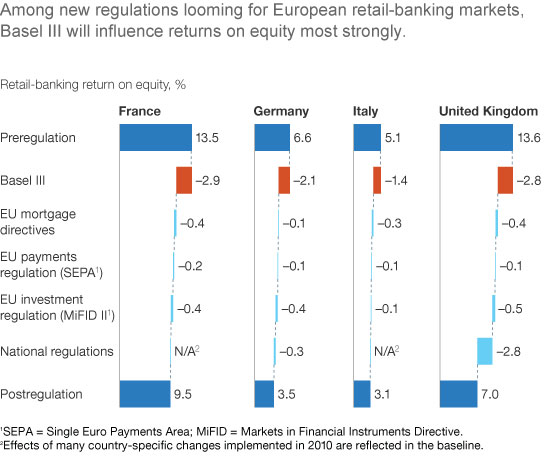

Europe’s retail banks are now entering a period of regulatory reform that looks certain to put pressure on revenues, profits, and margins, and may alter these banks’ core business models. We estimate that without any mitigating action by banks or material changes in the economic and competitive environment, recent global rules, especially Basel III,1 and new regional and national regulations will help reduce retail banking’s average return on equity (ROE) in Europe’s four largest markets to 6 percent, from about 10—a 41 percent decline. The analysis, based on 2010 financial-year data, assumes that the cumulative regulatory impact expected over the next several years will be realized immediately.

The effects vary across the four markets, but in all cases the outlook is grim (exhibit). In France, ROE will fall to 9.5 percent, from 13.5—a 29 percent decline driven by changes affecting mortgages, debit cards, and investments. In Germany, ROE will fall to 3.5 percent, from 6.6 (a drop of 47 percent); almost all retail products will be affected and many will become unprofitable. ROE in Italy’s retail banks starts from a lower base, 5.1 percent, but will fall further, to 3.1 percent. In the United Kingdom, returns will fall to 7 percent, from 13.6 percent. The impact here, 48 percent, is high because of extensive country-specific regulation.

All these figures assume no action on the part of banks, but of course they are already adjusting to the new world. While we think it unlikely that the industry will return to preregulation ROE levels in the short to medium term, individual banks can do so if they pull all four levers available to them:

-

Technical mitigation. By raising the efficiency of capital and funding (through improved data quality, better risk processes, and refined risk models), banks can increase ROE by 30 to 160 basis points.

-

Capital- and funding-light operating models. Banks can further improve their funding efficiency and reduce risk-weighted assets by, for example, changing their product mix and characteristics and pursuing collateral more vigorously. All told, these techniques might improve ROE by 10 to 80 basis points.

-

Repricing. Banks will have only a severely limited ability to raise prices but may still be able to do so in some product markets.

-

Business model alignment. Over the longer term, retail banks that embed an ROE consciousness in their management approach, address industry-wide cost challenges, and pursue some focused M&A (including divestitures) will probably make the biggest strides toward reclaiming their former profit levels. In the coming months, ongoing research will explore the development of possible future retail-banking business models.