The recent collapse of oil prices from a peak of $147 has once again made operational excellence a central imperative for upstream oil and gas companies. Previous industry cycles have shown that companies should use a price drop as an opportunity to drive through fundamental improvements in the way their operations function. Three factors influence a company’s ability to do so: a comprehensive approach to improvement across all functions; a continuing focus on building capability; and a permanent shift in leadership attention. Done right, world-class operational execution can add up to 30 percent of value to the production asset base.

The fall of oil prices has exposed an inflated cost base in many oil and gas companies, forcing them to reduce operating costs, rationalize investment budgets, and boost operational efficiency. Many of these programs focus on short-term expenditure reductions by cutting nonessential costs such as travel, minimizing inventories, postponing maintenance, deferring projects, and renegotiating service contracts. Though such measures are useful in a cash-constrained environment, structural opportunities for sustained operational effectiveness can be missed. Worse, as some exploration and production companies learned to their detriment in the last oil price cycle, deep cuts in maintenance and production budgets can damage asset integrity, reduce reliability and thus production, and lead to the loss of the most capable operations staff.

Upstream companies should remain focused on operational excellence for structural as well as cyclical reasons. Many hydrocarbon provinces have moved into the mature stages of their life cycle. Likewise, production facilities reaching the end of their economic if not their technical life spans require modifications and increased maintenance. The widespread application of infill drilling, water-flooding, and enhanced oil recovery schemes has increased activity levels and associated operating costs.

At the same time, there are fewer opportunities to create value from greenfield exploration and development projects. Access to the most promising provinces, such as the Middle East and South America, is restricted. Competition for the remaining opportunities is intense, and the commercial terms and conditions have become more onerous, putting ever more pressure on capital and operational efficiency. Access is often granted only to those companies that can maximize recovery of the marginal barrel in a cost-efficient manner. Companies that could once flourish because they were better at exploration or project development now find that they must achieve excellence across the value chain.

We base our experience in upstream operations on a proprietary database of benchmarks and best practices as well as on our recent support in upstream operations across all basins for almost 40 clients, a few of which involve large-scale operations performance transformations. Our operational benchmarking and client work demonstrates that world-class operators extract more volume and operate at lower cost than do average operators in comparable situations.

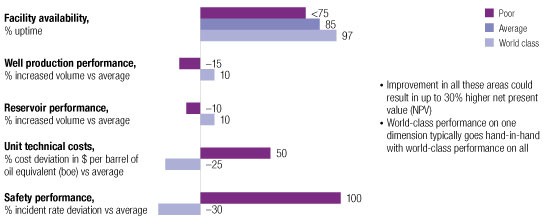

The result is that the financial upside from operational excellence could be up to 30 percent higher net present value (Exhibit 1). To realize this game-changing potential, companies need to address four major aspects of production performance.

Better operations bring big rewards

Total maintenance reliability. World-class operators achieve a best-practice-facility reliability of 95–98 percent even at old facilities serving depleted reservoirs. Their maintenance costs are 30 percent less than the average, with preventive jobs accounting for the majority (70 percent or more) of maintenance hours. The value of their small-modification project portfolio can be up to 50 percent higher than that of average operators because of better prioritization and optimization.

Lean-process execution. World-class operators achieve a schedule compliance of more than 80 percent. The effective time frontline workers spend on value-adding activities is 50–60 percent, compared with an industry average of half that. Planned overhaul shutdowns typically take half the time that is needed by average operators.

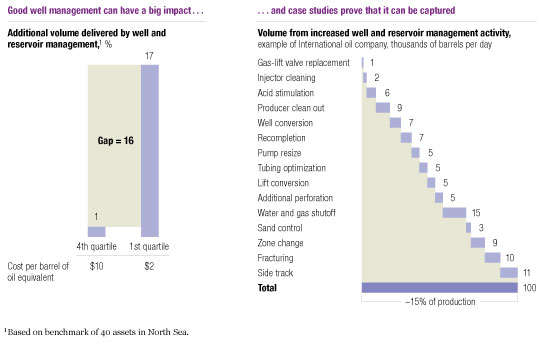

World-class well and reservoir management. World-class operators extract more than 15 percent more production from existing wells than the industry average through better understanding of well and reservoir performance and better delivery of interventions. They increase the ultimate recovery of their fields through better injection-pressure management. Their well interventions typically cost less than $5 to $10 per barrel of oil equivalent (BOE).

Superior contractor management. Best practice contract managers continuously monitor contractors to make sure their activities do not stray beyond their original mandate. Such additional activities often add up to more than 10 percent of contract expenditure. Operators also maximize value when they ensure that contractors’ incentives are aligned with their own.

Operational excellence also pays a safety dividend. Preventive maintenance results in fewer hazardous situations, planning and scheduling allow managers to think about how jobs can be done better and more safely, and efficient processes allow management to be out on the site for most of the day.

Identifying opportunities for operational excellence

Operational excellence involves focusing on the most important activities and then executing them well. Of the 25 or so processes that deliver value in upstream operations, the four just outlined should be given priority. Effective management of cost reductions also plays an important role in achieving operational excellence.

Total maintenance reliability. We often observe a reactive culture in operations, with many unplanned breakdowns and maintenance issues being solved as they come up during the day. This typically results in poor reliability and safety. World-class operators frequently review maintenance policies and nurture a culture of continuous elimination of all sources of loss. They optimize preventive and condition-based maintenance for critical equipment, while minimizing additional maintenance for less-critical systems. Key requirements are a full understanding of the criticality of equipment, a complete maintenance log, and a readiness to draw on all available expertise in optimizing maintenance policies. When regular maintenance policies fail to eliminate losses, the best operators propose modification projects with clear businesses cases and rank them according to return on investment.

Lean-process execution. Many facilities face a substantial backlog of maintenance work, despite having enough resources to complete it. The root cause is a poor planning and scheduling system that fails to allocate tools to frontline staff efficiently. World-class operators run an integrated planning and scheduling process that covers all on-site activities, from drilling to safety audits. Crucial to this are “gates” at fixed intervals—for example, 90 days, 28 days, and 7 days before execution of the plan. The gates ensure that all preparations and approvals are locked in to allow the activity in question to take place. The central planning team owns the plan before execution, while site management owns the plan during execution and manages deviations and interruptions throughout this phase.

For major overhauls, world-class operators minimize the duration of the shutdown. They take out activities that do not require shutdown and perform these outside the overhaul. They identify and compress the essential activities, as is done in a Formula 1 pit stop, and they plan and prepare long in advance while working closely with the subcontractors.

World-class well and reservoir management. One of the largest sources of value in operations is to extract more volume from existing wells, with activities ranging from acid stimulations of individual wells to optimizing the water injection pressure rates in the reservoir. World-class operators have up-to-date, transparent data on their wells’ technical potential and track how much additional volume is delivered by optimization activities. These businesses have a correspondingly strong focus on data management for up-to-date well and reservoir understanding. Cross-functional optimization teams, consisting of petroleum engineers, operators, planners, and well services staff, run frequent well reviews to analyze performance gaps and identify ways of restoring and optimizing volume. The well services function ensures that operators apply expert knowledge in well interventions, use prior learnings and optimize production (see Exhibit 2, which shows the significant volume opportunity from superior well and reservoir management).

Rewards of well and reservoir management

Superior contractor and supplier management. In the past few years, the market for oil field services has been very tight, and hence it has been difficult for many operators to tightly manage performance on existing contracts. World-class contract managers have a robust performance- management system in place and hold frequent dialogues with suppliers. They know how to set incentives so that the contractor optimizes value for the operator. Thus a well service provider is not rewarded according to the volume of acid used to clean up wells but receives incentives based on incremental production volumes. World-class operators manage suppliers globally and maintain development programs with select companies. They develop an in-depth understanding of supplier cost structures and continuously squeeze out waste while allowing margins appropriate to the current market environment.

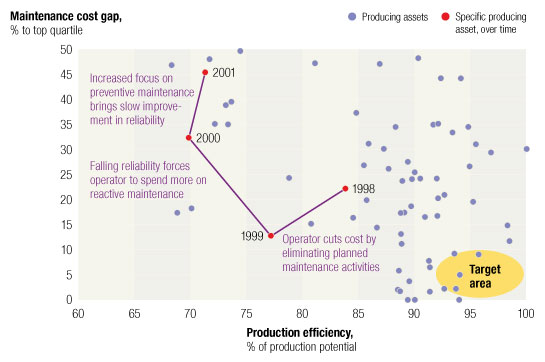

Cost-optimization management. World-class operators make the right decisions about which costs to reduce, thus avoiding a downward spiral in reliability performance (see Exhibit 3, which illustrates the vicious circle that many operators can go into when reducing maintenance expenditure). In addition to the cost opportunities inside the core delivery process described earlier, overhead support functions and supply chain and procurement management can significantly affect costs. Best-in-class operators understand the costs of each business support function in detail—for example, the cost of a specific report—and continuously prioritize must-have activities over nice-to-have activities. They also minimize the waste inside processes by cutting waiting time and the need to repeat tasks, reducing each activity to its technical limit. In supply chain management, great use of logistics services can yield big cost savings.

False economies

Shaping a successful program

Successful operations transformation programs have three factors in common: cross-functional integration, capability building, and leadership mind-set alignment.

Cross-functional integration. A clear distinction between an average and a world-class operator is the extent to which the value-delivering processes are coordinated. Especially in functional or matrix-type organizational models, management needs to ensure that planning and scheduling encompass all functional activities. For example, ensuring that facilities and subsurface activities take place simultaneously minimizes the length of shutdowns. Management also needs to ensure that performance-management metrics match across functions. For example, operators and petroleum engineers should both be responsible for water injection targets, to maximize production volumes.

Capability building. When getting the organization to adopt new ways of working, it is not sufficient to distribute a CD-ROM handbook with best-practice processes. The entire organization must upgrade its skills, and adults learn best by doing. Therefore, capability building is critical to the success of any attempt to transform operational performance. Action learning methods should be used to infuse new ways of working in everyone’s daily job. This also requires coaching to become part of the performance dialogues at all levels in the organization.

Leadership mind-set. Senior managers at world-class operators focus on operational performance and know what success looks like. They have clear performance expectations for both leading and lagging indicators, such as mean time between equipment failures and well test compliance. Reporting lines are clear at all levels and across functions. Targets cascade down all the way to the front line, and regular reviews ensure that everyone holds the proper performance dialogues, with the purpose of closing any performance gaps.

Finally, we recognize that a successful performance transformation needs to be driven both by real impact and by frontline engagement from the start. A common failure pattern occurs when the program’s design, start-up phase, and diagnostic take too long, creating the impression that the program is having little impact. As a result, frontline staff do not take ownership of the program. But achieving tangible impact and real frontline engagement early on generates a pull effect from the front line—the work becomes more attractive and employees’ performance improves—which then gives the program further momentum across the organization. An operations “project” then exceeds initial expectations and becomes an operations “performance transformation.”

Over the past few years, value in upstream operations has shifted from gaining access to new fields and delivering development projects to delivering best-in-class operational performance. Today’s challenging economic environment for oil and gas operators means that better operational performance—both in costs and production volumes—will play a significant role in delivering positive returns over the coming years.