Like most of the 150-plus employees at the Silicon Valley headquarters of Impossible Foods, David Lee often partakes of the vegan breakfast and lunch served daily in one of the company’s quirkily named meeting rooms (“Ketchup,” “Narwhal,” “Zeep”). But Lee isn’t vegan. He is—like the company’s target customer—a self-described “hard-core meat eater.” These days, though, the “meat” he eats is increasingly coming from plants, not animals. And he’s signed on to the mission that his boss, Impossible CEO Pat Brown, has set out: to have people stop eating animals and animal products by 2035.

It’s a bold mission. Then again, the company is called Impossible Foods. And it’s had a whirlwind year: as one of the two biggest brands of alternative proteins (its main rival, Beyond Meat, went public in May), it’s been in the news almost nonstop since early 2019. Its launch of the Impossible 2.0 burger—which looks and cooks (and, to many people, tastes) almost exactly like ground beef—led to a stratospheric rise in consumer demand that even the company didn’t anticipate. Massive out-of-stocks seemed to further stoke demand. Impossible ramped up production, hiring more people at its factory in Oakland, California, and partnering with large food manufacturer OSI Group. Just weeks ago, the Impossible Whopper became available at all Burger King restaurants nationwide; it will soon be sold in grocery stores.

Impossible Foods counts several celebrities among its fans, and some have even become investors. The company now employs close to 500 people and has been making new hires almost every week. In other words, it’s no longer the risky start-up that Lee joined four years ago. During a recent conversation with McKinsey partner Joshua Katz, Lee shared his thoughts on what differentiates Impossible Foods from its competitors, how it makes decisions about marketing and pricing, and the challenges that come with being the CFO of a company experiencing tremendous growth.

McKinsey: It feels like we’ve entered a new period of unprecedented demand and interest in plant-based proteins. What are the biggest factors driving this heightened demand?

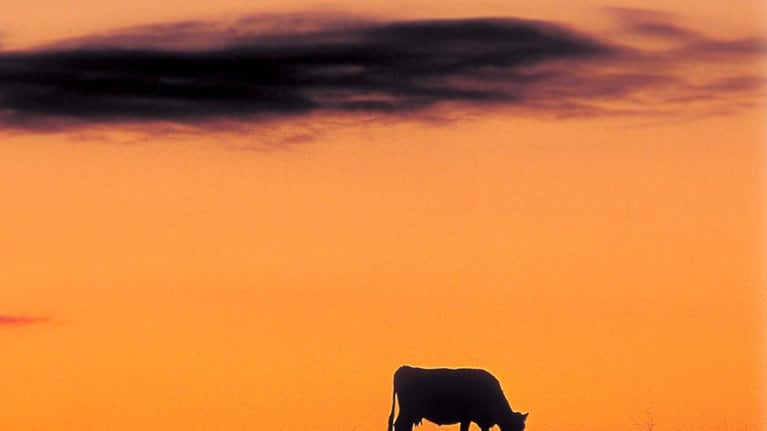

David Lee: It’s not so much the demand that’s new. The meat eater has desperately wanted something better than meat but has been starved for it for the past several years. What’s new is that there are companies like ours that now offer something “craveable” and delicious for meat eaters like me, without those compromises that we’re in denial about—like the impact to our health or the impact on the environment.

Meat eaters are in love with meat. They’re emotionally connected not just to the quality and the taste of the meat but also to the entire experience of meat eating. We believe that we can create that same craveability that feeds the meat-eater addiction—but without using animals. For us, the key has been this crazy molecule called heme, which is a building block of life in animals. We call it the magic molecule. We just happened to find it naturally occurring in a plant, and we believe it gives us an edge over a lot of the other competition.

McKinsey: Do you think the demand for your products will come primarily from Western millennials? How do you see consumption patterns evolving either by customer segment or by geography?

David Lee: In the US, the number-one demographic consumer of meat is the millennial. Many had thought that younger millennials don’t spend a disproportionate amount of their money on food. But it’s the opposite: they spend more on not only food but also on food experiences. The chef, the restaurant, and the mission all make more of a difference to millennials. They care about what food says about who they are and what they’re doing for the environment. So, millennials are not only the biggest consumer base for us from a financial standpoint; they’re also the most important strategic demographic, because they set food trends.

That said, meat and dairy are ubiquitous. In every demographic and every culture, people crave dairy and meat as part of their everyday life. And you can give the same ground beef to two different chefs—say, White Castle versus David Chang at Momofuku—and they will produce an entirely different experience. People ask, “How do you stay relevant for one market versus another?” Well, how does beef stay relevant for one market or another? It’s because it can be spiced differently. It can be “pattied” differently. It can be seared or long-simmered. It’s a great bao. It’s a great dumpling. The same is true of the Impossible burger, and we think that meat eaters everywhere will crave it. Since March 2019, our Asia business has more than tripled in Singapore and Hong Kong.

McKinsey: You’ve also made some very savvy marketing choices to build the Impossible brand. Tell us about those.

David Lee: We spend a lot of time thinking about creating followership in the market and doing it in a way that tends to break the playbook of the traditional food marketer. A lot of new food brands rush to retail. We instead pulled off a neat trick, which is to get the Impossible brand on every menu of every restaurant we’re in, without paying for it.

And we leverage social media to build followership among millennials, who are not influenced by “push” media like radio and TV and print. They tend not to trust promotions that are obviously paid for. None of our celebrity endorsements are paid—they’re all authentic. When Katy Perry [who is an Impossible investor] showed up at the Met Gala dressed as a burger and tagged us on Instagram, we didn’t pay for that.

McKinsey: Impossible has won many fans, but it also has detractors. One of the criticisms is that the Impossible burger isn’t a healthful food. How do you see the health profile of your products evolving?

David Lee: The Impossible burger was never designed to compete with the health benefits of, say, a piece of broccoli. It was designed to compete in the $1.7 trillion global meat and dairy market in which meat eaters want to eat meat not just every week but at every meal. They want it as a part of their everyday life. So if people could have an Impossible burger as part of their everyday life, they’re forgoing the cholesterol that they’d get from a cow, because the Impossible burger has no cholesterol. And it has 10 to 20 percent fewer calories.

McKinsey: But it’s more expensive than a beef burger, which might hinder some people from buying it. At Burger King, the Impossible Whopper is about $1 more than a regular Whopper. As the CFO, how do you think about pricing?

David Lee: Pricing for us is a strategic choice. We use a fraction of the resources the incumbent industry does to make its products, so with that comes the ability to choose. Could we have a much higher profitability and offer a lower price in the market? Absolutely. But to achieve that, we need scale—we need to actually have the size of the business that the incumbent industry has. So, I go back and forth: I know that meat eaters are willing to pay a premium, but I also know that the more Impossible burgers we sell, we fundamentally reduce the cost structure of the business. So it’s a strategic choice.

McKinsey: Impossible 2.0 was a major breakthrough. What’s next?

David Lee: Anything the meat eater can imagine will eventually be launched by this company. We do 100 prototypes a week. We’re working on technology that creates prototypes for plant-based pork. I’ve had a chicken noodle soup and a fish risotto that were both entirely plant based.

We already have platforms under way to develop what we call a whole cut—a great piece of steak, a whole cut of chicken breast, a whole fish filet. We’ve been shy about offering specific time frames, but we’re hard at work on all of those.

McKinsey: The competition is not stagnant. How are you thinking about the competitive environment?

David Lee: We welcome the competition. It’s a rising tide. Meat is such a ubiquitous product that there will be many winners. And our bet is that meat eaters will pick the best product. We think that innovation will be the biggest catalyst to change the world—not regulation, not browbeating. We don’t rely on any of that. We just rely on the better product.

At Impossible, some of our scientists previously worked on solving the problem of cancer—so they were not incrementalists but rather breakthrough scientists. Our approach has always been about breakthrough science. Our pace of innovation is much faster than a large food company. When I was running the consumer-products business at a large food company, we had hundreds of food scientists—but we were looking at how to make something 20 percent cheaper or 10 percent less salty. We weren’t thinking about the fundamentals of what creates craveability. And that’s been what distinguishes Impossible.

Anything the meat eater can imagine will eventually be launched by this company. We do 100 prototypes a week.

McKinsey: You’ve been a CFO before. How do you think your job at Impossible is different from your prior roles or from those of other CFOs at consumer brands?

David Lee: When a CFO has a team that is completely focused on a long-term mission, the choices about return on invested capital or picking a channel are so much easier, because the long-term mission—which is to become a sizable portion of this very large market—is at a level of profitability that serves the investor interest as well. So most of my job is to advise the team on how to create more market adoption. The unit economics are strong enough for that positive momentum to contribute to the bottom line. We obsess as much about gross profit as we do about market share, because gross profit is the financial fuel for us to invest in market expansion.

I think the best thing I ever did to prepare me for the CFO role was to start as a marketer, to spend time as a general manager, to own a P&L, to run a factory, to have to launch a business. Being a great CFO means you have to be able to provide great advice, and there’s no way to do that unless you’ve walked in the shoes of your peers. By the way, I don’t view being a CFO as a destination career. I think the CFO role can allow someone to go beyond just finance—to be a strategist or an operator. “Take a multifunctional view of the role” is probably the best advice I could offer someone who wants to be a CFO.

McKinsey: What’s the biggest thing you’ve learned at Impossible?

David Lee: I’ve learned that culture matters more than strategy. When I started at Impossible Foods, we had a total of 100 people. We were pre-revenue; the company had no commercial viability yet. We didn’t have a supply chain or a brand strategy or many of the commercial functions that we see today. Now we’re pushing close to 500 employees; we are nationwide. When it comes to talent, our challenges now are less about attracting capable people and more about making sure that the talent we’re seeing is truly mission-aligned—that they’re here not because they want to be part of the next big IPO but because they want to make a difference.

Preserving the DNA of the company—this notion that we blast ahead and we break rules against a big mission—is sometimes difficult when you’re onboarding so many people so quickly. So a big lesson for me is that culture is probably one of the biggest challenges in hypergrowth; it’s an even bigger challenge than developing a go-to-market strategy or creating a winning brand.