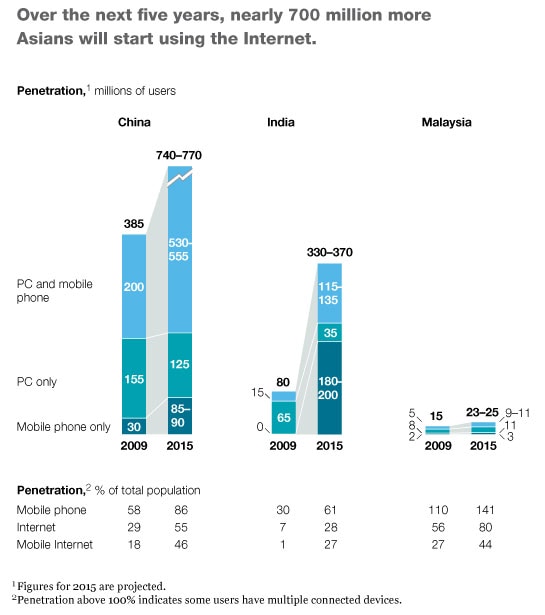

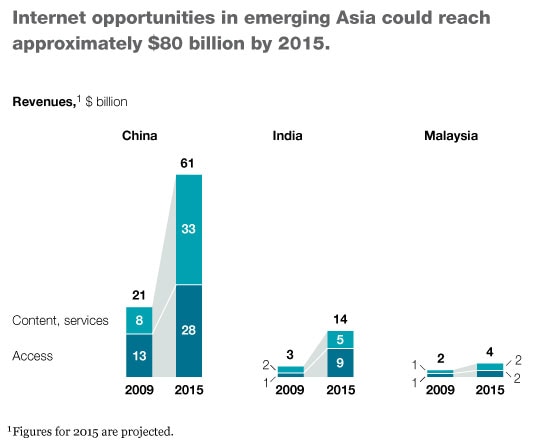

Asia’s emerging markets are poised for explosive digital growth. The region’s two largest economies—China and India—already boast some 500 million Internet users, and we forecast nearly 700 million more will be added by 2015 (Exhibit 1). Other emerging Asian nations have the potential to grow at a similarly torrid pace. We estimate that within five years, this billion-plus user market may generate revenues of more than $80 billion in Internet commerce, access fees, device sales, and so forth (Exhibit 2).

To better understand the consumers, growth prospects, and problems, we surveyed more than 13,000 individuals across China, India, and Malaysia—countries at very different stages of their digital evolution.1 The key finding? While there were some notable differences in the types of content consumers favor and the devices they use, significant demand is waiting to be unlocked in all three nations. That could lead to growing markets for digital content and services and to new opportunities around digital marketing, including efforts to reach consumers via Internet sales channels.

Malaysia

Of the three markets we researched, Malaysia is the most advanced. While the country has only around 15 million–plus Internet users, that’s close to 55 percent of the total population, and mobile Internet penetration is close to 30 percent of it. Given the Malaysian government’s push to expand high-speed broadband, we forecast that the country will have up to 25 million Internet users by 2015, or close to 80 percent of the population. As both fixed and wireless broadband grow, we project that more than 50 percent of all users will choose to have both personal-computer and mobile-device options for getting online.

Malaysians consume 35 percent more digital media than Internet users in China and 150 percent more than users in India, particularly on social-networking sites and instant messaging. That may, for example, give handset manufacturers opportunities to build social-network access into their devices. We also found that Malaysians like to multitask across both digital and traditional media. For advertisers, that’s problematic, since viewers are paying less attention to traditional media content—and thus advertising.

China

China leads the world in sheer numbers of Internet users—more than 420 million people, or close to 30 percent of the population. Over 80 percent surf the Web from home, while 230 million use mobile devices. We forecast that the number of Internet users will almost double over the next five years, hitting 770 million people, or 55 percent of the population. More than 70 percent will use both PCs and handheld devices.

China’s digital usage, which is similar to that of the United States, skews toward instant messaging, social networks, gaming, and streaming video. Increasingly, Internet users in China are substituting digital media for traditional ones, with the potential for further cannibalization as digital consumption grows. This development has stark implications for advertisers and how they allocate future marketing budgets. Consumers, meanwhile, also use the Internet in their purchasing decisions. They are more influenced by recommendations from social-network contacts and friends than by traditional marketing messages or visits to company Web sites.

India

With only 7 percent of the population connected (81 million users), India is Asia’s digital sleeper. Yet we believe that it’s poised to become a truly mobile-Internet society as new users leapfrog PCs altogether. We project that by 2015, the number of Internet users will increase almost fivefold, to more than 350 million—28 percent of the population—with more than half of those accessing the Web via mobile phones. To capture this opportunity, companies will need to roll out wired and wireless broadband networks aggressively, to make smartphones and network access more affordable, and to develop new content types.

Consumer demand clearly is robust. On average, Indians spend more than four hours a day consuming online and offline content. On PCs, often used in cyber cafés, Indians spend much time e-mailing and are heavy consumers of downloaded videos and music, as well as DVD movies. While Indian consumers use mobile phones predominantly for voice services, they also treat them as offline personal-entertainment devices, listening to radio stations or to downloaded music. There is significant pent-up demand for more convenient and personalized Internet access—a void the mobile Web could fill.

Embracing the opportunity

High hardware costs, inconsistent network quality, and limited access could check these optimistic growth prospects. But the extent of such barriers varies by nation, and there’s notable progress overcoming them. Construction of network infrastructure is proceeding apace—companies in India, for example, just spent nearly $25 billion on telecommunications spectrum. Meanwhile, hardware and access costs are declining in most markets. The biggest challenge is to make money while creating a variety of low-cost content. Three issues are especially important:

Innovators and entrepreneurs must develop content creation and delivery models priced low enough to compete against the pirated options currently available.

Content and Web services providers need to foster the growth of local and regional advertising markets to help defray the cost of content creation.

E-commerce platforms, including transaction systems that make purchases more convenient and trusted, must be developed.

At the same time, companies in consumer-facing sectors (for instance, automotive, packaged consumer goods, and retailing) will need to reconsider their marketing and advertising strategies in light of the shift away from traditional media. At stake is a significant competitive advantage in a region that already boasts more than half the world’s Internet users—and will only continue to grow.