The economic tumult of the past 18 months has affected every facet of corporate operations, and it has not spared IT. In McKinsey’s fourth annual survey on information technology strategy and spending, we asked chief information officers (CIOs), chief technology officers (CTOs), other executives in the IT function, and additional C-level executives about their companies’ business technology agendas, the impact of the recession on their IT organizations, and their approaches to developing and executing IT strategies.1

The results affirm the continuing importance of IT to strategic success, despite the recession. CIOs have felt strong pressure to deliver ever greater levels of efficiency in the downturn, but overall satisfaction with IT organizations remains high. In addition, most respondents foresee an increase in IT investment, perhaps because companies are applying IT to solve problems across the business. Meanwhile, as technology-related disruptions continue to affect businesses, executives persist in pushing for closer integration between business units and IT.

IT’s response to the recession

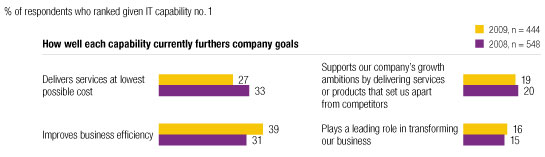

The value executives (both inside and outside the IT function) perceive IT as offering their companies has held up well since our previous survey, in October 2008.2 Respondents indicate that IT has become more important to improving business efficiency and reducing costs across the enterprise than it was last year. Notably, a smaller share of respondents indicate that their primary focus is to achieve the lowest IT cost (Exhibit 1). This suggests that executives are realizing better results from applying IT to solving problems across the business.3

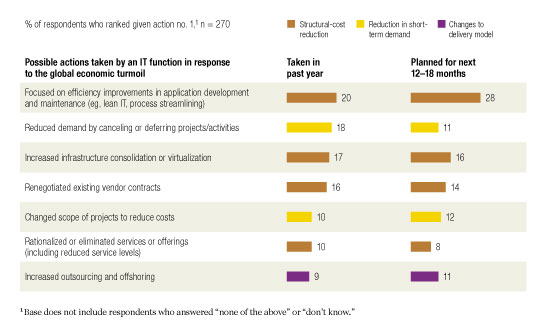

Running a tight IT organization remains important, however. We asked IT executives about the actions they have taken in the past year, as well as those they plan to take in the next 12 to 18 months in response to the crisis (Exhibit 2). Respondents indicated a strong preference for structural cost reductions: three of the top four actions discussed focus on reducing structural costs through efficiency improvements, including applications development, infrastructure consolidation, and contract renegotiation. Looking ahead, two-thirds of the respondents report they plan to undertake structural cost reductions in the next 12 to 18 months.

Green IT programs, such as those that increase energy efficiency in data centers, have fared well despite the slowdown. At companies with a green IT agenda (almost half of those surveyed), more than 25 percent of respondents indicate they are accelerating their plans, and about half say their plans will be unaffected by spending reductions. Cost savings and reputation enhancement are likely behind this strong push to protect green investments.

The role of IT

Responding to the crisis

Spending in the right place

Looking forward to 2010, projections for operating budgets follow trends seen in last year’s survey. More than 60 percent of respondents expect IT operating expenses to decline or hold steady (Exhibit 3), reflecting a continued focus on “resetting” operating costs for an uncertain future.

Expectations for new investments, however, paint a different picture. More than 45 percent of respondents expect to increase investments, while about 20 percent see them holding steady. When there is a payback, it seems businesses are willing to invest; many of these investments are geared toward improving business operations, both to lower costs and improve effectiveness, echoing respondents views on where IT is offering value to the business.

Digging deeper into the data, financial-services firms lead all sectors with their spending and investing plans, a finding that may reflect improving business conditions in that industry. Thirty-three percent of financial-services respondents expect to increase operating expenses in 2010 (up from the 15 percent who expected increases last year), and 61 percent are considering an increase in new investments (up from 40 percent last year).

Another notable finding is that spending plans for public and private companies diverge sharply. Only 31 percent of respondents at public companies expect to maintain or increase their current IT spending in 2010, while 62 percent of respondents at private companies say the same. For new investments, the pattern is similar: 60 percent of public-company respondents expect to maintain or increase new investments, compared with 73 percent at private companies.

Spending more on new investments

IT’s effectiveness

The view from respondents who aren’t IT executives suggests that, by and large, they believe their IT functions are responding effectively to the crisis and adjusting well to their businesses’ changing needs and priorities. Among non-IT executives, 55 percent say current performance in providing basic IT services is very or extremely effective—an increase from last year’s 50 percent level. For higher-value activities, such as on-time/on-budget project delivery and proactive engagement from IT, the share of executives who say IT is very or extremely effective hovers in the 30s, with roughly another third of respondents indicating that IT’s performance is somewhat effective. Significantly, these figures are largely unchanged from last year, despite all the economic turmoil.

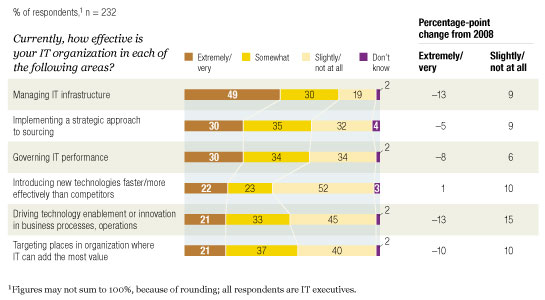

IT executives’ own view of their performance is less sanguine (Exhibit 4). Just under half of the IT executives surveyed say their management of IT infrastructure is extremely or very effective. Only 30 percent say their IT governance is extremely or very effective, and only 21 percent are happy with their ability to target places in their organizations where IT can add value (compared with 30 percent of non-IT executives who say IT is very or extremely or very effective on a corresponding measure).

Measured against last year, IT executives’ satisfaction with their performance is down across the board, including several categories that show double-digit declines. It seems likely that this drop is driven by a continued sense of frustration among IT staff, who are being asked both to reduce their own costs and, at the same time, to help business units do more to improve their operations.

Lower satisfaction

Shared vision for IT strategy

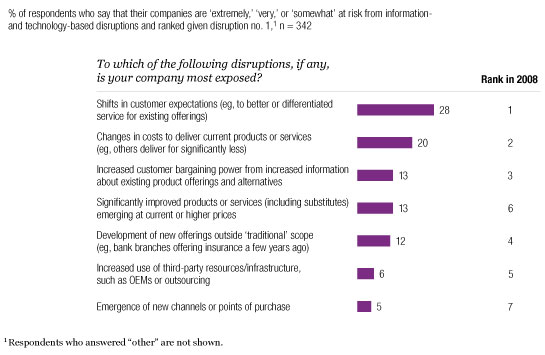

At the highest level, all executives remain concerned about information- and technology-based disruptions—albeit with some key differences from last year. These worries include competitors embedding IT in their products, executing strategies based on better analytics and information, and using IT to improve the effectiveness of their business processes. The degree of concern has eased, however: in this year’s survey, 50 percent of respondents say their companies are very or extremely at risk given the potential effects of information- or technology-based disruptions on their companies, down from 65 percent in 2008. At the same time, the share of respondents rating their companies as somewhat at risk has increased to 30 percent, from 19 percent last year. Seen in the light of the overall survey, this finding indicates that while core concerns about disruptions remain in the short term, recession-related preoccupations have become more acute. Nonetheless, companies remain exposed to the key unknowns they cited in 2008: shifts in customer expectations and bargaining power as a result of access to better information, and significant changes in the cost to deliver existing products or services (Exhibit 5).

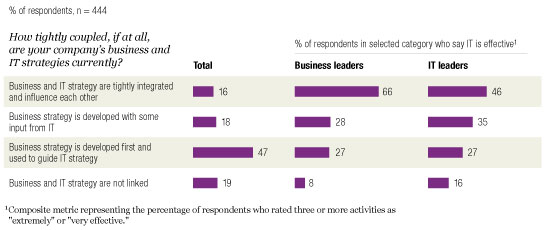

While the recession has shifted some short-term priorities for IT, the longer-term vision for IT remains consistent with views expressed by respondents in prior surveys. Non-IT executives continue to say they want to forge a closer partnership with IT in order to improve performance and better manage the risks and disruptions that lie ahead. While only 16 percent of respondents say they have put into place tightly coupled business and IT strategies (Exhibit 6), two-thirds of respondents indicate that this configuration would be their ideal. Significantly, the level of strategy integration is strongly correlated to the perceived effectiveness of IT: for both business and IT executives, effectiveness materially increases as the strategies become more tightly linked.

Top disruptions

More effective, with tighter integration

Looking ahead

IT executives’ dissatisfaction with their job performance could eventually lead to deeper problems in morale and performance. Clear and effective communication by both IT and business executives will be critical to ensure that the IT organization continues to understand how integral its efforts are to the success of the enterprise.

Respondents say they are willing to increase IT investments that drive real returns to their companies. Delivering on this promise requires business and IT to partner in building a comprehensive view of the necessary process and system changes, as well as defining a clear, measurable, and achievable set of returns.

Despite the economic crisis, leaders need to continue improving the integration of their business and technology strategies. IT can help underwrite growth when the recovery comes, but only if executives begin laying the groundwork during lean times.