Waste never sleeps in the finance department—that bastion of efficiency and cost effectiveness. Consider the reams of finance reports that go unread and the unused forecasts, not to mention duplicate computations of similar data, the endless consolidation of existing reports, and mundane activities such as manually entering data or tailoring the layout of reports.

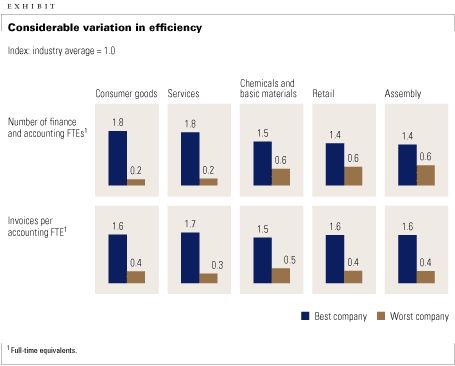

The impact is significant. In a recent exercise that benchmarked efficiency at consumer goods companies, the best finance function was nine times more productive than the worst (exhibit). Production times also varied widely. Among the largest European companies, for example, it took an average of 100 days after the end of the financial year to publish the annual numbers: the fastest did so in a mere 55 days, while the slowest took nearly 200. This period typically indicates the amount of time a finance department needs to provide executives with reliable data for decision making. In our experience with clients, many of these differences can be explained not by better IT systems or harder work but by the waste that consumes resources. In a manufacturing facility, a manager seeking to address such a problem might learn from the achievements of the lean-manufacturing system pioneered by Toyota Motor in the 1970s. Toyota's concept is based on the systematic elimination of all sources of waste at all levels of an organization.1 Industries as diverse as retailing, telecommunications, airlines, services, banking, and insurance have adopted parts of this approach in order to achieve improvements in quality and efficiency of 40 to 70 percent.

Finance and accounting efficiency varies considerably within industries.

We have seen finance operations achieve similar results. At one European manufacturing company, for example, the number of reports that the finance department produced fell by a third—and the amount of data it routinely monitored for analysis dropped from nearly 17,000 data points to a much more manageable 400.

Borrowing from lean

In our experience, the finance function eludes any sort of standardized lean approach. Companies routinely have different goals when they introduce the concept, and not every lean tool or principle is equally useful in every situation. We have, however, found three ideas from the lean-manufacturing world that are particularly helpful in eliminating waste and improving efficiency: focusing on external customers, exploiting chain reactions (in other words, resolving one problem reveals others), and drilling down to expose the root causes of problems. These concepts can help companies cut costs, improve efficiency, and begin to move the finance organization toward a mind-set of continuous improvement.

Focusing on external customers

Many finance departments can implement a more efficiency-minded approach by making the external customers of their companies the ultimate referee of which activities add value and which create waste. By contrast, the finance function typically relies on some internal entity to determine which reports are necessary—an approach that often unwittingly produces waste.

Consider, for example, the way one manufacturing company approached its customers to collect on late or delinquent accounts. The sales department claimed that customers were sensitive to reminders and that an overly aggressive approach would sour relations with them. As a result, the sales group allowed the accounting department to approach only a few, mostly smaller customers; for all others, it needed the sales department's explicit approval—which almost never came. The sales department's decisions about which customers could be approached were neither challenged nor regularly reviewed. This arrangement frustrated the accounting managers, and no one would accept responsibility for the number of days when sales outstanding rose above average.

The tension was broken by asking customers what they thought. It turned out that they understood perfectly well that the company wanted its money—and were often even grateful to the accounting department for unearthing process problems on their end that delayed payment. When customers were asked about their key criteria for selecting a manufacturing company, the handling of delinquent accounts was never mentioned. The sales department's long-standing concern about losing customers was entirely misplaced.

In the end, the two departments agreed that accounting should provide service for all customers and have the responsibility for the outstanding accounts of most of them. The sales department assumed responsibility for the very few key accounts remaining and agreed to conduct regular reviews of key accounts with the accountants to re-sort the lists.

Better communication between the departments also helped the manufacturing company to reduce the number of reports it produced. The company had observed that once an executive requested a report, it would proceed through production, without any critical assessment of its usefulness. Cutting back on the number of reports posed a challenge, since their sponsors regularly claimed that they were necessary. In response, finance analysts found it effective to talk with a report's sponsor about just how it would serve the needs of end users and to press for concrete examples of the last time such data were used. Some reports survived; others were curtailed. But often, the outcome was to discontinue reports altogether.

Exploiting chain reactions

The value of introducing a more efficiency-focused mind-set isn't always evident from just one step in the process—in fact, the payoff from a single step may be rather disappointing. The real power is cumulative, for a single initiative frequently exposes deeper problems that, once addressed, lead to a more comprehensive solution.

At another manufacturing company, for example, the accounting department followed one small initiative with others that ultimately generated cost savings of 60 percent. This department had entered the expenses for a foreign subsidiary's transportation services under the heading "other indirect costs" and then applied the daily exchange rate to translate these figures into euros. This approach created two problems. First, the parent company's consolidation program broke down transportation costs individually, but the subsidiary's costs were buried in a single generic line item, so detail was lost. Also, the consolidation software used an average monthly exchange rate to translate foreign currencies, so even if the data had been available, the numbers wouldn't have matched those at the subsidiary.

Resolving those specific problems for just a single subsidiary would have been an improvement. But this initiative also revealed that almost all line items were plagued by issues, which created substantial waste when controllers later tried to analyze the company's performance and to reconcile the numbers. The effort's real power became clear as the company implemented a combination of later initiatives—which included standardizing the chart of accounts, setting clear principles for the treatment of currencies, and establishing governance systems—to ensure that the changes would last. The company also readjusted its IT systems, which turned out to be the easiest step to implement.

Drilling down to root causes

No matter what problem an organization faces, the finance function's default answer is often to add a new system or data warehouse to deal with complexity and increase efficiency. While such moves may indeed help companies deal with difficult situations, they seldom tackle the real issues. The experience of one company in the services industry—let's call it ServiceCo—illustrates the circuitous route that problem solving takes.

Everyone involved in budgeting at ServiceCo complained about the endless loops in the process and the poor quality of the data in budget proposals. Indeed, the first bottom-up proposals didn't meet even fundamental quality checks, let alone the target budget goals. The process added so little value that some argued it was scarcely worth the effort.

Desperate for improvement, ServiceCo's CFO first requested a new budgeting tool to streamline the process and a data warehouse to hold all relevant information. He also tried to enforce deadlines, to provide additional templates as a way of creating more structure, and to shorten the time frame for developing certain elements of the budget. While these moves did compress the schedule, quality remained low. Since the responsibility for different parts of the budget was poorly defined, reports still had to be circulated among various departments to align overlapping analyses. Also, ServiceCo's approach to budgeting focused on the profit-and-loss statement of each function, business, and region, so the company got a fragmented view of the budget as each function translated the figures back into its own key performance indicator (KPI) using its own definitions.

To address these problems, ServiceCo's managers agreed on a single budgeting language, which also clearly defined who was responsible for which parts of the budget—an added benefit. But focusing the budget dialogue on the KPIs still didn't get to the root problem: middle management and the controller's office received little direction from top management and were implicitly left to clarify the company's strategic direction themselves. The result was a muddled strategy with no clear connection to the numbers in the budget. Instead of having each unit establish and define its own KPIs and only then aligning strategic plans, top management needed to link the KPIs to the company's strategic direction from the beginning.

Getting to the root cause of so many problems earlier could have saved the company a lot of grief. Once ServiceCo's board and middle management determined the right KPIs, the strategic direction and the budget assumptions were set in less than half a day, which enabled the controller's office and middle management to specify the assumptions behind the budget quickly. The management team did spend more time discussing the company's strategic direction, but that time was well spent. The result was a more streamlined process that reduced the much-despised loops in the process, established clear assumptions for the KPIs up front, and defined each function's business solution space more tightly. The budget was finalized quickly.

Getting started

It takes time to introduce lean-manufacturing principles to a finance function—four to six months to make them stick in individual units and two to three years on an organizational level. A new mind-set and new capabilities are needed as well, and the effort won't be universally appreciated, at least in the beginning.

Integration tools can be borrowed: in particular, a value stream map can help managers document an entire accounting process end to end and thus illuminate various types of waste, much as it would in manufacturing. Every activity should be examined to see whether it truly contributes value—and to see how that value could be added in other ways. Checking the quality of data, for example, certainly adds value, but the real issue is generating relevant, high-quality data in the first place. The same kind of analysis can be applied to almost any process, including budgeting, the production of management reports, forecasting, and the preparation of tax statements. In our experience, such an analysis shows that controllers spend only a fraction of their time on activities that really add value.

The challenge in developing value stream maps, as one European company found, is striking a balance between including the degree of detail needed for high-level analysis and keeping the resulting process manual to a manageable length. Unlike a 6-page document of summaries or a 5,000-page tome, a complete desk-by-desk description of the process, with some high-level perspective, is useful. So too is a mind-set that challenges one assumption after another.

Ultimately, a leaner finance function will reduce costs, increase quality, and better align corporate responsibilities, both within the finance function and between finance and other departments. These steps can create a virtuous cycle of waste reduction.