With more and more countries in Asia–Pacific (APAC) committing to net zero targets, decarbonizing emissions from business operations has become a license to operate for companies across the region—and this trend is accelerating.

One key indicator of a company’s commitment to tackling climate change is setting clear emission reduction targets. So far, over 670 companies across APAC have set (or committed to setting) emissions reduction targets via the Climate Disclosure Program (CDP) and Science Based Targets initiative (SBTi).1

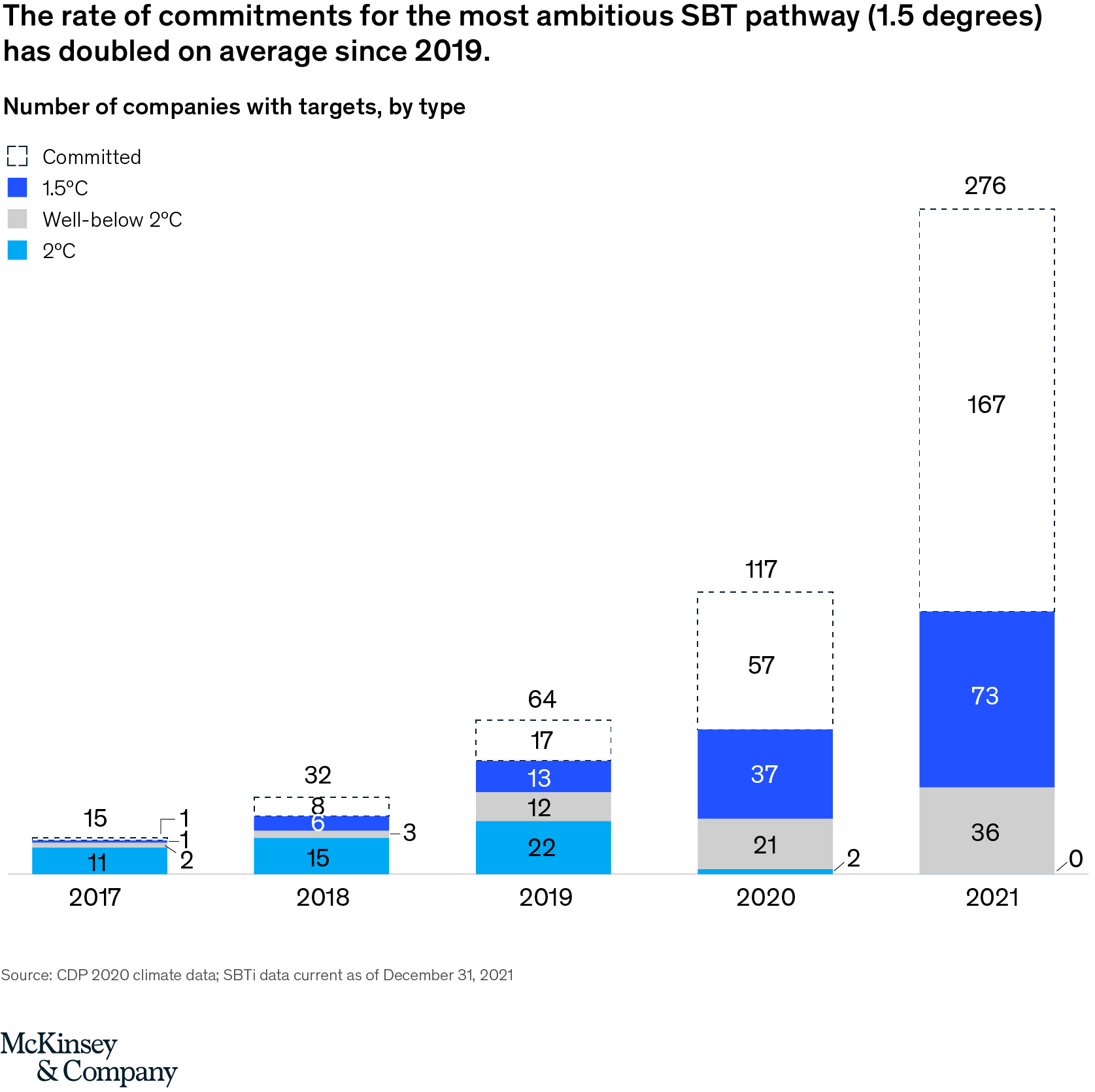

SBTs provide companies with a rigorous framework that allows targets to be set in line with the Intergovernmental Panel on Climate Change (IPCC) goal of limiting global warming to 1.5°C above pre-industrial levels. Their 1.5-degree pathway equates to a linear reduction of 4.2 percent of absolute emissions per year. To date, 254 companies have set an SBTi target, and despite the COVID-19 pandemic, the rate of commitments to the most ambitious pathway (1.5°C) has continued to double on average since 2019.

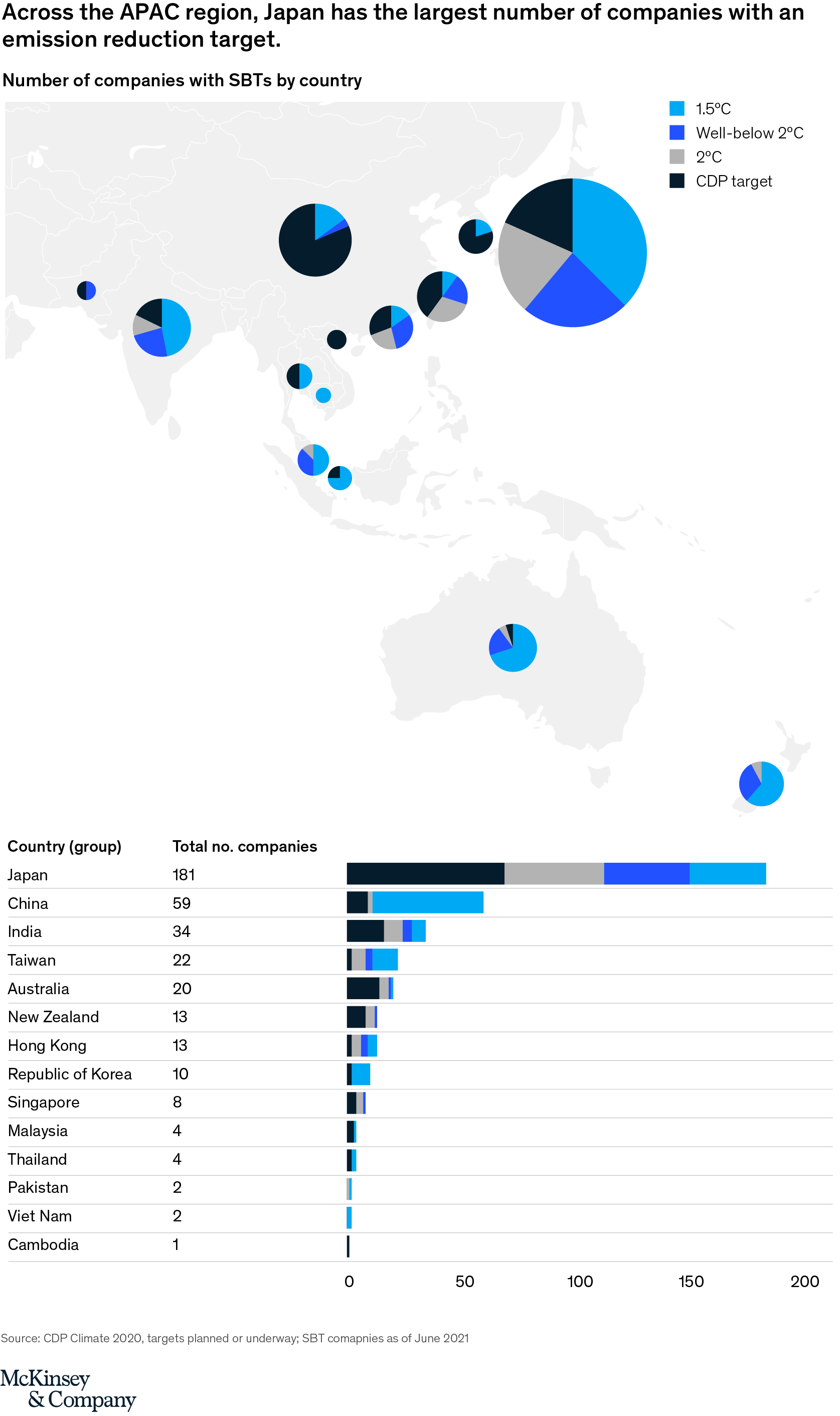

The number of companies with emissions reduction targets varies widely across the region. Japan has the largest number of companies with an emissions reduction target from SBT or CDP—despite only accounting for approximately 6 percent of regional emissions.2 Australia has the highest proportion of companies with targets on the 1.5-degree pathway.

Targets also vary significantly across industries. Most companies that have set (or have committed to setting) targets are those in the manufacturing and services sector, accounting for 29 percent and 21 percent of total companies respectively. High emission sectors such as power generation and fossil fuels, on the other hand, only account for 3 percent and 0.1 percent of total companies respectively. This trend is consistent across all countries in the region.

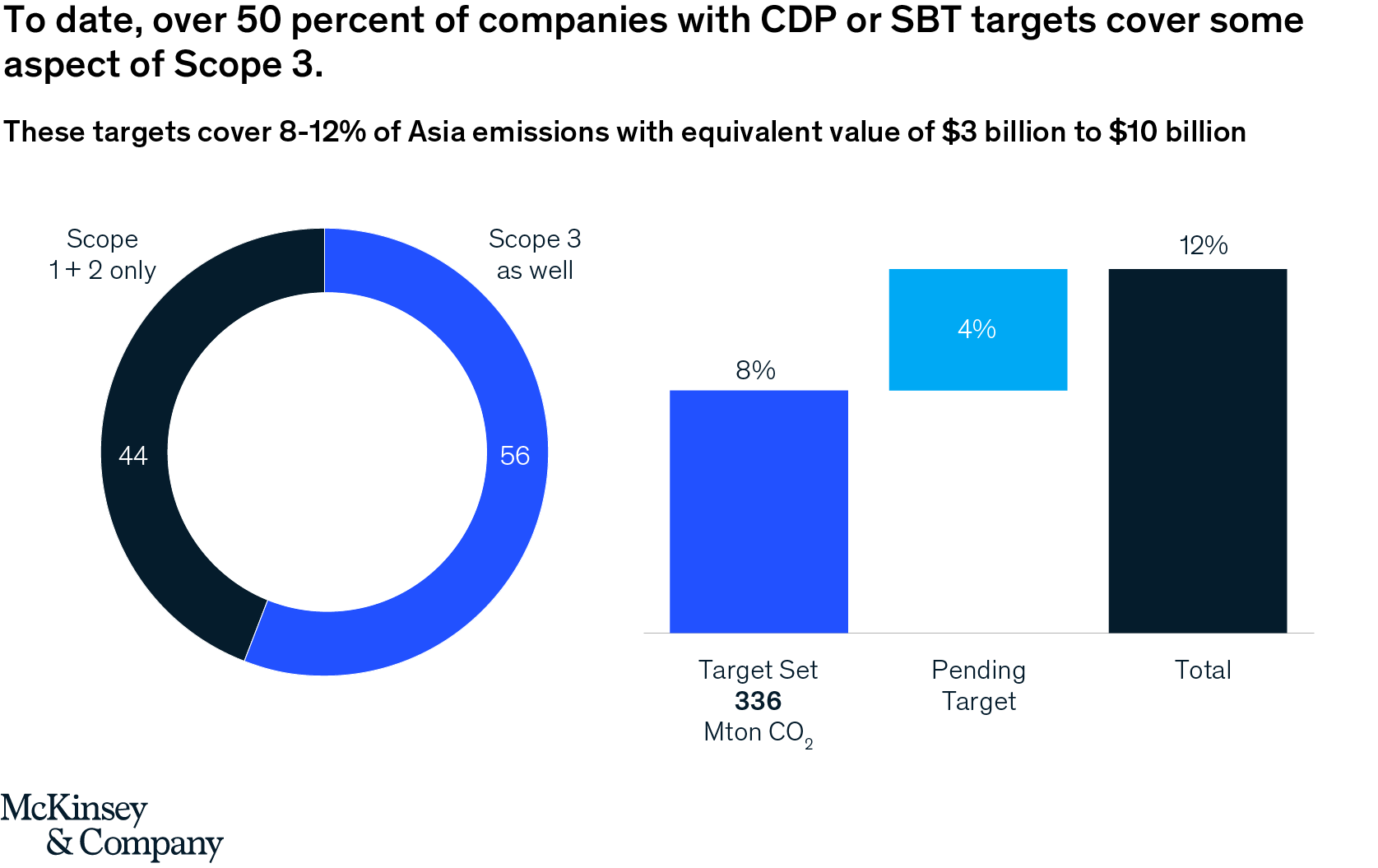

For organizations with a large value chain, Scope 3 emissions—which are the result of activities from assets not owned or controlled by the reporting organization—make up the greatest proportion of emissions. These emissions are often the most challenging to address. To date, over 50 percent of companies with CDP or SBT targets cover some aspect of Scope 3, with the largest portion of companies belonging to the biotech, healthcare, and pharma sectors. These companies have committed to getting their top suppliers or customers to set decarbonization targets, which creates a virtuous reinforcement cycle that will drive an exponential increase in commitments and emissions reduction over time.

Overall, these targets cover at least 8 percent of regional emissions, which translates to 336 million tons of carbon dioxide equivalent (CO2e) abated by 2030, and an additional 104 million tons by 2050. If companies that have committed but not yet set an SBT are also included, this would cover approximately 12 percent of regional emissions.3

Putting a price on this is challenging, since there is still a large degree of variance in carbon prices. If carbon pricing is implemented and by 2030 the average price in APAC is $10 to $30 per ton CO2e, it presents an opportunity of $3 billion to $10 billion in avoided costs for organizations across the region.4

With the cost of renewables, alternative fuels, and other technologies dropping rapidly—and energy efficiency becoming more scalable—the roadmap for decarbonization often paints a promising picture. Based on our analysis of the abatement pathways for selected Asian countries, approximately 40 percent of their emissions could be abated with an economically positive business case—with another 20 percent abated at a cost of less than $50 per ton CO2e.5

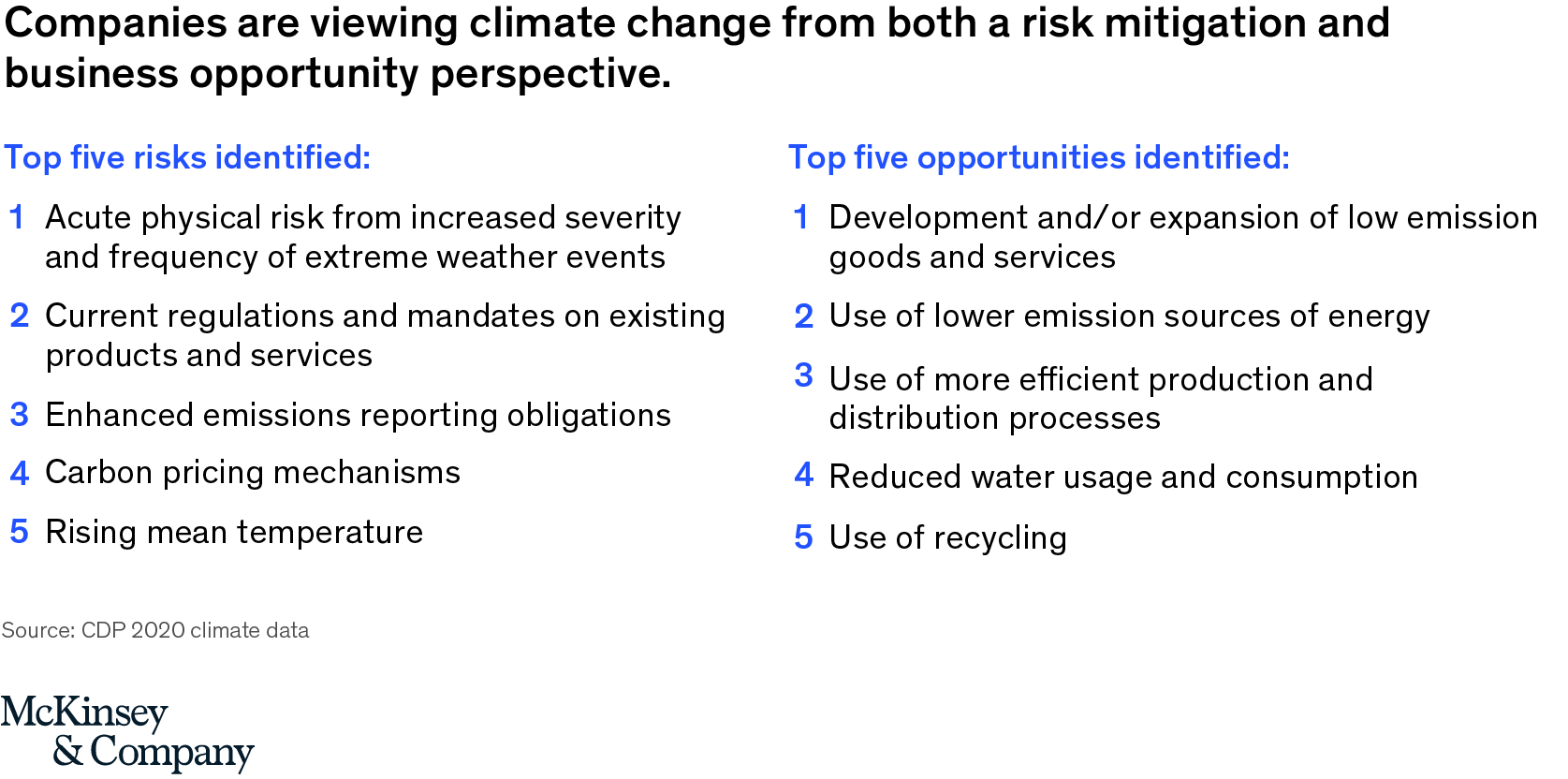

Companies are also viewing climate change from both a risk mitigation and business opportunity perspective. According to data from CDP, organizations identified top risk coming from dealing with extreme weather events, with a financial impact of approximately 26 percent of their revenue on average.6 The opportunities, associated first and foremost with green growth expansion into low emissions products and services, had an overall estimated financial impact of approximately 18 percent of their revenue on average.6

To stay competitive in an environment that is increasingly conscious of its impact on climate change, companies must proactively address their own footprint and seize the opportunity for sustainable growth. This can be done by ensuring that corporate strategies explicitly include emissions reduction targets, and then working out reduction potentials and pathways to decarbonization—while building new value pools through green growth.

The authors would like to thank Vaibhav Dua, Varshini G, Vignesh Kiran, and Christina Wallgren for their contributions to this article.

1 Source: CDP 2020 climate data; SBTi data current as of December 31, 2021

2 Source: World Development Indicators, 2021

3 This assumes that companies that committed to setting an SBT after August 2019 set an SBT target in 2021 in line with the well-below 2-degree pathway.

4 In 2021, the global weighted average carbon price was approximately $20 per ton.

5 Based on net-zero pathways for Japan and Philippines for 2050; Source: McKinsey Sustainability Insights analysis

6 Source: CDP 2020 climate data; based on 19 respondents, and the company’s 2020 revenue

7 Source: CDP 2020 climate data; based on 13 respondents, and the company’s 2020 revenue