Over the past few decades, consumer-packaged-goods (CPG) companies have seen tremendous growth: they’ve ventured into new markets, launched myriad new products and brands, and vastly expanded their distribution networks. But in doing so, they’ve built up complex, expensive organizational structures—and costs have risen almost as fast as revenues.

CPG executives, looking for an arrangement that simultaneously enables growth and contains costs, now invest considerable time and effort experimenting with organizational designs. It isn’t easy: between 1997 and 2007, fewer than half of the top 30 CPG organizations managed to reduce their selling, general, and administrative expenses (SG&A) by more than one percentage point.

Granted, no single blueprint can guarantee both effectiveness and efficiency, and a company’s organizational design should support its specific strategy. But are certain design choices right for a CPG company regardless of its strategy?

A quantitative analysis of more than 40 of the world’s largest CPG organizations suggests that the answer is yes. This new McKinsey report, Designing a winning consumer goods organization (February 2012), identifies six organizational-design choices that appear to be linked to a CPG company’s ability to drive growth and keep costs down. The choices involve how to take advantage of scale; the degree of centralization and specialization in the marketing, sales, and back-office functions; the location of R&D resources; and staffing in emerging markets.

Some highlights from the research:

- Large global companies (those with annual revenues of $10 billion or more and operations on at least two continents) enjoy significant economies of scale. But there appears to be a tipping point—both in revenues ($20 billion) and the number of countries that host operations (about 50)—where the scale advantage tapers off.

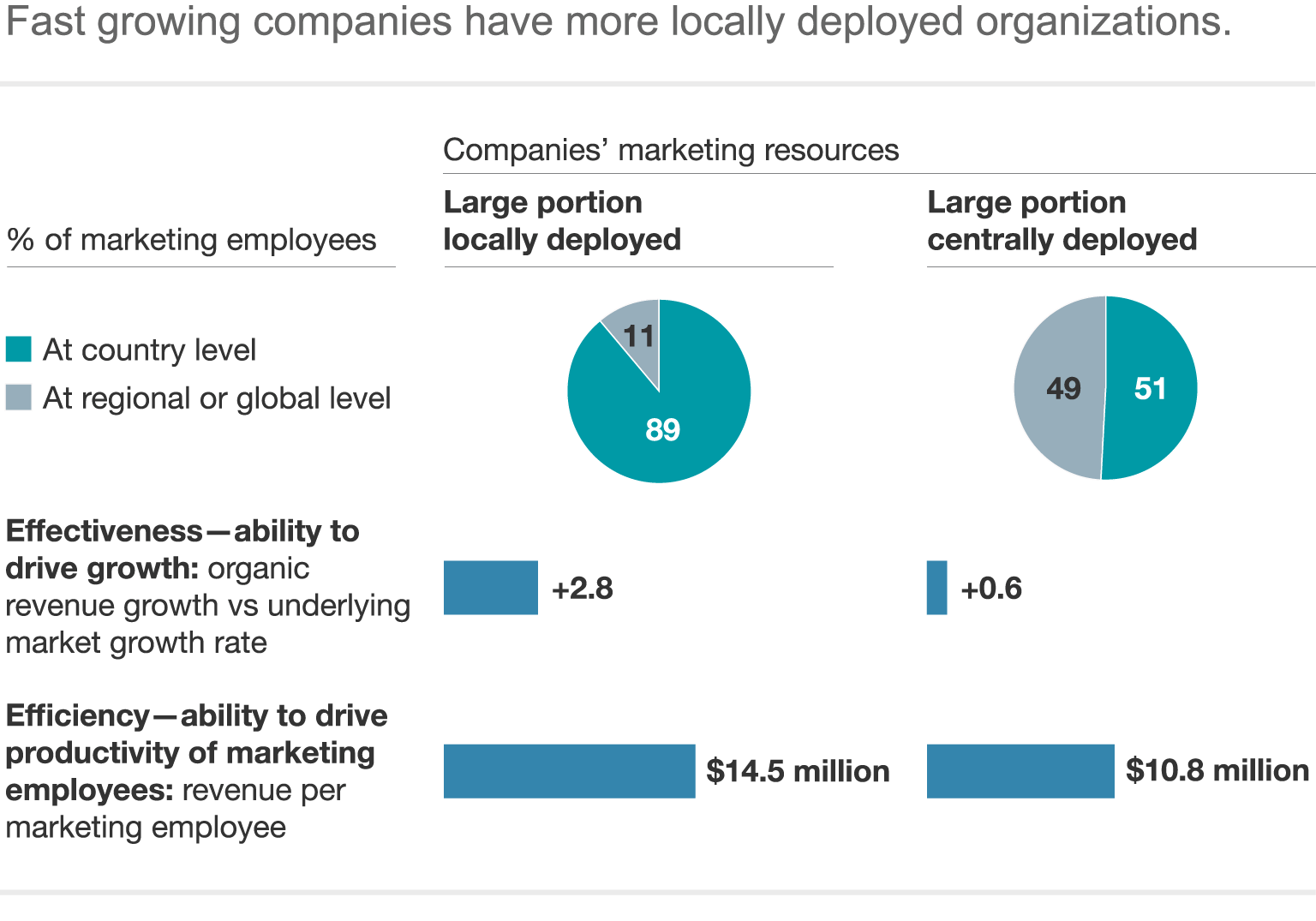

- It pays to have a locally deployed marketing function, in which most marketing employees work in country offices supported by a small set of centers of excellence. Companies that take this approach tend to grow faster and to have lower costs than those with a large proportion of centrally located marketing personnel (exhibit).

- Selectively moving research-and-development centers to low-cost countries can reduce total R&D labor costs by 6 to 8 percent on average, without reducing the centers’ effectiveness (measured as the percentage of incremental growth from new products).

- In the emerging world, staff size doesn’t matter: we found no link between the number of employees in such a market and a company’s growth rate there. What matters is having a skill mix tailored to local market dynamics.