As the “Asian miracle” continues to unfold, perhaps the most intriguing—and least understood—of the region’s fast-growing economies is South Korea. During the four decades following the Korean War, it evolved from one of the most abject states in the region to one of the most vibrant, a manufacturing powerhouse that has virtually eradicated poverty, malnutrition, and illiteracy. In a region of fast growth, since the 1960s Korea has increased its per capita GDP more quickly than any of its neighbors.

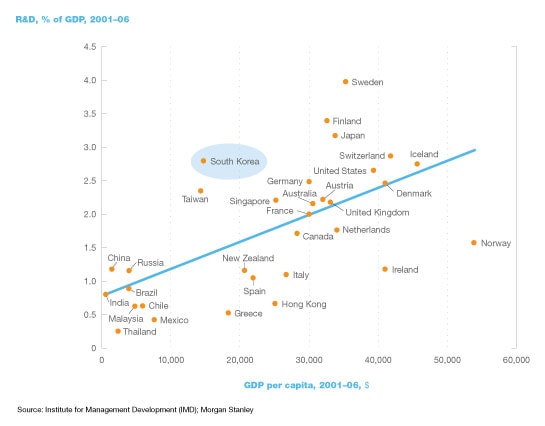

Despite these successes, the country remains largely unknown to outsiders. It attracts few foreign tourists, and English speakers are still rare. Geographically, Korea finds itself squeezed among three titans: China, Japan, and Russia—a position that confers great challenges and, potentially, great benefits. Economically, the country is poised at a critical juncture. While its mighty manufacturing engine powered it to great heights in the last century, to thrive in the new one it will need to develop an equally strong service sector. South Korea has already shown that it’s willing to invest; it spends a bigger percentage of its GDP on research and development than Germany, the United Kingdom, or the United States do (exhibit).

The essays that follow offer probing looks at these issues. Morgan Stanley’s Stephen S. Roach and Sharon Lamm and McKinsey’s Richard Dobbs and Roland Villinger offer separate takes on Korea’s economic challenges. Christopher Graves, CEO of Ogilvy Public Relations, provides a marketer’s view of the steps Korea could take to build a national “brand.” Shen Dingli, a professor at Fudan University, distills five strategies for continued prosperity. Bill Emmott, former editor-in-chief of the Economist, addresses the country’s geopolitical position, with a prescription for turning geography into an advantage.

The R&D factor

Over the past year, as part of McKinsey’s work with an international advisory council to the president of South Korea, we convened more than two dozen renowned business leaders, academics, and policy makers to share their views on the country’s options for the future. The result was a book, Korea 2020: Global Perspectives for the Next Decade, published by Random House Korea. These five essays have been selected from that volume.

The resilient economy

Stephen S. Roach and Sharon Lam

South Korea sailed through the 2008–09 financial crisis with remarkable aplomb. Despite its heavy reliance on exports, South Korea registered only a single sequential quarterly decline in real GDP during the global downturn, thus avoiding full-fledged recession. By the third quarter of 2009, South Korean growth had bounced back to nearly 3 percent while unemployment—which even in the worst of the crisis never rose more than a single percentage point—had already begun to ease. Indeed, it took barely three quarters for South Korea’s production and consumption to regain pre-crisis levels. Among Asia’s “tiger economies,” South Korea suffered least from the crisis and recovered the most rapidly.

Why was the South Korean economy so resilient? Because its businesses and government leaders recognized the opportunity this crisis presented. The familiar rap on South Korea is that its economy is “stuck in the middle,” trapped between an advanced Japan and a rising China. South Korea’s great dilemma—or so it’s often said—is that it falls short of Japan on quality and can’t hope to match China on price.

And yet South Korean producers’ performance in the wake of the financial crisis suggests the middle ground may offer advantages. In the post-crisis era, consumers the world over have turned cautious. The new mantra is value for money. South Korean companies are well positioned to capitalize on that new ethos with products that optimize the quality and price trade-off. South Korean exporters have, in fact, gained market share during the crisis. South Korea’s global market share in phone handsets, for example, rose to 33 percent in the third quarter of 2009, from 22 percent at the end of 2007. In fact, in the US market alone, South Korean mobile phones are currently taking up almost 50 percent of the market share. Its LCD-TV global market share also jumped to 37 percent in 2009, from 27 percent at the end of 2007, and it will soon replace Japan as the world’s number-one LCD-TV supplier. South Korea’s automobile global market share climbed to 9 percent in the third quarter of 2009, from 6.5 percent in the final period of 2007.

The depreciation of the won in 2008 contributed to South Korea’s recent export gains, but it was hardly the decisive factor in South Korean competitiveness. Rather, South Korean producers’ ability to thrive amid crisis reflects a relentless focus on improving product design and quality, as well as savvy and aggressive marketing efforts to enhance the image of South Korean brands. Less than a decade ago, Samsung Electronics was a maker of lower-end consumer electronics, barely noticeable in global markets. The company figured out how to move up the value chain by building a strong brand image and innovation. Its efforts are paying off: in 2009, Samsung ranked 19th on Interbrand’s Best Global Brands list. Samsung’s rise in ranking over the last decade was the fastest among any of the top 100 brands. It has even surpassed rival Sony, which now ranks 29th. Hyundai Motor and LG Electronics are making similar dramatic progress.

As South Koreans look to the next decade, the key question is whether they can maintain this strategic advantage. Does South Korea have the right model to withstand the inevitable next round of shocks to the global economy? Can the nation grapple with other problems that threaten long-term growth?

In pondering such questions, one thing seems clear: an attempt to compete with China on cost or scale is bound to fail. South Korea’s best hope is to move higher up the value chain. Capital investment will play a crucial role in that ascent. South Korean firms have a solid record for investing in productive capacity, as the exhibit at the beginning of this article makes clear. Indeed, South Korea’s capital investments in research and development are among the highest in the world relative to national income. This is a strength South Korea must preserve.

South Korea’s recently announced decision to expand tax deductions for business investments in research and development is a step in the right direction. But such incentives should also look forward, targeting investments in new growth areas such as alternative energy, green technologies, and biotechnology. South Korea’s comparative advantage lies in technology and design, not in resource-intensive heavy-manufacturing industries, which will inevitably lose market share to competitors in China.

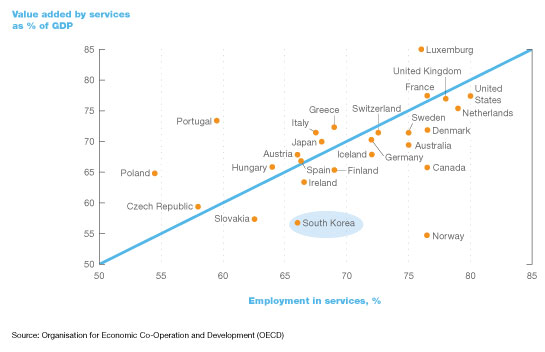

In the long run, South Korea can’t rely solely on manufacturing, because investments in technology-intensive industries are inherently labor saving—in other words, they do not create jobs. If South Korea is to achieve balanced, sustainable growth, it must also place greater emphasis on its labor-intensive services sector. Services employed only 66 percent of South Korea’s workforce in 2008, compared to 70 percent in Japan and 85 percent in the United States. South Korea’s 30 percent self-employment rate—among the highest of any nation in the OECD1 —reflects a fragmented, overregulated services sector dominated by inefficient “mom and pop” proprietors.

The surest solutions to this shortfall are liberalization and greater openness to foreign competition in key areas such as finance, distribution, professional services, and communications. At the same time, the nation must increase infrastructure investments in medical care, tourism, and education.

South Korea also must focus on raising the living standards of its people and narrowing the gap between rich and poor. Growth must be distributed more equitably between urban and rural areas. Currently, Seoul and adjacent cities generate nearly half of South Korea’s GDP. The excessive concentration of South Korean growth is manifest in the nation’s property market, where prices in Seoul are climbing while prices in the rest of the nation remain sluggish. The government has used the crisis as an opportunity to accelerate regional infrastructure spending. It should complement that effort with investment policies designed to encourage the creation of regional economic clusters.

It’s always tempting to predict the future by extrapolating trends from the recent past. In the case of South Korea, that would be a serious mistake. Yes, the nation’s real GDP growth, which averaged 6.3 percent in the 1990s, declined to 5.2 percent during 2000–07 and plunged to 0.8 percent in 2008–09 in the midst of the global crisis. This downward trend has led some to warn that South Korea’s potential for economic growth over the coming decade has fallen to an annual average of as little as 3 percent.

We believe South Korea can sustain an average growth rate of 4 percent or better— provided government policy, in conjunction with forward-looking private-sector strategies, focuses on three fundamentals: continued investment in R&D, service sector reform, and regional development. Should South Korea take decisive action in these areas—and we suspect it will—it will emerge as one of Asia’s most impressive post-crisis growth surprises.

About the Authors

Stephen Roach is chairman of Morgan Stanley. Sharon Lam is vice president of research at Morgan Stanley Asia.

Designing a distinctive national brand

Christopher Graves

Before the Internet, before airlines, before movies, our impressions of foreign lands were created through a mix of oral folklore, historical accounts, and travel writing. For centuries, the Western world’s notions of China, India, and all points between were derived almost entirely from the fragmentary accounts of Marco Polo and a handful of itinerant traders and Jesuit missionaries. Some of these accounts reflected keen observation. Others were the purest fantasy. All were refracted through the biases of the original observer, then again through the biases of those who retold their tales.

In 1882, author William Elliot Griffis first coined the term hermit nation in portraying Korea as reclusive. In the preface of his book Corea, the Hermit Nation, he recounts strolling in the Japanese town of Tsuruga along the sea that separates Japan from Korea. He noticed Korean influence wherever he looked, musing, “Everywhere the finger of tradition pointed westward across the waters to the Asian mainland,” and yet he wondered, “Why should Corea [sic] be sealed and mysterious, when Japan, once a hermit, had opened her doors and come out into the world’s marketplace?”

Today, no longer dependent on a single adventurer’s journal, we can read firsthand accounts of millions of bloggers all over the planet, join their tribes on social networks such as Facebook or Cyworld (where one-third of South Korea’s entire population is registered), see their personal photos, or peer directly into their lives via webcams. And yet, our collective understanding or appreciation of some countries does not appear to have advanced from the Griffis account more than a century ago.

Consider South Korea—it is a major economy and a world-class manufacturer whose products trade around the globe. It has hosted an Olympics, in 1988, and cohosted a World Cup, with Japan, in 2002. Still, how many Westerners can name its president? Or bring to mind a single cultural icon of this ancient civilization? To be sure, the so-called Korean wave did bring fame to some pop and soap opera stars, mostly from South Korea’s neighbors, but there are signs that it is waning, or even evidence of a backlash in some countries.

South Korea lacks a cohesive, differentiated brand in the minds of those outside the country. There is no touchstone that brings to mind an idea, or a feeling, about the country; no symbol that inspires trust or affection.

How can this be? Imagine that 90 percent of Americans thought the Eiffel Tower was in Berlin, or that BMW was an Italian brand, or that prosciutto di Parma came from Finland. Such misconceptions seem preposterous. And yet when citizens of the Western world think of South Korea—to the extent they do so at all—many suffer equivalent confusion.

In a survey of 1,000 US college students across 375 schools by Anderson Analytics in 2006, only 39 percent believed South Korea produced quality products, while 81 percent thought Japan did.

If high-quality, award-winning product designs have the power to transform a country’s reputation, why hasn’t that worked with South Korea? Well, for a start, no one seems to know that South Korean companies are in fact South Korean! Less than 10 percent of the students in the Anderson Analytics survey identified Samsung or LG as South Korean (they thought they were Japanese). Notably, students who did recognize LG and Samsung as South Korean also gave higher marks for quality to South Korea as a country, thus giving evidence of the bidirectional benefits of perceived high-quality products. The implications are huge. South Korea invests vast sums in R&D and design (exhibit). Its companies make world-beating products. But who gets the credit? Japan.

Looking for the next big thing

“People build brands as birds build nests, from scraps and straws we chance upon,” wrote Jeremy Bullmore, a British advertising executive who wrote several books about the industry. Perceptions, he argued, often are “outside the control or even influence of the product’s owner.” The question, then, is, how much can a nation’s brand be created and managed? And does it matter?

In January 2009, South Korea formed the 47-member Presidential Council Nation Branding, a government initiative meant to coordinate all nation-branding efforts. It includes 8 ministers, numerous business leaders, and professors. The council has embarked on a ten-point “Brand Korea” action plan. The following strategies are among the action points: promote the martial art tae kwan do; send 3,000 South Korean supporters abroad through something like a cultural Peace Corps; increase state-of-the-art technologies; and so on. I fear this committee-made framework will not succeed. It overlooks South Korea’s most powerful engine of transformation.

Simon Anholt, in collaboration with New York–based market research firm GfK Roper, has created a six-dimensional national-brands index that assigns individual nations a single branding score based on foreign perceptions of a host of variables, including desirability of its exports, the competency of its government, and the appeal of its culture and heritage. By this measure, South Korea ranks 39th out of 50 nations surveyed, below countries such as Mexico (26th), India (27th), China (28th), and Egypt (31st).

Elaborate brand frameworks can be reassuring; indeed, the very act of designing them suggests branding is a form of engineering and that the hearts and minds of the world’s consumers must inevitably yield to the rigorous application of science.

But make no mistake, winning brands are an amalgam of love and aspiration, of cool and joy, of longing and belonging. They cannot be faked. And neither hard work nor big investment can guarantee branding success.

One factor, though, that can radically improve the odds of creating a great brand is great design. It’s hard to overstate the importance of this element. Great design has the power to elevate an entire corporation; sustained over a long period across many companies, it can lift an entire nation in the world’s esteem. Japan’s excellence in design, for example, played a key role in its economic rise. Italy’s undoubted sense of style means consumers willingly pay a premium for a “Made in Italy” label. So getting design right is a crucial step in creating a brand identity.

Sometimes design-driven brands beautifully reflect the country of origin. “Frankly, IKEA is doing more for the image of Sweden than all governmental efforts combined,” wrote Ollie Wästberg, director of the Swedish Institute, in Public Diplomacy magazine. “That might be a sad statement coming from a governmental official tasked with enforcing the brand of Sweden,” he continues, “but IKEA’s 285 stores in 37 countries feature the blue-and-yellow national colors, serve Swedish meatballs, and sell blond-wood Swedish designs and books about Sweden. To visit IKEA is to visit Sweden.”

South Korea has launched the Korea Plaza concept in some countries. It seeks to tie together in one space South Korean pop culture (hallyu, or the “Korea wave”), language, songs, and traditional dance. This may well succeed in introducing people to all aspects of South Korea. But a more concentrated effort specifically around South Korean design is called for. Think of the Apple retail spaces that are works of art in their own right, while at the same time functioning to educate consumers about the products.

South Korea’s investment in design has been substantial, from the Korea Institute of Design Promotion to its 230 design schools (more than the United States) to the design institutes at both LG and Samsung. And there are signs the investments are paying off.

South Korean designers are driving the most innovative designs in the auto industry—the revival of the Camaro, the new concept crossover Cadillac Provoq, the electric Chevy Volt, and the Lincoln MKT. In fashion, South Korean designers have been sewing up excellence as well. In 2008, according to the Financial Times, half of the most talented emerging designers chosen to be honored in Gen Art’s Fresh Faces fashion exhibition were from South Korea or were Korean American, and at Parsons The New School of Design in New York, nearly a third of all students are Korean. At Cannes last year, ten Korean films were screened—a record—and one (Thirst) won the Jury Prize.

Companies such as LG and Samsung have been sweeping international design awards. In the prestigious iF design rankings, awarded by International Forum Design in Hannover, Germany, Samsung is number one in the world—ahead of number-two Apple. LG is number eight, ahead of German design legends BMW, Miele, and Gaggenau. And yet, South Korea still gets no credit for these accolades. A recent survey by the South Korean Presidential Council on Nation Branding found there is a discount when it comes to comparing the country of origin of products; consumers in Japan, Germany, and the United States marked down the value of identical products by 30 percent or more when told it came from South Korea. Japanese consumers would bump up the value of a $100 product from South Korea to $141 if they were told the same product came from Japan. And in emerging markets, the gap was even bigger. This gap is evidence of the power of nation branding. Product quality alone won’t close the gap. Negative perceptions of the country of origin will exacerbate the gap. The relationship is bidirectional: superior product design and quality has the potential to burnish a nation brand, while a strongly positive nation brand will boost perception of quality of the products exported from that country. And yet, it’s not as easy as merely improving product design and quality.

South Korea must do more to connect its product design with the country itself. South Korea must make design and its brilliant young designers the centerpiece of its national brand-building effort. Government can help to set the stage for telling South Korea’s design story, but the story must be told by the designers, artists, and stylists themselves rather than in the voice of a faceless government agency.

Several specific things South Korea could do to create a national brand based on design are the following:

1. Create a unifying organization and brand imagery. South Korea now has a coordinating body. But this is a situation where the products will shape the national brand. So the Presidential Council on Nation Branding needs to enlist leading consumer-product companies to support the effort so every time a consumer test-drives a Hyundai or buys a Samsung refrigerator or an LG television he or she knows it came from South Korea. This includes a country brand logo. The “!ncredible India” mark even brands the immigration forms as you enter India. The Joan Miró sun painting for the Spanish national brand campaign unified all efforts.

2. Find, capture, and retell the stories of South Korean designers. The Council will need to engage a team of story hunters trained in interviewing and helping the designers tell their own stories of how they do what they do, of reliving their moments of discovery. My company, Ogilvy Public Relations Worldwide, helped Lenovo create a design blog written by Lenovo designers to share their passion for great design; Ogilvy has also worked to give voice to Ford drivers as they discovered the new, high-quality, superefficient vehicles. Hearing candid stories from consumers and designers themselves lends far more credibility than institutional messaging does.

3. Create a living design experience, a design theme park. Not just an exhibit of cool tech products, but a world of designers at work that allows visitors to experience the design process. Think of it as though a Disney Imagineer created a new “Design World” wherein you can try fashion design, auto design, city design, green design, or myriad other forms of design while being surrounded by the coolest designs and concepts from South Korean companies.

4. Create a global design award. This would be on the order of a Nobel Prize (for science) or the Pritzker (for architecture). To ensure high-quality entrants, make it valuable—money speaks to designers too—and have an awards ceremony that attracts the global A-list.

South Korea has made great progress in creating opportunities for design to blossom, in both aesthetic and commercial terms. Without a unifying thread, though, the country’s excellent products have not fully succeeded in creating a national brand. Worse, it may have actually burnished Japan’s reputation by neglect. Consumers are caught in a syllogism: Japan makes high-quality, well-designed products; products such as those from LG and Samsung are high quality and well designed; therefore those products must be Japanese.

The solution must surely lie in solving the conundrum that tugged at Griffis back in 1882 as he observed all the threads of Korean influence around him in Japan and wondered why Japan had blossomed while Korea had not. The South Korean national brand must no longer be satisfied ghostwriting great design; it must emerge as a story of the world’s best industrial design, most creative fashion design, and even most innovative cinematic design as told by the designers themselves.

About the authors

Christopher Graves is the global CEO of Ogilvy Public Relations Worldwide.

Beyond manufacturing

Richard Dobbs and Roland Villinger

In the minds of many South Koreans, the ideas of job growth and manufacturing are as tightly welded as the hull of a South Korean–made supertanker. And little wonder. South Korea’s economic miracle was wrought by manufacturers—giant enterprises that consumed labor, fuel, and materials and cranked out tangible objects: steel, ships, buildings, cars, bridges, appliances, memory chips, TVs, and mobile phones. Alas, this manufacturing-centered growth model is less durable than the products it has created. If South Korea is to generate new jobs and continue raising its living standards in the decades to come, it must stop relying so much on manufacturing and place a greater emphasis on developing its service sector. South Korea must embrace the notion that its future prosperity will depend less on the production of physical things and more on intangibles such as skills, knowledge, and information.

In recent years, the government has taken the first steps to developing a stronger service sector, but more concerted actions and more popular support are needed. Other economies around the world—both mature and developing—face or faced this same challenge as manufacturing jobs are erased by automation, new technologies, and more efficient use of labor. In South Korea, however, both the problem and the opportunities are particularly acute. Its economy is more reliant on manufacturing than any other country in the Organisation for Economic Co-operation and Development (OECD), partially because the government’s sustained focus on manufacturing siphoned capital, talent, and other resources away from the domestic-service industries. As a result, the service sector today has ample room to grow. South Korea’s highly educated, hard-working, service-oriented and tech-savvy workforce gives the nation a big advantage in launching a services revolution. The benefits of such a transformation would be measured not just by the creation of national wealth but also by improvement in the quality of life for South Koreans.

Services are the key to Korea’s future growth, employment, and prosperity

One of the first critical steps is to break the mind-set that equates manufacturing with job growth. The notion that gains in manufacturing will bring equivalent gains in jobs is deeply rooted in the minds of many South Koreas because of the important role manufacturing played in the early development of their economy. Over the long run, however, gains in manufacturing bring ever higher levels of automation and thus come at the expense of jobs. Indeed, between 1995 and 2002, nearly 22 million manufacturing jobs disappeared from the global economy despite numerous policy efforts to promote employment in that sector. No mature economy today, not even Germany or Japan, generates net job growth in manufacturing. South Korea is not immune to this trend, having lost nearly 740,000 manufacturing jobs from 1995 to 2008. Today, manufacturing accounts for 4.1 million jobs out of 23.6 million total.

Services, meanwhile, have become the primary generators of GDP and employment growth in the world’s advanced economies. Indeed, as economies develop and per capita incomes rise, it is typical for the service sector to account for an increasing share of GDP. Research by the McKinsey Global Institute (MGI) finds that over the past 25 years, nearly 85 percent of GDP growth in high-income developed countries came from services. This is a broad category that comprises everything from cobblers, beauticians, and taxi drivers to police officers, teachers, surgeons, lawyers, architects, accountants, software developers, bankers, and providers of telecommunications. Services consumed locally, including those provided by government and private businesses, account for more than 60 percent of all jobs in middle-income and developed economies today, and virtually all of the job creation.

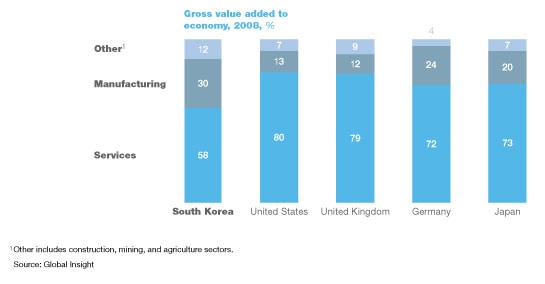

Yet South Korea’s service sector growth has lagged in relative terms (Exhibit 1). Services account for 58 percent of the economy in South Korea, compared with 80 percent in the United States, 79 percent in the United Kingdom, 73 percent in Japan, and 72 percent in Germany.

Where’s the service economy?

Service creates more high-skilled work than manufacturing. In the United States, upward of 30 percent of service jobs are in the highest-skill categories—professional, technical, managerial, and administrative occupations—compared with just 12 percent of manufacturing jobs. And as skills rise, so do incomes. This allows families to spend a smaller share on necessities—food, shelter, clothing, and so on—and more on services that can enhance the quality of life, such as better health care, telecommunications, entertainment, travel, or even just a trip to the beauty parlor.

Finally, a stronger service sector in South Korea would reduce the economy’s exposure to external demand shocks as seen at the end of 2008. And it would reduce South Korea’s vulnerability to competition from low-cost manufacturing rivals in countries such as in China.

Korea’s services productivity challenge

But the service sector challenge is not just about employment. South Korea also needs to improve the productivity—the output per labor hour—of its service sector.

MGI has estimated that for South Korea to reach Japan’s current GDP per capita of $37,000 by 2020, GDP would have to grow by around 5.6 percent per year. While this is in line with South Korea’s average growth rate since 1990, this pace will be harder to achieve going forward. This is because economic growth is driven by growth in the population and workforce and by growth in productivity. With an aging population and low birth rate, South Korea will likely have slower growth in its workforce in the years ahead. So to sustain the historic pace of GDP growth, labor productivity growth will need to be 26 percent higher over the next two decades than it was over the past two.

To achieve this, South Korea will need strong contributions from three sources of productivity—a vibrant and dynamic private-services sector, an efficient government services sector, and a strong manufacturing sector. Sheer size assures that private and public services are the most important potential driver of overall productivity and GDP growth. Services, including those provided by the government, account for 58 percent of the economy, while manufacturing accounts for just 30 percent, with the rest coming from construction and agriculture. Therefore, any increase in productivity in services will have nearly double the impact on South Korea’s economy than will a similar change in manufacturing.

South Korea’s service sector isn’t keeping up its side of the bargain, at least as measured by productivity. According to the OECD, South Korea’s private-sector services productivity is only 56 percent of manufacturing productivity, in stark contrast to other developed nations where the two are about the same. This represents a huge opportunity to boost the country’s overall productivity.

This productivity problem is one of the chief legacies of the historic push to build the manufacturing sector. Many of the policies aimed at supporting export-led growth left services starved of capital and innovation resources, often leading to subscale and inefficient operations. In the past, for example, South Korean banks were prohibited from lending to consumer-service subsectors such as leisure and real estate. Heavy regulations created significant barriers to entry over the years, and continue to exist for nearly 30 percent of services subsectors. For example, service providers still have to pay charges for site development, while manufacturers do not.

Barriers to foreign competition continue to shelter inefficient service providers, while limits on foreign direct investment (FDI) inhibit the transfer of world-class capabilities. For example, in pharmaceutical distribution, fragmentation of wholesalers and “unhealthy practices” such as back margins and lack of transparency have led to higher overall system cost. As a result of these types of problems, South Korea’s overall service-industry efficiency ranks a dismal 17th out of 18 OECD countries analyzed.

South Korea’s lack of competitiveness in services also results from the preponderance of small- and medium-sized providers in the sector. This partly reflects policies aimed at protecting them from competition. The government provides small- to medium-sized enterprises (SMEs) with subsidies, financial assistance, and tax incentives that effectively preserve the status quo. South Korea’s nearly 3 million SMEs account for nearly 80 percent of South Korea’s service sector output and nearly 90 percent of its employment. These SMEs are about 45 percent as productive per employee as large companies are, a level significantly below that of other developed nations (Exhibit 2).

Beyond manufacturing

Finally, another serious symptom of low productivity in services is the difference between the country’s exports and imports of services; this deficit reached $16.7 billion in 2008, up from around $2.9 billion in 2000, behind only Germany and Japan. More than 30 percent of this deficit in 2008 came from educational spending abroad, reflecting the decision of many families to send their children, often accompanied by their mothers, overseas for secondary schooling and university. South Korean families do this because of the high value they place on education and their low regard for their own country’s education services. This is a heavy burden in regard to both financial and personal costs. It has created a uniquely South Korean social problem; an army of “goose fathers” who remain in South Korea to work while their wives and children live and study abroad.

Unlocking Korea’s services potential

The government began the process of strengthening the service sector, starting with its 2004 regulatory reform task force, and followed by additional initiatives in 2008. But these efforts have not achieved the necessary transformation. Change is never easy. Vested interests resist. The process of “creative destruction”— in which uncompetitive businesses are allowed to fail, workers lose jobs, and resources are redirected to more productive endeavors—brings long-term growth but inflicts considerable short-term pain. And yet, South Korea has no choice but to endure this pain if it hopes to create new jobs with higher incomes.

There are many things that need to be done, but we see three priorities. First, South Korea’s business and government leaders must build political consensus for change. Second, South Korean policy makers must loosen regulations that have hindered the development of services. Finally, the decision makers in government and business must demonstrate stronger leadership.

To start, South Korean leaders need to build popular support for such a fundamental economic transformation so people will commit to bearing the cost of change. The country will never succeed in developing a strong service sector until its policy makers, business leaders, and workers really believe the task is urgent, unavoidable, and achievable. Change will require political and business leaders alike to articulate a clear vision for South Korea’s future.

Companies must believe that they can adapt and prosper. Workers must have confidence that they can obtain the skills needed in a changed economy. Civil servants must be assured they will not be singled out for political attack for pursuing policies in the interests of the broader economy.

To instill this confidence, South Korea will need to invest more in its workers. This means establishing incentives so companies invest in helping employees develop new skills. It also means more support for lifelong learning programs, including vocational training. Currently, South Korea spends less than 1 percent of its total education budget on such programs. By comparison, Japan and the United States spend proportionately 8 and 30 times more, respectively, on lifelong learning and vocational-training programs. Policy makers should help older employees extend their work lives by expanding continuous education programs and providing incentives for companies to hire them. At the same time, the government needs to ease worker anxieties about change by providing more social safety nets and more employment-placement services.

South Korean leaders also will have to forge a consensus to allow creative destruction. This process is inhibited by red tape that makes it difficult to either open or close a business. Bankruptcy laws, in particular, strongly discourage business failures. The existence of “joint personal guarantees” on business owners make entering corporate bankruptcy often the same as personal bankruptcy. And with more than a hundred provisions in various laws discriminating against bankrupt persons, people go to great lengths to avoid that fate. But if weak companies survive, they constrain the growth of the successful organizations that would otherwise consolidate resources, weed out the low-productivity performers, and build enterprises of larger scale. Companies need to be able to fail without the owners being charged with criminal offenses and seeing their families and careers ruined. South Korea must also eliminate the credit guarantees and subsidies that sustain weak companies that would otherwise fail.

South Korea must become more receptive to outside ideas and innovation and upgrade its education services, both to better serve its own citizens and to attract the best students from abroad. The nation’s leaders should encourage more collaboration between domestic and foreign universities, schools, and businesses.

South Korean business leaders also should increase spending on R&D in the service sector. Currently, service sector investments account for 7 percent of total R&D spending by South Korean firms, compared with 25 percent in the G-7 economies. The South Korean government spends only 3 percent of its total R&D budget on services. South Korea also needs to lower the barriers to competition and FDI. In the mobile-phone industry, for example, the government’s requirement that all mobile phones conform to its standard wireless platform for interoperability effectively prevented foreign phones, such as the iPhone, from entering the South Korean market. Lacking iPhone customers at home, South Korea’s otherwise formidable online-gaming companies missed the potential market for iPhone-gaming applications and now lag behind global competitors just as global demand for such services is taking off. More broadly, South Korea needs to eliminate the old rules and policies that have traditionally stymied services. This means scrapping the many fiscal, financial, and development policies that have favored manufacturing over services, prevented competition within the service sector, or held back productivity growth generally. The government, for example, should end punitive taxes and special charges on domestic services, as well as tax breaks and subsidies for manufacturing.

South Korea must also do more to protect intellectual property and other intangible assets. Too many service industries, ranging from banking to telecom, are overregulated, which chokes entrepreneurs, drives up costs, and undermines global competitiveness. Policy makers, for example, should repeal limits on retailing, such as those prohibiting the sale of over-the-counter drugs outside of pharmacies (namely, in supermarkets and convenience stores, as is allowed in other developed countries). South Korea also needs to revise its labor laws to allow employers more discretion in hiring the best people and firing nonproductive workers. Job turnover is higher in services than in manufacturing, meaning that service sector employers require more flexible labor laws. South Korea’s rigid labor rules raise costs, limit job creation, slow adoption of best practices, and discourage technological innovation. In South Korea, laying off workers is all but impossible. According to the World Bank, South Korea ranks 101st out of 175 countries in terms of ease of employing workers. The irony is that these laws, which were supposed to protect workers, have inadvertently led to the emergence of a whole new crop of “irregular” younger workers on temporary contracts.

South Korean leaders need to focus on efforts that will quickly produce high-impact, visible success. One quick win could be reform of the legal sector, a highly symbolic segment of protected business services, by accelerating the rate of change beyond what is proposed under the South Korea–United States Free Trade Agreement. Under the current plan, US law firms will be allowed to form partnerships with local law firms and only hire local lawyers five years after the agreement is ratified. Another possibility is to reform medical-services regulations, such as eliminating rules that allow only not-for-profit corporations to provide medical services, improve competition, and attract investment from the private sector. South Korea must then go on to tackle the most unproductive sectors, such as segments of finance, educational services, health care, and social welfare. To get this revolution in the service sector, South Korea must align some of its best business leaders to the long-run task of building the sector. This means redeploying some from manufacturing. In financial services, this means scrapping term limitations for senior management. World-class financial-services businesses can’t be built by chairmen on three-year contracts.

The chaebols can also contribute. South Korea’s leading chaebols remain focused on exports and manufacturing. Indeed, only 4 of South Korea’s top 30 large enterprises in South Korea are in services; in the United States, by comparison, 12 of the 30 largest enterprises are active in the services sector. Chaebol executives often express concern that their domestic-services market is too small and that they are ill equipped to compete in the sector overseas because they lack experience, language skills, or cultural savvy. This lack of confidence—surprising for such powerful companies—must be reversed.

Many chaebols also have talent-rich businesses that serve other group companies in areas such as advertising, IT, and logistics. Are these businesses of sufficient scale to compete globally? Or should they be divested, liberating their talent to build Korean national champions that provide outsourced services to the whole Korean economy?

Decades ago, South Korea made the choices required to become a global manufacturing champion, and succeeded. Today, the country can choose to change again, to chart a new economic future. South Korea can and must develop its own rich and productive service sector—one that meets the aspirations of its people at home and competes abroad. But this will only happen if government, business, and indeed the entire nation act quickly. South Korea’s highly educated, hardworking, service-oriented, and entrepreneurial labor force is exactly what is required to capture the opportunity. Just as South Korea excelled in manufacturing, so can it excel in high-quality services. Such a transformation would bring gains in living standards that would outweigh the short-term cost of adjustment.

Four steps to prosperity

Shen Dingli

The question for South Korea in the 21st century is this: can it move into the ranks of the world’s top seven economies, as President Lee Myung-bak suggested during his campaign? The answer: probably not. But sheer size does not matter much. Quality of growth does.

South Korea sits in a difficult neighborhood. It has long competed with Japan, and compared itself to it. But Japan is richer, both in terms of money and in human resources. Now China is catching up. While Japan leads South Korea in high-tech prowess, China is narrowing its technological gap. And given that both China and Japan have many more people, it is unlikely that South Korea will ever match them in economic scale.

Add to that the rise of the BRIC nations—Brazil, Russia, India and China—and it seems even less likely that South Korea will reach the top tier of world economies. In fact, it has been slipping. In 2006, according the CIA’s World Factbook, it was the 11th largest economy; in 2008 it dropped to 15th.

But it doesn’t matter so much if South Korea is bigger than others as long as it continues to be economically competitive enough to deliver prosperity to its people. I believe that if it takes advantage of the following four opportunities, it can do just that:

1. Choose technologies in which it can be world class.

The most critical technology areas are IT, nanotechnology, life science and engineering, energy and the environment, advanced instruments, and clinical medicine. South Korea is a world leader in IT, including cell-phone and digital-TV technologies, but its lead is narrowing. And in life science and engineering, South Korea is not as competitive as it was; it also needs to be aware of newly emerging technologies where it doesn’t lead at all.

As a relatively small country, South Korea cannot do everything. And as a country largely lacking in natural resources, it must depend on its wits. That means making choices: it is better to be brilliant at a few technologies than mediocre in many of them.

Therefore, in cooperation with the universities and the private sector, the government should map out, in broad terms, a national science strategy. The goal is to identify crucial areas of technology where South Korea can be top tier. This will be the key to raising the economy to the next level. Cars and televisions were and are important to South Korea, but it needs to be exploring new economic frontiers too.

The advantage of selecting a few high-value fields to concentrate on is that it plays to the country’s strengths. South Korea sends a higher proportion of students to tertiary education than any other country, according to the United Nations Educational, Scientific and Cultural Organization, and they do conspicuously well on international math and science tests. With this base, nurturing a generation of scientists and engineers is very much a possible dream.

2. Tighten the capital markets.

South Korea’s financial markets are more or less a copy of those in the United States, with an emphasis on liberalization that gives the country increased access to foreign capital and technology. Seoul also stresses expansion of its markets and has been quick to adopt new financial instruments, which it hopes will improve the standing and efficiency of their markets.

However, too much liberalization can undercut the government’s ability to monitor and regulate the financial markets, which makes the country more vulnerable to shocks from foreign markets. South Korea has undergone two quite terrible financial crises in the last 12 years; although it came out of the trauma relatively quickly in both cases, less volatility would be a good thing. Therefore, the government and the financial sector should work together to create a better balance between regulation and liberalization.

3. Accelerate engagement with China.

Ten years ago, South Korea definitely had the upper hand over China economically, technologically, and in terms of productivity and the quality of the economic structure. Since then, the gap has shrunk. And now, it has to be said, it is simply impossible for South Korea to keep its high-tech lead for much longer. China has too many people studying math, science, and engineering. It is time for South Korea to reconsider its mind-set and think about building mutually cooperative relationships with China, rather than seeing China as a less-than-equal partner.

Of course, South Korea can and will sustain its lead in terms of per capita income for the next 20 years or so. The countries’ proximity and China’s ever-growing middle class provide endless opportunities for a South Korea that picks its competitive positions shrewdly.

4. Turn North Korea into an economic asset.

Thirty years ago, being a poor country was seen as a liability. But then China showed that there was opportunity to be tapped. China allowed foreign capitalists to use its cheap labor. This took a major change in mind-set. Chinese leaders used to consider such investment exploitative; now the leadership sees it as allowing the country to benefit from the money, technology, and skills of the investors. It’s good for the Chinese too. Cheap labor, lack of independent unions, the protection (under the Communist Party) of foreign investment—all of these help to create good economic returns, and China has used this base to develop an increasingly sophisticated economy.

What China has been to the international market economy, North Korea can be to South Korea. The south has capital; the north has labor. Together, they could create a peninsular economic force.

Of course, Pyongyang has shown little eagerness to play this role, except for a few carefully watched economic-development zones, so perhaps this is more an aspiration than a plan in the making. But with patience from Seoul, the China model could apply: as the North’s economy became more advanced, people would be more satisfied, and the party itself would be strengthened. The leaders of North Korea have to see such economic engagement as being in their interest—not a potential trap for the ruling elites to lose power. Indeed, greater engagement could increase the party’s power, while also improving the lives of its people.

In sum, with the rise of the BRIC nations, and particularly China, South Korea’s relative economic position is likely to be shadowed. Nevertheless, the country’s performance in technology, education, and finance is impressive, and with consistent, imaginative policy, Seoul can sustain a healthy level of growth. For South Koreans, the best may still be to come—even if it never cracks the top tier of world economies.