Many banking operations leaders feel caught in a tug of war, expected to deliver cost savings while customer demands continue to increase. And they must meet these dual imperatives against a backdrop of fierce competition among traditional rivals as well as digital disrupters. To address these challenges, banks have deployed tools including lean, process digitization, robotics—and, in some cases, advanced analytics—to lower operations costs on one hand, and provide customers with experiences that match those delivered by digital natives like Amazon or Uber.

These efforts have delivered tangible benefits over the last five years, but often in isolated pockets, and without dramatically reducing overall operations costs. For example, one bank achieved a 20 percent efficiency improvement by applying lean in its account-closure process; a good result, but the process constituted less than 1 percent of the bank’s total operations cost and so did not move the needle. Another bank used smart workflow tools to automate corporate-credit assessments, improving productivity by 80 percent. But it failed to replicate this success in other high-potential areas and thus aggregated operations costs hardly budged.

Consider: Despite the transformational efforts by European and North American banks, their operational costs have on average remained mostly flat; with a few exceptions having achieved small reductions. Because they are not applying transformation levers across operations in a systematic way, banks are in effect winning battles, but losing the war. But there are a few banks that have identified a full range of levers and developed plans to apply them across all of their processes, putting them in position to achieve efficiency gains of 30 percent or more.

In our experience, banks that achieve significant productivity gains take the following five steps:

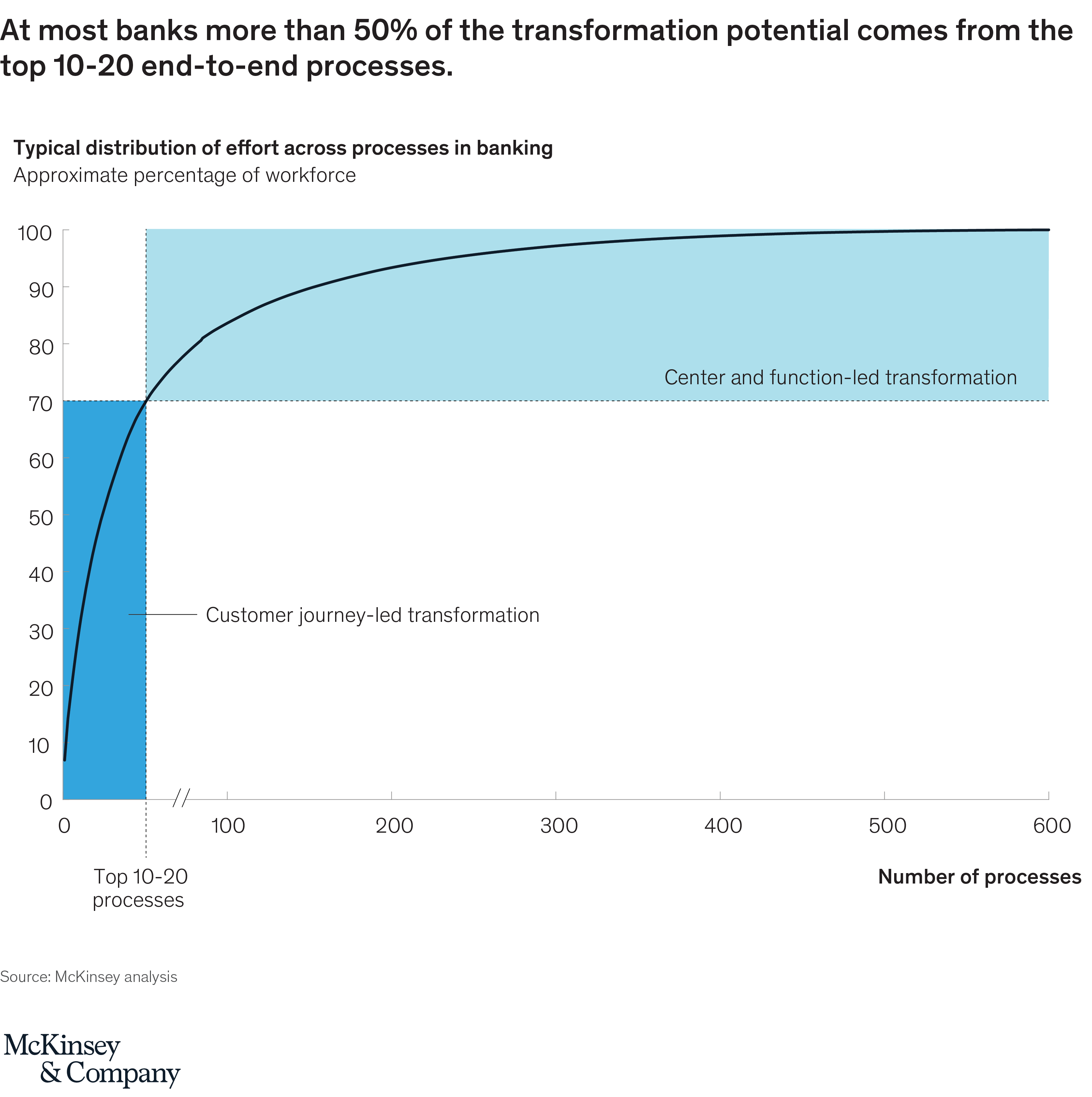

- Pinpoint where costs are today. Build a forensic view of operations costs and key demand drivers. For example, a large UK bank mapped about 50 end-to-end processes (e.g., account closure and change of address), and the resulting transparency made clear that 15 of these processes accounted for roughly 80 percent of the overall cost base, with a “long tail” of smaller, more fragmented activity.

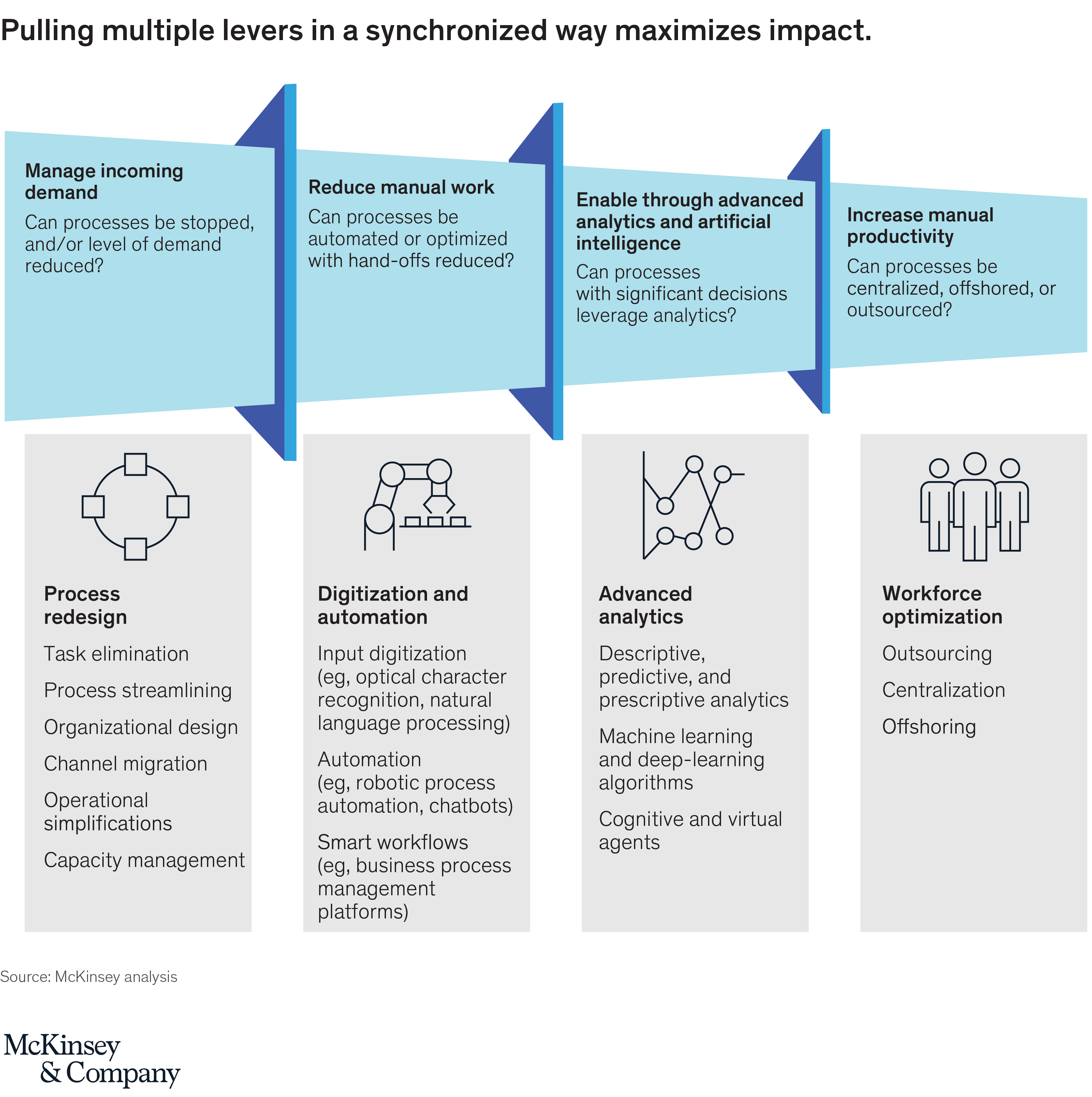

- Identify an integrated set of levers. Build a comprehensive lever improvement toolkit that applies across all target processes (Exhibit 1). At many banks this toolkit can build on existing investments (for example, a fledgling robotic process automation platform, or an analytics platform built for specific use cases).

- Reimagine the selected processes. Take a fresh look at processes from the ground up and imagine how they can better meet current customer needs. The aim is to essentially redesign processes from scratch without being constrained by legacy considerations.

- Estimate the transformation’s full potential. Based on current process costs and the ability to apply the toolkit systematically to those reimagined processes, determine how to transform each process and estimate results.

- Tailor the delivery approach. At most banks more than half of the transformation potential comes from the top 10 to 20 end-to-end processes, most of which are typically customer-facing (Exhibit 2). In these cases, banks should aim to digitize and automate the entire customer journey, paying particular attention to the customer experience and to resolving front-end pain points. To improve the remaining long tail of smaller processes that are usually functional in nature, banks should take a more tactical approach, applying only the most relevant technology levers (for example, combining process redesign and RPA) to deliver cost-efficient benefits. These efforts are often “center based,” systematically transforming all back-office operations in a single operations site.

The potential gains from following these steps are meaningful. A major European bank followed this “recipe” to transform its top 15 end-to-end processes using a customer journey-led approach. It managed to reduce costs through productivity gains by 35 percent and saw a 40 percent lift in its net promoter score. After pursuing the customer journey-led transformation, the bank embarked on a center-led transformation—systematically transforming each operations center. This effort is targeting a further 25 percent savings in small processes (e.g., RPA to automate account closure, optical character recognition and RPA to reduce manual rekeying for incoming mail).

Given the challenges they face, banks need more than incremental or isolated productivity gains. To achieve improvements in cost efficiency and customer experience that make a significant bottom-line difference, they need to rigorously apply the full set of levers across their entire operations cost base.