As COVID-19 lingers and the Russian invasion of Ukraine continues to have deep human, social, and economic impacts, European consumers remain pessimistic about their economic prospects. McKinsey’s latest European Consumer Pulse Survey, carried out from September 23 to October 2, 2022, garnered the views of 1,000 respondents in each of France, Germany, Italy, Spain, and the United Kingdom. It confirms trends observed in our June survey—in particular, concern about inflation, which has been escalating since then. Consumer confidence remains low, worsening especially in Germany and France; downtrading behavior has intensified.

A few intriguing shifts are newly highlighted. While omnichannel persists, in some categories there is a movement back to more in-store shopping. Cooking from home and working from home are the most “sticky” behaviors stemming from COVID-19. More people are digging into their savings for routine purchases. And this year, not even the coming festive season is enough to coax shoppers to splurge.

The following charts illustrate our key findings:

- Most people are concerned about rising prices. For 58 percent of European consumers, increasing prices are their number-one worry. This is followed by the invasion of Ukraine, extreme weather events, unemployment, and political uncertainty as important concerns.

- Economic confidence has dipped. Consumer pessimism has inched higher, with 43 percent expressing doubt about economic recovery—up from 36 percent in June. This is much worse than even the first two years of COVID-19 (when pessimism peaked at 32 percent in May 2020). Responses vary by country, however, with net confidence declining by 22 percentage points in Germany and by ten percentage points in France, in contrast to unchanged confidence in the United Kingdom, Italy, and Spain.

- Consumers are pulling back on spending and dipping into savings. Consumers are buying deliberately, exercising discernment about what they purchase. Nearly four in ten have reduced spending on nonfood discretionary items, up from a third in June, while over a third took out money from savings to cover typical expenses.

- Consumers are opting for more affordable options. To stretch their wallet, three out of five consumers changed behaviors when shopping for groceries and essentials. Of these, almost three-quarters switched to lower-cost or private-label household products. Migration to discounters continued.

- Most European consumers have no plans to treat themselves in the next three months, while only one-quarter plan on doing so in the near future. Almost seven in ten say they plan to shop less or not shop at all. Splurging is most often planned for travel and restaurants, with consumers in France, Spain, and the United Kingdom typically intending to splurge less than in other European countries.

Rising prices are consumers’ top concern by far

Continuing a trend noted in June, inflation has almost completely supplanted other concerns: 58 percent of European consumers cite price increases as their number-one worry, up from 53 percent in our last survey (Exhibit 1). This pattern is consistent across countries, with some variations. UK consumers display the greatest focus on inflation, with almost seven in ten respondents naming it as their biggest concern (up from two-thirds in June). In Spain, concern about unemployment retains second place, chosen by 14 percent. In Italy, extreme weather events have inched ahead of job security as a top worry.

The invasion of Ukraine remains the top concern of the second-largest group of respondents in Europe overall. But this group represents only 12 percent of respondents, down somewhat from 15 percent in June. The decline is most notable in Italy, where respondents choosing the invasion as their top concern decreased from 20 to 11 percent.

The COVID-19 pandemic, once all-consuming, no longer ranks among the top concerns of the European respondents. This concern may yet resurge, however, given the periodic appearance of highly transmissible variants.

Almost all respondents perceive price changes across categories. A vast majority—95 percent—say they have recently observed price changes for goods they often buy, up slightly from 93 percent in June (Exhibit 2). These changes are felt across all categories. This pattern is largely unchanged since our June survey, although consumers are a little less likely to report witnessing fuel price increases.

Notably, perceptions of price increases have become more intense for all other categories of goods. Across the board, more consumers describe these increases as “significant.”

Would you like to learn more about our Growth, Marketing & Sales Practice?

Consumer confidence falls to a new low

Consumers are feeling less optimistic about economic recovery. Pessimism remains at levels not seen even at the height of the pandemic and widespread lockdowns: 43 percent of respondents describe themselves as pessimistic about a successful economic recovery, up from 36 percent in June (Exhibit 3).

Optimism is weakening across countries. The decline is particularly severe in Germany, where net confidence has declined by 22 percentage points over the same period.

Consumers pull back on discretionary spending

Consumers are saving less and spending less on nonfood discretionary items. As respondents also indicated in June, they are spending more on their essential needs: two-thirds report spending more on energy and utilities (up from 61 percent in June), and 71 percent expect to do so in the next three months (Exhibit 4). In June, only 58 percent predicted a continued increase.

Spending on groceries and gasoline increased sharply and is predicted to grow further. While consumers expect to continue paying more for these items, their outlook has slightly improved since June.

Consumers have started to cut back on their spending elsewhere: nearly four in ten respondents report a decrease in spend on nonfood discretionary items, up from a third in June. A third, however, expect this spending to increase in the near future, which represents a slightly improved outlook since June. Spend reduction was especially notable in jewelry and in home and furniture (Exhibit 5, which highlights several categories selected from the many that were mapped).

More than half (55 percent) of consumers say they put less money into savings over the last three months; the same number anticipate this situation will persist. These figures have worsened since June—up by four and seven percentage points, respectively.

Over a third of European consumers say they took money from their savings to cover typical expenses, particularly in Italy, the United Kingdom, and Spain. In the United Kingdom, use of consumer credit is particularly prevalent (Exhibit 6). There are generational differences here, too. Most notably, half of millennials across Europe are digging into their savings.

Consumers are changing up and trading down

Four out of five consumers changed their shopping behavior in the past three months, a trend that has strengthened from 68 percent of respondents in April to 80 percent in September (Exhibit 7). Among the 20 percent of respondents who report no change in their behavior, nearly half (46 percent, equal to 9 percent of all respondents) plan to make changes in the next three months.

Looking at specific changes, half of all respondents say they tried a private-label brand in the last three months, up from 40 percent in June. And 21 percent of respondents plan to try a different retailer in the next three months, compared with 27 percent who did so in the last three months.

These behavior changes are predominantly occurring among young people—Gen Z and millennials. Nearly nine out of ten shoppers in these generations say they have tried something new in the last three months.

A prominent aspect of changed shopping behavior is a quest for better value, as consumers seek out more affordable brands and retailers. Six in ten consumers changed their groceries and essentials brands in the last three months. Of these, 72 percent switched to lower-cost or private-label household products, while just under two-thirds report similar changes when buying frozen foods and snacks and confectionery (Exhibit 8).

In these top three categories for trading down, the net trade-down was not significantly different from June’s figures. However, in the next two categories (dairy and eggs; healthcare, beauty, and baby supplies), there have been noticeable increases in net trade-down by four and six percentage points, respectively.

How US consumers are feeling, shopping, and spending—and what it means for companies

Brand switchers seek value for money plus prices and promotions

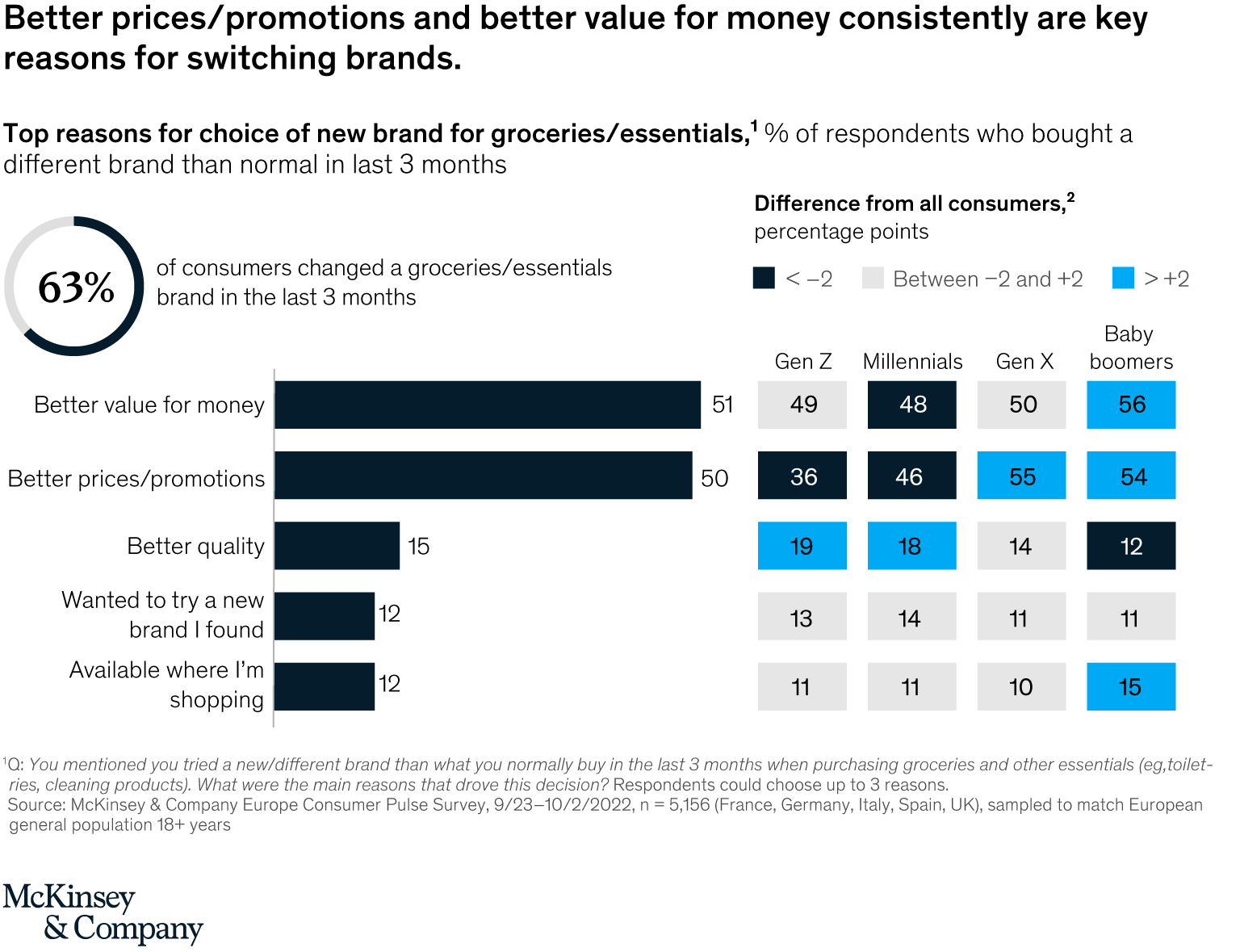

Major reasons for trying a new brand are better value for money and better prices and promotions. The survey asked the 63 percent of consumers who recently switched brands of groceries and other essentials to identify their top three reasons for switching. Around half of them mentioned these factors—a figure that has remained stable since April (Exhibit 9).

While these trends are present across all generations, they are particularly prominent among Gen X and baby boomers. Gen Z and millennials also emphasize changing to a better quality of goods, though this is not as important as prices and value.

Consumers gravitate to discounters

Discounters continue to benefit as consumers manage tighter budgets by opting for more affordable, value-based options. Among the 27 percent of consumers who changed their retailer during the last three months, shopping at discounters has increased 16 percentage points, cementing an ongoing trend toward cheaper alternatives (Exhibit 10).

Consumers reported lower use of the other retail formats we asked about, which tend to be more expensive. As in June, the discounter trend is strongest in Germany, while Spanish consumers report the lowest level of switching behavior. Organic supermarkets, a new category not previously surveyed, show a marked dip of 19 percent over the last three months, particularly in Germany and Italy.

Omnichannel shopping remains strong, despite a slight shift to in-store only

In 16 out of 21 categories the survey asked about, omnichannel remains the preferred way to shop. At the same time, responses show a slight movement of shoppers out of the omnichannel journey and into in-store-only research and purchase since March. This is particularly prominent for food takeout (where in-store-only activity rose by six percentage points), footwear (up six points), and apparel (up seven points).

Online-only shopping remains at relatively low levels. It is most common for consumer electronics (used by 36 percent) and food takeout (26 percent, down 4 percent versus June).

Consumers are cautious about spending during the holiday season

Most European consumers say they have no plans to treat themselves with special purchases in the next three months. Roughly one-quarter say they plan on “splurging” in the near future; these figures are even lower in France (20 percent) and the United Kingdom (18 percent). This trend has intensified since June, when 44 percent predicted they would treat themselves in the following six months, compared with 27 percent in September (Exhibit 11). The trend holds across the five countries surveyed—most strikingly in Italy (where the group planning to splurge has decreased by 18 percentage points to 29 percent) and France (down 14 percentage points to 20 percent).

Those who do intend to splurge most often say it will be for travel (especially in Germany) and restaurants (notably in Italy and Spain).

Here, too, there is a distinct generational divide, with unwillingness to splurge rising steadily with age. While 83 percent of baby boomers are unwilling to splurge, 45 percent of Gen Z say they plan to treat themselves in the next three months.

Consumers also anticipate doing less holiday shopping this year. Roughly two-thirds say they plan to shop less or not shop at all over the festive season. This is a consistent trend across the continent and particularly pronounced in Italy, where 61 percent plan to spend less than in previous years (Exhibit 12). Ten percent of Europeans say they plan to do no holiday shopping at all.

Russia’s invasion of Ukraine in February 2022 is having deep human, social, and economic impact across countries and sectors. The implications of the invasion are rapidly evolving and are inherently uncertain. As a result, this document, and the data and analysis it sets out, should be treated as a best-efforts perspective at a specific point in time, which seeks to help inform discussion and decisions taken by leaders of relevant organizations. The document does not set out economic or geopolitical forecasts and should not be treated as doing so. It also does not provide legal analysis, including but not limited to legal advice on sanctions or export-control issues.