Banks recognize the importance of digital technologies as a powerful lever to improve their profits, improve regulatory compliance, and transform their customer experience. The latter imperative has taken on heightened importance in the COVID-19 crisis, as remote and mobile access have shifted from conveniences to necessities for many millions of customers. Going forward, we expect digitization to play an even more central role, as banks find innovative ways to serve their customers during the crisis.

Our analysis—based on research done before COVID-19—suggests that those banks that successfully use digital technologies could also see an increase in profit by 40 percent from a combination of increased revenues and lower operational costs.

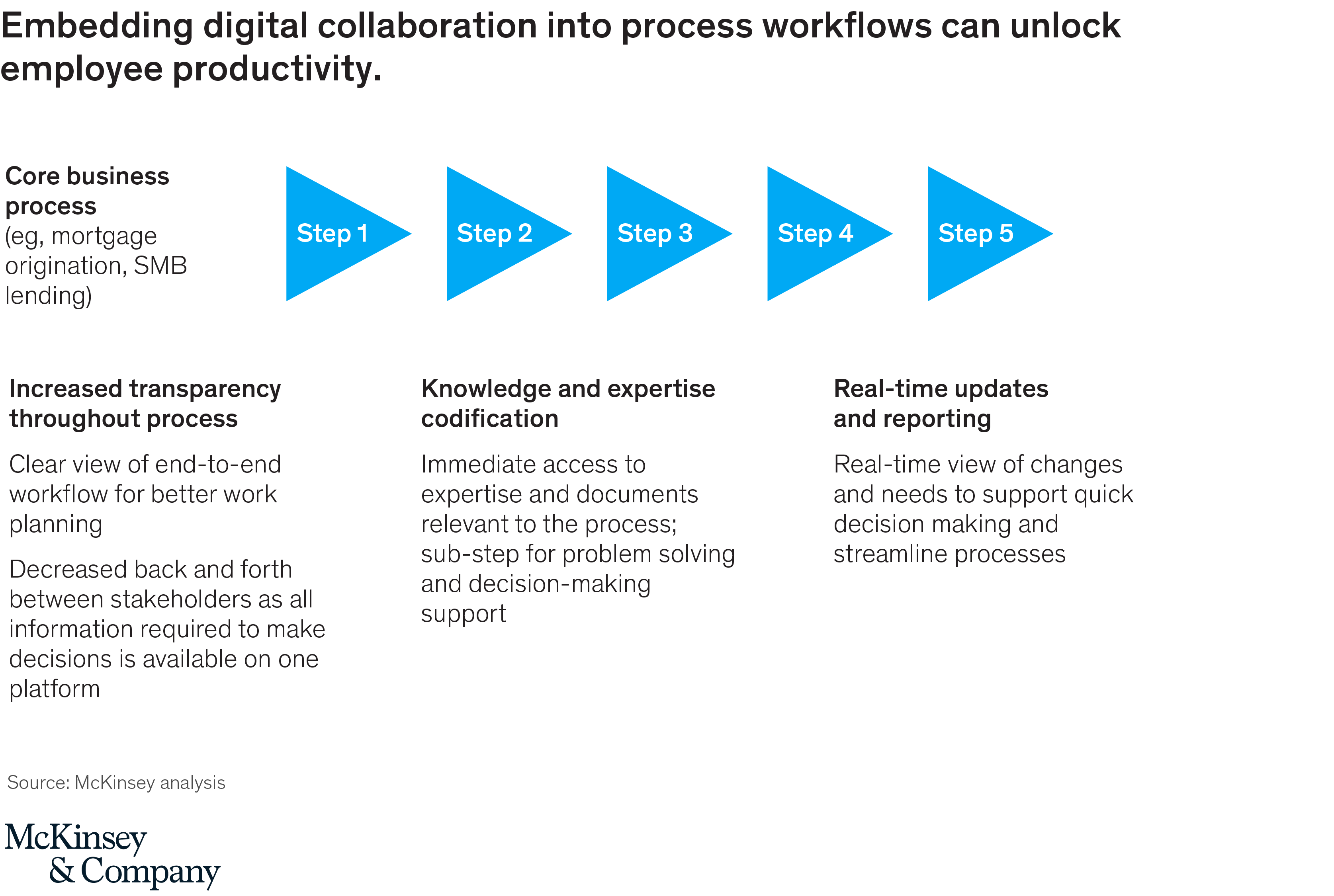

Digital proficiency involves a range of capabilities including advanced analytics, intelligent process automation, and digitization. While customer-facing products and touchpoints have become more digitized (e.g., online interactivity with customers and mobile payments), business processes are less so. Embedding digital collaboration into business process workflows promises to open up steep improvements in employee productivity, leading to significant value creation for the industry.

The case for embedding digital collaboration in process workflows

Banks have focused on automation as the primary lever for business process digitization. Automation indeed has great potential that banks are gradually realizing. Based on our research, machines will perform from 10 to 25 percent of work across bank functions in the next few years, increasing capacity and freeing employees to focus on higher-value tasks and projects. As more repetitive tasks become automated, what will separate leaders from laggards is how they empower their employees for the teamwork required for complex tasks—both front-line and information workers alike.

The technologies available to employees for collaboration thus far have been limited to basic communication tools such as e-mail, chat, and text messages. These tools are typically disconnected from actual information flows related to business processes, and this lack of integration results in unneeded back-and-forth on status, hand-offs, and inquiries among employees, hurting their productivity. We believe embedding digital collaboration into process workflows will unlock the next S-curve in employee productivity (Exhibit 1). Assuming that core business processes which represent 15 to 20 percent of spending could be streamlined to improve productivity by 8 to 10 percent (e.g., eliminating unneeded back-and-forth), the result of scaling up to the entire global banking industry might generate new value of $30 billion or more.

To view PDF of exhibit, click here

Implementing digital collaboration-enabled processes

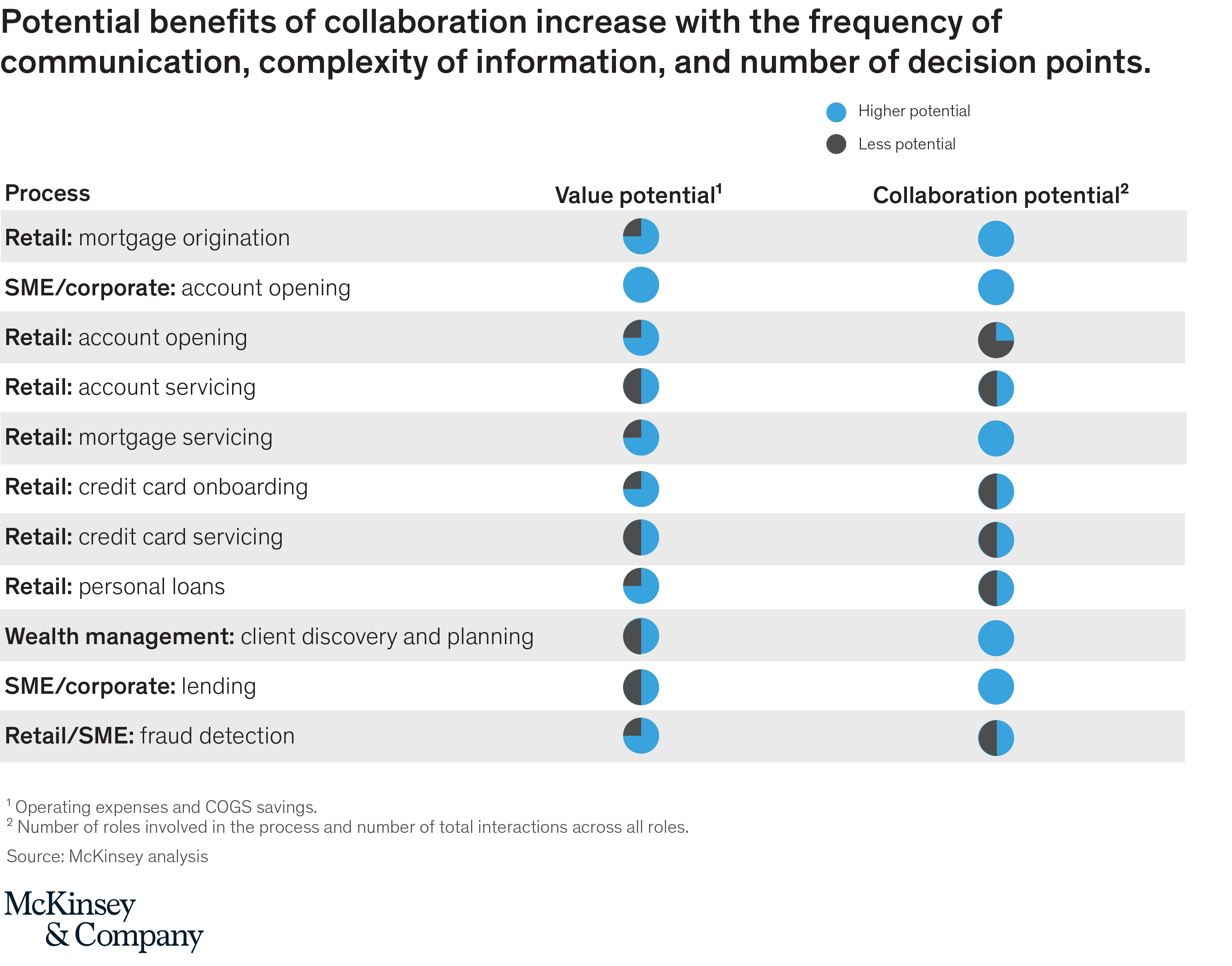

Digital collaboration solutions are relevant for many processes within banking, across customer segments and product categories. The potential benefits increase with the frequency of communication, complexity of information, and number of process decision points (Exhibit 2).

To view PDF of exhibit, click here

As examples, mortgage origination and commercial customer onboarding demonstrate how digital collaboration could unlock substantial gains in productivity and cost savings. Both are currently highly inefficient, with many manual touchpoints and contributing employees, frequent iterations, and poor transparency and information sharing.

Mortgage origination

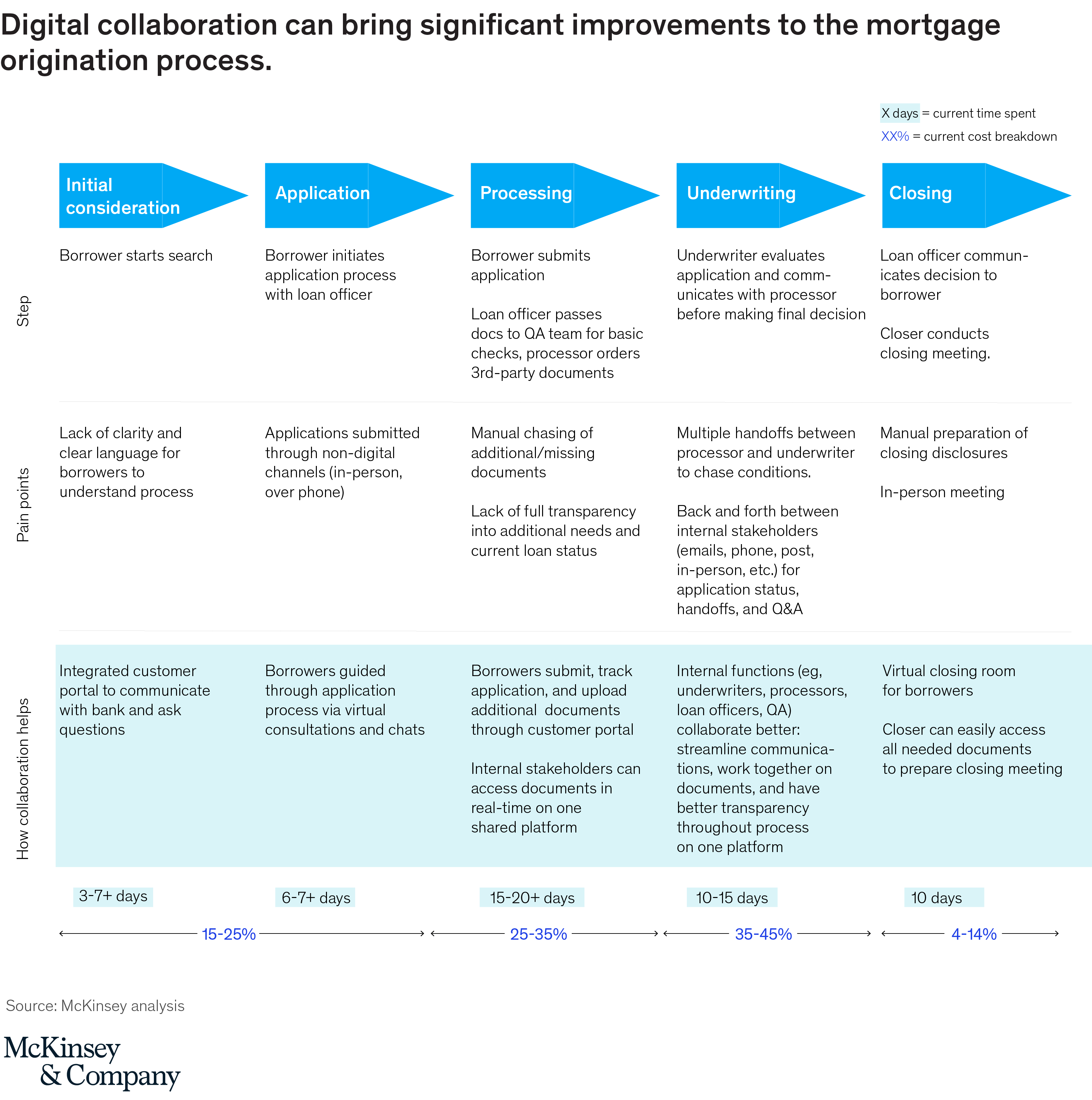

With current technologies and processes, the traditional US mortgage process takes roughly 46 days on average to complete and costs the originating bank about $2,000 to $2,500 per loan.1 At a high level, mortgage origination comprises five steps: initial consideration, application, processing, underwriting, and closing (Exhibit 3).

To view PDF of exhibit, click here

Typically, it involves six unique roles—loan officers, sales assistants, processors, underwriters, quality assurance and control, and closers—with over 30 touch points and interactions. Traditional methods involve old-school exchanges of information, and are burdened by long wait times, and frequent back-and-forth and corrections. Collaboration technology can eliminate these shortcomings and lower costs, and by reducing delays and repeated contacts, improve the customer experience.

A reimagined mortgage process

Collaboration technologies can contribute to significant improvements for both mortgage borrowers and originators. Borrowers will likely connect with their mortgage providers through an integrated portal, which enables seamless communication and collaboration between customer and the bank.

Chatbots, videos, interactive calculators, and self-serve tools for uploading documents and confirming progress will all enhance the borrower experience. Applications can be submitted through the portal with the help of virtual consultations, and continuous updates and push notifications will prompt actions from customers and keep them fully current on the status of their applications.

On the bank side, mortgage team stakeholders including underwriters, processors, loan officers, and quality assurance and control teams can interact through the portal, streamlining communications that are currently transmitted through multiple channels (phone calls, e-mails, post, or in-person). For example, a dashboard will prompt action only on those loans that need it (so employees do not have to review every file in their pipeline); a daily file prioritization will focus attention on the most critical loans; and notifications will flag missing or recently submitted information and highlight urgent actions.

As an application moves toward closing, the collaboration platform can help assist the closer through the standard creation of closing disclosures, an e-signature, a virtual closing room for borrowers, and a welcome letter. A defined and standardized process built on one set of tactical steps will reduce variability in routines across the operations staff and accelerate the process.

Impact

Increased collaboration among internal stakeholders and borrowers will improve customer experience, operational efficiency, and transparency. We estimate that a reimagined mortgage origination journey will enable both cost and time savings, including:

- Reducing costs per loan by 10 percent

- Shortening loan processing time by 15 to 40 percent

- Reducing the frequency of underwriting touches per application by 15 to 40 percent

Commercial banking: Customer onboarding

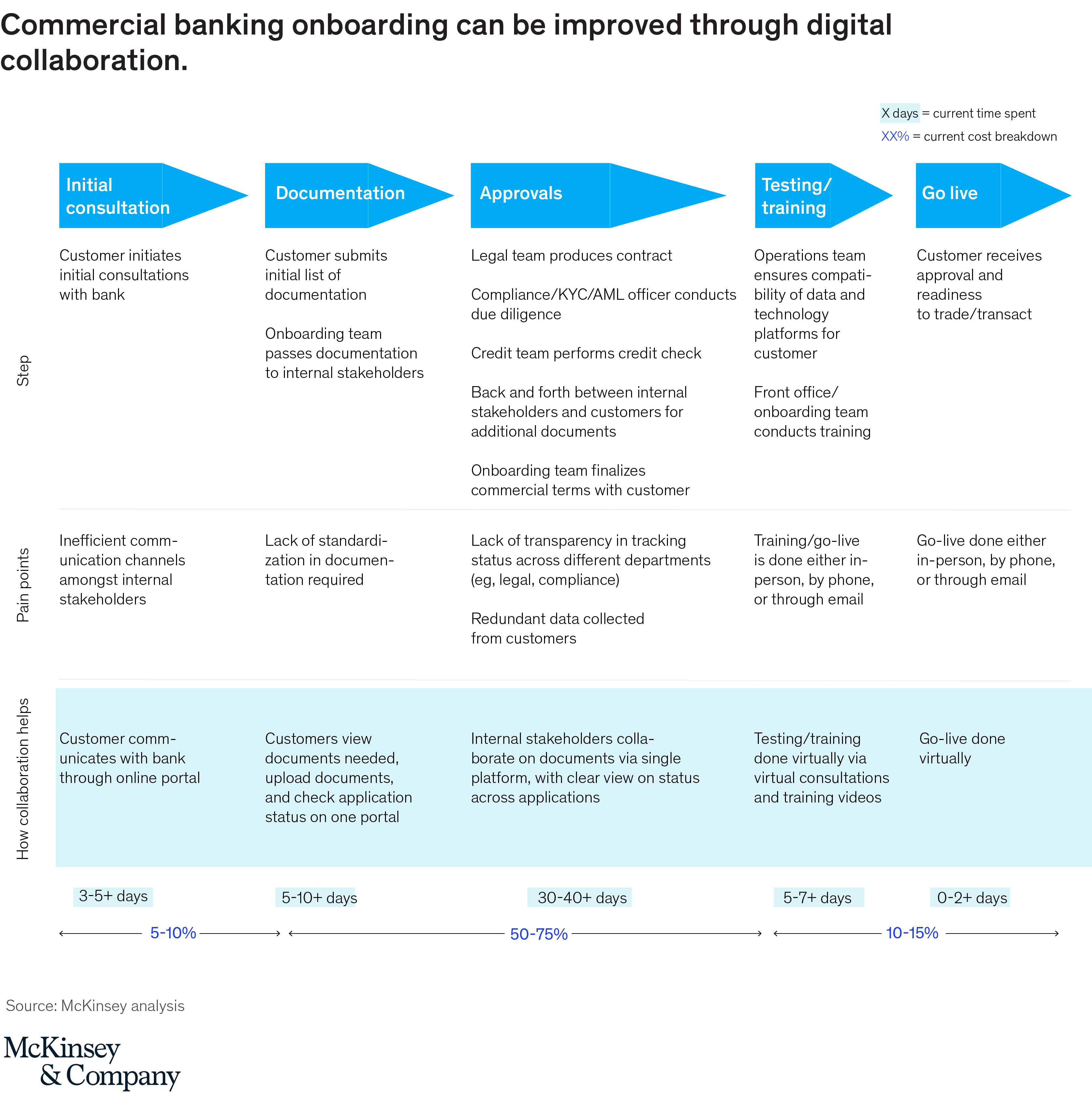

Customer onboarding in commercial banking consists of five broad steps: initial consultation, documentation, approvals, customer training and testing, and going live (Exhibit 4). As with mortgage origination, pain points stem from inefficient communication between stakeholders and poor transparency throughout the process.

To view PDF of exhibit, click here

Reimagined process

In a reimagined commercial banking onboarding process, customers can indicate their interest in opening accounts through an online portal. (Alternatively, relationship managers can proactively contact potential customers and guide them to the portal.) Customers then use the portal to consult with relevant bank employees, such as an onboarding team, through video consultations.

The onboarding team can search the platform to determine whether customers have existing relationships with the bank, and what documents they have already submitted. Customers can view these documents as well, and upload any additional required documents, reducing back-and-forth between bankers and clients. Throughout the rest of the approval process, customers can check their status in real time, and arrange virtual consultations.

After the application is submitted, relevant groups within the bank can execute their workflow in parallel. For instance, a legal team would produce contracts; compliance, KYC, and AML teams would conduct diligence and confirm that regulatory requirements are met; and credit officers would assess creditworthiness and set credit lines. Status and completion of tasks are clearly indicated, and customers are notified when their applications have been approved.

Customers can then learn the functionality of their new accounts, submit test transactions, go live, and keep in touch with their relationship managers.

Impact

Collaboration platforms that connect customers and internal teams can have significant impact, including:

- Reducing cost per customer by 15 percent and more

- Cutting time to onboard by 20 percent

Capturing the value

To capture the opportunity offered by digital collaboration, banks can take several tactical steps.

1. Identify business processes that can be most improved through digital collaboration: Tactically, this involves mapping out all core bank processes and prioritizing those with the greatest potential for uplift from digital collaboration (e.g., because they have significant “friction” associated with internal and external communications). In most cases, a small set of processes is responsible for generating the bulk of costs. For example, one UK bank found that out of its 50 end-to-end processes, about 15 accounted for roughly 80 percent of the entire cost base.

More broadly, banks should also examine thoroughly the operating metrics of all significant business processes, comparing performance to their own KPI targets and metrics across the industry, particularly with respect to customer satisfaction. Areas of persistent shortfalls should be considered candidates for digital collaboration programs.

2. Plot the required technology roadmap: For the top use cases for digital collaboration, banks should determine what technology is required to address pain points in the most inefficient processes and enable further collaboration. Tools should be implemented in an agile way, to identify early successes and iterate with user feedback.

3. Drive user adoption: Banks should promote digital collaboration to a high strategic status, prioritizing training, publicizing savings of cost and time and improvements in KPIs, and demonstrating its importance within the organization’s broader digital efforts.

Digital technologies have a well-established fundamental role in banks’ operations and relationships with their customers. As part of a second wave of digitization in banking, digital collaboration is not only a powerful new tool on its own, but provides a natural and logical extension of the greater need for remote working and selling that are sure to be prominent in a post-COVID-19 environment. Digital collaboration also can bring broad gains in productivity, and please customers through greater speed and simplicity across a range of bank products, thus promising significant value through enhanced revenues and reduced costs.

The authors would like to thank Stephanie Bao, Nandita Bothra, and Neha Jindal for their contributions to this article.

1 For retail or D2C channels; excludes sales and loan officer commissions.