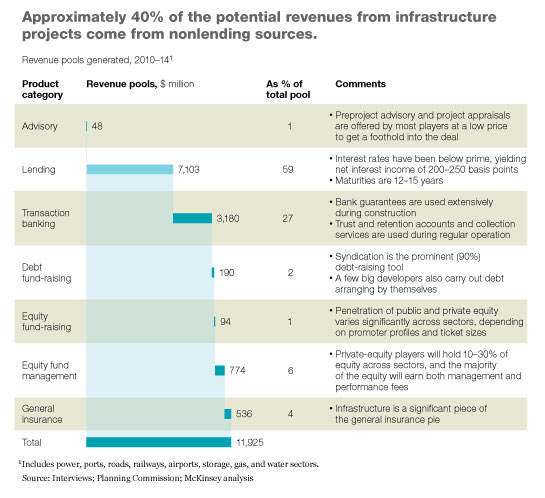

In recent years, savvy financial institutions with a well-rounded suite of financial services have begun adopting integrated models for infrastructure investment. For example, besides funding the construction of an airport, an integrated player might also offer transaction banking services and insurance to the airport operator. Such cross-selling can deliver significant value, as our research suggests an estimated 40 percent of potential revenues from infrastructure projects come from nonlending sources (Exhibit 5). Even better, this extra value opportunity comes with relatively little additional risk—after all, the operation of an airport, or indeed a power plant, once up and running, is relatively straightforward compared with getting it built in the first place.

It is critical, however, to note that infrastructure investment requires significant dedication of time, organizational resources, and management focus. The example of Macquarie Group provides a good illustration of how a global infrastructure-investment business can be built. Macquarie first developed its expertise in infrastructure by capitalizing on the wave of Australian privatization of national infrastructure in the 1990s. Armed with the knowledge built up, Macquarie then launched its international expansion. Despite its expertise, however, it still took Macquarie more than six years for infrastructure to become a significant international platform. Along the way, it has developed sophisticated risk-management techniques to oversee activities in disparate markets.

Despite the challenges and risks, Asia’s infrastructure growth over the next ten years is an attractive opportunity for global investors and financial institutions. There will be more than $1 trillion of infrastructure projects open to foreign investment, and further value can be captured by offering a full range of associated financial services besides lending. To tap into this growth, global capital players must select the appropriate participation model and dedicate sufficient resources to build up their expertise and familiarity with Asian infrastructure markets.