Back in July 2015, Amazon’s iconic Prime Day online summer retail event made its first debut in nine countries; the US, the UK, Spain, Japan, Italy, Germany, France, Canada and Austria. Since then, Prime Day has become established as a global ‘one-day’ shopping event, where Prime members can shop thousands of deals sitewide, with new deals starting as often as every five minutes.

The inaugural event and the year 2016 offered Prime members a 24-hour shopping bonanza. By 2017, Amazon had extended the shopping period to 30 hours to make more of its members’ desire for a bargain. Fast forward to 2018, and this year Amazon reports its fourth annual Prime Day surpassed all prior sales records in the e-commerce giant’s 24-year history–including every Black Friday and Cyber Monday–with Prime members ordering over 100 million products during the 36-hour sales event.

To examine shopper sentiment toward the event and how it’s reshaping purchasing behaviors, Periscope surveyed consumers to understand their attitudes and actions during Amazon Prime Day 2018.

The research1, conducted in the US, the UK, France, Italy and Germany, found that:

- Awareness of Amazon Prime Day is exceptionally high – even among non-Prime members – with consumers in all countries surveyed reporting over 80% awareness of the event, except for France where just 63% of consumers were conscious of the occasion.

- Amazon has strong loyalty among its consumers. 61% of US respondents confirmed they have a Prime account followed closely by 58% of Italians. Germany (54%) and the UK (53%) also showed strong loyalty to Amazon through their Prime memberships with only 40% of French consumers confirming that they have a Prime account.

- Consumer participation in Amazon Prime Day is growing fast, increasingly typically 4-5x between 2015 and 2018 in all countries surveyed, with the greatest multiple increase observed in the UK (6.8x).

- Prime members bought more items and spent 50% or more compared to last year–the biggest move was in the UK where 59% of Prime members say they spent ‘a bit more’ or ‘much more’ compared to 2017, closely followed by shoppers in France (57%) and Germany (54%). US consumers were more constrained in their spending, however, with 40% of shoppers saying they ‘spent the same’.

- Shoppers appear increasingly sophisticated in their approach to Amazon Prime Day, with an average of 62% of consumers in the UK, the US and Italy confirming they had pre-planned the product categories they wanted to shop within on the day. However, 51% of consumers in France and Germany adopted a more spontaneous shopping approach.

Many consumers evaluated the value of the Prime Day 2018 deals they encountered; an average of 62% checked ‘a couple’ or ‘several’ item prices before committing to a purchase.

Key Findings: Online Shopping Comes of Age – Amazon Dominates in All Markets

Online and multichannel shopping behaviors predominate

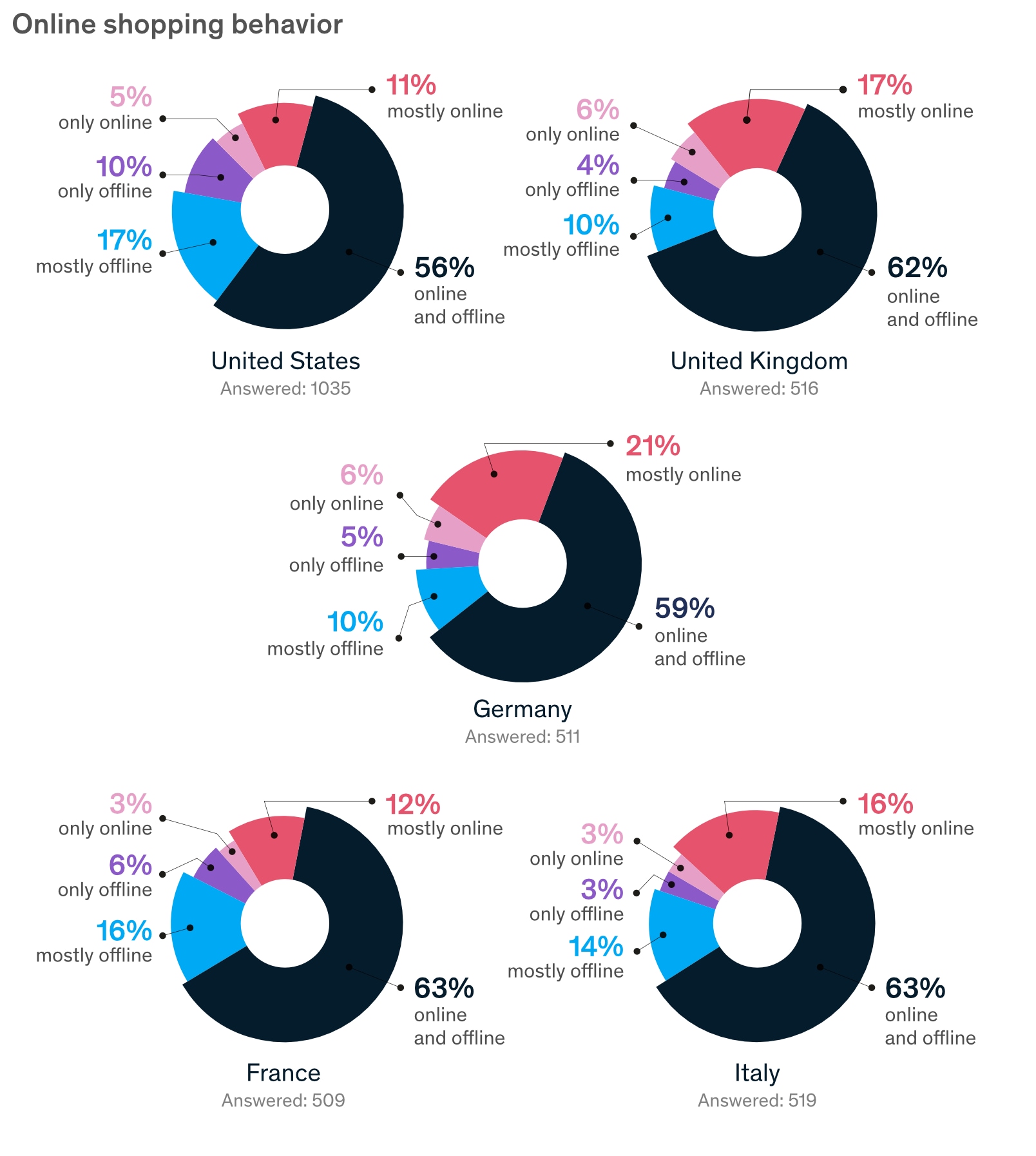

Appraising the typical channel shopping preferences of today’s consumers, this year’s survey highlights how multichannel shopping behaviors predominate, with 56% or more consumers in all markets balancing on- and offline channels to make purchases.

Similarly, the findings reveal how a growing number of consumers in all countries surveyed are shopping exclusively or mostly online, with just 10-12% of consumers stating that they now predominantly or only shop offline.

By contrast, the US trails other countries in its adoption of online shopping; consumers in the US appear the most committed offline shoppers with 27% saying they mostly or always shop in-store. Furthermore, a significant 10% say they only ever shop offline – more than double that of other countries where the average is 5%.