In this episode of the Inside the Strategy Room podcast, we explore how digital analytics is revolutionizing strategy. Nicholas Northcote, who for years led McKinsey’s research on strategic decision making, is joined by Sagie Davidovich, the cofounder and CEO of SparkBeyond, a McKinsey partner company that operates an AI-driven analytics platform, and Sasha Vesuvala, who leads much of McKinsey’s work in applying advanced analytics to strategy and growth-related questions. This is an edited transcript of the discussion.

Sean Brown: Let me start by asking a blunt question, Nic. Will computers take over the process of developing strategy?

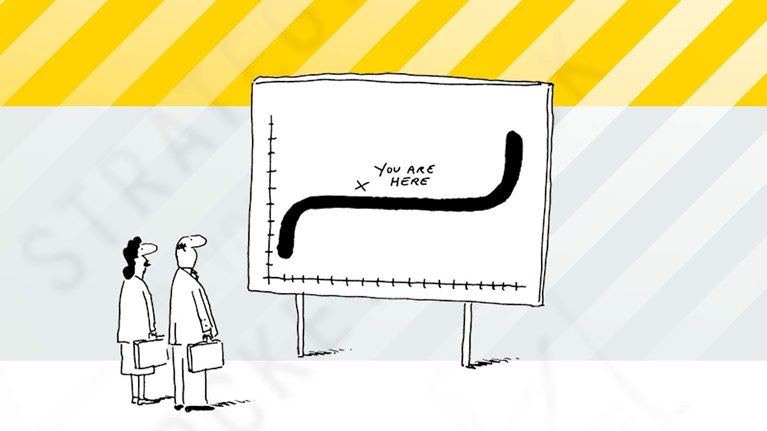

Nicholas Northcote: Strategy development is always going to require creative and thoughtful executives to set aspirations and make bold choices, but we believe advanced analytics is an opportunity to bring more science to the art. Over the past decade, advances in digital analytics have transformed the way businesses operate.

From marketing and pricing to customer service and manufacturing, advanced analytics is central to many corporate functions. However, the same cannot yet be said for strategy.

We see four ways that companies can use analytics in their strategy-setting practices. The first is to identify early-stage trends. Some companies are using AI engines to track, in near real time, the evolution of trends that matter to their businesses, based on news alerts, investment data, patent filings, and other inputs. They then use the results to decide when to trigger strategic moves related to those trends. The second application is around identifying new growth opportunities. Here, again, AI can complement traditional brainstorming methods to help companies reveal what we call nonobvious growth opportunities, such as granular areas where competitors are present but your company is not, potential acquisition targets, or even new applications for products and services already in your portfolio.

The third application is reducing bias in decision making. By using historical data about the strategic moves and performance of thousands of companies, business leaders can calibrate the likelihood of a strategy succeeding before allocating resources to it. For example, if you are planning a transformative merger, knowing that 70 percent of large acquisitions in the past decade destroyed value could be helpful. It would give you a fact base to challenge and stress-test the plan by asking questions like, what makes us different? Are we overestimating returns or synergies? What would it take to get execution right? The last one is using analytics to anticipate complex market dynamics. Tools such as agent-based modeling can help you understand how the actions of customers, competitors, regulators, and other market players could combine to affect demand, supply, and prices, allowing you to extract proprietary insights.

Sean Brown: Sagie, your company has developed an AI tool that mines online information for insights about trends, product applications, and business ideas. What inspired you to build SparkBeyond?

AI can complement traditional brainstorming methods to help companies reveal . . . growth opportunities, . . . acquisition targets, or even new applications for products and services already in your portfolio.

Sagie Davidovich: Less than a decade ago, it would be borderline impossible to build a machine that mines the web, which contains hundreds of billions of pages that include all sorts of documents, from patents and clinical trials to news publications and Wikipedia. But the web is imperfect. It is full of biases, contradictions, outdated or partial information, as well as inconsistencies in formats. We wanted to build a machine that could read the web, connect the dots, and synthesize insights, providing answers to complex research questions and creating coherent, holistic, and data-driven decision support. That was the journey we started a couple of years ago, and the partnership with McKinsey has helped us discover a new universe of applications.

Sean Brown: What types of problems or questions have clients used SparkBeyond to address?

Sagie Davidovich: Anything from discovering novel applications for existing chemicals or products to finding root causes of outcomes by identifying cause-and-effect relationships that exist on the web. In our work with pharma companies, there is a fascinating application around discovering pathways from a certain gene to a particular disease. While the results of these analyses may not appear in any single scientific article, by connecting the dots, we can uncover the path and make serendipitous discoveries. Another arena of applications relates to sustainable development goals, such as addressing the climate crisis, discovering how to drive sustainable agriculture, or fighting child detention through our pro bono work with NGOs and governments. When you have the web in a box, the universe of applications is quite unlimited.

Sean Brown: Sasha, you recently worked with a company that used SparkBeyond to answer some very specific strategic questions. What was the problem the company was trying to solve?

Sasha Vesuvala: It was a materials company, and the challenge for it was growth. When we broke the problem down, we realized there were three issues within it. First, it was important for this company to keep tabs on the next set of trending materials so it could anticipate the industry’s and its customers’ changing requirements. The second question was, “We know X, Y, Z applications and, therefore, A, B, C customer segments for the materials we focus on. But are there niche applications out there that we do not know about or completely different customers segments for our materials?” This could present an opportunity for margin-accretive growth because it might not require significant R&D investment but simply mean capitalizing on the existing materials and know-how.

This is a fragmented space, and there are many specialists in individual materials, so the third question for the company was, “How do we identify the universe of potential acquisition targets or partners?”

Sean Brown: How did the company envision using SparkBeyond to get those answers?

Sasha Vesuvala: I want to underscore that we do not believe these are solely technology-driven answers. When it is an expert-plus machine, when the human continues to apply judgment, that’s when you get ideas that make sense.

Think of it as being able to do thousands of expert calls in minutes. As long as the information is out there, the machine will find the answers because it can read incredibly fast.

This helped us identify materials such as nanodiamonds that this company found of great interest. Think of it as being able to do thousands of expert calls in minutes. As long as the information is out there, the machine will find the answers because it can read incredibly fast at the level of a first-year university student. SparkBeyond differs from your traditional web search in that it does not return individual links that you need to click through but actually returns answers. We could also define the sources by, for example, telling the platform to focus only on patents and publications if we were interested in scientific information.

Sean Brown: So how did the company use the answers the search tool provided?

Sasha Vesuvala: The next important question was about what these materials were used for. There were about 10,000 applications for the 78 materials we picked, which is obviously too many. The company was aware of classic applications, but it had not considered biomedical applications for its products. We were able to come up with 30 to 35 ideas that the company thought were relevant and wanted to evaluate.

We also asked the platform, “Who produces these products?”—companies that could be potential partners or acquisition targets. On the first pass, the platform generated a long list of 1,800-plus producers globally, including in some markets where the company was interested in making inroads, particularly in Asia.

Sean Brown: What share of the applications that the company focused on were new?

Sasha Vesuvala: Conservatively, 60 to 70 percent of applications that the company prioritized were new, and it had not considered them in the past. Now, the sources of all these insights are on the web, in patents, or journals, but not necessarily in journals that a traditional R&D scientist or business-development manager looks at.

Sean Brown: Very interesting. Let’s move on to another area where advanced analytics help with strategy development. Nic, how do executives use analytics tools to reduce bias in strategic decisions?

Nicholas Northcote: One of the greatest difficulties with strategy is that human behavior, whether consciously or not, often gets in the way of good choices. We call this the social side of strategy, and there are two parts to it. The first is the fact that strategy is the wrong problem for human brains. We are dealing with novel decisions under uncertainty, and this is fertile ground for cognitive biases—everything from overconfidence in our abilities to anchoring on what worked in the recent past to being overly optimistic or unduly risk averse. These biases can lead us to form skewed judgments. The second part of the social side is that strategy is exactly the right problem for human games. Everyone has their own financial, career, and emotional incentives. When these incentives are not aligned with the company’s goals, it leads to behaviors that are not conducive to choices that maximize shareholder value. Additionally, strategy discussions often become battles for resources, where getting a plan approved is more important than debating strategic assumptions or alternatives.

Subscribe to the Inside the Strategy Room podcast

Sean Brown: So how can advanced analytics help overcome these biases?

Nicholas Northcote: In three words, the outside view. The idea was originally proposed by world-famous psychologist and Nobel laureate Daniel Kahneman and his research partner Amos Tversky. They noticed what they called the planning fallacy: the fact that even experienced planners are overly optimistic in their forecasts for some of the reasons I mentioned before. For example, when building a business plan for a capital project or an acquisition, even experienced people underestimate costs, overestimate revenues or synergies, and therefore overestimate returns. Kahneman and Tversky argued, and proved, that by complementing project-specific projections, or business cases, with external data from a distribution of outcomes in similar cases, one can combat the overoptimism.

This can be done in strategy, too. By studying historical data from thousands of companies that describe their strategic initiatives and performance, you can understand the likelihood of a strategy succeeding. This view can reveal that your plan may be too optimistic—in other words, few companies achieved the outcomes you want—which you can use as a fact base to motivate bigger, bolder moves to meet your aspiration or alternately reduce your performance expectations.

Sean Brown: Can you give an example of how the strategic expectations might be adjusted based on this kind of review of past corporate performance?

Nicholas Northcote: If you are a large company with a target to grow economic profit by $100 million per year, we know from the data that only 35 percent of such companies managed to achieve that level of performance over a ten-year period. We can then overlay additional information. For example, we can tell you that companies that implemented a programmatic M&A strategy—meaning they were serial acquirers—and that achieved top-quintile productivity improvement increased their odds of reaching that performance target from the 35 percent to a 52 percent probability. This provides you with a fact base by which to calibrate your strategy and then challenge the organization to be bolder. The analysis can be extended to hundreds of strategic and performance metrics relevant to your company and the planned initiatives.

Take a multinational energy company we served. It had an extremely ambitious profit-growth target, and we used this outside-view approach to show that of all the companies with the same set of strategic moves in the last decade, only 10 percent achieved the level of performance improvement it was targeting. In other words, the strategy was simply too timid. There were not enough big strategic moves, such as substantial capital expenditures or big digitization and productivity-improvement programs. For example, what the company was planning was in line with the kinds of improvements achieved by the industry median company rather than a top-quintile performer on productivity. In the end, the company reassessed the plan and looked for bolder strategic moves, which it then included in its next iteration of the plan to fundamentally improve its chances of achieving its performance aspiration.

On the other extreme, we worked with an industrial company that had a very bold strategy with multiple big moves. In fact, the strategy was almost too bold. Only 5 percent of companies in our database of thousands had managed to successfully execute a plan like that in the last decade. By highlighting the fact that this was such a stretch ambition, we were able to demonstrate the importance of establishing a rigorous execution and performance-management infrastructure to deliver the plan. The company is now in the process of setting up a governance structure that you would typically see in a large operational transformation to ensure that they give this strategy the best possible chance of success, given it is an $8 billion investment.

Sean Brown: You mentioned that these analytics tools can also allow companies to understand complex market dynamics. How does that work?

Nicholas Northcote: This is a catch-all for anything related to forecasting or understanding competitive dynamics in the market. Some companies use AI engines to forecast demand, for example. Another company built a very detailed agent-based model, which models the behavior of individual market actors including customers, competitors, suppliers, even regulators, and effectively allows these agents to interact, helping to map unpredictable behavior in the system. It is similar to epidemiology: how individuals act leads to collective emergent behavior. This company used the model to understand demand for different types of products based on customer searches and buying patterns, among other factors. Electric-power companies do something similar involving fewer agents.

War-gaming, which is a way of understanding how competitors will respond to different strategic moves, is also becoming more analytics-driven. I have seen a cement company considering a merger go through an exercise like that, analytics-enabled, to understand the impact of a low-cost entrant on pricing behavior in the market.