Let’s face it: business models are less durable than they used to be. The basic rules of the game for creating and capturing economic value were once fixed in place for years, even decades, as companies tried to execute the same business models better than their competitors did. But now, business models are subject to rapid displacement, disruption, and, in extreme cases, outright destruction. Consider a few examples:

- Bitcoin bypasses traditional banks and clearinghouses with blockchain technology.

- Coursera and edX, among others, threaten business schools with massive open online courses (MOOCs).1

- Tencent outcompetes in Internet services through microtransactions.

- Uber sidesteps the license system that protects taxicab franchises in cities around the world.

The examples are numerous—and familiar. But what’s less familiar is how, exactly, new entrants achieve their disruptive power. What enables them to skirt constraints and exploit unseen possibilities? In short, what’s the process of business-model innovation?

For incumbents, this kind of innovation is notoriously hard. Some struggle merely to recognize the possibilities. Others shrink from cannibalizing profit streams. Still others tinker and tweak—but rarely change—the rules of the game. Should it be so difficult for established companies to innovate in their business models? What approach would allow incumbents to overturn the conventions of their industries before others do? Our work with companies in telecommunications, maritime shipping, financial services, and hospitality, among other sectors, suggests that established players can disrupt traditional ways of doing business by reframing the constraining beliefs that underlie the prevailing modes of value creation.2 This article shows how.

Reframing beliefs

Every industry is built around long-standing, often implicit, beliefs about how to make money. In retail, for example, it’s believed that purchasing power and format determine the bottom line. In telecommunications, customer retention and average revenue per user are seen as fundamental. Success in pharmaceuticals is believed to depend on the time needed to obtain approval from the US Food and Drug Administration. Assets and regulations define returns in oil and gas. In the media industry, hits drive profitability. And so on.

These governing beliefs reflect widely shared notions about customer preferences, the role of technology, regulation, cost drivers, and the basis of competition and differentiation. They are often considered inviolable—until someone comes along to violate them. Almost always, it’s an attacker from outside the industry. But while new entrants capture the headlines, industry insiders, who often have a clear sense of what drives profitability, are well positioned to play this game, too.

How can incumbents do so? In a nutshell, the process begins with identifying an industry’s foremost belief about value creation and then articulating the notions that support this belief. By turning one of these underlying notions on its head—reframing it—incumbents can look for new forms and mechanisms to create value. When this approach works, it’s like toppling a stool by pulling one of the legs.

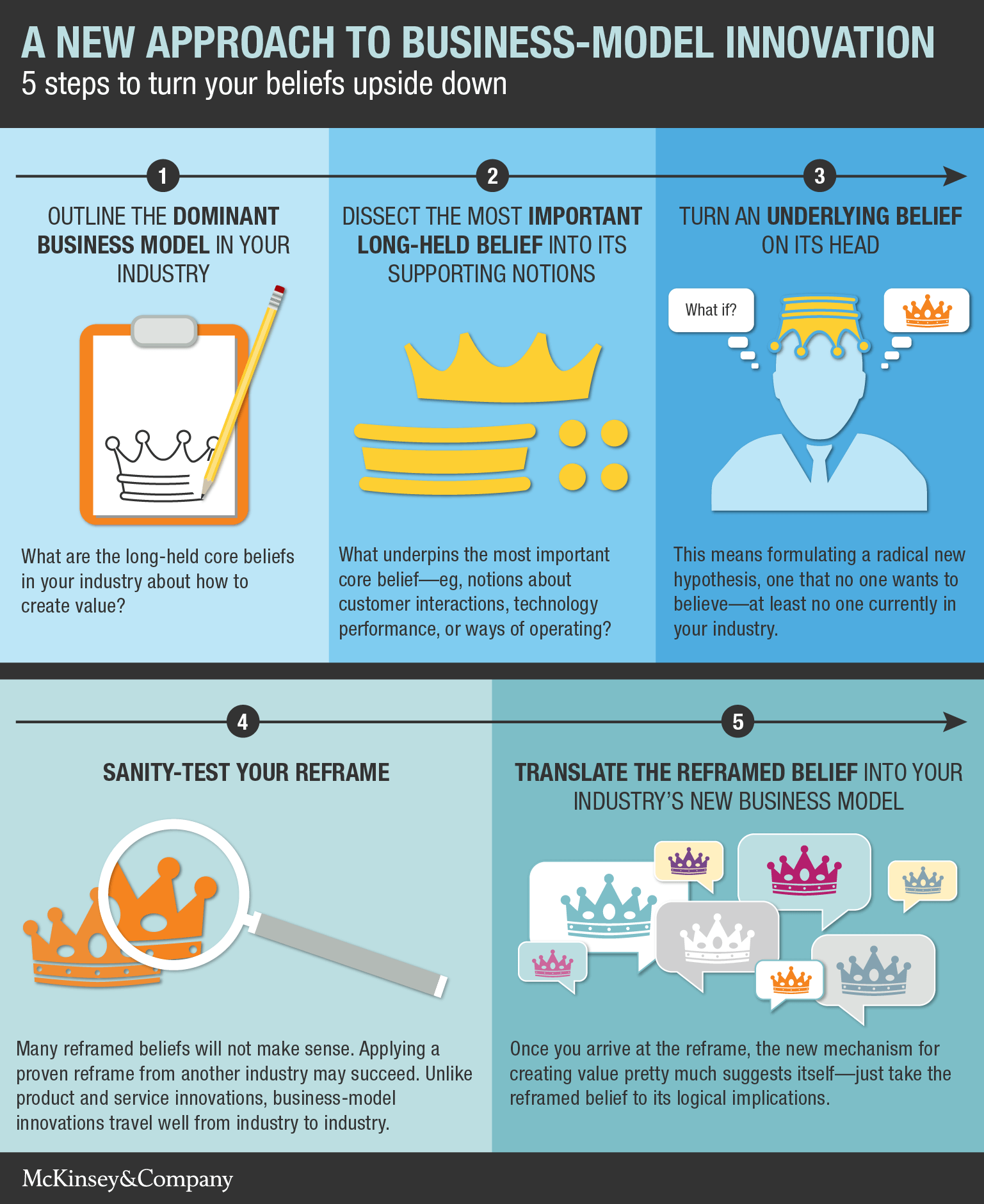

The fuller process and the questions to ask along the way look like this:

1. Outline the dominant business model in your industry. What are the long-held core beliefs about how to create value? For instance, in financial services, scale is regarded as crucial to profitability.

2. Dissect the most important long-held belief into its supporting notions. How do notions about customer needs and interactions, technology, regulation, business economics, and ways of operating underpin the core belief? For instance, financial-services players assume that customers prefer automated, low-cost interfaces requiring scale. Because the IT underpinning financial services has major scale advantages, most of a provider’s cost base is fixed. Furthermore, the appropriate level of risk management is possible only beyond a certain size of business.

3. Turn an underlying belief on its head. Formulate a radical new hypothesis, one that no one wants to believe—at least no one currently in your industry. For instance, what if a financial-services provider’s IT could be based almost entirely in the cloud, drastically reducing the minimum economic scale? Examples of companies that have turned an industry belief on its head include the following:

- Target: What if people who shopped in discount stores would pay extra for designer products?

- Apple: What if consumers want to buy electronics in stores, even after Dell educated them to prefer direct buying?

- Palantir: What if advanced analytics could replace part of human intelligence?

- Philips Lighting: What if LED technology puts an end to the lighting industry as a replacement business?

- Amazon Web Services: What if you don’t need to own infrastructure yourself?

- TSMC: What if you don’t need to develop your own process technology or invest in your own infrastructure?

- Amazon Mechanical Turk, TaskRabbit, and Wikipedia: What if you can get stuff done in chunks by accessing a global workforce in small increments?

4. Sanity-test your reframe. Many reframed beliefs will just be nonsense. Applying a reframe that has already proved itself in another industry greatly enhances your prospects of hitting on something that makes business sense. Business-model innovations, unlike product and service ones, travel well from industry to industry: Airbnb inspires Uber inspires Peerby. So look again at the reframes described in step three above. All of them have broad application across industries.

5. Translate the reframed belief into your industry’s new business model. Typically, once companies arrive at a reframe, the new mechanism for creating value suggests itself—a new way to interact with customers, organize your operating model, leverage your resources, or capture income. Of course, companies then need to transition from their existing business model to the new one, and that often requires considerable nerve and sophisticated timing.3

Four places to reframe

Executives can begin by systematically examining each core element of their business model, which typically comprises customer relationships, key activities, strategic resources, and the economic model’s cost structures and revenue streams. Within each of these elements, various business-model innovations are possible. Having analyzed hundreds of core elements across a wide range of industries and geographies, we have found that a reframe seems to emerge for each one, regardless of industry or location. Moreover, these themes have one common denominator: the digitization of business, which upends customer interactions, business activities, the deployment of resources, and economic models.

Innovating in customer relationships: From loyalty to empowerment

Businesses should strive for customer loyalty, right? Loyal customers tell their friends and contacts how good a company is, thereby lowering acquisition costs. Loyal customers stick around longer, keeping the competition at bay. Loyal customers provide repeat business, a bigger share of wallet, and more useful feedback about problems and opportunities. No wonder companies in so many industries emphasize locking in customers by winning their loyalty.

But the pursuit of loyalty has become more complicated in the digital world. The cost of acquiring new customers has fallen, even without loyalty programs. Customers—empowered by digital tools and extensive peer-reviewed knowledge about products and services—now often do a better job of choosing among buying options than companies do. Switching costs are low. Most significant, the former passivity of customers has been superseded by a desire to fulfill their own talents and express their own ideas, feelings, and thoughts. As a result, they may interpret efforts to win their loyalty as obstacles to self-actualization.

Instead of fighting that trend, why shouldn’t companies embrace the paradox that goes with it: the best way to retain customers is to set them free. The invention company Quirky, for example, lets the ideas and votes of its online community guide the products it designs and produces. MakerLabs, an interactive design–build collective, provides its members with the tools and expertise they need to build what they want.

Established companies can also make the switch from loyalty to empowerment. Consider the pension and insurance industry, long governed by the belief that complex investment decisions are best made by experts (companies or intermediary financial advisers) on behalf of account holders. A multinational insurance and pension provider reframed that belief by proposing the opposite: what if customers preferred to make their own investment decisions, even if they didn’t have the credentials of investment professionals? The company now provides customers with web-based investment information and decision-making tools, along with appropriate risk warnings. These enable customers to invest a percentage of their funds directly in businesses of their choice. This effort is in its early days, but customer pick-up and the profitability of products are promising.

Innovating in activities: From efficient to intelligent

One of the most dominant beliefs governing today’s big companies is that improving efficiency is the most reliable way to increase profits. Especially if market requirements change only gradually, companies have plenty of time to minimize the production costs of their existing products. Today, of course, constant efficiency improvements are a prerequisite for a healthy bottom line.

They may be necessary, but they’re not sufficient. In today’s rapidly changing markets, many products become obsolete before they have been “leaned out,” so managers get less time to optimize production processes fully. Companies are therefore building flexibility and embedded intelligence directly into the production process to help them adapt quickly to changing needs. Embedded intelligence can, over time, help companies to improve both the performance and the value-in-use of products and services and thus to improve their pricing. In essence, digitization is empowering businesses to go beyond efficiency, to create learning systems that work harder and smarter.

Consider how a web-based global hotel-booking platform used quick feedback cycles to reframe the focus of its business model from efficiency to user satisfaction, thereby opening new revenue opportunities. The hotel-booking industry’s central belief has been that success depends on two things: negotiating power with hotels and a reliable web interface for customers. The company reframed this dominant belief by asking if customers booking a hotel room might look for more than convenience, speed, and price. It tested this reframe through a series of iterations to its website. Even minor changes—such as the use of photographs, a warmer (or sometimes cooler) tone for the site’s text, and the inclusion of testimonials from happy customers—raised the click-through rate. This insight confirmed the reframe: a booking site is more than just a functional service; it can also become an engaging customer experience.

As a result, the company has integrated constant feedback loops and daily experiments into its key activities, creating a true learning system. Now it improves and adjusts its site daily to boost customer engagement and increase revenue. It may well be on its way to becoming the industry’s global standard.

Innovating in resources: From ownership to access

One widespread premise in business is that companies compete by owning the assets that matter most to their strategy. Competitive advantage, according to this belief, comes from owning valuable assets and resources, which tend to be scarce and utilized over long time periods, as well as firm and location specific. Thus ownership (rather than, say, leasing) frequently appears to be the best way to ensure exclusive access.

But what if assets are used infrequently or inconsistently? In these cases, digital technology, by increasing transparency and reducing search and transaction costs, is enabling new and better value-creating models of collaborative consumption. As a result, ownership may become an inferior way to access key assets, increasingly replaced by flexible win-win commercial arrangements with partners. On the consumer side, the examples include Peerby, an app that allows neighbors to share tools and other household items that would otherwise sit idle in garages, and Uber, which allows any driver with a qualified vehicle to provide taxi service. House- and room-sharing programs apply the same thinking to underused real estate. In every case, consumers opt to access rather than own these assets.

Big companies are following suit—for example, by reducing sourcing costs through “cradle-to-cradle” approaches that collect and repurpose what they previously considered waste.4 Instead of buying (and thus owning) the raw materials needed for products, companies access these materials in previously sold products and repurpose them. Similarly, the global sourcing firm Li & Fung limits risk, increases efficiency, and enhances flexibility by using broad networks focused on access to (rather than majority ownership of) suppliers. The software maker Adobe Systems no longer licenses new versions of its products to customers through one-time sales; instead it provides access to them through monthly subscriptions. (For more on Adobe’s transition to its new business model, see “Reborn in the cloud.”)

The move from ownership to access mirrors a more broadly evolving societal mind-set toward open-source models. For example, in 2014 the electric-vehicle company Tesla made all of its intellectual-property patents freely available in an effort to encourage the manufacture of clean vehicles.

These possibilities penetrate deeply into traditional industries. Consider how a big European maritime port embarked on a large-scale land-management program. The industry belief reframed by the port was that large liquid-bulk-load ships valued private access to storage tanks. The underlying assumption was that shipping companies wanted the ability to deliver their bulk loads anytime and therefore required entry to their tanks at close range.

In response to this perceived need, most maritime ports have developed jetties to which they provide individual shipping companies private access—essentially the equivalent of “ownership.” As a result of each company’s varying schedules and traffic, many jetties ended up being mostly unused, but others weren’t sufficient for peak times. Seeing this problem, the port’s management reframed the industry belief by asking if customers cared more about access on demand than exclusivity. The port now intends to help all customers use any jetty to access any fuel tank, by developing a common-carrier pipe connecting them. Just as Peerby in effect shifts a neighborhood’s “business model” by increasing the utilization of underused assets, so the maritime port is making more of underutilized jetties and storage tanks by shifting the business model so that shipping companies pay for access to jetties and storage rather than the exclusive use of them. In the future, this model may evolve into a dynamic multiuser slot-booking system that matches the real-time availability of jetties with demand for liquid-bulk-carrier ships.

Would you like to learn more about our Strategy & Corporate Finance Practice?

Innovating in costs: From low cost to no cost

According to historian Peter Watson, humans have been trading goods and services for more than 150,000 years. During that time, we’ve always believed that to sell more of an offering you had to produce more of it. The underlying notion was that a single unit of a given product or service could be used only by one customer at a time. Any increase in production therefore required a commensurate increase in labor, resources, and equipment. While volume advantages did translate into lower average costs per unit, economies of scale could never get the average cost down to zero.

Digitization is reframing this ancient belief in powerfully disruptive ways. In fact, of all the reframes discussed here, this one has had the most devastating effect, since it can destroy entire industries. What’s driving prices to zero is the reframe that multiple customers can simultaneously use digital goods, which can be replicated at zero marginal cost. Massive open online courses, for example, provide a nearly zero-marginal-cost education.

Consider the implications for telecommunications, where the dominant belief has been that value is best captured through economies of scale—the more telephone minutes sold, the lower the unit cost. As a result, the larger the mobile-phone plan, the lower the cost per minute. One telecommunications company is upending this belief by making customers an “all you can eat” offer. It realized that unlimited use of voice and texting units comes at no additional cost to itself, so it can compete against emerging voice-over-IP competitors. As a result, the telco started to offer unlimited texting and voice plans by focusing its economic model on making money from data usage and from its investments in a huge data network and storage capacity. Such plans eliminate confusion among customers and increase their satisfaction. As soon as the network has reached its planned return on investment, incremental data service will also be free.

Big companies have traditionally struggled to innovate in their business models, even as digital technology has brought business-model innovation to the forefront of the corporate agenda. Yet big companies can be disruptive, too, if they identify and overcome common but limiting orthodoxies about how to do business.