To get the most out of "should-cost," understand "could-cost" and "theoretical minimum cost," too.

Should-cost is only a starting point. It's just as important to understand "could-cost" and "theoretical minimum cost."

In the first article of this series, we defined the concepts of should-cost, quoted cost, and theoretical minimum cost. Now we'll examine why the price of a product or service almost always exceeds its should-cost—often by a substantial margin. We'll review the major cost categories that account for the gap, and explain why understanding them in detail is critical for any company hoping to close the gap.

We call this process of calculating cost from the bottom up, rather than assuming a percentage reduction off of a previous quote or invoice, the Cleansheet costing process.

When companies first start to use the Cleansheet methodology in supplier negotiations, they quickly hit a seemingly insuperable barrier. The leader of one purchasing team told us, "I tell the supplier the should-cost. Then there's an awkward pause. They refuse to accept it, or just look at me politely, expecting me to say something more." The chasm between two numbers—the buyer's cost model and the supplier's quote—can seem dauntingly wide, and neither side can seem to get across it.

The problem is a common one. But borrowing an engineering approach can help. Engineers solve big, difficult problems by breaking them down into smaller, manageable ones. Companies need to do the same with the cost model to quote gap.

Mapping the gap

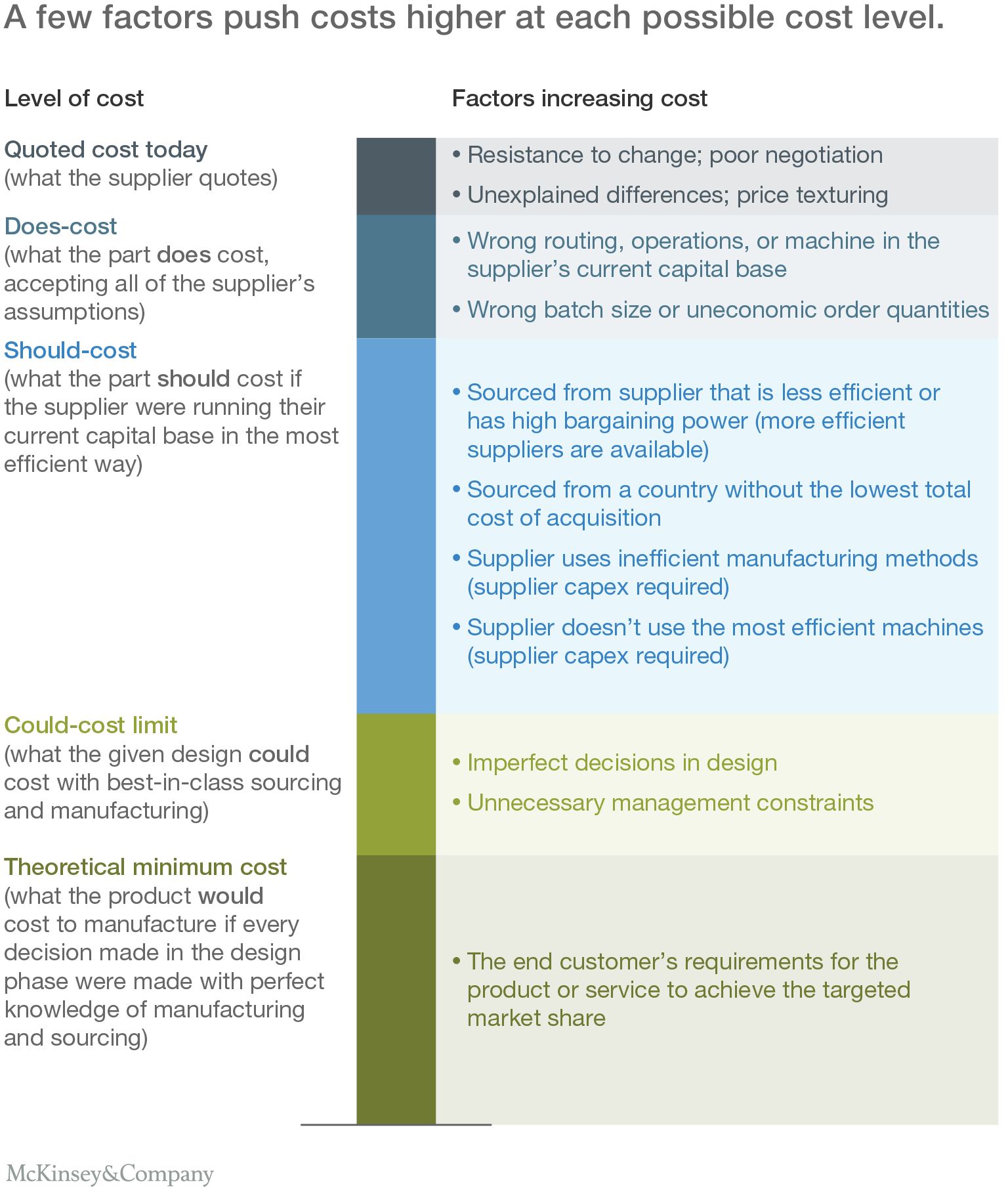

There are several different ways to break down the gap between the cost we calculate with the Cleansheet method and quoted cost. Moreover, a company may need to go down more than one level to have a profitable discussion. The exhibit shows how cost builds up to what we see in a quote. We'll start from the top down.

- At the top, in dark blue, we have the quoted cost, which may be the invoice cost if we are making the purchase immediately. This is the price the supplier wants us to pay. It will probably differ from the price we eventually do pay at the end of a negotiation, unless we negotiate poorly.

- The next level down, in medium blue, is the "does-cost." This is what the product or service would cost if we accepted all of the supplier's assumptions for calculating their quote, including their profit margins, verbatim, without questioning them.

Shouldn't the does-cost equal the quote or invoice cost? The answer is yes… in theory. The difference, represented by the dark-blue segment, often includes things such as excess profit for the supplier, a resistance to change pricing in line with reality, or unexplained differences that the supplier himself does not understand.

Another common problem in quotes is price "texturing." This occurs when the supplier and customer (often by mutual consent) agree to underprice one part or service and then later are required to overprice another part in order to keep the supplier financially viable.

We call the top of the medium-blue segment the "does-cost" because this is, to the best of everyone's understanding, the appropriate selling price for a part or service—assuming a rational customer and supplier, and taking the current manufacturing environment of the supplier as a given.

- The next level down, in bright blue, is the should-cost. This is what the product should cost at the supplier's factory, assuming that the factory is run efficiently, with the supplier's current capital base. (The calculation would be the same if the buyer were instead considering its own factory as a source of supply.) Another way to think of the should-cost is, "what would it cost to manufacture the item in a reasonably efficient set of factories with the same supply chain?" For example, if the incumbent supplier casts a part in China and then machines it in the USA, what price could well-run factories in the same two countries charge under the same basic manufacturing approach?

The gap between does-cost and should-cost can often be closed through manufacturing-operations or supply-chain changes that don't require material CAPEX investments. Examples of the addressable inefficiencies represented by the bright blue bar include using non-optimal routings, operations, machines, batch size, or order quantities. Lean manufacturing improvements will often fall in this category, too.

The next level down, in light green, is "could-cost," or what the part or service could cost in a best-in-class manufacturing environment. That would mean, for example, being in a country with the lowest total cost of acquisition, and following a manufacturing strategy (machines, personnel, material) with the lowest total cost of operation (including capital depreciation). Capturing the often-large gap between should-cost and could-cost often requires time and capital investment—by the supplier, the buyer, or both. The supplier's manufacturing team may need to build a new plant or line, or the buyer's sourcing department may need time to certify a new supplier.

- Up until now, we have said nothing about the design of the part or service being supplied, because we have assumed that the parties are dealing with a frozen, released, or in-production design. To breach the could-cost threshold, however, the design itself must change. The lowest level of cost, in dark green, would be the theoretical minimum cost, which represents the minimum viable product (MVP) that can capture the desired market share by meeting the end customer's needs.

Why all the complexity? Isn't should-cost enough?

At first glance, this framework may look too complex. However, we hope that the reader has already understood why these different levels of cost model are so useful. People tend to have very different ideas of what is meant by the word "should-cost." This approach is powerful way to overcome the internal resistance of purchasing teams, who often find themselves at loggerheads with proponents of the Cleansheet methodology. Faced with what appears to be an unreasonably aggressive cost target, buyers may lack confidence in the entire approach, to the frustration of managers who think they have identified a powerful source of profit improvement.

Once everyone recognizes that the level of cost depends on the assumptions in the cost model, and that some changes and savings will take longer than others, all sides can take a more pragmatic approach and work together.

Questions for the product cost-management team

We'll conclude with some questions teams should ask themselves about their own understanding of the cost gap:

- Have we broken the gap between the Cleansheet cost and the quote or invoice cost into the different categories discussed above?

- Do we know the assumptions behind the supplier's does-cost quote?

- How much supplier power does the supplier really have relative to the industry, and how much of a premium do we believe this translates to?

- Has the team taken the time to calculate the could-cost and parse the gap into separate does-cost and should-cost thresholds?

- What part of the gap between the quote or invoice cost and the could-cost gap is actionable, and when?

- Does the entire team have confidence in the numbers from the Cleansheet cost model? Which parts of the various types of cost model are is the team more or less confident in?

- Has the organization set an unreasonable expectation that purchasing can immediately buy a part for the should- or could-cost, rather than the does-cost?

- Conversely, has the organization set an unreasonable expectation that if purchasing cannot buy a part for the does-cost, that the should-cost and could-cost are not useful numbers?

- Is the team focused only on achieving does-cost savings, and forgetting about the longer-term savings attainable with the should-cost and could-cost?

About the authors: Eric Arno Hiller is an expert in McKinsey's Chicago office.