Selling public assets can be an effective way to improve fiscal health but can also be unpopular, slow, and risky. It is also just one of many available options. From real estate and roads to state-owned agencies and monopolies, there are multiple approaches to create new sources of general revenue that governments can use to improve finances or invest in new infrastructure and other key priorities.

As financial deficits remain high in much of the developed world and spending needs continue to rise, full asset sales will be an important option for meeting these needs. In the United Kingdom, for example, the government has announced a £20 billion (US $33 billion) target for asset sales.1

The Australian government announced plans to raise up to AU $130 billion (US $120 billion) from asset sales.2 And there is substantial scope for such sales: eurozone governments hold €4 trillion of fixed assets, and the US government owns an estimated 45,000 underused or underutilized buildings.3

But privatizations are only one way to raise funds from government-owned assets. Our work with infrastructure and other assets of regional and national governments suggests there is a substantial ability to monetize value short of an actual sale—in one case, 60 percent of asset value was realized through sales, and 40 percent, totaling multiple billions of dollars, was better realized through other means, such as making operational improvements and restructuring the financial model. Often, these types of changes can be easy, quick, and ultimately have the potential to create substantial value for the public.

Four steps, which we explore further in the sections below, are needed to make any approach to monetizing government assets a success:

- First, understand the motivations and policy concerns of the current government. Subtlety matters—different objectives point to different assets and to different strategies for monetization.

- Second, scan and sift. A full and detailed scan of assets is needed, tracking data to the most detailed operational and financial level possible. These data stimulate ideas for value creation at an asset level that go beyond outright sale.

- Third, identify the opportunities. Rapid diagnosis of the current and future operating and financial potential, asset by asset, with fine-grained benchmarking and interviews, can often reveal substantial opportunities to unlock value, including cost-reduction programs and partial equity sale, sale-and-leaseback, contracting for operations, and obtaining a credit rating.

- Fourth, execute with care; carefully manage stakeholder, legislative, accounting, policy, and other barriers.

Understand motivations

The first step is to understand the motivation: governments’ need for extra resources is simple, but their specific requirements may be more varied and can strongly shape the way assets should be monetized.

Is the government looking for a simple fiscal impact? In such cases, governments should bear in mind that public-sector accounting rules may mean that the sale of an infrastructure asset, having been marked to market in previous years, would have little impact on the fiscal position. Operational or other improvements that affect bottom-line economic improvement in the asset need to be captured through general revenues or a special dividend to the government to record a gain. The sale of the asset might not achieve the objective of making a financial gain.

Alternatively, is the government looking for cash? If a government needs liquidity to deal with urgent spending needs or priorities, accounting rules are less important—and an operational change, such as increasing revenues of the government asset through additional fees for a service or changing pricing on an existing service, may be quickest in the short term; however, a sale would have a substantial impact.

In other circumstances, for example, when a government is being asked by ratings agencies to demonstrate a path to more sustainable debt, the overarching concern might be the total balance-sheet impact on indebtedness, or ownership, or liquidity.

Or the government may be focused on none of these but rather on an indicator such as the ratio of debt or government spending to GDP.

In all cases, establishing clarity about goals is the first step to understanding which assets can be monetized and in which ways.

Voices on Infrastructure, Number 3

Scan and sift

With the objectives set, a thorough scan of government assets is needed. Such scans are often surprisingly hard—and surprisingly illuminating. Balance sheets can be opaque, and the data rarely exist in a central, usable format. In the United Kingdom, a national asset register was published for the first time in 1997, but it has not been updated since 2007 and does not include assets owned by local authorities.4 For regional governments and in many other nations, a trawl is needed of government statements of accounts, infrastructure agencies’ assets, and agency-specific databases.

The results can include state-owned enterprises; real-estate assets, including real estate used by government agencies; vacant, undeveloped land; land for redevelopment; roads or transportation assets; and other monopolies that could be monetized, such as lotteries, gaming entities, or convention centers.

Many of these may be out of bounds given various challenges. Core government programs, such as health-care facilities, are often sensitive. Trusts, including pension-plan trusts—as well as deposit-insurance funds, regulators, and entities mandated by statute—may be too legally challenging.

Others can be seen as clearly higher priority, based on revenue, expenses, or total asset base.

Identify opportunities

Opportunities can be identified rapidly, moving asset by asset.

First, and often least disruptive, there can be scope for a systematic, multiasset program of operational improvements without changing the ownership structure: new key performance indicators for managers, changes to pricing, reductions in general and administrative expenses, and optimized capital programs.

Opportunities in different industries or geographies will emerge via detailed benchmarking of revenues, cost, operating performance, balance-sheet health, and other measures, as well as through interviews with senior management.

For example, for one regulated retailer, a rapid diagnostic covered pricing, procurement, geographic coverage of stores, and labor productivity. It showed there were opportunities to make pricing more dynamic, flexible, and regional; to learn from the purchasing practices of private-sector and international peers; and to improve labor productivity through commonly used benchmarks and techniques.

The rapid diagnostic for a utility included outside-in benchmarks of operations and maintenance, capital expenditures, and operational performance. It showed clear opportunities to improve billings and collections effectiveness, reduce generation-plant downtime through maintenance planning, and make capital spending more efficient.

And for a real-estate portfolio, the diagnostic revealed opportunities to rent to other occupants, charge for use, and develop some vacant land still owned by the government, as well as to pursue some outright sales.

Second, in addition to—or instead of—making operating changes, the business and financial model can be restructured. A state-owned retailer could move to franchising or licensing or become a wholesaler. These new approaches to the existing business model of a state-owned entity could produce an entirely new stream of dividends to the government.

Third is a potential change in ownership. But this, too, can involve more options than many policy makers usually consider: whole or partial sales, stock-market flotation, strategic sales, or long-term concessions. Each can achieve different objectives. Incremental value can be unlocked by the “signaling effect” when a large state-owned asset is considered for sale. A partial sale provides a valuation marker and incentive for management to create even more value for subsequent sales of the asset. A “monopolistic value” strategy might require buyers to pay a premium to stake their claim on initial sales of an asset so as to stake their claim early and be better positioned for future sales.

Would you like to learn more about the Global Infrastructure Initiative?

Execute with care

Finding alternative ways to monetize an asset can sometimes be easier than a sale. But it is still not necessarily easy.

Above all, stakeholder support or resistance can make or break any opportunity. It’s important to anticipate and carefully manage opposition from labor unions; government, environmental, or local groups; special-interest groups; management teams; and boards of directors.

Beyond that, however, there could be formal barriers. Changes may require a shift in government policy, the approval of regulators, or, at the extreme, legislation.

And there may be liabilities attached to the asset, from environmental liabilities on real estate to pension liabilities.

In fact, there is often a good reason—beyond simple inertia—for why a move that creates value has not already been made. This demonstrates again the benefit of a systematic program: alone, each objection or policy obstacle seems insuperable given the value at stake. The prize is not worth the effort. Bundled together as a program, though, the combined value becomes sufficient to mobilize the forces and management time needed.

With an explicit understanding of motivations, a thorough scan and sift of assets, rapid diagnostics to identify opportunities, and execution with care, governments can create new sources of revenue. By exploring the range of options from asset sales to alternative approaches, governments can create unexpected value for the public.

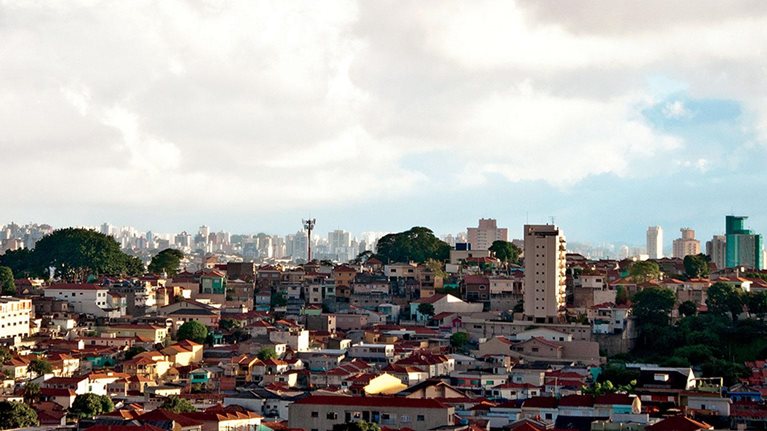

A new compendium of articles, Rethinking Infrastructure: Voices from the Global Infrastructure Initiative, has been released to coincide with McKinsey’s Global Infrastructure Initiative conference, to be held in Rio de Janeiro on May 28–30. For more information, visit McKinsey’s infrastructure practice website.