Insurers subject to the International Financial Reporting Standards (IFRS) are preparing to implement IFRS 17, which will replace IFRS 4 in January 2022. As a result, the entire organization beyond the finance function will be affected by the new standard’s far-reaching strategic implications. Insurers will need to review their strategies to ensure they are adapted to the post–Solvency II world. Areas of focus should include the product and investment portfolio, asset and liability management (ALM), key performance indicators (KPIs), and strategy.

In adapting their strategies for IFRS 17, insurance executives must address five distinct challenges.

1. Increased balance-sheet volatility. Valuations of assets and liabilities under IFRS 17 will be based on market value rather than on historic or book value, meaning balance sheets could fluctuate more with market conditions.

2. Risk of lower profits. As part of setting the opening balance sheet, IFRS 17 requires insurers to determine the projected profits of their legacy portfolios. Higher future expected profitability will reduce IFRS 17 shareholder’s equity,¹ meaning that insurers need to make a trade-off between post-implementation profitability and balance-sheet strength.

3. Short and uncertain timelines. For most companies, implementing IFRS 17 by 2022 will mean heavy expenditures on external, skilled resources to plug the capacity gap as well as investments in data and IT. The added uncertainty around an extension of the implementation deadline could double expenditures.

4. Increased pressure from investors. IFRS 17 will require increased granularity in financial reports, which will invite additional questions from investors.

5. Internal capabilities. Leaders must ensure all teams across the organization have the right capabilities to manage their business units’ performance under IFRS 17.

If insurers fail to properly manage the complexity and volatility introduced by IFRS 17, they stand to face two major consequences. First, there could be a dramatic decrease in transparency around financial performance, which makes it more difficult for investors to accurately value insurers. Second, insurers that mismanage IFRS 17 implementation are likely to incur extensive cost overruns. Therefore, executives should proactively develop a comprehensive strategy that includes organization-wide capability building to ensure they can deliver a strong financial performance once IFRS 17 goes live.

Uneven preparation

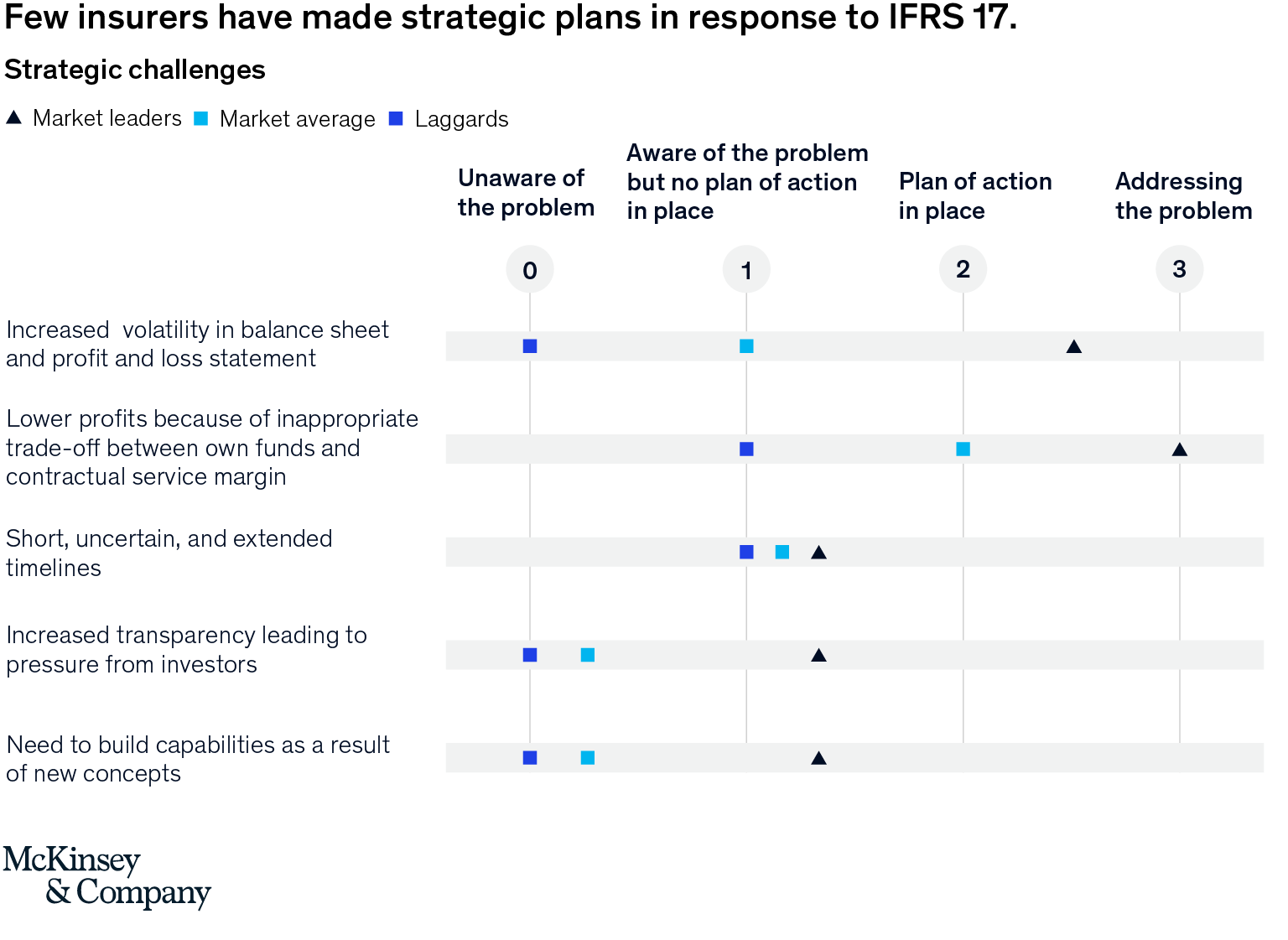

A McKinsey-led benchmarking of insurers shows that while the transition to IFRS 17 is imminent, and most respondents have some understanding of its strategic implications, few have made plans to address potential problems (exhibit).

Notably, the greatest gap between market leaders and laggards is in their preparation for increased balance-sheet volatility. While the average respondent reports having no current plans to acknowledge the problem—and laggards are unaware there is a problem—market leaders seem to have made progress toward addressing it. These leaders are also addressing the possibility of lower profits.

Still, no participants have yet prepared for how they will manage uncertain implementation timelines, increased investor scrutiny, and the need for new organizational capabilities. Laggards are especially at risk: while they are aware of the short and uncertain timeline, they report being unaware of the increased transparency in reporting and the need to build organizational capabilities.

Addressing the strategic challenges

Executives who understand the strategic implications and challenges of IFRS 17 and know how their organization can best address them can avoid cost overruns and decreased transparency around financial performance. Effectively tackling these challenges will depend on each insurer’s specific product and investment portfolio, KPIs, and strategic goals.

1. Increased balance-sheet volatility

Insurance organizations should approach managing increased balance-sheet volatility from two angles. First, they must make smart technical implementation choices on both the asset and liability sides of the balance sheet. Finance, actuary, and investment functions should work together under the guidance of the CFO to ensure their calculations and inputs do not lead to unnecessary volatility. When doing so, the following areas should be considered:

More prudent accounting valuation of insurance contracts.2 This will decrease the likelihood of having to book adverse loss experienced through the P&L account. Insurers will also need a robust process to update parameters and modelling choices to manage modelling volatility.

The volatility of individual contracts or lines of business. The IFRS 17 principle gives insurers the ability to adopt a company-specific, aggregated approach to decreasing the volatility visible to investors. Furthermore, asset and liability movements should be aligned—meaning that IFRS 9 and IFRS 17 are aligned in terms of how interest rates, currencies, and spread movements are booked in the P&L statement and balance sheet.

Second, insurers will also need to change the way they manage their businesses. Led by the CEO and chief investment officer, insurers should reconsider their product offerings as well as the assets they should invest in. The following two trends should be accounted for:

Life insurance product design will become even more asset-driven, which means insurers need to evaluate their life insurance contracts for which they cannot hedge risks by investing in matching assets. As part of this, insurers will need to consider both investing more in derivatives and changing the options of guarantees they offer to their customers.

Market value-based accounting making ALM more important to managing P&L and balance-sheet volatility. Companies will need to upgrade their ALM capabilities to better manage ALM mismatches. Insurers should continuously assess their open positions to see if they are sustainable and assess the P&L impact of de-risking these positions.

2. Lower profits from suboptimal trade-offs

When transitioning to IFRS 17 and setting up the opening balance sheet, each insurer must make the right trade-off between contractual service margins and shareholder equity when producing IFRS 17–compliant financial reports. Contractual Service Margin (CSM) represents the expected future profit of the legacy portfolio, making this an additional trade-off between higher profits in the future and lower IFRS equity for shareholders.

3. Short, uncertain timelines

The implementation timeline for IFRS 17 is short, uncertain, and may even be extended. Skillful management can keep costs down even if implementation timelines are extended. Organizations should be agile during the transition, monitoring and responding promptly to possible changes to the IFRS 17 deadline. Should the deadline be extended, insurers can shift implementation workloads from external resources to trained, internal staff. Indeed, a timeline extension should not lead to the adoption of a more complex and costly solution.

4. Increased investor scrutiny and pressure

Investors may pressure insurers to discontinue unprofitable products, sell closed books, and exit lines of business after examining the more-detailed reports required by IFRS 17. To manage these pressures, insurers will need to carefully monitor the performance of their books of business, focus on technical pricing, and make bold decisions when necessary. They will also need to reassess the value of existing reinsurance arrangements, as investors may question arrangements that mostly transfer profits to reinsurers without meaningfully reducing portfolio volatility.

5. The need for (new) internal capabilities

Finally, a strategic change will require updated capabilities. Significantly, new ways of financial reporting will involve managing businesses to a new set of KPIs. Leaders will need to ensure that all relevant stakeholders within the company understand the imminent changes and can manage the new metrics that are important to their functions and teams under IFRS 17.

During the transition, insurers should help their employees learn new skills and analytical methods. Doing so will allow internal teams to more quickly and smoothly take over tasks that may initially require external resources. Adequate preparation and regular reinforcement will further help teams effectively manage new KPIs under IFRS 17.

The way forward

Insurers should be proactive in addressing the strategic implications and challenges introduced by IFRS 17. And while the deadline is rapidly approaching, it’s not too late to get started. Insurers must act decisively, as delayed action will have significant consequences for implementation cost and post-implementation financial performance.

To make meaningful progress, insurers should understand and evaluate the specific strategic implications and challenges for their organizations and expand their IFRS 17 implementation plans to include a strategic agenda beyond the technical implementation. This includes reviewing—and subsequently adapting—the organization’s goals and strategies to focus on the product and investment portfolio, ALM, and KPIs.

1Shareholders’ equity comprises all capital contributed to the entity plus retained earnings. International Accounting Standard 1 suggests that shareholders’ interests be subcategorized into three broad subdivisions: issued share capital, retained earnings, and other components of equity.2IFRS 17 requires insurers to book losses on loss-making contracts at inception or when they become aware that the contract has become lossmaking. Conversely, profits are booked over time as risk emerges. To avoid volatility, insurers should ensure that a contract does not become lossmaking over time. Adopting more conservative modeling choices regarding contractual service margins, yield curves, and expenses canhelp control this risk.