Consolidation among the world’s major stock exchanges continued in 2011 with Deutsche Börse’s announced acquisition of the New York Stock Exchange (NYSE). If that merger goes through, it will be part of a trend that ultimately benefits listed companies: it is simpler to manage the reporting requirements for one exchange than for two or three.

Yet consolidation is also likely to intensify competition among the remaining exchanges, especially as technology whittles away their traditional points of distinction: promises of a more diverse equity base, cheaper access to capital, or enhanced liquidity. Companies consider three things when choosing a listing location—the actual out-of-pocket costs for establishing and maintaining the listing, the effects on valuation and liquidity, and the nonfinancial benefits. But for which of these—if any—is there a meaningful distinction between locations?

Listing in multiple locations gradually fell out of favor in the late 1990s, as companies came to question whether there were real differences among them in valuation and liquidity. Yet in recent years, a belief in these differences has revived: the argument most often heard is for listings in Hong Kong.

We find, however, limited evidence that a listing on any of the major global exchanges brings an advantage in valuation or liquidity. All the top-tier institutions—including Euronext, the Hong Kong Stock Exchange (HKEx),1 the London Stock Exchange (LSE), Nasdaq, and NYSE—have reached a sufficiently high level of maturity and internationalization that they can host companies from anywhere in the world: enough institutional capital will follow across national boundaries. Although the costs of listing differ slightly among locations, this of itself is probably not sufficient to swing the decision one way or another. Companies considering a listing should therefore focus on whether the non-financial benefits are compelling enough to prefer one exchange over another.

The current Hong Kong IPO market provides a useful illustration. It attracted more capital in new primary listings in 2011 than any other equity market,2 as it has done since 2009, and is the most successful of the major exchanges in attracting foreign listings. Yet our analysis of the 2010 and 2011 data finds that companies coming to Hong Kong for a second listing enjoy few direct financial benefits from doing so: the motivation lies elsewhere.

Effects on valuation and liquidity

If listing in a given market had quantifiable benefits, we should see evidence for them in the valuations or liquidity of the companies that list there. Yet when we look at the companies that executed a second listing in Hong Kong, the evidence doesn’t support an economic argument for a move on the basis of liquidity or valuations. Companies listing in Hong Kong have not, on average, experienced a significant increase in their shares’ liquidity—even if they have enjoyed, as some argue, increased exposure to a broader analyst and investor community and therefore better price discovery for those shares. Although there was a broad range, the average trading volume of companies adding a second listing in Hong Kong fell by 5 percent. When we adjusted for the size of an issue and looked at liquidity as a proportion of shares outstanding, less than a fifth of the companies listing experienced any material improvement, and the median company saw its liquidity fall by 37 percent.3

Nor did a second listing in Hong Kong lead to higher average valuations for most companies. Our analysis of the P/E ratios of companies adding a second listing in Hong Kong in 2010 and 2011 found that multiples there have been, on average, 24 percent lower than those in the original listing location. Many of the companies listing in Hong Kong had already been listed on exchanges in mainland China, where they enjoyed substantially higher valuations.

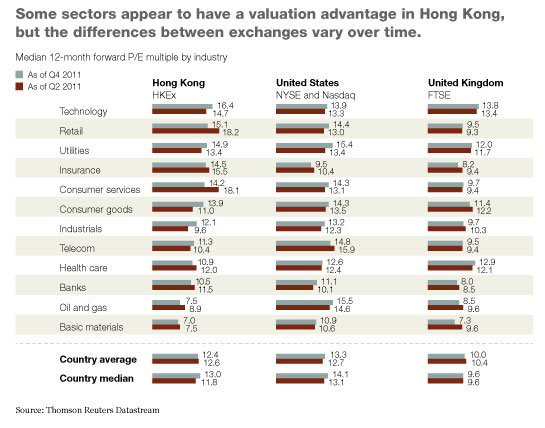

Still, many observers believe that valuations have a location-specific element—that listing on some exchanges attracts higher multiples than on others—and point to a few cases of Western companies listing in Hong Kong at higher multiples than they previously had on other exchanges. When we look systematically at valuations in the same sectors across exchanges, however, the evidence is mixed: it is hard to see a consistent pattern in which sector multiples are higher in one location than in another. In 2011, for instance, some industry sectors enjoyed higher valuations in one location at midyear, but in a different location at the end of the year. In July, 5 of 12 key industry sectors in Hong Kong had higher multiples than their US counterparts did, but that dropped to 3 of 12 by December. Similarly, 7 of 12 sectors had higher multiples in China than their UK counterparts in July, but in December, 9 sectors had an advantage in China (exhibit).

Some sectors do appear to have consistent differences in multiples: however, this may simply reflect the mix of companies in those industries. Compared with other markets, Hong Kong has a higher proportion of mainland Chinese enterprises, which generally have better growth prospects than UK and US ones do but operate in a very different regulatory environment. This factor would play a role in sectors such as insurance, oil and gas, telecommunications, and insurance; in all of them, multiples differ across locations.

Finally, it is not clear that Hong Kong gives companies access to investors they wouldn’t access through Western exchanges. If it did—and if that made a difference to a company’s valuation—significant numbers of companies originating in Europe and the United States would be moving their primary listing to Hong Kong. Despite the media excitement, however, relatively few have actually done so—certainly fewer than the number of Asian companies listing in London or New York. Of over a hundred IPOs and listings by introduction in Hong Kong during 2010 and 2011, only a handful involved relocations of Western companies: the majority were Asian.

Out-of-pocket costs

The expense of establishing and maintaining a listing varies among markets, though maybe not by enough to give companies a compelling reason to select one location over another. For primary and follow-on equity issues, average total initial listing fees in Hong Kong over the past three years were 2.5 percent of the issue proceeds, compared with 2.9 percent in London and 4.2 percent in New York.

For the main component of the ongoing costs—regulatory compliance and reporting requirements—exchanges can differ in meaningful ways. A listing in Hong Kong, for instance, does not impose the same degree of legal liability for executives and boards or carry the compliance and reporting costs of a listing in New York—and investors seem comfortable with the level of protection Hong Kong’s legal and regulatory infrastructure offers. But it is hard to place a definite value on these protections, which at the margin will affect where some companies choose to list, even in the absence of a visible effect on valuations.

Nonfinancial benefits

If companies don’t derive significant financial benefits from a listing in any of the major markets, they still might consider a number of nonfinancial benefits—ease of access, regional proximity, or the expertise of the analyst and investor community in a specific location. This is a more persuasive explanation of Hong Kong’s success in recent years.

The unique feature of the Hong Kong market is the greatest concentration of investors knowledgeable about China and Asia of any major financial center, much as technology companies may feel better understood by the US investor community or early-stage mining companies by the investor community in Toronto. That kind of knowledge has value to companies whose businesses depend heavily on specific regions—there’s a certain logic to seeking out the location that best understands your business.

In Hong Kong, this logic was an explicit part of several high-profile listings by nonlocal, non-Chinese companies. Consider Prada’s decision to conduct its June 2011 $2.1 billion IPO in Hong Kong. A third of Prada’s sales in 2010 came from Asia, excluding Japan. The company’s sales in the region are growing at more than twice the rate of those in any other part of the world. By 2015, China will account for one-fifth of demand for luxury goods and for a considerably higher share of growth in demand.4 Prada’s future development would clearly be served by listing as close as possible to China (foreign companies currently can’t get listings in the domestic Chinese A-share market). Similarly, demand for commodities from China was a stated reason for recent listings in Hong Kong by Rusal (the largest global aluminum company) and Glencore (the multinational commodities company).

Companies that aren’t already listed on a major exchange may find that one of them offers a more natural home. Yet managers should explicitly define their rationale for the decision—and not put too much credence in the supposed financial benefits.