The Internet of Things (IoT) has generated excitement for a few years now, with start-ups and established businesses placing bets on the industry’s growth.1 Some of the earliest investments have begun to pay off, with smart thermostats, wearable fitness devices, and other innovations becoming mainstream. With new IoT products under development or recently launched—ranging from medical-monitoring systems to sensors for cars—some analysts believe that the Internet of Things is poised for even greater gains.

Semiconductor companies, perhaps even more than other industry players, might benefit from the IoT’s expansion. With growth rates for the smartphone market leveling off, the Internet of Things could serve as an important new source of revenue. Given the size of the potential opportunity, McKinsey recently collaborated with the Global Semiconductor Alliance (GSA) to investigate the Internet of Things more closely, with a focus on risks that could derail progress. In addition to assembling a fact base, we surveyed and interviewed senior executives from the semiconductor sector and adjacent industries, as described in the sidebar, “Our methodology.”

Our research suggests that the Internet of Things does indeed represent a major opportunity for semiconductor companies—one that they should begin pursuing now, while the sector is still developing. We also found, however, that the timing and magnitude of the IoT’s growth may depend on how quickly industry players can address several obstacles, including inadequate security protections, limited customer demand, marketplace fragmentation, a lack of standards, and technology barriers. Semiconductor companies, which have encountered similar problems in other nascent technology sectors, are well positioned to serve as leaders in resolving these issues.

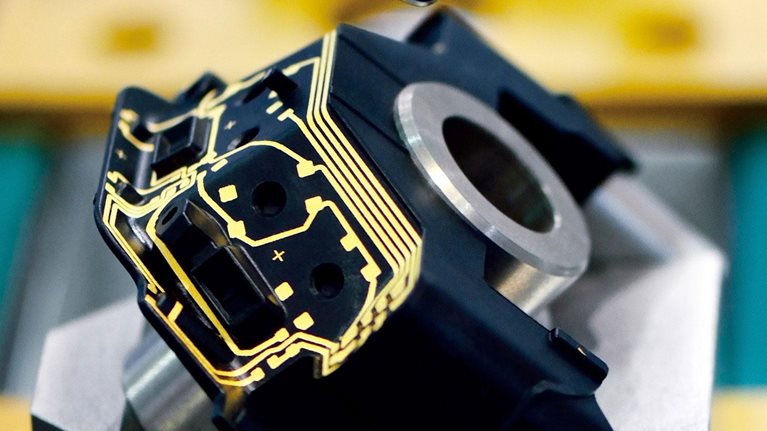

Another important insight relates to the nature of semiconductor companies themselves. Their traditional focus on silicon, which allowed them to profit in many industries, may not be optimal for the Internet of Things because chips represent only a small portion of the value chain. Instead, semiconductor companies will be required to provide comprehensive solutions—for instance, those that involve security, software, or systems-integration services in addition to hardware. As with any major change, this move entails some risk. But it could help semiconductor companies transform from component suppliers to solution providers, allowing them to capture maximum benefits from the Internet of Things.

A new source of growth

The McKinsey Global Institute recently estimated that the Internet of Things could generate $4 trillion to $11 trillion in value globally in 2025. These large numbers reflect the IoT’s transformational potential in both consumer and business-to-business applications. Value creation will stem from the hardware, software, services, and integration activities provided by the technology companies that enable the Internet of Things.

Analysts also estimate that the current Internet of Things installed base—the number of connected devices—is in the range of 7 billion to 10 billion. This is expected to increase by about 15 to 20 percent annually over the next few years, reaching 26 billion to 30 billion by 2020.

In keeping with these projections, many executives we interviewed stated that the Internet of Things would significantly boost semiconductor revenues by stimulating demand for microcontrollers, sensors, connectivity, and memory. They also noted that the Internet of Things represented a growth opportunity for networks and servers, since all the new devices and services will require additional cloud infrastructure. Overall, the Internet of Things could help the semiconductor industry maintain or surpass the average annual revenue increase of 3 to 4 percent reported over the past decade. These results are particularly significant in light of slower growth in the smartphone market, which has served as the major driver for the past few years.

Our interviews did reveal some ambiguity about whether the Internet of Things would be the semiconductor industry’s top growth driver or just one of several important forces. In particular, interviewees questioned whether the Internet of Things will trigger demand for new products and services, or if there will just be an increased need for existing integrated circuits. Similarly, our survey showed that executives from GSA member companies had mixed feelings about the IoT’s potential, with 48 percent stating that it would be one of the top three growth drivers for the semiconductor industry and only 17 percent ranking it first.

Despite the size of the IoT opportunity, some semiconductor companies have hesitated to make significant investments in this sector. The greatest issue is that products within the Internet of Things tend to appeal to a niche market and generate relatively low sales volumes. With individual products delivering a relatively low return on investment, some semiconductor companies have limited their R&D expenditures for IoT-specific chips, preferring instead to adapt existing products. For instance, wireless system-on-chip players may offer repurposed wireless processors and chip sets for the Internet of Things, while microcontroller players often bundle lower-end processors and connectivity-chip sets to compete for the same opportunity.

As the IoT market matures and increases in scale, semiconductor companies may decide to pursue new approaches more aggressively. Before moving ahead, however, they should first determine which verticals and applications are growing strongly and assess when their markets will be large enough to justify significant investment. While semiconductor companies could potentially capture growth in many IoT verticals, six of the most promising markets—those where we chose to focus our research—include the following:

- wearable devices such as fitness accessories

- smart-home applications like automated lighting and heating

- medical electronics

- industrial automation, including tasks like remote servicing and predictive maintenance

- connected cars

- smart cities, with applications to assist with traffic control and other tasks within the public sector

The challenge ahead

Like many other high-tech innovations, the Internet of Things is garnering intense interest in the press, with reports of connected cars and smart watches making headlines. Although we do not want to diminish the IoT’s potential, our research suggests that the following six issues could derail its growth:

- inadequate security and privacy protections for user data

- difficulty building customer demand in the absence of a single “killer application”

- a lack of consistent standards

- the proliferation of niche products, resulting in a fragmented market and an unprofitable environment for creating application-specific chips

- the need to extract more value from each application by providing comprehensive solutions, rather than focusing solely on silicon

- technological limitations that affect the IoT’s functionality

These problems are not insurmountable, particularly if semiconductor companies are willing to take an active role in solving them.

Security and privacy: High stakes, serious consequences

A majority of our interviewees cited security as an important requirement for growth in IoT applications. One called it the “critical enabler,” claiming that many developers and companies initially underestimate its importance when creating IoT devices. He noted, “Security is not a key issue while your application or product has not reached scale, but once you are at scale and maybe have a first incident, it becomes a most important problem.” Our survey results echoed the interview findings, with respondents ranking security as the top challenge to the IoT’s success. Recent hacks to online car systems also highlight the importance of addressing security challenges for connected devices, vehicles, and buildings.

Ensuring security will not be easy, however, given the numerous applications and verticals within the Internet of Things, each with its own quirks and requirements. For instance, fitness wearables might only require relatively basic security measures that ensure consumer privacy, such as software-based solutions. But IoT applications that control more critical functions, including medical electronics and industrial automation, need much higher security, including hardware-based solutions.

Most executives we interviewed believed that the technology needed to secure the Internet of Things was already available. They were concerned, however, with the piecemeal nature of most security products and wanted to ensure that players protected the entire IoT stack—cloud, servers, and devices—rather than focus on only one of these areas. As one executive said, “Overall security is only as good as its weakest point.”

Semiconductor companies can assist with end-to-end solutions by providing on-chip security, partitioning processor functions on chip, or supplying comprehensive hardware and software services, including authentication, data encryption, and access management. Those that specialize in security might be able to use their own products to provide comprehensive solutions, but others will need to undertake M&A or form partnerships with players further up in the stack to gain broader expertise in software or the cloud. For instance, semiconductor companies could lend their knowledge of hardware security to application designers or network-equipment manufacturers, since this information would assist with the design of secure software.

Customer demand: Developing the end market

Many of our interviewees envisioned a future in which IoT applications are more common than cell phones are today. Others were more cautious, however, with one noting, “No one really knows when the volume will show up; this is a clear challenge. . . . If you cannot show a $1 billion opportunity, then it’s hard to get attention.”

In other technology sectors, a single groundbreaking application or use case—a so-called killer app—has often spurred explosive demand. Such was the case in 2007, when the introduction of the iPhone triggered significant growth in the smartphone market. While the Internet of Things could potentially follow this path, most of our interviewees felt that growth would stem from a string of attractive but small opportunities that use a common platform, rather than a single killer app.

Some of the most innovative IoT applications—and those most likely to stimulate customer demand—could come from start-ups. Businesses outside the technology sector, such as retailers, insurers, and oil and gas players, might also develop interesting products that appeal to a wide customer base, although some of our interviewees felt that these companies would face tough odds. Semiconductor players could help indirectly stimulate demand for IoT devices if they adopt new strategies to help these players thrive. For instance, start-ups and nontechnical businesses often have limited experience with semiconductors, so they might appreciate simple solutions and more hands-on support, including guidance from dedicated field engineers who assist with board-level design and solution integration (from silicon through applications in the cloud). IoT customers might also prefer one-stop solutions—complete platforms with all relevant elements that an IoT device needs, including connectivity, sensors, memory, microprocessors, and software. For some small businesses with limited funds, such platforms may be the only economically feasible option.

IoT standards: The need for consistency

Some layers of the IoT technology stack have no standards, and others have numerous competing standards with no obvious winner. In our survey and interviews, most respondents cited this situation as a major concern, with one executive stating, “What is critical is which standards will win and when this will happen.”

To see how a lack of uniform standards can complicate product development and industry growth, consider connectivity issues. There are competing, incompatible connectivity standards for devices with a low range and medium-to-low data rate—for instance, Bluetooth, LTE Category 0, and ZigBee. With so many options, product designers may be reluctant to create new devices, since they do not know if they will comply with future standards. Similarly, end users may be reluctant to buy devices that may not be interoperable with existing or future products of the same type (Exhibit 1).

Although multiple organizations, including interest groups and industry consortia, are attempting to establish standards, it is impossible to predict which ones will prevail in each IoT vertical. Faced with this uncertainty, semiconductor players should pursue a hedging strategy, focusing on selected standards that are likely to gain widespread acceptance while simultaneously planning for alternative scenarios. In all cases, semiconductor players should actively engage with industry associations or other groups that are trying to develop IoT standards, with the goal of supporting the best ones.

How to address a fragmented marketplace: Creating common platforms

IoT devices have widely varying requirements for power, data-processing speed, form factor, price, and other dimensions. Smart water meters, for instance, need to run for months, if not years, independent of power supply. They also require high-range connectivity, but data rates can be under one kilobit per second. By contrast, IoT devices used for industrial automation typically require a direct connection to a power supply and high data rates, but their connectivity range is lower than that for smart meters.

These variations in device specifications become significant when considering R&D costs for a single chip. Assuming typical integrated-circuit design costs and product lifetimes, semiconductor companies will need to ship 20 million to 70 million chips annually to break even.2 Only a few segments, such as wearables, are large enough to require so many chips, making it impractical to create customized solutions for individual applications. But rather than abandon the IoT market, semiconductor companies should investigate an approach that involves classifying devices into archetypes based on their specifications and then creating a single platform to cover each one.

Products from multiple verticals can fall under one archetype as long as they have similar specifications. For instance, many low-cost applications have common requirements for short-range, medium-data-rate connectivity and limited data processing. If semiconductor companies create a common platform for applications that fit this archetype, they will simultaneously increase demand and reduce R&D spend. One downside of a platform approach is that the chips may not deliver optimal performance for every application they cover.

Extracting value beyond silicon: Opportunities in software and more

Semiconductor companies have a well-deserved reputation and track record for technological innovation, with some of their inventions spurring advances in personal computing, mobile telecommunications, and elsewhere. But they are also known—fairly or unfairly—for failing to extract full value from their innovations, with other high-tech players, such as software firms, profiting most from device enhancements. Our analysis suggests that semiconductor companies might face a similar dilemma with the Internet of Things. One executive we interviewed noted, “Value extraction has always been a particular challenge for semiconductor players, and it becomes particularly challenging in the Internet of Things, as even more players participate in the stack and business models are still immature.” Other interviewees stated that big data and cloud companies were positioned to capture far more value from the Internet of Things than semiconductor businesses.

To tackle this problem, some semiconductor companies have already begun to create complete solutions that cover multiple layers of the technology stack, especially since nontraditional customers—start-ups and businesses outside the technology sphere—prefer this approach. It is still too early to identify winning strategies, but the advantage may go to companies that pursue the following three opportunities (Exhibit 2).

- Software. Semiconductor companies have been complementing integrated circuits with supporting software for many years, but this trend will become even more important as the Internet of Things grows. Many semiconductor companies have recently sought to build their software skills through M&A or partnerships, while others have focused on improving their in-house capabilities.

- Security. As noted earlier, the Internet of Things requires end-to-end security across the stack. Semiconductor players have traditionally provided chip-security solutions, but they may find additional opportunities in other layers, particularly if they can offer software products.

- Systems integration. One interview subject stated, “Today most players have a partial but not full solution for integrated systems, so who is the integrator?” Semiconductor companies could fill this role, especially if they provide system- or application-level software supporting integrated circuits, although some interviewees noted that this might be too much of a departure from their core competencies.

Technological issues: Finding opportunities within the challenge

In our survey, two-thirds of respondents stated that technological issues present little to no challenge to the success of the Internet of Things.3 The remaining respondents were split evenly between those who thought that technological issues were above average in importance and those who considered them a major challenge. Executives may hold varying opinions because technological issues differ by vertical and application. For instance, the interviewees agreed that wearable technology needs improvement. “With wearables, there is a constant issue of charging,” one executive stated. “We need to make devices last for a trip.” By contrast, technology for smart-home applications is well advanced, but there are few standards governing interoperability, which has limited their adoption.

When we asked our interviewees about the most crucial technological innovations for the Internet of Things, most focused on lower power consumption and battery life. A step change in the time between charges will increase demand for existing devices while also enabling product designers to create new applications. Wearable computers, distributed sensors for agricultural applications, and retail beacons are just a few of the applications that require improvement. Innovation in power and battery life will likely come from various sources, such as on-device power management, further advances in storage, over-the-air and wireless charging, and energy harvesting.

Although semiconductor companies that offer leading-edge technological advances will find themselves in high demand, not every player has to focus on innovation. Those companies that offer more dated solutions will still have a role in the Internet of Things, since many applications—particularly the sensors they contain—will continue to rely on existing (albeit highly specialized) technology.

Would you like to learn more about our Semiconductors Practice?

Implications for semiconductor players

Semiconductor companies that want to capture the IoT’s enormous growth potential might be tempted to move ahead quickly, without changing their existing operating model, but this could be a mistake. The Internet of Things is unlike any high-tech segment that they have previously served, and their traditional strategies may not succeed with the new customer base. With so much at stake, semiconductor companies need to reevaluate all aspects of their businesses and potentially make some significant changes. From a strategic perspective, three tactics will be particularly important.

Finding the right niches suited to your competencies

There are likely to be many profitable I0T niches within the fragmented market, and semiconductor companies will need to identify the most promising ones that represent a fit with their capabilities. The use of a platform approach to cover multiple niches will be important, since R&D costs may otherwise be prohibitive. When companies are selecting the right niches, one of the most important considerations is their own expertise. Semiconductor players that have strong ties to consumer-electronics companies and possesses full-system-integration capabilities might best focus on wearables and smart-home devices, developing silicon, software and algorithms, and device-level designs. They could also potentially provide server-side software, connectivity gateways, and associated infrastructure. By contrast, a company with specific expertise with high-reliability integrated circuits and security might be well suited to provide full IoT solutions for medical applications.

Developing a solid strategy to seek value beyond silicon

Semiconductor companies are mostly well aware that their chips represent only one small part of the IoT value chain, so they are exploring opportunities in software, the cloud, and other services. But they may also need to consider more radical approaches to improve the value captured, including a shift to new business models. For instance, a move to usage-based pricing would allow semiconductor players to capture revenue for the entire lifetime of a device or service, not just at the time of chip purchase. (This might only be possible if a semiconductor company is willing to provide the full system or partner with a system-level player.) To mitigate risks and avoid moving too far from their core competencies, however, new solutions should be carefully evaluated. The fact that the IoT has many niches will be helpful during the evaluation process, since companies can test solutions in one of them and make necessary adjustments before undertaking a broader rollout.

Revisiting (and revolutionizing) the corporate operating model

Operating models focusing on hardware and embedded software helped semiconductor companies thrive in many high-tech segments, but they may not be well suited to I0T customers. For instance, most companies now include a limited number of large business units, a focus on direct sales and field-application engineers, and an emphasis on application-specific R&D programs. A more appropriate organizational structure for the Internet of Things would emphasize a multimarket sales approach and a greater reliance on channel partners, such as distributors, as part of the go-to-market strategy. This arrangement is well suited to the I0T’s fragmented market, which contains very different companies, including many small businesses, with unique needs. Other possible areas for improvement include the following:

- R&D. The move from customized chips to a platform approach should occur as soon as possible, but this does not always entail massive internal changes. Instead, companies may be able to license another player’s intellectual property to build a platform—for instance, for image processing—thereby gaining access to new technologies without increasing development costs.

- Investments. Rather than making a limited number of large portfolio bets under the direction of a business-unit lead, companies should investigate numerous applications in diverse markets. This approach will help companies avoid the common mistake of allocating most funds to core products, rather than using them to develop new applications.

- Change management. If management wants employees to cultivate new capabilities or develop innovative products, they may need to revise their key performance indicators. For example, companies should provide incentives that encourage R&D to develop chip platforms that are appropriate for several verticals, such as connected cars and industrial automation, rather than optimize integrated circuits for a single vertical. Likewise, leaders that want to focus on mergers or other outside alliances must help companies recognize their importance by encouraging such partnerships more aggressively.

Our survey, interviews, and research show that semiconductor executives are optimistic about the Internet of Things and its potential to transform the industry. More important, they recognize its ability to help society as a whole, with one executive calling it “a chance to change and enrich our lives.” The exact form that this change will take is still uncertain, as is the point at which the Internet of Things will be widely adopted. It is clear, however, that the semiconductor sector will play a major role in its ascent. Those companies that take action now, while the Internet of Things is in its early stages, stand to gain the most.