Our most recent survey of economic conditions was in the field from March 7 to March 11, 2011, a week when Libya, which has the largest oil reserves in Africa,1 fell into near civil war and oil prices fluctuated. The earthquake and tsunami in Japan, given their timing, did not have a meaningful effect on results.

Accordingly, executives are far more concerned about the effects of inflation and high commodity prices than they were in December. Yet their overall expectations for their nations’ economies and for their own companies’ prospects have changed little from three months ago, when they were slightly more positive than not.2 Low consumer demand remains a concern but a much less urgent one. Also at the national level, less than 20 percent of respondents expect unemployment in their countries to increase in the next six months.

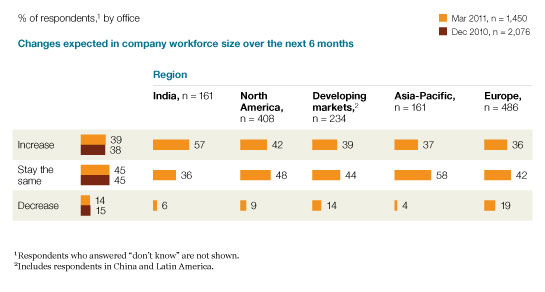

That’s consistent with the expectation of the vast majority of respondents that their companies’ workforces will remain the same size or increase during this period. Among those who report that their companies are hiring right now, more say they can find all the people they need than those who say they can’t, and only 20 percent of respondents say their companies aren’t hiring at all. More broadly, executives’ expectations for their companies’ results are positive and flat overall since December, and nearly half expect to increase capital expenditures in the next six months.

Nationally, new barriers and emerging sources of growth

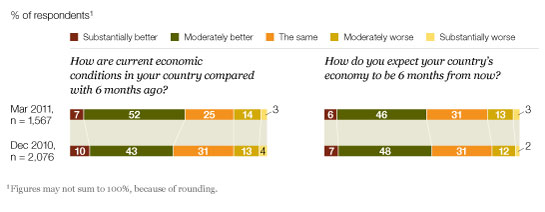

Executives are slightly more positive about their countries’ current economic condition than they were six months ago (Exhibit 1). Their expectations looking ahead six months are slightly, but not significantly, lower.

What is most notable is the shift in what executives see as barriers to economic growth, with high commodity prices and inflation being cited far more frequently than they were in December (Exhibit 2). In tandem with those new concerns, more than two-thirds of all respondents expect oil prices to rise—not surprising given the fighting and political instability in Libya, one of Africa’s biggest oil producers. Seventy-four percent of respondents expect a rise in inflation, compared with 65 percent in December.

Over the next six months, executives in India are the most positive about their country’s economic prospects, with 71 percent expecting improved conditions, and about the global economy, with 64 percent expecting improvement. By comparison, just 53 percent of all respondents expect the global economy to improve. In other emerging markets, the views of executives are closer to the global average on both points.

A mixed outlook

Changes in the risk landscape

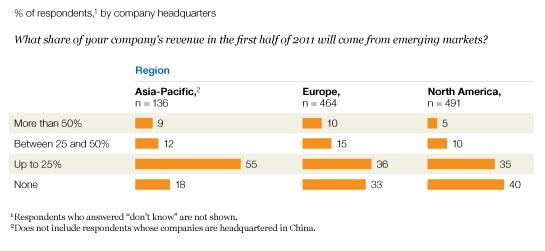

Nonetheless, the overall positive view of executives in emerging markets is consistent with the finding that many respondents in all regions, including developed economies, expect emerging markets to be the source of significant revenue for their companies in the next six months (Exhibit 3).3 And in the much longer term, over the next ten years, a majority of all respondents expect the most economic growth to come from emerging markets, particularly China and India.4

Emerging-market push

Companies inch toward investment

A majority of respondents in all regions and all industries except financial services5 say their companies need the same number of employees as they did before the recession. In addition, 34 percent of respondents expect unemployment to decrease in their countries over the next six months; 48 percent of North Americans say so. Despite all this, executives’ expectations that their own companies will hire haven’t shifted since December. There is, however, some geographic variation: respondents in India are the most likely to expect an increase in workforce size (Exhibit 4).

Among those who say their companies are hiring right now, more say they can find all the employees they need than not. Nonetheless, a full third say they can’t—a difficulty expressed by more than half of those in the developed countries of Asia.6 Managers and technical staff (such as engineers or medical staff) are the most difficult employees to find, according to respondents in all regions.

More workforce growth in India

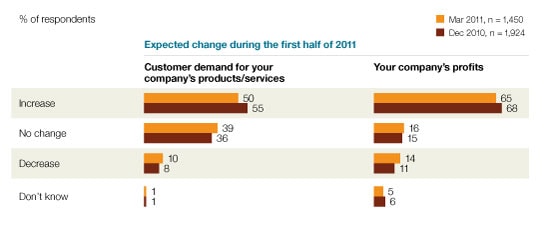

Demand and profits hold steady

Executives’ expectations on consumer demand and corporate profits haven’t shifted meaningfully over the past three months (Exhibit 5). However, slightly fewer respondents say their companies are currently postponing either capital investments or mergers: 29 percent compared with 32 percent in December for capital investments, and a more striking 19 percent compared with 25 percent for mergers. Only 9 percent of respondents expect a decrease in their companies’ capital expenditures over the next six months, while 45 percent expect an increase.